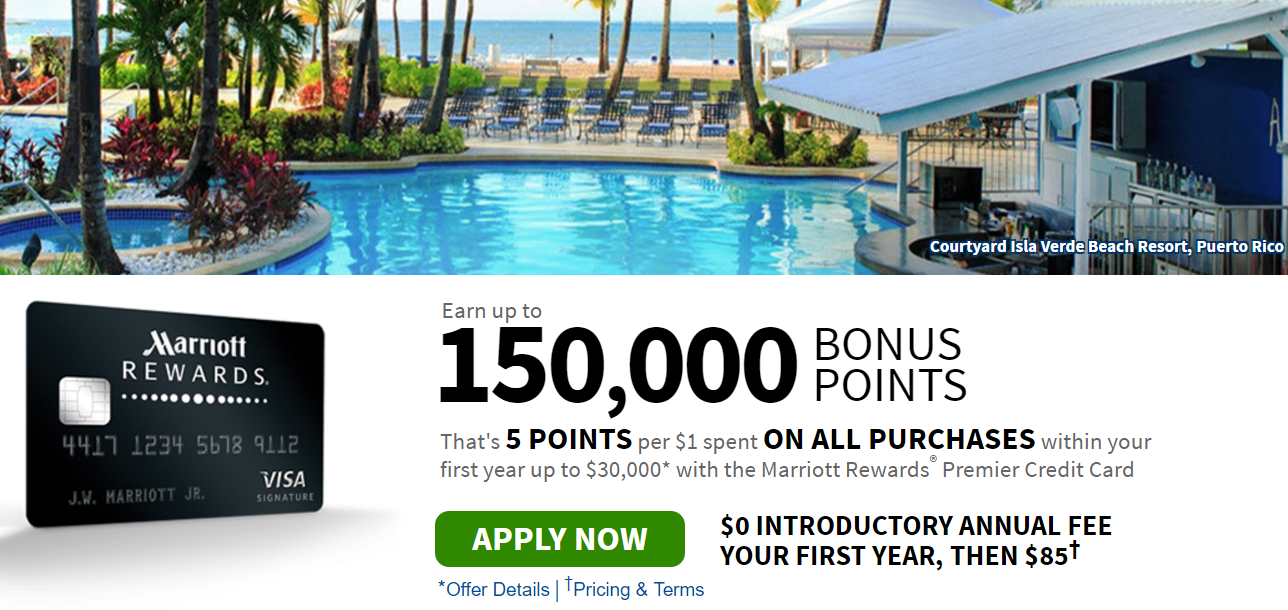

Last fall, Marriott began advertising a so-called 150,000 point offer for their Marriott Rewards Premier credit card. The offer was so clearly inferior to the public 80K offer that I never even wrote about it. To my surprise, I learned recently that Chase and Marriott are still trying to sucker people in with this offer…

False Advertising?

First I want to point out that this ad is terribly misleading. It clearly says that you can “Earn up to 150,000 BONUS POINTS“. But the offer details (which I preserved here) say that you’ll earn a total of 5 points per dollar on all purchases within your first year up to $30,000. And the offer details clearly indicate that those 5 points per dollar are a combination of base points (that you would have earned anyway) plus bonus points. For example, if you use the card to purchase groceries, you’ll usually earn just 1 point per dollar (since grocery is not a bonus category for this card), but while this offer is active you’ll earn the usual 1 point per dollar plus 4 bonus points per dollar. Or if you use the card to purchase airline tickets, you’ll usually earn 2 points per dollar, but while this offer is active you’ll earn the usual 2 points per dollar plus 3 bonus points per dollar.

My point is this: with $30K spend, you can, at most, earn 4 x 30,000 = 120,000 BONUS POINTS. The other 30,000 points cannot reasonably be called bonus points. Unless I misread the offer, the headline saying that you can earn up to 150,000 BONUS POINTS is simply false.

Why no one should apply for this offer

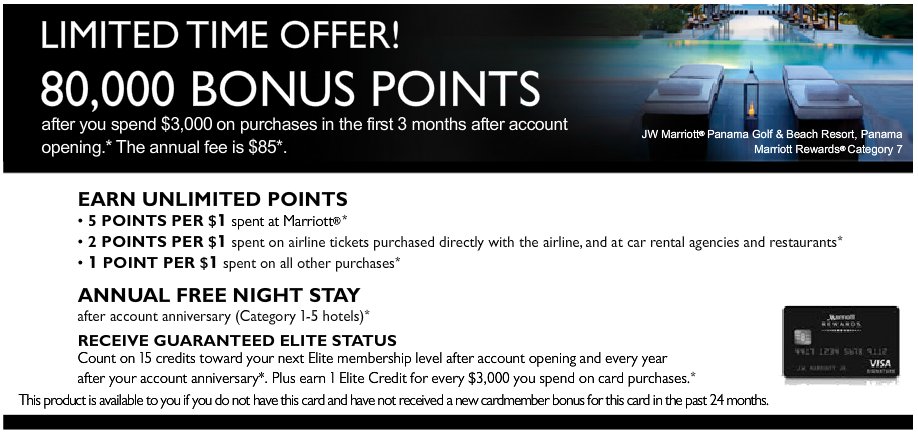

The standard public offer for this same card is 80,000 bonus points (and these are real bonus points) after $3K spend.

Both offers will give you an additional 7,500 Bonus Points for adding an authorized user and making a purchase in the first 3 months, so that does not differentiate the two offers. And, both offers result in you getting the same card with the same bonus categories.

The difference is that the standard offer only requires $3K spend while the so-called 150K offer requires $30K spend to maximize it. If you were to spend only $3K with the “150K” offer, you would get only 15,000 points.

What if you really want 150,000 points?

A few readers have mentioned that they have no trouble manufacturing spend and they’re working towards getting a Marriott Travel Package so they could really use those 150,000 points. Even then, you could easily do better. Here are a number of ways that you could earn 150,000 or more Marriott points for less than $30K spend:

- $6K spend to get 160K points: You could sign up for both the Marriott personal 80K offer and Marriott business 80K offer in order to get a total of 160,000 bonus points after only $6K spend.

Since SPG points transfer to Marriott 1 to 3, there are many ways to get 150,000 Marriott points more easily than spending $30K on the lame Marriott 150K offer:

- $25K spend to get 150K points: If you already have an SPG card, then you could get the first 83K from the standard Marriott signup offer, and the additional 67K from just over $22K spend on your SPG card. Your total spend, then, would be about $25K rather than $30K with the “150K” offer.

- $15K spend to get 150K points: With either the SPG personal 35K offer or SPG business 35K offer, you could sign up and spend a total of $15,000. This way you’ll earn a total of 50,000 SPG points

- $13K spend to get 249K points: If you sign up for both the SPG personal 35K offer and the SPG business 35K offer you would end up with at least 83,000 SPG points after meeting spend requirements. Those 83,000 SPG points = 249,000 Marriott points!

- $8K spend to get 203K points: You could sign up for both the Marriott 80K offer and the SPG personal 35K offer. After meeting spend requirements, you would have at least 83K + 120K = 203,000 Marriott points!

Summary

The Marriott Premier credit card’s 150,000 point offer is a bad deal. If you need 150,000 Marriott points, there are many easier ways to get them.

[…] initial reaction was that the offer was surely terrible. After all, I had previously reviewed and dismissed an advertised 150K Marriott offer. I figured that this one would be just as bad. But, I was sort-of wrong. Under certain […]

[…] Bonus points” that is so bad that we’d never written about it until now. Find out why you should avoid this 150,000 point offer so you don’t fall for the misleading marketing […]

[…] response to my post yesterday about the 150K Marriott offer (see: The 150,000 point offer everyone should avoid) a reader commented “To be fair, people who use hotel cards for their everyday spend are […]

I agree, the 80,000 bonus point offer on the personal and business card, for 3k spend, is far better. Also, I believe the business card is not subject to the dreaded 5/24 rule.

Wha what…a card offer that is not so good….and he says so….arrrgghhh prepare for the apocalypse.

[…] 150K point offer to avoid: This is a great example to thoroughly read the fine print, and do the math before applying for a credit card. While many could be hypnotized with a 150K offer, if you dig a little deeper, this card is one to avoid. It’s misleading and there are easier ways to get up to that point balance. […]

I don’t think it’s an analogous comparison to include instances where you have to sign up for more than one card, because there are ramifications for doing so that you’re not accounting for. Apples and oranges.

To be fair, people who use hotel cards for their everyday spend are usually fools anyway.

Appreciate you reading the fine print. Please continue to do so. Keeps me coming back.

Thanks for sharing. I really like the breakdown of using other cards with less spend and getting the same or more points. Great posting.

Doesn’t that ad say clearly “5 points per dollar on ALL PURCHASES within one year up to $30,000” ? That seems pretty clear that you get 5x on everything…did you find something different in the terms and conditions? (I can’t click through to that as you just posted the image)

Actually the image does click through to the offer. Not sure why that didn’t work for you. But since they will probably pull the offer at some point, I created another page where I preserved the full offer terms:

https://frequentmiler.com/marriott-150k-offer-terms/

Thanks for sharing. I looked at the terms and it seems to indicate when I mentioned in my first comment. That all spend does get you 5x, if thats true, isnt this essentially a good deal when factoring in the transfer to SPG?

From the terms and conditions:

5 points on purchases in the first year: You’ll earn 5 points for each $1 spent on all purchases made within your first 12 months from account opening up to $30,000. The five points will appear on your statement as 5 points on qualifying purchases made at participating Marriott®, The Ritz-Carlton, and SPG locations; 2 points plus an additional 3 points on each $1 spent in the following categories: restaurants; airline tickets purchased directly from the airline; car rental agencies; and 1 point plus an additional 4 points for each $1 spent on all other purchases for a total of 5 points. After your first year you’ll earn: 5 points: You’ll earn 5 points for each $1 spent on qualifying purchases made at participating Marriott® and The Ritz-Carlton locations, and all Starwood-branded Hotels

Ahh I think I see you point. That yes you earn 5x but you would have earned more than 1x anyways in certain categories…so this only really makes tons of sense if you want to spend that 30k on categories that normally would only earn 1x as this offer would get you up to 5x for that spend. Indeed, not a “bonus” per say but I don’t think its a terrible deal if you can put 30k in non-bonus category spend on this thing.