I first wrote about Capital One offers a couple of months ago. For clarity, this is not Capital One shopping (which is available for anyone regardless of whether or not you have a Capital One card; Stephen covered the shopping portal here). Rather, Capital One offers are available for select cardholders (you see these offers when logged in to your account if eligible — see my original lost for more detail). Today I noticed that Capital One is offering 10% back on Viator purchases, which beats other portals at the moment. Unfortunately, I also noticed that the offers as a whole have become significantly poorer in the past week or two.

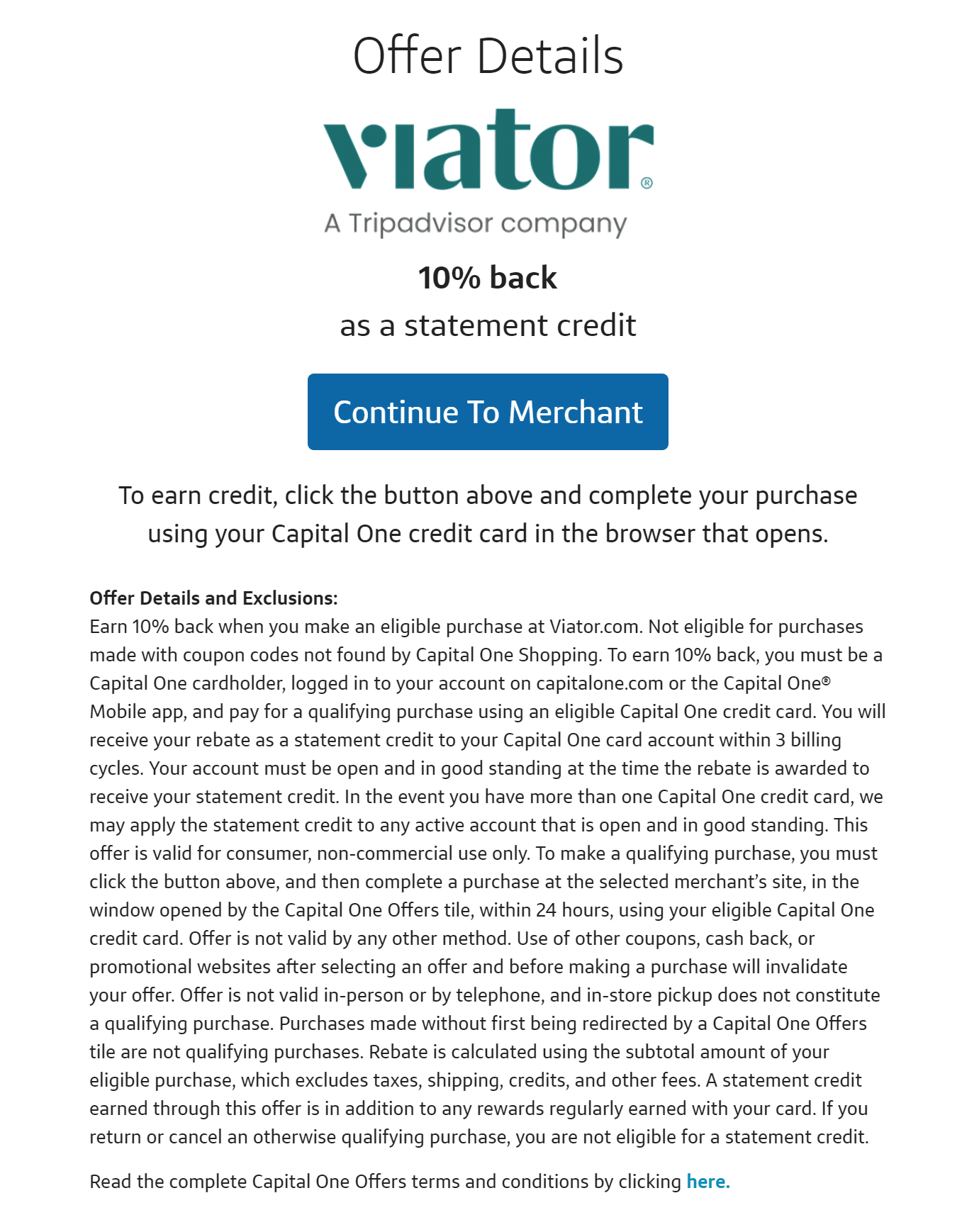

10% back on Viator purchases

Capital One is offering 10% back as a statement credit at Viator.

This one caught my eye today in part because of the fact that opportunities to get good value for points on activities is on my mind thanks to Greg Passing the GUC. Since Viator is a travel purchase, booking an activity through Capital One should give me the ability to later erase the purchase at a value of $0.01 per point. I don’t know for sure that you’d keep the 10% statement credit rebate even after paying yourself back with points, but if you do it would mean very good value for Capital One points. Of course, this is appearing far too early for me as I have no idea yet where I’ll plan our trip to maximize all of the bonus point opportunities that have been created for me. It is way too early for me to book activities today, but I’ll hope to see this one again down the road.

Unfortunately….

Capital One offers have largely decreased in value

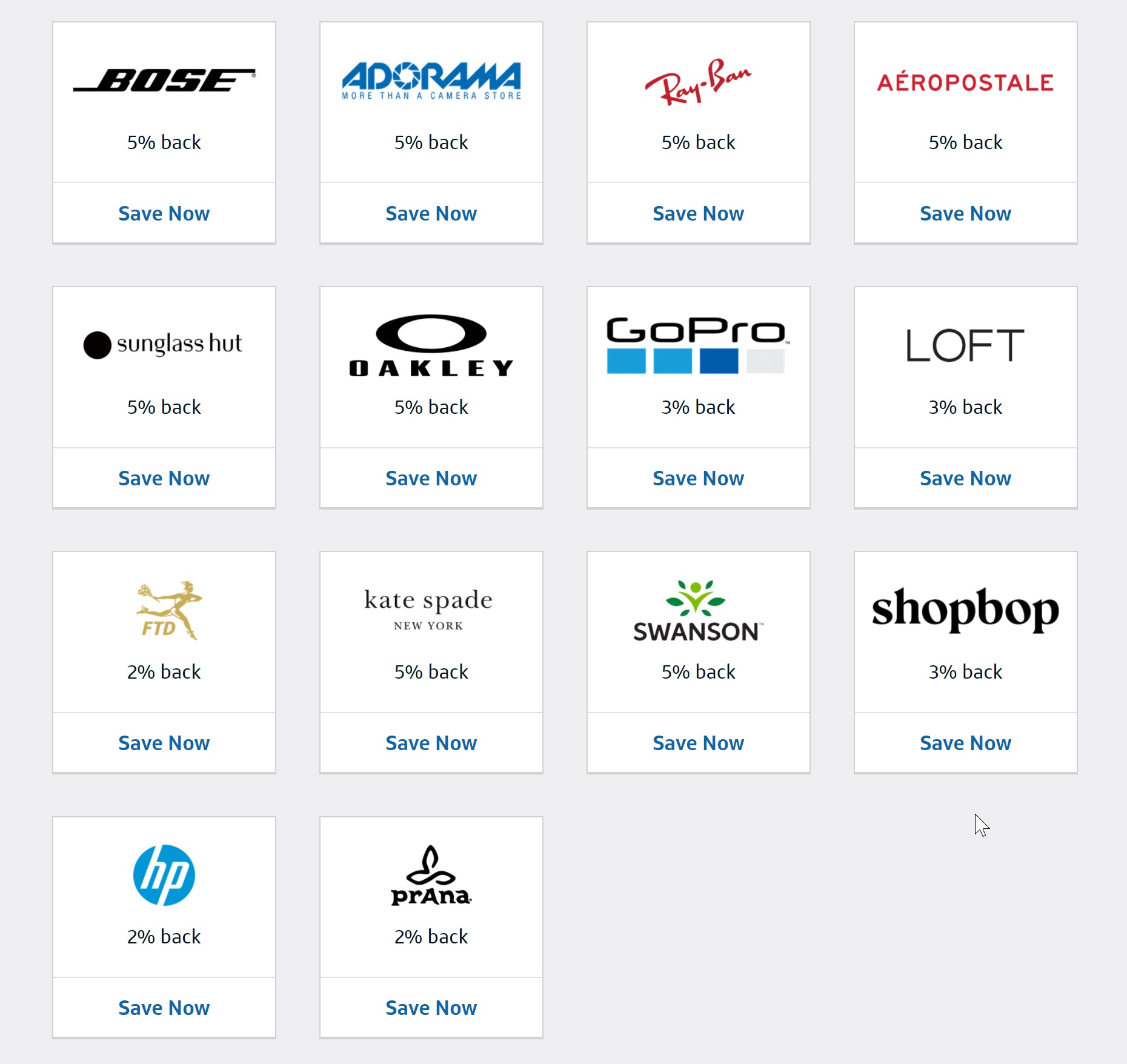

When I first wrote about Capital One Offers and still just two weeks ago when I was shopping for a new computer, most Capital One Offers were good for 10% back, with a couple available at 15% back.

Today, that has totally changed. Stores now range from 2% back to 15% back with many of the best offers decreasing significantly. For example, when these offers launched, I noted that both HP.com and Adorama.com were available for 10% back. That was still true 2 weeks ago. Today, HP.com is just 2% back and Adorama is down to 5% back.

It’s a shame to see this decrease in value so substantially in such a short period of time. While 5% back is still relatively good for Adorama, it’s disappointing to see it halved. There are routinely much better offers for HP. I didn’t check all of the stores against rates at Cashbackmonitor.com, but most of them didn’t look very good.

Also relevant: tracking doesn’t appear to be particularly quick for these offers. I made purchases through Capital One offers a couple of weeks ago and haven’t seen any sort of email or indication that anything is pending. The terms state that it could take up to 3 billing cycles to see a statement credit, but I’d like to at least see a pending purchase that shows they have a record of owing me a statement credit after the pending period has ended. Unfortunately, there doesn’t seem to be any indication that a transaction has tracked.

Bottom line

These Capital One Offers are likely only relevant for a niche segment of the rewards enthusiast world, but the offers debuted quite strong just about 2 months ago. While they were out of the gate strong, it is disappointing to see them fade away from relevance so quickly. That said, the Viator payout here is pretty strong (not the best in the past 15 months according to Cashbackmonitor, but better than you’ll find elsewhere at the moment). Hopefully we’ll continue to see at least some of the options offer strong payouts.

[…] 10% back on Viator, but Capital One Offers have otherwise declined by Frequent Miler. […]

Offers in general seem to decrease after the holiday season, besides what Amex has been up to the last year.

Holding Capital One cards beyond the bonus is about as pointless as collecting Spirit miles. C’mon Nick, be better than the Gap.

I agree that it won’t make sense for most people in this game. In my case, it has turned out to be a great way for me to generate Marriott gift cards at a huge discount.

https://frequentmiler.com/the-best-hotel-credit-card-ever/

It also isn’t horrible way of generating some types of airline miles given that the card essentially earns 1.5 airline miles per dollar spent for some types of airline miles (and with transfer bonuses, that occasionally becomes 2 miles per dollar). It obviously wouldn’t make sense to spend on the Capital One card instead of, for example, the Blue Business Plus at 2x. However, if you generate significantly more than $50K spend per year, at some point there becomes value in diversifying.

The other reason for me to keep Capital One cards is that I know I am unlikely to ever be able to get them again since they are so difficult on approvals for those with many cards.

Thanks for the thorough response! I didn’t see that post and you’re right, if you have that option, it could still be worth it for sure!

If you’re considering it as a catch all card though, 1.5 airline miles isn’t that great, specially for $99 a year given you can 2x, 2x and 1.5x catch all cards from Citi, Amex(limited to 50k yes) and Chase. All of whom have far superior partners and no annual fee.

True – though keep in mind that with Chase and Citi, you’ll need at least two cards, one of which will carry a similar $95 AF. I’m not arguing that Capital One is better, just that it’s not worse by as large a margin as it may seem.

That’s a good point! And don’t get me wrong, it wasn’t anything against you, FM is one of only 3 blogs I still read. You run a fairly complicated setup and I definitely see the value in diversifying your points if you MS.

I just don’t and without MS and with my current cards with Amex(Plat, Gold, Aspire, BBP), Chase(Ink, Ink Preferred, CFF, CF, CFU, Hyatt) and US Bank’s Altitude Reserve, Capital One Venture is just objectively a hard pass since there’s no way I could get even close to the $95 value out of it, let alone more. The Venture wouldn’t even be worth it if the transfer ratio wasn’t the 1:0.5-1-0.75 since they don’t have any unique transfer partners or benefits unlike Chase, Amex and Citi.

I get getting the Venture card if you can’t be approved for anything with the major league banks but if you can, you really should aspire to be better than the Gap.