Chase has been steadily hacking away at the value of its Pay Yourself Back (PYB) Program over the last year or so, whittling down both categories and redemption rates on Ultimate Reward(UR)-earning cards. At the same time, it has added PYB options for Southwest, Aeroplan and United cards, although the value for redeeming Southwest points is poor.

Previously, Ink cardholders could redeem points for 1.1-1.25 cents each towards cable, internet, phone services and shipping. Those categories are all gone now, leaving “select” charities as the last soldier standing (like it is with the Freedom cards). It’s a shame to see the program for UR-earning cards getting so degraded. I don’t really see much value for anything outside of the Sapphire Reserve or for booking travel through the Chase portal.

What is Chase Pay Yourself Back?

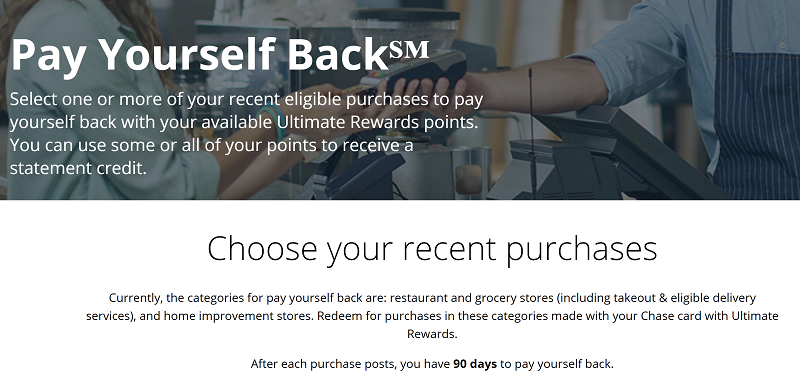

Chase has a useful benefit for select cardholders called “Pay Yourself Back”. The basic idea is that you can exchange your Chase Ultimate Rewards points for statement credits against certain categories of purchases. Here’s the link to use this feature yourself.

The best use for Ultimate Rewards points (besides transferring points to high value travel partners) is to book travel through the Chase travel portal. Sapphire Reserve cardholders get 1.5 cents per point value this way. Sapphire Preferred and Ink Business Preferred cardholders get 1.25 cents per point value.

The Pay Yourself Back feature does provide some value for everyday purchases, although it’s somewhat diminished with the new, lower redemption rates. For example, if you’re a Sapphire Reserve cardholder, you can use your card at wholesale clubs and later exchange your points to pay off those charges at 1.25 cents per point value.

Using these Pay Yourself Back categories, Chase’s Ultimate Rewards cards can become more like super-charged cash back cards. You’ll still have the ability to transfer points to travel partners, but you can also cash out points for certain charges instead.

Pay Yourself Back categories for eligible Chase credit cards

Sapphire Reserve

Redeem points for 1.25 cents each to pay back the following charges:

- Wholesale Clubs: Through 6/30/24

- Pet Supply Stores & Services: Through 6/30/24

- Gas Stations: Through 12/31/24

- Select Charities: Through 12/31/24 (still at 1.5 cents per point)

American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corps (also aiding efforts in Ukraine), Leadership Conference Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen (also aiding efforts in Ukraine). - Annual membership fee: Through 12/31/24

- Expired Options:

- Grocery stores (3/31/24)

- Restaurants and dining (12/31/22)

- Airbnb (12/31/22)

Sapphire Preferred

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/24

American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corps (also aiding efforts in Ukraine), Leadership Conference Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen (also aiding efforts in Ukraine).

Freedom Cards (Unlimited, Flex, Visa)

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/24

American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corps (also aiding efforts in Ukraine), Leadership Conference Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen (also aiding efforts in Ukraine). - Expired Options:

- Dining (includes restaurants and food delivery service): ended 9/30/21

Ink Business Preferred, Ink Plus

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/24

American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corps (also aiding efforts in Ukraine), Leadership Conference Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen (also aiding efforts in Ukraine). - Expired Options:

- Internet, Cable, Phone Services: ended 6/30/23

- Shipping: ended 6/30/23

- Select Advertising: ended 3/31/22

Ink Business Cash, Ink Business Unlimited

Redeem points for 1.25 cents each to pay back the following charges:

- Select Charities: Through 12/31/24

American Red Cross, Equal Justice Initiative, Feeding America, Habitat for Humanity, International Medical Corps (also aiding efforts in Ukraine), Leadership Conference Education Fund, NAACP Legal Defense and Education Fund, National Urban League, Thurgood Marshall College Fund, United Negro College Fund, United Way, World Central Kitchen (also aiding efforts in Ukraine).

- Expired Options:

- Internet, Cable, Phone Services: ended 6/30/23

- Shipping: ended 6/30/23

Aeroplan Card

Redeem points for 1.25 cents each to pay back the following charges:

- Travel Purchases: Through 12/31/24

- Annual membership fee: No end date

Southwest Cards

Redeem points for 1 cent each to pay back the following charges:

- Annual Fee: No end date

Redeem points for 0.8 cents each to pay back the following charges:

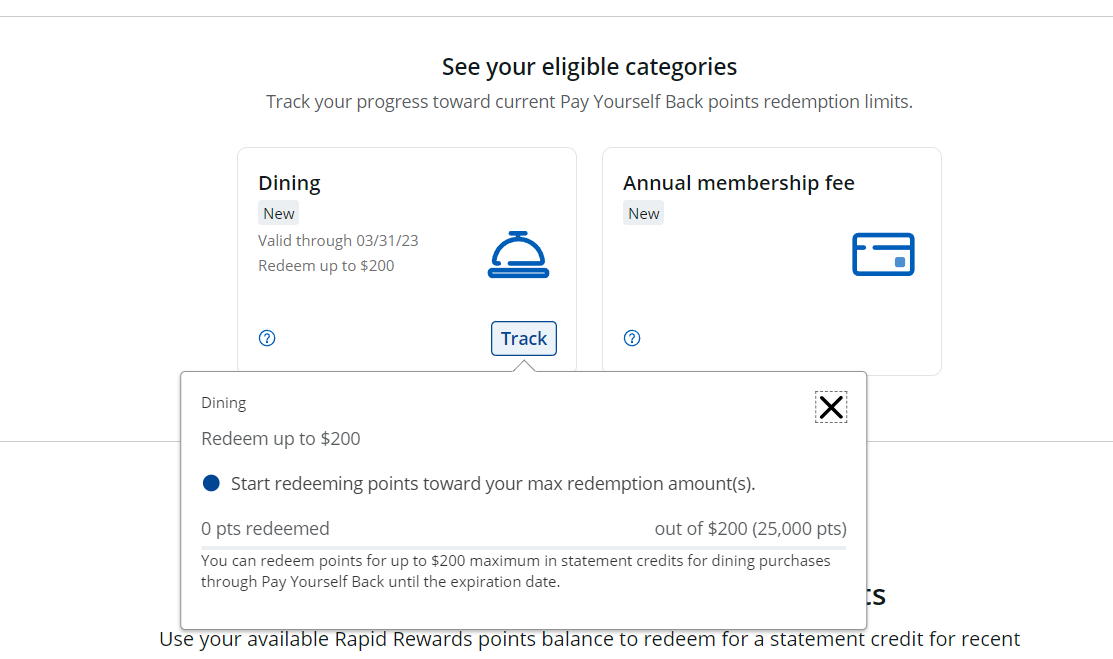

- Dining ($200 maximum, in total credits)

- Groceries (personal cards only, $200 maximum, in total credits)

- Gas (business cards only, $200 maximum, in total credits)

United Cards

Redeem points for 1.5-1.75 cents each to pay back the following charges:

- Annual Fee: No end date

How to use Chase Pay Yourself Back

Note: This example is from the time when this feature first debuted. Grocery & dining purchases were both valid categories at that time and the redemption level was still 1.5 cents per point.

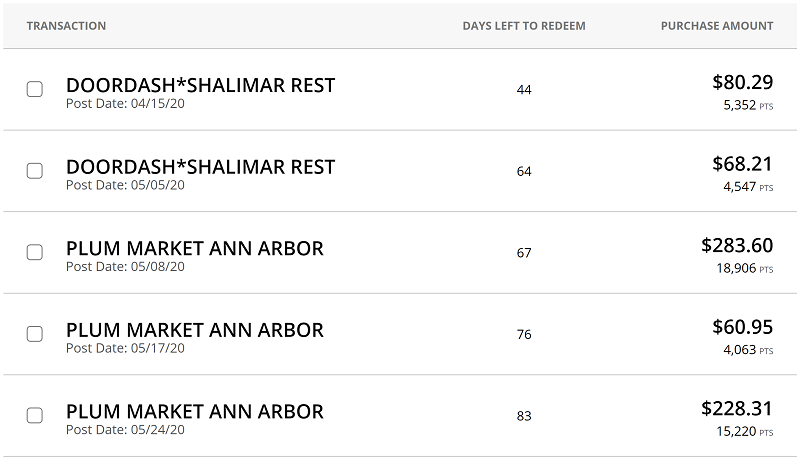

When I logged into my Chase account and browsed to Chase’s Pay Yourself Back page, I found a number of qualifying purchases. I had a couple of DoorDash purchases and a few grocery purchases:

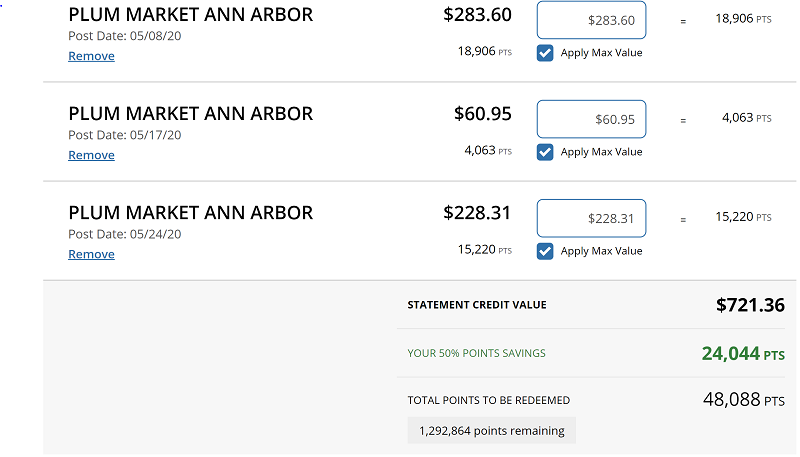

I selected each of the above purchases and then had the opportunity to enter how much of each purchase should be paid back with points. In each case, I selected “Apply Max Value”. I was a little concerned that it might be better to pick a round number to get full point value, but that concern was unfounded. Chase rounded up the value of the points in my favor. Take, for example, the $283.60 grocery purchase at Plum Market. 28,360 cents divided by 1.5 = 18,906.67. One would expect Chase to round that up to 18,907 to determine how many points were required. Instead, they rounded down to 18,906. Cool.

Chase Pay Yourself Back FAQ

How often does Chase change the eligible categories?

Originally, Pay Yourself Back was offered only through September 30, 2020. Then it was extended through April 30, 2021. Now, Chase extends the program every quarter and with each extension we see some changes such as which types of expenses can be used.

Can I transfer points between Chase cards to get better redemption value?

Yes. Points earned on other Chase cards can be moved to your Sapphire Reserve or Ink Business Preferred account in order to get more value. So, if you consider that this feature makes it easy to cash out Sapphire Reserve points at 1.25 cents each, then we can calculate the cash back equivalent earnings of each Ultimate Rewards card by multiplying the earnings rate by 1.25. For example, the Sapphire Reserve card earns 3X for travel & dining, so it now earns the equivalent of 3 x 1.25 = 3.75% cash back for groceries and gas. Similarly, the Freedom Unlimited card earns 1.5X everywhere (in addition to its 3X and 5X categories), so by transferring those points to your Sapphire Reserve, it now earns the equivalent of at least 1.5 x 1.25 = 1.875% cash back everywhere.

Can I use Pay Yourself Back for purchases made on previous statements?

Yes, Chase’s Pay Yourself Back can be used for transactions within the past 90 days.

Do I earn points for purchases that are paid back using Ultimate Rewards?

Yes. Erasing purchases does not cause Chase to pull back the points earned on those purchases.

Where can I find more information about Pay Yourself Back?

Chase’s Pay Yourself Back FAQ Can Be Found Here.

[…] Another program was “enhanced” smh…if you are keeping notes: Cathay Pacific Flight Reward Devaluation On October 1, 2023. Also, Chase continues to steadily diminish its “Pay Yourself Back” benefit… […]

This is the biggest bait and switch in the points and miles game in the past 5 years. Earn UR worth 1.5c. I mean 1.25c. I mean..

“

Sapphire Preferred

Redeem points for 1.1 cent each to pay back the following charges:

Grocery Stores: Through 9/30/23

Gas Stations: Through 9/30/23

“

Is this rate targeted? My account shows 1cpp for these categories.

Nope, that’s a typo. Fixed it.

[…] Chase Pay Yourself Back devalued redemptions on Ink cards, but so far not others […]

Now that Bilt has Hyatt, IHG, and United as transfer partners, what unique value-add does Chase have left? Greg? Nick?

Lots of different sign up bonuses on personal and business cards. No sign up bonus on the Bilt card and the multipliers are in line with the Chase setup so if you already have the Chase “trifecta/quadfecta” you aren’t going to switch over to Bilt.

I said “unique value-add.” Amex has SUBs. Capital One has SUBs. Citi has SUBs. A person can spend one’s time on any platform earning SUBs. So, I again ask, what unique value-add does Chase have left? Chase’s earn rates are mediocre. The only “unique” transfer partner Chase has is Southwest.

Regarding Bilt, if you don’t get it, you don’t get it.

Best of luck.

You can earn 100,000 Hyatt points by spending $8,000 on the Chase Ink Preferred right now. And afterwards you can get another SUB on the Chase Ink Cash, Chase Ink Preferred etc…. or whatever is elevated – rinse and repeat.

How much are you spending on your Bilt card to get 100,000 Hyatt points?

Bilt might make sense to people who get a handful of cards and then just use them repeatedly to earn points but for people who are actually want to earn points quickly via churning, it makes little sense.

Best of luck.

I use all my Chase points for International Rescue Committee donations. We have more refugees than at any time since WWII and IRC does fantastic work–best group out there. They also help Ukrainian refugees so you can highlight them as you do for similar Ukraine-related ones.

[…] Chase will give you $900 in free groceries (minus the credit card annual $95 fee). So, do the math! Chase “Pay Yourself Back” Complete Guide (Categories Extended). And please do not waste your points donating to charities this way, just donate cash to them (or, […]

What a downgrade. The benefit of this feature is that you can redeem equivalent to redeeming with Chase travel. The drawback is that the categories have become less useful. Redeeming for restaurants as that category was one that earned the most on the card was a good deal, but probably was too costly for the bank.

Chase made another change in the past week or two that again devalued this. My wife and I have many Chase cards and both have our own CSR (not just an additional card on one account). We also both have old Ink Cash cards for our businesses. Suddenly, this week we can no longer tranfer points from our Chase Ink Cash cards to any of our other cards–I cannot even transfer points to my other Ink business cards. I can still transfer from the Ink Business Ultimate card to any other account, but both of our Ink Cash cards are now orphaned as far as point transfers. Transfers for these cards has worked for many years until the past week or so.

Do you have an old Ink Plus card? The Ink cash card is still available. The Ink Cash card can transfer to the CSR.

PS I was able to “combine” my points using my Ink Cash and CSR this evening.

It says Ink “Business Cash”, but it is an old card. We have had these cards since they started issuing them (originally, it was just the “green” business card from Chase when we got them over twenty years ago). Over time, Chase converted them to the Ink “Business Cash” cards. It is the card that gets 5x on phone/internet/office supply stores.

I think some cards you may have to call the card services to have them manually transfer the points for you

Great info, AS ALWAYS. Do you have a similar guide on which cards allow transfer of points to partner airlines/ hotels?

I know these do:

CSR, CSP, the old Ink that’s no longer available.

Amex Plats, both EveryDay

The Chase Ink Preferred cards can transfer to partners. Capital One Venture cards and the Citi Premier card can transfer to their respective partners.

Any membership reward earning card can transfer to Amex’s partners.

Thank you!

Does anyone know if the PYB function on Chase’s United cards has also been devalued? When they first rolled it out, you could pay your annual fee on at least some of the cards using United miles at 1.5 cpp.

This is highway robbery! I signed up for this card with the huge fee and used it with the idea of using my points to pay myself back. So this is a 16% devaluation of my points’ nominal value. What’s next .75c per point?

I’m sure they’ve written the terms so they can do that; however they’ve created a fiat currency, advertised its valued and devalued it in a classic bait and switch! The telltale? NO categories for value (only charitable contributions) at the advertised 1.5cpp and ZERO notice.

Congress and the CFPB need to step in. Hell what does the Treasury think of companies creating what are effectively currencies? Probably ok while they weren’t being devalued. Time for the blind eye to stop.

I’m hopping mad and I’m sure I’m not the only one.

The only place this doesn’t totally suck is transferring from ink 5x on gift cards at office supply when $0 fee promos running, still get 6.25% instead of 7.5%

Dear Nick or Greg – we are only about 10 days away from the 50% Dining bonus on the Reserve expiring. Any idea if it will be extended again? Thank you

Reported elsewhere that it will be reduced to 25%. Grocery shopping added.

PS Rumor at the moment.

What did you buy for groceries $283