American Airlines has announced some major changes coming to the AAdvantage loyalty program in 2022: elite status is being simplified (some will find this to be an improvement and others will not) and members will be able to earn elite status through credit card and shopping spend, which might make elite status (but not necessarily choice benefits) easier to obtain.

No award chart changes

I thought it was worth including this at the top of the post for those who assume changes mean changes to the award chart. The good news is that American Airlines has not announced any partner award chart changes and in a quote to View from the Wing indicated that we shouldn’t expect any in 2022. That’s great for those who have miles to take advantage of American’s sweet spot awards!

Loyalty Points are the new status metric

American is getting rid of Elite Qualifying Miles, Elite Qualifying Dollars, and Elite Qualifying segments in favor or “Loyalty Points”. That actually seems like a smart move to me — multiple qualifying metrics makes things complicated for those who don’t pour their time into learning loyalty programs (I imagine most business travelers are more focused on other things). Further, in an environment where business travel may not ever return to pre-pandemic levels (and where selling miles to banks makes up the most profitable part of the loyalty program), it just makes sense to incentivize loyalty in ways beyond flight activity.

In the new program, Loyalty Points will be the single metric and interestingly you’ll earn them through credit card and shopping portal spend as well as from flights. This is a simplified breakdown:

- Base members will earn 5 loyalty points per dollar on paid tickets with American Airlines (elites earn as many as 11 loyalty points per dollar spent on paid tickets)

- Credit card holders earn 1 Loyalty Point per dollar spent on most AAdvantage credit cards (though there are some cards that will earn different amounts — see more about this below). Only base miles count — so you will not earn additional Loyalty Points for spending in a bonus category nor from the welcome bonus on a new card.

- Shopping portal spend, AAdvantage Dining spend, and SimplyMiles spend will also earn Loyalty Points. While my initial assumption was 1 Loyalty Point per dollar spent through those programs regardless of the redeemable miles multiplier earned, upon further consideration of the way things are written I believe that 10x through the shopping portal will mean 10x points and SimplyMiles offers like 2,150 miles for spending $200 at an IHG property will mean 2,150 Loyalty Points. We’ll see whether that proves to be true.

- Ancillary spend like upgrades, seat selection, etc, will not earn Loyalty Points

- Transfers from other programs (like Marriott or Citi) will not earn Loyalty Points

American says that more is coming on this front. Gary Leff at View from the Wing makes an educated guess that American is trying to extract some additional revenue from partners for the earnings from their activity to be Loyalty Points-earning and that was my immediate reaction upon reading about the new program also. I wouldn’t be surprised to see some additional methods of earning Loyalty Points — perhaps through the partnership with Hyatt or rental car companies — but time will tell who is willing to pay up.

Interestingly, Loyalty Points will determine upgrade priority. Someone who spends a ton on American Airlines credit cards or through the shopping portal will position themselves higher on the upgrade list. Truthfully, this makes sense to me: those customers who are diving in to the credit card, shopping portal, dining program, etc, are truly buying into loyalty (and making American Airlines more money than those who only fly).

New elite status calendar

Moving forward, elite status on American Airlines will be determined by Loyalty points earned from March through the following February. American says the idea here is not forcing people into mileage runs during the December holiday period and also the fact that holiday shopping done on AAdvantage credit cards will count (which will likely only post to statements in January for many people). I guess Black Friday and Cyber Monday will become the hot new way to “mileage run” in your pajamas.

This new qualification calendar creates a small window of opportunity for some people: January and February 2022 will count toward earning elite status in 2021 (so for example those chasing EQDs via credit card spend to qualify this year will still have January and February to do so) and those months will also count toward earning elite status in 2022 (which means that those earning status in 2022 have from January 2022 through the end of February 2023 to earn the required loyalty points). Starting in March 2023, those looking to earn status moving forward will need to earn the necessary loyalty points between March and the following February.

New Elite requirements

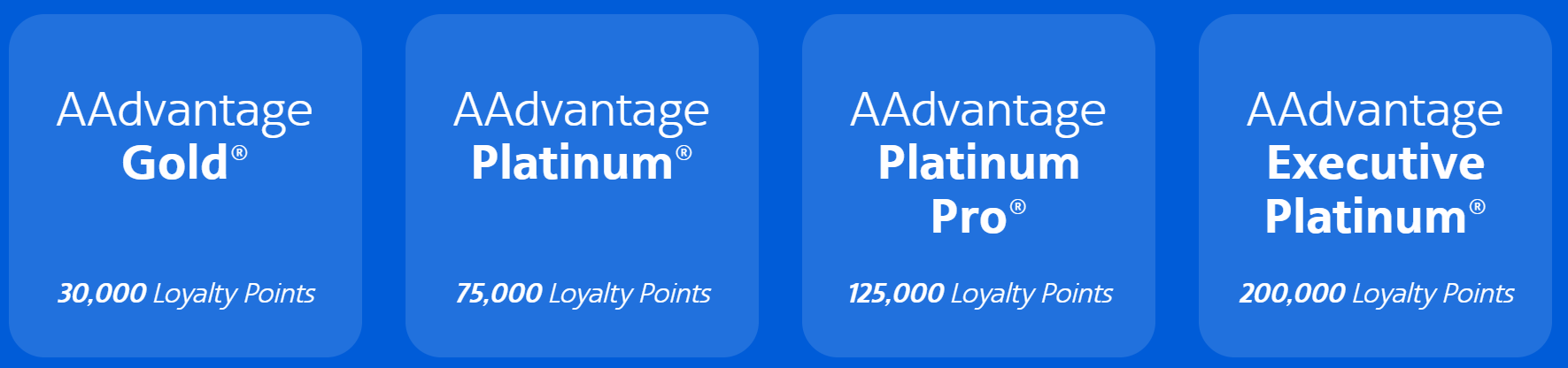

The new elite status requirements for American Airlines AAdvantage in 2022 will be:

- AAdvantage Gold: 30,000 Loyalty Points

- AAdvantage Platinum: 75,000 Loyalty Points

- AAdvantage Platinum Pro: 125,000 Loyalty Points

- AAdvantage Executive Platinum: 200,000 Loyalty Points

Keep in mind that as you move up, you’ll earn more Loyalty Points per dollar spent on airfare. For instance, a member with no status will only earn 5 Loyalty Points per dollar spent, but an Executive Platinum member earns 11 Loyalty Points per dollar spent. Re-qualifying for status will be easier than qualifying in the first place.

Furthermore, qualifying on flights alone will become much more expensive. However, I imagine that most who feel especially loyal to the program likely have the credit card and now there is a strong incentive for them to use things like the shopping portal, AAdvantage dining, etc. I don’t have data on which to base this, but I would bet that earning elite status will become significantly less expensive for many folks who simply shift things they are already doing — shopping online, spending money at SimplyMiles merchants, dining out — to doing those things in ways that earn Loyalty Points.

Whether or not it will be worth shifting significant amounts of spend to the AAdvantage credit cards in order to earn Loyalty Points is a more difficult question to consider, but I suspect that some folks already spend on those cards just to earn the miles so also earning Loyalty Points sweetens the deal for them.

For some big spenders, the ability to spend all the way to top-tier elite status may be appealing on the surface, though the most popular status benefits will still require flying American and its partners.

Elite choice benefits will require 30 flight segments

While the ability to spend your way to elite status will no doubt be somewhat appealing, the disappointment here is that choice benefits will only be unlocked if you earn enough Loyalty Points and also fly at least 30 segments on American Airlines and its partners. Note that AAdvantage award tickets on American Airlines flights will count (though it doesn’t sound like award tickets on partner airlines will count).

I imagine that regular American Airlines travelers will appreciate this minimum number of segments in order to earn systemwide upgrades or other valuable choice benefits. On the flip side, those of us who could potentially qualify with shopping portal, SimplyMiles, and credit card activity will feel left out of the top benefits of status. I’m not sure it is worth pursuing high level status without the ability to get things like those systemwide upgrades.

Is there something new coming for the premium American Airlines cards?

The big news today is that credit card spend earns Loyalty Points — 1 Loyalty Point per base mile. In most cases, that will mean 1 Loyalty Point per dollar spent on an American Airlines credit card. Greg noticed something interesting in the FAQs section though:

“Base miles earned vary by credit card type and issuing bank. For example, most AAdvantage® credit cards earn 1 base mile per US$1 spent on eligible purchases, but some earn .5 base miles per $1 spent, others 1.5 miles or 2 miles, etc.”

Based on the chart on this page, the AAdvantage Aviator card (this is a no-fee card, NOT the Aviator Red) earns 1 base mile per $2 spent (that’s the .5 base miles per $1 spent card). However, all of the other cards on that page show 1 base mile per mile spent. So then what does the FAQ answer mean when it says “”others earn 1.5 or 2” base miles?

It is possible that this is just a typo (or that AAdvantage cards issued in other countries have a different structure). On the other hand, perhaps there are plans to bump up the earnings of the Aviator Silver or Citi Executive cards. If that happens, it could certainly make those cards more appealing for those chasing status.

Bottom line

American Airlines has completely changed its loyalty program for 2022. There have been no award chart changes, but the way members will earn elite status will now be based on loyalty as measured by a combination of flight spend, credit card spend, shopping portal and dining activity, and more. This won’t be good news for all members, but overall I find it an innovative way to reward more complete loyalty. I’m personally bummed about the 30-segment requirement in order to earn choice benefits, but I may still consider shooting for some level of status if shopping portal and SimplyMiles activity counts as we suspect it will. Some folks will find this new structure less appealing, but I expect the majority will find it a net positive. Maybe that is bad news for current elites since it will likely create even more elite members, but it is nice to see an airline recognize that credit card and shopping portal customers also have value that helps keep them in business. Overall, I’m mostly a fan of the changes.

Nick, big fan and a daily reader.

In 2022 I want to spend towards Platinum Pro.

I am currently Gold and my Gold status will continue through 2022.

In the AA program beginning in 2022, I need 125,000 Loyalty Points to earn Platinum Pro. If I spend the entire $125,000 on AA credit cards in the first half of 2022 will that Platinum Pro status last only until early 2023?

If I wait until July of 2022 to hit the $125,000 Loyalty Points threshold, would that Platinum Pro status carry me through early 2024?

I have AA Platinum status for life. It was great for a short while when it was their top level status – all earned through spend.

Does this status reduce the loyalty points required for Platinum Pro or Executive?

I would guess not, but …?.

All things considered I think it’s a fair loyalty play by AA.

I’m a Plat Pro based in PHX that has historically earned it the hard way with DOM flights and a few INT Prem Y or cheap J class partner trips per year.

I’m typically a relative big spender on other CCs (Chase WOH, AMEX PLT, CSR, SWA, Costco, Chase Marriott) each year and will be >$200K this year. I don’t have a current AA CC and this new loyalty play, now forces me off the sidelines and has me considering at least one AA CC, after having x2 cards in the past. AA wins by diverting some of my CC spend, and I should win by renewing Plat Pro or even bump-up to Exec Plat. Since i fly on AA and will have spend, I should have a decent chance for u/g’s as well.

With additional enhancements to come, I’m excited for additional partner offerings, especially as a Globalist with Hyatt. AA & Hyatt have an opportunity to sway additional business away from the disenfranchised Marriott (I’m LT Titanium) and SWA companion pass big CC spenders.

How about a post of which AA cards make sense for those of us coming off the sidelines to consider an AA CC?

The strongest vote is always with your wallet and I will let my wallet speak for me.

Thanks,

AirAzona

It’s odd to me that if you earn elite status toward the end of year 1, your status expires in March of year 2. With Southwest, if you earn status at the end of year 1, your status remains for the entirety of year 2.

Airlines sell miles to banks and partners and at a very high price. many of these miles are never used so the net profit on selling them is astronomical.

Their profits these days are more dependent on selling miles than actually selling tickets.

Delta’s deal with AmEx brings in billions in profits.

As a result most of the frequent flier loyalty programs in recent years have become so watered down that they no longer are an attraction for an authentic frequent flyer. They require loyalty but offer nothing in return.

Someone has already had some fun at Dougs expense! http://www.disaadvantagestatus.com

That is outstanding.

Also, hi Scott Kirby!

So if we spend $200k on credit card we can get aa highest status??

On an AA co-branded credit card. Yep.

Sure, and none of the loyalty benefits… so “status lite.”

Just based on my initial calculation you could pay your mortgage with plastic on an AA Mastercard and gold would cost you $750. Combine that with the miles you get and the companion certificate and that seems like a pretty good deal

The average household spends about $10k on gas and groceries in a year. The average household spends about $3k at restaurants in a year. Add in your gas/electric bill, water will, cable bill, Netflix, etc. Add in your home and auto insurance. Perhaps health insurance payments. Finally, add in Loyalty Points from your flights. You should hit Gold and might even hit Platinum . . . without doing your mortgage on Plastiq.

Plastiq might be good for meeting minimum spending to receive a sign-up bonus. But, for ongoing spending, it is way too expensive.

This is terrible for engaged leisure travelers who earn by flying and don’t want a gAArbage cobrand card. Who would spend $6k plus taxes on AA flights for entry-level elite status when the same spend gets you DL Gold, and almost UA Gold?

The new system will benefit most but not all. It sounds like you have a choice.

Big benefit for those that can MS cost effectively. If AA guaranteed it would keep its partner awards, I could rationalize getting their card, but with anticipated deval, I just don’t get the appeal of accruing AA redeemable miles over maximising cash back and buying J when desired

I wish they would get rid of the stupid 500-mile upgrades at this point. They’ve taken so many steps to make it revenue based to reach Gold, why continue CHARGING for free upgrades that might not materialize.

So this pretty much puts members living outside the US and unable to get AA affinity credit cards out of the game completely. No way to earn enough points to even reach Gold!

Uh, you could fly.

Right, I’d need to spend U$100K+ a year on AA tickets to qualify for mid-tier status and get no real benefits like upgrades because US credit card users will always be accruing more points and thus priority. And I do t work for a big corporation that can pay for premium class tickets as most ExecPlat elites do.

I did earn my status by flying and without many of the bumps received by previous spend elite miles credits earned from the AA affiliated credit cards. And with after tax dollars.

The US border has been closed to us as well for almost 2 years, so no ability to do domestic US flights or use AA…which I flew on as my last flights in February 2019 when grounded.

And it’s pretty clear AA will shortly close the loophole that earns actual miles and COS as points when flying non-US OW airlines.

Not sure this will add a lot of elites. Ways to earn are going up but so are requirements. And the people who qualify by nonchalantly spending $200k on a 1x credit card aren’t going to get the SWUs and other benefits.

This will establish two tiers of elites at each level: “elite” and “elite with benefits” and create the spectacle of well-heeled high spenders flying around the country in February on eight segment one-ways hoping to qualify for benefits.

Well-heeled high spenders have better uses of their time.

The value of a system-wide upgrade doesn’t compare to the value of their time lost.

They are not going to chase it. They are going to pay for first class.

Trust me on this one.

Quick question – Is the current promotion to extend status by earning $2,000 in EQD by 12/31/21 also now extended to 2/28/21?

I’m not sure about that. I would think you need to do it by 12/31 still, but I don’t know that for sure.

They are copying DL – 250k spend on 2 credit cards = Diamond status with a tiny bit of flying

1

Lost Cash Back 2.625% = 200k spend = 200,000×2.625= $5125

Value of AA mile never above 1c nowadays except partner awards

So real cost 3125 for 2 yrs if you do it by MS before March 2023 – over 14 months

About 150 a month for free upgrades and a free drink on AA while in economy

They are giving 10k boost in points for 40k spend on Citi Exec and 15k boost in points for 50k spend on Barclays; so it really takes only 175k spend total if you have those 2 cards – so real cost 500$ less = about 2600$ really = quite low for 2 yrs = ~100$ a month at most

The boosts are to keep the use / value of the premium cards higher than regular cards – previously Barclays gave 6k EDQ- then that was reduced to 3k EQD – assuming an EXP spent 20k, this was about 15%; they have reduced that to 7.5% towards EXP (but given MUCH more credit to pure spend); Both cards gave 10k EQM each; now they can take you all the way to EXP

They are also shortsighted in not using miles bought at full price – if you buy AA miles at 3c each = 200k = 6000$ there is no reason not to give EXP to that person

AA recognizes that in future business travel may be much less; you need to engage a flyer to stay with AA and not move – Keep the money coming in via cc acquisitions – increase value of AAdvantage

2

Overall not much different from DL process but a bit cheaper

There it takes 250k spend + 2 reserve cards @ 600 each gets DM = 125k MQM

250k spend = lost cash $6562+1200 for 2 cards = $7762

Less 2500$ in value of DL miles (max value at pay with miles) = $5262 for 2 yrs of DM

However DL also gives Choice benefits at PM and DM that you do not get on AA – easy value minimum 1000$ (just choosing 20k miles and 25k milesx3)

I get much more value using their global upgrades.

So real net cost on DL is max about 4200 for DM but that is a higher target than AA with much better benefits

The loser is UA – They treat their loyal card holders – eg Presidential Plus much worse and are going to lose more as time goes on

So are loyalty points just used as a denomination for status or is also replacing their miles? If it’s just for status as OMAAT seems to suggest, you can now fly Alaska and earn Alaska miles but still also earn towards AA loyalty without crediting the flight to AA. If you do some CC and shopping activity (or maybe the Hyatt partnership will expand) it’ll be easier to get 75k or 100k MVP status via Plat Pro/ExPlat than through Alaska’s own program.

Loyalty points and award miles are two separate things. Loyalty points are only for status and cannot be redeemed for anything. Award miles are for award flights, etc. as we’ve always known.

For flights, one earns loyalty points and award points at the same rate. Base fare multiplied by one’s tier multiplier. Both are based on revenue.

This new system is sort of like British Airways system. It has tier points and it has award points. Tier points are reset to zero at the end of one’s membership year and the clock / counting starts again.

200,000 divided by 11 is approx 18,000. Does this mean that as an Exec Platinum earning the 11x rate, I must spend 18K in flights alone to keep Exec Plat?

If you have zero credit card spend on an AA card, this is correct. If you put ONLY that flight spend on an AA card, you’d only need $16,667 (because you’d earn 11+1 per $).

Also zero premium cabin bonuses. I would guess that most ExPlat members have at least one annual premium flight bonuses they’d get.

Yes, as Mike says, if you have zero credit card spend, zero shopping portal use, zero SimplyMiles offers, and zero AAdvantage dining and only earn points from spending on flights, you will need to spend $18K on flights.

Staying w DL for now then. I have top status on DL and AA. Unless something changes I can do my 2 long distance cheap Business flights on a partner carrier such as AM to hold on to status. Hopefully there is something we are missing. New system is very complicated.