Last week, members on Flyertalk began reporting a stealth devaluation that we first saw reported at Loyalty Lobby: Hilton has devalued without notice, increasing the price of a standard room award at some top properties from 95K per to either 110K or as high as 120K points per night. It’s very disappointing that this happened without any notice or announcement and was instead uncovered by members and shared on Flyertalk.

Dynamic pricing = easy stealth devaluations

This change happened last week, but we hadn’t previously reported it and we realized it was worth a quick post to alert readers who might have missed the news last week.

This devaluation (and indeed this post) highlights the downside of dynamic award pricing: programs can re-price awards at will and we are left to figure out what happened on our own. While I’m sure that some readers read this story elsewhere last week, I am equally sure that there are likely many who didn’t see it reported on blogs and would otherwise get an unpleasant surprise when they went to book their next trip.

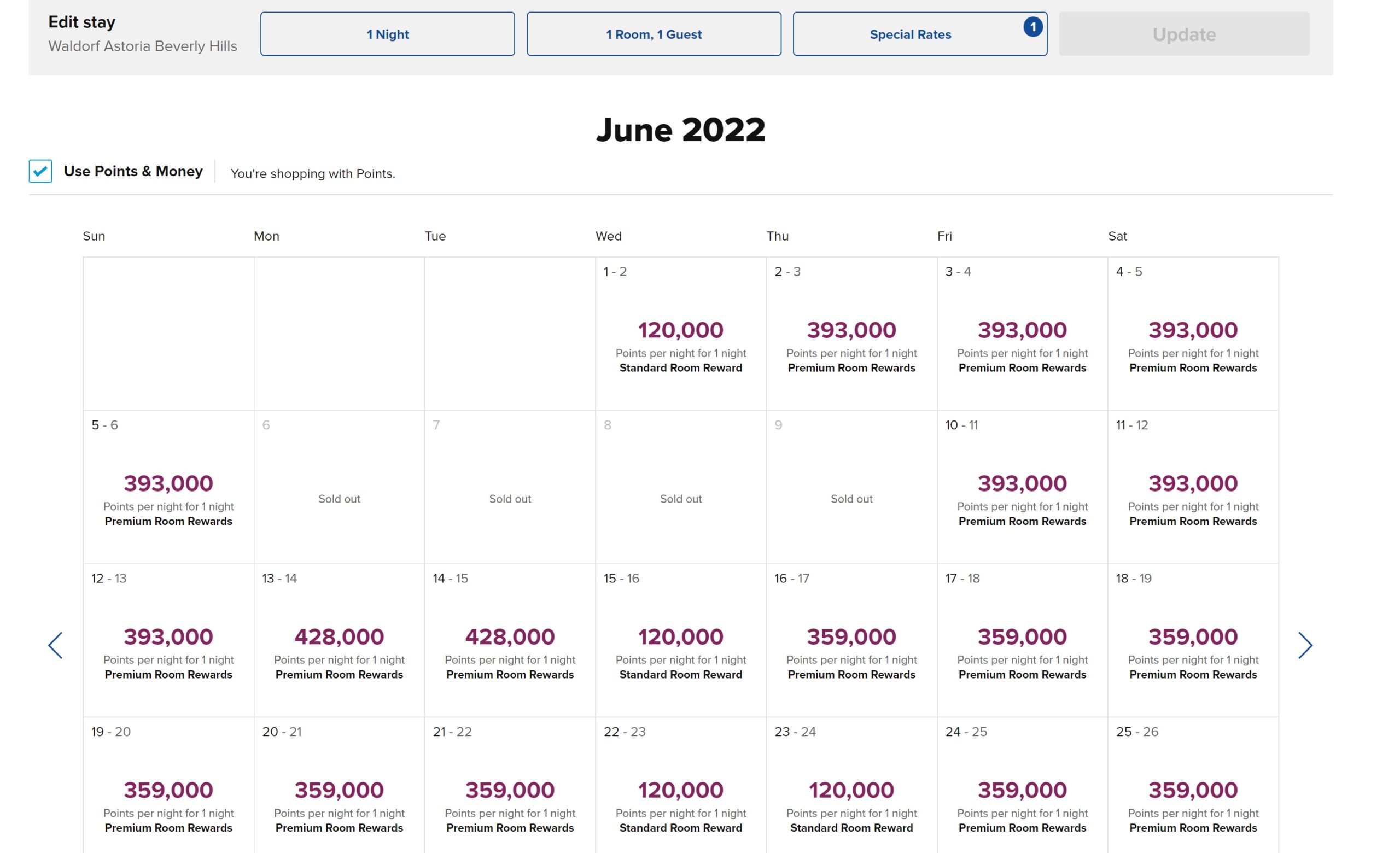

Equally frustrating is that we don’t yet know how many properties were affected by this change. Loyalty Lobby reported on this devaluation effecting the Conrad Maldives, Mango House Seychelles, Roku Kyoto, Grand Wailea, and Wadorf-Astoria Amsterdam, though I also noticed the 120K-per-night pricing at properties like the Waldorf-Astoria Beverly Hills:

I’m sure there are more examples like this waiting to be found. To my knowledge, Hilton hasn’t made any official announcement but rather just quietly changed award pricing at a handful of properties.

Keep in mind that free night certificates should still work even with this elevated pricing as those certificates are valid for a standard room award, regardless of the standard room award price (though you won’t be able to book a premium room award with a free night certificate).

Again, the difficulty of dynamic pricing is that it is very challenging to catch devaluations. This one got picked up because it broke through the program’s ceiling, but it is far easier to raise award prices at properties in the middle where the top and bottom end of the pricing range is more opaque.

For example, I stayed at the Conrad London St James a couple of years ago for about 66K points per night and I’ve used it in example posts in that price range a few times. Today the cheapest nights I saw in a quick search were 80K points per night. It is certainly possible that we’ll see award rates drop when prices decrease, but I won’t hold my breath.

If you’re searching a multi-night stay, keep in mind that you may need to search nights separately as there are sometimes slight differences in the room type of the available standard room and the website prices things strangely when there are different prices for the nights of your stay and you might even save points by staying more nights.

Sulia House Local Porto Rotondo – Sardinia. Point rates also well above 150,000 / night on the calendar. Some at 220,000+

Loyalty programs are a thing of the past. There was a time when companies valued loyalty. Now they only care about maximizing cash flow. Their MBA’s say this the correct way to do business. As long as everyone does it they can vote with our feet. Why did loyalty programs ever start? It was because there was in value in getting and keeping customers. Now that the only thing that matters is cashflow there is no need to maintain customer loyalty. In the new paradigm the customer is viewed as a “mark.” Get what you can and move on. This creates the opportunity for new businesses to come in and do it better. That is what capitalism is really all about. That value in returning customers was built up as part of the “good will” of an operation business. The companies who buy into demand pricing and cash flow analysis alone ignore that the “profits” they are seeing are eating into the good will value of the company. Eventually they loose customers, and they they have to figure out how to get customers to come back, but the only way is to compete on price and their statistics start to look bad. Many big companies have been brought low by thinking that the loyalty doesn’t have a value GM and GE come to mind. When the bean counters run the business it won’t be long before things get screwed up. Just ask the US auto industry who until the 70’s ran the world for cars but got kicked to the curb by Toyota, Honda, and Nissan. And they had terrific loyalty, I’m a Chevy guy, or I’m a Ford guy…But, a lot of people switched to Japanese cars anyway.

If and when Hilton and Marriot see their bottom line adversely effected…. we will see if they catch it in time or their businesses will have lost the customers forever.

You confused me longer than I’d like to admit by linking to the same article twice. You meant for your second link to point to this article:

https://frequentmiler.com/save-hilton-points-with-longer-stays/

This is ancient history, but my family and I vacationed at the Hilton Waikoloa Village on the Kona Coast of the “Big Island” in the summers of 2001 and 2004 We had back to back stays in each of these summers, and it only cost 100,000 HHonors points for each 6 night stay. I stopped staying at Hilton properties several years ago due to the devaluation of Hhonors points. I find myself more frequently staying at Marriott properties now, and I am currently using my Marriott Bonvoy credit card for most of my purchases. This may change since it appears that Marriott may soon be devaluing their points.

Conrad Centennial Singapore – booked 5 nights (using 5th night free) in May. 60k/night, so 5 nights (S,M,T,W,Th) = 240k or 48k/night. Fri & Sat are 124k & 130k, which is more than double the weekday rate — crazy!!!

it’s like Vegas! Su-Th often super cheap. Come Fri & Sat…

When their basic hotels are consistently 60k+ per night..,what do you expect? Only “value” of their points has been for their exorbitantly priced hotels for a while.

Hilton Paris Opera was 80k now 205k for a basic room. 1 night 205k.

Just saying, the Conrad st James has been in the 80k range for a few years. Commonly being priced at 85k. No devaluation there.

If tier status benefits are unreliable and inconsistent, one might look at hotel loyalty programs solely as a game of points. And, if we did that — play along with me — what’s the worth thing that can happen? Never mind dynamic pricing. I’d say it would be that Hilton or Hyatt or Marriott or whichever sets points at a fixed value. A fixed value that none of us cares for. That’s their nuclear option. Pray they don’t go down that road. But, don’t be surprised if it happens at some point. You heard it here first.

Total BS. Hilton is a total douche. Marriott will soon join this BS as well. Time to ramp up MS to beat them.

I agree with the sentiment that it is frustrating not knowing how many properties are affected. The aspirational properties, such as the ones listed, stand out when changes to the standard redemption rates are made, but it is less noticable when changes are made to the multitude of mid-tier hotels, unless one is familar with booking a particular hotel. To add to this confusion, it has always been unclear to me when or why a hotel will be priced at the “standard” points rate, or when the redemption rate will be lowered due to the dynamic pricing model based on a lower cash room rate. Sometimes dynamic pricing kicks that results in a lower point rate, sometimes the point rate doesn’t go down correspondingly when cash rates are low. As an example, I routinely check the Hilton hotels in London. Two of my personal favorites, the London Bankside and London Tower Bridge, have shifted over the last couple of months from a 60,000 standard rate to a 70,000 standard rate, and lower dyanmic point redemption rates at these properties are also much less prevalent even when there are low cash room rates. The same is true accross the board for many London Hilton hotels (although, for what it’s worth, my observation has been that the Conrad has been at 80,000 for some time). I actually think the devaluation is a lot more comprensive and ongoing, and doesn’t just affect the aspirational properties. Perhaps an imperfect comparison, but it would be like Hyatt moving up the categories of not just a bunch of Park Hyatts, but also a multitude of category 3 and 4 and 5 hotels.

If Hilton uses the same methodology at Marriott, then here’s how it works.

For a given property, an algorithm is run monthly to recalculate point prices (for the entire ensuing twelve months — being stepped one month in each successive month) and they are typically updated around the 5th to the 10th of the following month. For example, it is now March 2022, so the algorithm is calculating April 2022 to March 2023 points prices — which will be updated in early April 2022.

The algorithm is based on Bayesian statistics, which starts with historical data. From that historical data, it establishes a baseline price for each room type on April 1st, April 2nd, April 3rd . . . March 31st. Analysts determine that certain variables have influenced in the past and determine how sensitive prices are to those variables. They then plug in the current values for those variables, which then adjusts the baseline points price. These variables can be of nominal, ordinal, interval, and range data types.

In short, it’s data geeks who set the prices.

Reno Joe must have been the kid in school that was good at math. Seriously, this is a great post. This guy gets it.

Thanks. This information came directly from a Marriott EVP.

I’m not a fan of all the devaluations, however the USD is devaluing at +7% due to inflation. I think the real question is how does all of these hotel point devaluations line up versus cash prices.

Is there really any trust left with Hilton after they’ve been devaluing for years and even got rid of the breakfast benefit?

Assuming you guys will reassess the value of a Hilton point now that this is going on.

Why does anyone want to show any loyalty at all to Hilton or Marriott?

When Amex devalues, I’m out of the hobby.

Didn’t Amex just devalue when Hilton did since they’re a transfer partner?

Anyone transferring MR to Hilton deserves to die on my sword…..oh sorry, I’m watching season 4 of The Last Kingdom.

At the hotels the blog speak to there is good value transferring to Hilton. For March 18-19 the Contad Maldives is $1290 net or $1600 gross per night. At 120k points that is 1.3 cent per Hilton point or 2.6 Amex MR point. Not bad, but a devaluation since at 95 k Hilton points it gave an Amex value of 3.4 cent per MR point.

There has been value in Amex to Hilton transfers at the high end hotels but it has been greatly devalued.

There’s always an outlier one can use to make Hilton look good. Two points: 1) I’ve stayed at Conrad Maldives in an overwater bungalow for $385 per night so I’m sure I can do better than $1290.

2) Every time I look for a redemption at a hotel where I want to go, the nights are astronomically priced. Dynamic pricing = no loyalty

3) Maldives will bore you to tears

Ok so that’s 3 points. Hilton devalued my two points.

I’m not trying to make Hilton look good. I’m not a fan. I’ve stayed at the Conrad Maldives as many point enthusiasts have. It’s not a big deal. I was not bored to tears but I was bored nonetheless.

But my point is AMEX was devalued when Hilton devalued at the top end. The top end was the only place one could find transfer value. So it hit Amex when it did it on top tier properties.

Those $385 Conrad Maldives days I think are gone or available so selectively they’re of little value. You might knock a 1/3 off the price during off season, but most the year when people want to travel points are the way to go (in fact even in the off season at 1/3 off it is the way to go and offers value).

I understand you don’t see it as an Amex devaluation but this is a forum to share thoughts with a broader audience. There are many people who will see it as both a Hilton and Amex devaluation when looked at through a different perspective.