Bilt Rewards announced a couple of cool enhancements today that both make the program more exciting in a broader sense as well as specifically more rewarding for Bilt Mastercard cardholders. Note that to see Bilt’s full info about Rent Day, you’ll want to update to the latest version of the app which has a “Rent Day” tab.

If y

If y

Bilt makes “Rent Day” twice as rewarding

For a 24-hour period on the 1st of each calendar month, Bilt will offer members with the Bilt Mastercard double points on all non-rent purchases. Not only does this make the base earning rate 2x on rent day, it also doubles existing bonus categories, meaning that cardholders earn 6x dining and 4x travel on the first of the month. That could make the first of the month a great day to buy a gift card at your favorite restaurant or to book pending travel (though it would likely be harder to plan that specifically for the first of the month given the fluidity of pricing).

Note that your earnings potential won’t be infinite: you can earn up to 10,000 bonus points on rent day. Still, that’s a fairly high ceiling given that it would take $3,333.34 or more in dining purchases to exceed the 10K bonus point cap (or $10K in non-bonused purchases). While it is certainly possible to envision scenarios where you could hit the cap pretty easily (like with new furniture purchases for your new home and/or catering for an event that codes as dining), most people will find the 10K bonus point cap to be plenty generous to make the card worth using on the first of the month.

Also remember that you’ll still only earn 1x on rent. The double rewards is for non-rent purchases. In that regard, remember that you need to make 5 non-rent purchases per month in order to earn 1x on the rent. This double rewards deal on the first of the month should make it increasingly easy for cardholders to meet that threshold.

Virgin Voyages discount for Bilt Rewards members (no Bilt Mastercard required)

The part of today’s news that I find most broadly interesting is that Bilt Rewards is teaming up with Virgin Red to offer 50% off the original advertised fare on Virgin Voyages cruises booked between September 26, 2022 and October 31, 2022 and completed by December 31, 2022.

It is worth noting the phraseology: you’ll get 50% off the original advertised fare, which isn’t necessarily 50% off the actual current fare. I haven’t closely tracked the price of Virgin Voyages cruises, but it is fairly common cruise pricing practice to cross out some “original” price and display a “sale” price at pretty much any time one looks to book.

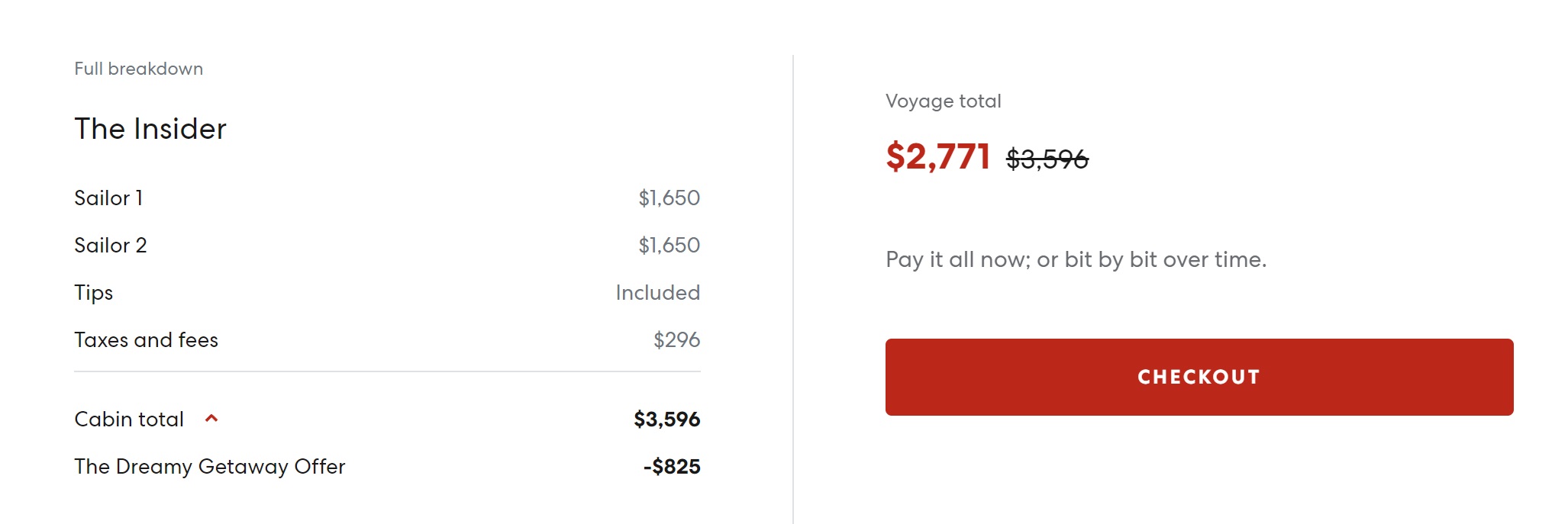

That technique appears to be at play to some extent here. For instance, here is one Mediterranean cruise I price-shopped before the Bilt discount:

As you can see, the “original” total was $3596, but it is currently being offered for $2,771 before the Bilt discount.

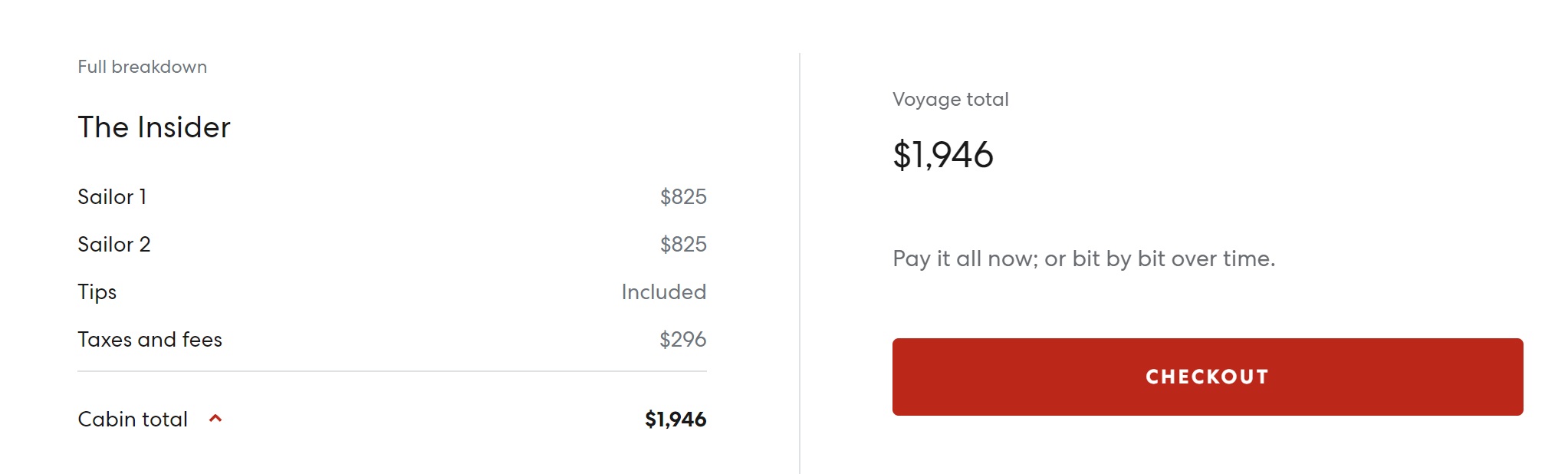

The Bilt 50% off code takes half off the “original” price of $1650 per passenger. You’re still on the hook for full taxes & fees of course.

As you can see, the Bilt discount isn’t 50% off of the currently advertised fare, but the discount is nonetheless quite substantial — in this one example, a couple would save more than $800 on the above cruise. That’s no small potatoes discount.

Some of the Caribbean cruises on the docket during the rest of this year become very affordable for those interested in trying out Virgin Voyages. Frankly, I’d be tempted to book one of the Caribbean cruises just to check it out if I were looking to plan a getaway with just my wife. Keep in mind that Virgin Voyages cruises are adults-only.

While this specific deal won’t appeal to everyone, I find it exciting that Bilt has partnered with a popular loyalty program to offer a substantial discount on something that certainly will be of value to many members. The limited-time nature on this deal tells me that Bilt has more up its sleeve and I’m excited to see what other broadly-available deals come about for those loyalty members who do not have a Bilt Mastercard.

On that note, this Virgin Voyages discount is available to all Bilt Rewards members. In other words, you do not need the Bilt Mastercard to get the discount code. All you need to do is head over to the “Rent Day” tab in the Bilt Rewards app for instructions on creating and linking your Virgin account and then you can find info about the discount code in the app (it is said that you’ll receive the code via email, but I found it in the app first).

Note that I didn’t find linking my Virgin account to be entirely intuitive. Bilt Rewards (like Capital One) partners with Virgin Red, which is sort of like a hub account that you link with your Virgin Atlantic Flying Club account. You’ll need to set up a Virgin Red account here and during the account setup process you’ll be prompted to link your Virgin Atlantic Flying Club account number (make sure your name and date of birth match your Virgin Red account).

Then, in the Bilt app, head to the “Travel” tab and scroll down to the transfer partners section to link your Virgin Red account. While the Bilt app prompts you to enter your Virgin Atlantic Flying Club number or your Virgin Red ID, I got an error when entering my Virgin Atlantic Flying Club number saying my account was not found. I had to go into my Virgin Red account profile to find my Virgin Red ID (which is a string of random words). I was able to link with that Virgin Red ID and I received 500 Bilt points almost immediately. Speaking of that . . .

Get 500 free Bilt points for linking your Virgin Red account

For a limited time, when you link your Virgin account with your Bilt Rewards account, you’ll receive 500 free Bilt points. I believe this should stack on top of the 100 points you ordinarily receive for linking a rewards program, though only the 500 bonus points posted to my Bilt account immediately. Still, I was happy to earn 500 cheap / easy / free points.

SoulCycle “bring a friend” benefit

On the first of the month (“Rent Day”), Bilt Rewards members will be able to book a special class where they can bring a friend for free at 50 SoulCycle locations. I believe that bookings open on Mondays at noon, so you’ll presumably need to book for the 1st of the month on the Monday preceding it in order to take advantage of this. I have no idea off the top of my head how much this is worth, but for those who can take advantage I’m sure it’ll be a nice benefit.

Bilt trivia and contests for points and free rent

Finally, on Rent Day, Bilt will be offering opportunities to win free Bilt points or possibly even free rent. You’ll wan to head over to BiltRewards.com/RentDay on October 1st for more details about how to enter. Bilt will be offering a Bilt Point Quest TikTok virtual trivia game with an opportunity to answer a series of questions for 350 free Bilt points on October first, so you’ll want to check it out for what will presumably be some more easy points.

Bottom line

I really like that Bilt is getting creative with its offerings. The double rewards on rent day won’t move the needle for everyone, but it is hard to argue with 6x transferable points on dining, whether you’re planning a big dinner on the first of the month or you can buy a gift card at a restaurant to sort of time-shift your spend for the first of the month. Double points on unbonused purchases could also be a great deal as there aren’t otherwise straightforward ways to earn 2x Hyatt, United or American Airlines points on all types of unbonused purchases (sure, you could buy gift cards and then use them for unbonused spend, but this isn’t always practical with larger purchases or items where you may want to make a return or have credit card protections). The Virgin Voyages discounts could be awesome for someone who was already tempted to try a Virgin cruise, and overall I like the idea of monthly offerings on rent day that will make Bilt Rewards worth keeping top of mind at the beginning of every month since other offers will presumably launch each month — and not just for cardholders, but for anyone who joins Bilt Rewards.

Some nitpicking: it’s a 27 hour period from 12am ET through 11:59pm PT

I still can’t get my Virgin account linked. At first I tried to link using my Flying Club number like Nick did and got the error. But then when I tried to use my Virgin Red ID, it would take me to a different page with an error, and now whenever I click on “Link existing account” it just gives me an error that says “Whoops! Something went wrong. Please come back later or try again”

This Rent Day is the first promo Bilt has had that I might actually use. There are a couple restaurants that I go to for lunch once a week, so I might just start getting gift cards to them on the first of the month to get 6x Bilt points instead of 4x Amex on the Gold. And then maybe I’ll start paying otherwise unbonused bills on the first with Bilt instead of the Citi Double Cash to diversify my points since my Citi balance is higher.

I had the same problem and submitted a help ticket with Virgin Red. It took them several tries to fix it but they eventually did and they were very good about regular communication over email.

@Richard Kerr or @Nick Reyes, does “Travel expense” include Uber/Lyft, public transit? Thanks in advance.

Rent Day? More like Estimated Tax Day.

Is the 5 monthly purchases required for a calendar month or statement month? I’ve been looking around and haven’t found the answer.

I also get nervous with a 24 hour window because some purchases don’t post until a couple days later. I hope the Bilt system is smart enough to differentiate (or have memory of when a transaction first went pending).

Statement period

Also funny that Kerr monitors all these blogs and comments on them. Its like they’ve been paid to post and he knows who will post favorably about them and jumps on the opportunity to comment about how AMAZING his non-starter of a card it. Zzzzzzzz.

Bilt shilling again… No disclosure of going on that all expenses paid trip in exchange for favorable coverage. Come on guys… you are better than this!!!

We don’t normally display disclosures on pages that don’t include affiliate links, but I went ahead and turned on our disclosure here because of the strange sensitivity some readers seem to have to coverage about it. For the record, I don’t believe for a second that our coverage is biased due to gifts or compensation from Bilt. Sure. for people who ms or people who earn points primarily through signup bonuses, Bilt is not interesting. Fine. But the vast majority of our readers don’t fit those profiles. And for those who don’t do those things, and especially for those who pay rent, Bilt is very interesting. I’ve personally recommended it to good friends. If you pay rent and if you’re not constantly signing up for new cards, you’d be crazy not to get Bilt.

You had a good explanation of your relationship with Bilt (that you have received all expenses paid trip etc) and now have just changed that to say “We have a business relationship with Bilt”

What was the reason for the change in wording? Did Mr. Kerr tell you to take down the exact wording that you previously had? Wouldn’t be surprised if he did. “Fully loaded blog disclosing that we gave them something- 33.5 secs to remove it”

LOL, if Bilt tried to tell us what to write or not to write we would end our business relationship with them immediately. The reason I changed it is that we realized that the description made it sound like Bilt has more influence on our business than it does. Compared to just about any other business relationship we have, Bilt is nothing. If Bilt disappeared completely overnight it would have no affect on our business projections at all.

I’m sure I’m not the only one connecting the dots on how useful the Curve card’s “Go Back In Time” feature will be to leverage and maximize Bilt’s Rent Day!

I love how these bloggers keep talking about this card when they were heavily compensated to do so. Yet they dont provide ANY appropriate coverage about the multiple shutdown reports with this card.

No one using the card as intended has been shut down. If you have, send me a message anytime.

I am sure that is the case; but this is a blog that proudly advertises giftcards.com deals and the like. They have a responsibility to their readers to responsibly report what is “inappropriate use” and shutdown reports. Its the right thing to do and if they have integrity they would do it. My concern is that they are not reporting this information because it would jeopardize whatever future island retreats/compensation from the cards creators.

For the record, I do not hold the card, nor have I been shutdown – I just heard the reports/rumblings and didnt put an application through.

As a regular reader, you should trust Nick, Greg and team to tell the fair and honest truth as they always do.

Why don’t you enumerate the instances of Bilt shutdowns you know about right here in this thread to educate both the Frequent Miler team and those of us who are considering the card (or, in my case, considering recommending it)?

In the absence of any such actual cases, there’s nothing for Frequent Miler to “responsibly report”.

The shutdowns were in relation to gift card purchases on the card like fluz. They were implicitly acknowledged by Mr. Kerr’s comments above.

Also, could you post any information you have on the “heavily compensated” statement you made? Would definitely be interested to know about that.

There was some controversy about this back in April/May. I have no problem with blogs making CC affiliate money; but it should be disclosed. Happy to post a link with permission.

Just out of curiosity, Tom, how do you imagine that we’re making affiliate money off of this post when there’s no affiliate links in it?

Prepaid with that Moskito Island trip they went on. Come on guys. You are normally so good at saying when a link is affiliate or not- why not do a post on that trip, what Kerr requires you to say in these posts, the punishment for bad press on Bilt and why you are literally bedding them for coverage. Good ol’ boys club?

You mean like this one? https://frequentmiler.com/blogging-and-accepting-gifts-on-gregs-mind/

I’ve also noticed that you make the same comments when Stephen and I write about Bilt, even though we weren’t on the trip that it seems like you think has FM’s coverage in Bilt’s pocket. I can gaurantee you that I’ve never recieved a penny from Bilt and have never been told to write anything about Bilt by anyone else at FM.

In the last 30 days, we’ve written over 50x the amount of posts on Amex and 40x the amount of posts covering Chase as we have on Bilt. Why the sensitivity here? You seem to trust FM when it comes to waaaaayyy larger affiliates than Bilt, but not with posts on Bilt..even here when there’s literally no affiliate link and thus no way to get paid from it.

I’m honestly confused about the Bilt hate (and how you seem to apply it to FM) even though you trust us to be fair and honest with much bigger fish (and justifiably in my opinion…the firewall that Greg has between affiliates and what we write is incredible).

I’m not aware of multiple shutdown reports.. Where have you seen them? I haven’t seen any in our Facebook group or in comments on our many posts about Bilt. I’m not saying they don’t exist, just that I haven’t seen them. Always possible I’ve missed something (I definitely don’t read every website every day and in fact often don’t have time to comb through info elsewhere at all unless someone points out something particularly notable), but I know many people who have the card and haven’t heard of any of them being shut down. I don’t know anyone MSing on any card at 1x, so I’m not sure where Giftcards.com deals are relevant here or why anyone would be buying them at 1x, but if that’s a known shutdown trigger with Bilt I’d be interested in knowing it.

Sorry. Didn’t realize Richard K was Richard Kerr, and hope he is still following. What I was really asking was whether paying taxes on the first day of the month would work long term and yield 2x spending that could be applied to Hyatt. Richard said no one has been shut down who has been using the card “as intended”. Would using the card only on the first day of the month and only for nonbonused spending and for no rent payments (since I own my house) constitute using the card “as intended”? Understand I may have posed the question not as clearly as I could have, but that is where I am going with it. Makes the difference between a card that would be useless to me and a card that could be quite useful.

Trying to get my head around this. So if I paid $5000 of estimated federal or state taxes on the first day of the month, I would earn the equivalent of 10,000 Hyatt points? That would absolutely beat CFU and could be worth it to me (combined with four small additions to my Amazon gift card to get to five monthly transactions). Am I missing anything?

6x on dining and 4X on travel

Straight from the article: “For a 24-hour period on the 1st of each calendar month, Bilt will offer members with the Bilt Mastercard double points on all non-rent purchases.”

Yes, I think you asked “am I missing anything?” and Richard responded to that with “6x dining and 4x travel”. But yes, I expected estimated tax payments would work.

Did you read your own promo? Why did you fail to mention the 2x on all other spending?

Hi Richard – I’m a little late to the Bilt party. I didn’t understand how easier it is to earn AA miles by using your credit card feature over any other card option. Citi AA offers 2x dining, Barclays 1x, Bilt 3x & 6x during Rent Day & 5x during 5×5 period (via transfer); Citi/Barclays 2x AA purchases, Bilt 2x & 4x Rent Day/Bonus Periods & 5x during 5×5 period; Citi/Barclays 1x Non-Bonus spend, Bilt 1x & 2x on Rent Day/Bonus Periods & 5x during 5×5 period. DSK helped me on my path to enlightenment so I signed up for your card & just earned 50,000 AA miles,

There are so many AA haters on travel blogs. I chalk much of it up to because they are the hardest points to accumulate whether thru SUBs (cc app restrictions) or spend (above) & that frustrates & annoys the churn & burners. So I understand not a big push from blog writers to really lay out the AA point accumulation potential of your card. That & a lot of your promos are only that – no guarantees in your contracts if you maybe apply for the card at the wrong time (Rent Day/Bonus Weeks/5×5 perhaps yanked?). You should be making a much bigger deal out of Bilt’s 1x for HOA fees – icing on the cake for so many of us with large fees

Just want to say I really like your card & features. You threw in a little excitement to the otherwise rather staid world of financial tools. The Welcome Kit is a great reflection of that & your brand.

What I want to know (since you monitor these sites) is whether Amazon small reloads are allowed towards the 5 transactions or does that subject a cardholder to shutdown? You seem pretty itchy to shut down & what I read sounds like a violation of Wells Section 3 T&Cs but maybe not, please let me know & thanks:

“Cardholders may not separate qualifying net purchases or rent payments into multiple transactions for the purpose of earning more points than would otherwise be available through a single transaction.”

For a second i thought this would finally entice me to get the card until i realized it doesn’t apply to rent. Why do they call it “rent day” when it literally applies to everything EXCEPT rent? Who approved that?

Rent day is even more rewarding

Mr Kerr that doesn’t answer the question at all. Why is it called rent day when you earn double points on everything except rent? It should be called “double everything but rent” day. I was so excited at first when i saw “rent day” and “double points” but then was disappointed. These card still is still not worth getting when you can’t even offer a 10,000 sign up bonus. I will just continue to use my rent payments to generate new SUB on other cards.

It’s strange that one of the card’s creators takes the time to respond to questions online, but then gives corporate non-answers.

“Rent Day” is a common phrase referring to the day of the month, frequently (but not always) the first of the month, on which rent is due.

Because the first of the month is colloquially known as “rent day” in much/most of the US. And that’s Bilt’s shtick…points on rent.

Also, it’s probably a bit unreasonable to expect double points on rent. I wouldn’t expect them to give double points on a charge they’re already certainly losing money on.

Nick, Is American Airlines a permanent transfer partner with Bilt or just a temporary partner?

Permanent