Last month, Greg published a post about why we should recognize the difference between the value we get out of our points versus the savings we get from using them (See: Stop telling me that “value” is what I would have been willing to pay). I understand and appreciate his core point: the “value” you got should be based on some sort of objective public price. The money you would have otherwise spent if you hadn’t redeemed the points is your “savings“. See his post for far more detail explaining the difference. But the point of the points (that is to say the point of our hobby) is to bring within reach those things that you wouldn’t otherwise buy, so I struggle a bit calculating both the value and the savings. In 2023, my family will take $100,000+ worth of vacations based on Greg’s definition of value. That’s insane. It’s hard even for me to believe that miles make that possible. But how much have we saved? Have we saved at all? I always struggle with that question and land somewhere between “yes, we have” and “no, we’ve spent” and “I don’t know how much”.

I think that a large part of the excitement this week over the fast track to Hyatt status stems from the chance to get something that would otherwise be unattainable for many of us. That type of opportunity is the kind of thing that has kept me highly engaged in this game. But am I fooling myself if drink the kool aid on value being related to the cash price of my redemptions? Does that cloud my judgment of savings?

I wrote a post the other day about How to get 57 free nights of vacation with a single credit card and a reader named DMoney picked a bone with me over my choice to use the word free when surely I recognize that most of it wasn’t free. They weren’t wrong. The truth is that it’s a little hard to fit “really highly discounted since you can cruise for 24 nights that won’t even require you to pay the port taxes and you can easily cash out the deposit they make you pay but you will have to pay port taxes on another cruise but nothing at all for most of the hotel nights” into a neat subject line, so I took a bit of a shortcut in wording the title knowing that I took more than six thousand words to explain all the detail in the post. But the point that we can’t look at this stuff as being free is nonetheless a good one and one that I’ve reflected upon plenty of times myself.

I’ve argued several times this year already and in years past also about how we should collectively think more critically about the value of our points and the cost of our redemptions (See: The rose-colored glasses come off and How much do you pay for your miles and points? for a couple of examples). To be clear, I don’t like to be a killjoy by highlighting / arguing how much a redemption costs you. This truth is that this hobby is full of joy for me.

We recently put together a map for our 5-year old son with pins for all of the “places he’s played”. If I’m being truthful, upon looking at it, the map initially seemed emptier to me than I expected despite the fact that it had 100 pins in it (there are still so many places to see!). At the same time, his map is worlds beyond what my own would have been even in my mid early 30s, so it’s a pretty good start at age five. But the key thing is that we never could have afforded to have brought him to the places he’s seen so far without miles and points (for those who will inevitably question why we’ve traveled far and wide with kids who won’t remember half of the places and things, see my full thoughts in Why travel with a baby).

When friends ask about our 2023 travel plans, I don’t usually give them the full picture because I know it sounds ridiculous — a Caribbean cruise, Fiji, Australia, three trips to Europe — flying in business (and even first) class and staying in places “far beyond” our means. And that’s to say nothing of the multiple free cruises and free nights at Wynn and Resorts World in Las Vegas thanks to status matching that we haven’t even booked yet. We get to live a jet-set lifestyle that is so ridiculously far beyond anything we could have ever reasonably expected before we found this hobby.

In Greg’s post, he defined the metric whereby you decide what you would have otherwise paid for a particular redemption as the “savings” and argued that is a separate thing from the “value” (i.e. the selling price). While I agreed with that explanation to some extent, I had to look at my 2023 travel plans and laugh. What am I “saving” on my trips this year? The truth is that none (or at least almost none) of them would have happened if we were paying cash. When I was growing up, my family never (as in not even one time) took an airplane to go somewhere for vacation (I once flew to Puerto Rico with just my grandmother when I was in second grade, but I never flew anywhere for vacation with my immediate family). Instead, my family went places to which we could drive and we generally stayed 3 or 4 nights at most. My parents had very limited means when I was first born, but they worked very hard and by my teenage years they certainly could have afforded to have flown the family somewhere for vacation. But they didn’t do that because they valued saving for a rainy day over a sunnier vacation.

I’m definitely not nearly as frugal as they were, but they succeeded in instilling some amount of frugality in me (and I’m thankful for that since it gave me the skill set needed for a job that I had never could have anticipated here at Frequent Miler). According to figures on the Internet, the average American family of 4 spends $4,000 to $5,000 per year on vacation. Let’s say that I could spend $4,000 every year on a family vacation. Would I spend $4,000 for the four of us to fly to Florida and spend a week at a resort on the beach somewhere? I probably wouldn’t. Instead, I’d probably drive to the Delaware or Virginia coast and find a more reasonably-priced alternative that saves us on airfare x 4 and also on accommodation. Or maybe I’d skip the ocean altogether and spend a long weekend near a waterpark in my home state (as my family often did when I was growing up).

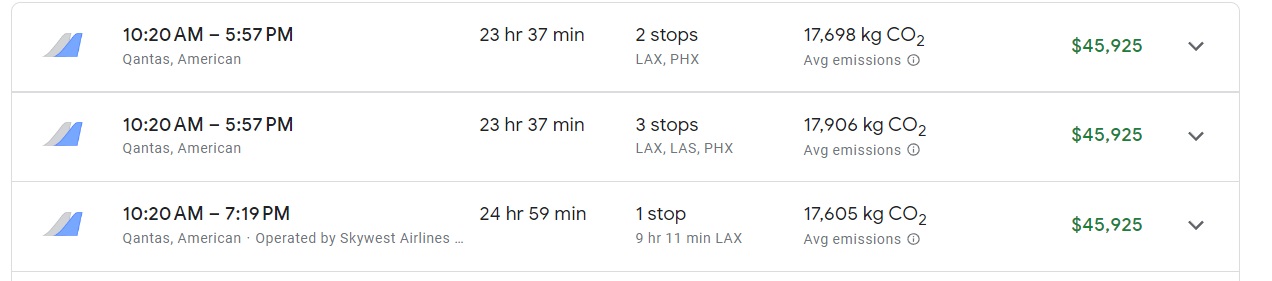

So when I go to Fiji for a family vacation this year, is my “savings” based on the $4,000 I could probably afford but wouldn’t have spent to go to Florida or should I base it on the more reasonably-priced beach vacation in Delaware or the waterpark closer to home? Do we calculate the value based on cash prices? Business class to Fiji would have been about $4,000 per passenger at the time we booked, our flights from there to Australia were another ~$800 per passenger, and the flights that we booked back from Australia were selling for about $12,000 per passenger. The hotel in Fiji would have been another ~$2300. For my family of four, we’re at $69,500 in “retail value”. That’s for one trip that we’re taking this year. Add in the three business class round trips we’ll take to Europe later this year and a fancy hotel or two and we’re easily north of $100K worth of travel this year based on retail cost. That’s straight insanity. It blows my mind when I think about the fact that we can do that.

The thought that $100,000 worth of family travel this year has been covered by points is bonkers — and that’s not even including domestic trips or the “free” cruises we’ll take . This is all part of what I enjoy about this hobby: Even if I had the money to comfortably travel like this at cash prices, I don’t think I would ever spend that much on a year’s worth of travel.

Likewise, even if those trips were quite cheap, I don’t think there is any reasonable cash price I would pay to do them all. At most, I’d pick one trip. We don’t need four trips and if thousands in cash were coming out of my pocket for each trip, we certainly wouldn’t do that four times this year.

On the flip side, I have made the argument that cash is coming out of my pocket for these trips. That’s easiest to see with the first class flights we booked home from Australia. I made a large donation to Conservation International during the wild SimplyMiles promotion a couple of years ago, so the ~105K miles per passenger that we paid for our first class tickets from Sydney to Los Angeles (and onward) is roughly $430.50 of real investment. Is a one-way flagship first class flight from Australia (with flat bed seats, better service, etc) worth $430.50 each? I think most who would consider traveling to Australia would think the answer to be such an obvious “yes” that it’s almost silly to ask. That’s less than what most people pay in economy class. At the same time, multiplied by four passengers in my family, the total cash cost one way was $1,720 for that trip in just one direction. I know that still seems amazingly low for flagship first class on a 14hr flight, but it’s not necessarily cheap or free.

We also have to consider that flights to Fiji cost us 55,000 Alaska miles per person. That’s not really a biggie since we’ve had the Alaska miles for years, mostly accumulated thanks to welcome bonuses and/or SPG Nights and Flights redemptions (RIP) and a Marriott Travel Package (RIP also). There is obviously some cost there, but it feels less cash-like since we’re pretty far removed from having earned those miles. They’ve been waiting for this moment.

We also used about $1200 worth cash-like points and some actual cash to book hotels for the trip. With $1720 effectively spent on the miles for the first class AA flights plus the 120,000 points that we could have redeemed for $1,200 in cash and a hotel night or two paid in cash we’re at over $3000 in cost even if we don’t put a cash value on the Alaska miles. We also redeemed Membership Rewards points for the flights from Fiji to Australia that we could have redeemed for another $2,000+ in cash, bringing our “could have had in our pockets” number up to $5,000. Did this trip save us anything? Or did it cost us five grand?

Next consider our trips to Europe. In one instance, we transferred 35,000 points per passenger from Amex to LifeMiles (140,000 total points) for the flight to Europe and 60,000 points per passenger on the way home (240,000 total points). That’s 380,000 Amex points round trip. Had we redeemed those points for deposits with Schwab, that’s $4,180. And that’s before we consider a few hundred bucks in taxes and a few hundred more on flights within Europe and hundreds more for hotels. That one trip to Europe will have likely “cost” us north of $5,000 that we could have had in the bank if we had cashed out points out instead of using them to travel. That puts the price tag (in terms of what we could have had if we redeemed for cash / kept our money instead of traveling) at more than $10,000 for just two of our trips. Add in two more major trips this year and the number starts to seem nutty to the guy who would probably spend a couple of long weekends at local waterparks over flying the family to Florida if I were paying all cash all the time.

And therein lies the eternal struggle of this game. I don’t know whether our little hobby of easily collecting miles and points and leveraging them for $100,000 “worth” of travel will last forever, so I am very tempted to make it work to the greatest advantage for as long as it lasts — in other words, I strongly feel the temptation to go to Fiji and Europe and fly in business and first class and stay in the hotels we never would if we were using cash out of pocket. When I consider Greg’s definition of “value” — what other people pay for the same experience — it’s hard to turn down these great redemptions! And truthfully, I enjoy scoping out the great values and stepping into a business or first class cabin or a fancy hotel with my family where I know that we don’t “belong” or getting an upgrade that allows us a glimpse into a different life (and then by extension, I like being able to write about whether or not I felt good about those redemptions in hindsight by reviewing the experiences here on the blog).

And I enjoy crunching numbers. That’s funny because, although you may not believe it if you’ve ever caught a math mistake in one of my posts, I did quite well in math class as a kid….but I hated it. I thought it wasn’t relevant to my life and that I’d never use most of it (I just now stopped while typing this to write a letter to a high school math teacher thanking her for her influence. My mom was also originally a math teacher, so I owe any math ability I have to my mom and one particular math teacher). I never thought I would use the things they taught me and yet here I am, crunching numbers on the regular.

So I enjoy determining how many cents per point I’m getting on my redemptions against the cash price as Greg alluded to in his post — after all, even if I use $10,000 or $15,000 or more worth of points, I’m getting $100,000 worth of “value” as per Greg’s argument. But I am also astutely aware that these redemptions aren’t actually saving me anything. Rather, they are costing me the chance to redeem points for a not-insignificant amount of cash (before even considering other travel-related costs like meals, airport transfers, car rentals, etc).

And we’ve had that argument before, where I’ve said that when you choose to use a credit card that earns points it costs you what you could have earned in cash back and Greg has argued that I’m looking at it incorrectly (if you really want to hear me get his hackles up, you’ll have to listen to this podcast episode). At the very least, I can agree that travel redemptions are a choice — and to some extent they can be hyper irrational. Here I am telling you that I wouldn’t spend $4,000 on a vacation while also using AA miles for which I traded actual dollars and using points that I could have traded for dollars that add up to an amount that’s even more than that number. So how do I reconcile that? I guess I do it with Greg’s argument: Look at all the value I’m getting with those points :-).

That last sentence was totally meant tongue-in-cheek. I know that Greg isn’t exactly suggesting that I’ve leveraged my points into a $100,000 vacation year (and he certainly isn’t arguing that I should think of it that way). Or maybe by some measure he is arguing that I got the Porsche value for the Hyundai price. But I circle back to this: What have I saved? Have I saved anything at all? I didn’t need that Hyundai…

I can’t come to a satisfying answer to that question. I can defend my travels a bit by pointing to acquisition cost of the points. My acquisition cost to get the points I’ve used is mostly very, very low. I’ve earned Membership Rewards points from referrals and I’ve earned a bunch more from the best credit card welcome bonuses and then I’ve earned Ultimate Rewards points from getting 5x every time Staples runs a gift card deal. The points I’ve used have largely been low-hanging fruit that I probably never would have been driven to collect were it not for this beautiful hobby that enables my family of four to take $100,000 worth of vacations in a single year.

The truth is that I never looked at a credit card intro bonus or category bonus until I found that I could use those things to do something I love (travel) more and more comfortably. What drew me into this hobby was the chance to take a couple of the trips like the ones that I’m planning this year, though truth be told I never imagined I’d take several of them in one year.

But arguing that redeeming the points for my trips has saved me something seems….incorrect. I’ve clearly accepted my redemptions as being good enough value to part with the points. On the flip side, if I could have $100,000 instead of this year’s trips, I’m pretty sure I’d take the money and plan that more reasonable trip to a drivable coastal destination or a water park. If I could take back all of the points and redeem them for their cash-out value instead of trips, would I do that? I didn’t take that option at the time I redeemed them….

In my case, this kind of tortured thought exercise probably isn’t worth the sleep I lose over it. At the end of the day, I earn a living writing about collecting and using these mystical miles and points, so of course I’m going to use them to travel. But I think this is an important debate to have with yourself — because if I weren’t also writing about these things, would I still travel the way I do? Part of me certainly thinks I would because I know that it is possible to do, but part of me knows that just by writing this post I’m buying myself a ticket to a more thorough discussion with my wife the next time we plan a trip anywhere and that she’ll keep me grounded in reality….and maybe grounded in real life, too.

At the end of the day, I don’t know if I’m really getting $100,000 worth of vacations this year or what I’ve saved or if I’ve saved. I know that this hobby gives me a chance to live a life I never would have dreamed possible and hopefully I’ll show some others how to do the same. But I’ll remind you to think about those redemptions — because DMoney is right that free isn’t free.

Thank you Nick, for this amazing illustration on how “free” travel is done. This website is now my go to for “free” travel.

Great analysis. I [over]think about this stuff all the time. For me it’s all about maximizing – if I’ve gotten max value I’m happy; if not, frustrated. Sometimes that means Waldorf Astoria on a free night certificate: others a Best Western Plus for $78: most frequently a Hilton Garden Inn or Hyatt Place for cash or points, whichever the better value (tonight 9,000 UR for a $250 Hyatt).

Much angst when a Hilton redemption is worth between .0045 per point (cash, getting about 22% back in points) and .0055 (points). In 2020-21 somewhat resignedly used about a million URs on PYB groceries for .015 pp. Then happily redeemed PYB URs at restaurants at .015, plus getting 3x. Wouldn’t even consider it at .0125, and even at .015 the value now would be tempered by weighing against getting 4x MR on spend on Amex Gold. This is the fun, as much as the travel itself, and Greg and Nick really resonate. I don’t consider time cost at all: no more than a golfer would consider the time walking or carting between holes as opportunity cost. Keep up this content: it is life enriching.

If more people with a great credit rating and a moderate vacation budget realized just how well they could travel if they took advantage of credit card signups and bonuses they would be thrilled. Thanks to you and your team for doing a great job spreading the word. Among my great experiences this year has been 7 free nights at the Grand Hyatt Kauai, 2 very inexpensive nights at the Bellagio in Vegas thanks to Amex Fine Hotels and Resorts, and, thanks to you Nick, a wonderful 9 night almost free Caribbean cruise in a veranda cabin on Celebrity. Total outlay for 4 shore excursions, 3 specialty restaurants, excellent wi-fi, tips and beverages was about $1800, and we even earned 52,500 Amex Membership Rewards points on two Amex offers for purchasing most of these items online in advance. If anyone had told me when I started collecting points and miles over 20 years ago that all this would be possible, I would never have believed it

I like this article. It’s very though provoking. I’m in the “Enhanced Travel” philosophy camp.

However, just a glaring point: Nick says the game is his job so the rest of us have to work at other jobs AND spend time on the game. Time is priceless. Having just come home from Asia and spending time with Buddhists, I’m rethinking everything. For me, much of what this game is based on is FOMO and the idea that I WANT something I don’t have so I do the game to get it. That’s a very American mindset which I have indulged but it’s made me think hard about the time-cost which isn’t mentioned. Our Buddhist guide and I got into this pretty deeply and his response was “when does the wanting end”. This has really rocked my world. I do spend more because I enhance my vacations but in the end, the money is gone either way and that is a fact.

I just booked a one night stay at the four seasons in Philly because I WANT to use my FHR credit and WANT to treat my son for his birthday. It’s costing me 90k points which I could cash out with Schwab so now I’m sitting here wondering if I really care about staying at the Four seasons or do I care about getting $900 and rebooking with rocket miles and staying at the Sonesrs for 300 ….

*Sonesta

I’ve made comments on this idea thread before because I think it’s super interesting and important to think about.

I think you arrived at the right—in my opinion—conclusion: in effect you ARE spending ~5-10k in dollars you could have had, but you’re also getting the $100k plus “worth” of vacations.

I think both are true and important to remember. It’s up to each of us to decide whether the cash is more valuable or the experiences that for me and probably for many others in the hobby are unattainable outside the hobby.

For me, it’s the leverage that your points get you from outsized travel redemptions that make the game so fun. I love to travel and find it incredibly fulfilling. This game has turbocharged that lifestyle to an unthinkable place for me.

I think there’s a place where luxury becomes unnecessary and also one where the cash cost becomes too large to ignore, but I also would not have dreamed of flying to Australia in business class for example, staying in the Park Hyatt Sydney, and doing other things like that without this hobby. I would’ve gone to Australia at some point, probably flown economy, and done it much less “well” otherwise.

You’re taking on an opportunity cost, absolutely, but you’re exchanging it for experiences that are likely worth more than that opportunity cost.

Can we have a ‘Bottom Line Review” of this article ?

don’t overthink. If you don’t like free, just say 57 ALMOST free nights. 🙂

and if you want to travel…do it now. In a few years when the China-Taiwan conflict takes off…well…everything is going to change. Nevermind Russia-Ukraine / Europe amplification, Israel-Iran? etc…nevermind weather changes and more sickness on the horizon.

I think this hobby attracts people who are analytical and frugal yet also dream of effortless luxury travel. Those two things ( at least in my case ) are constantly at odds with each other as they’re almost always mutually exclusive.

Almost.

After thinking about it, I think acquisition cost is what to look at. The time we spend on the hobby is well-spent fun (plus, if we were spending it on other hobbies, we’d probably spend money as well). I will grant that there’s a cost to not cashing out Amex points, etc. (And I think it’s true that the more Chase etc. make it easy to cash out, the more psychological cost to having fun travel experiences.) But in the end, if you got into the points game in order to travel, you’re not losing anything by “spending” your points on travel as opposed to cashing out.

I think about cash outlays differently. When we buy points, or pay annual fees, or pay 2.85% fees, that’s a real cost. I do think it’s easily possible for this hobby to cost us more than we perceive, or to get so fixated by cpp or value that we fail to notice this. Mentally, I try to adjust by cashing out a little in the way of points… but the truth is, I rarely follow through on those plans.

I aim for travel that maximizes value while keeping cash outlays to not-much-more than we’d otherwise spend. Our trip to Kauai for Spring Break involved economy class travel on Southwest, with 2 CPs it came to ~70K rt (so = $69 AF + $44.80 in fees). Our 10 Vacasa nights required 2 AFs ($198) for the earner card, $40 for points to top off. That’s about $250. We did spend some cash on cars, though we used the $300 Venture X credit and some Hertz points to cover some. I think it came to around $350. We didn’t do many restaurants, but between shave ice, expensive groceries, and a meal or two, I think we spent another $600. But we would have spent something on food anyway, so I see that as maybe $300 more. With postcards, stuffed chickens, etc., we spent about 1K on a >10K trip. So it was a good “deal” in that sense. But I also find it important to say that it cost in the same ballpark as the amount we would have spent on spring break driving to visit family or to visit a local water park, etc.

In a normal summer vacation week when we don’t travel, P2 drops $500-1000 on summer camps for the kids. (It’s insane.) Sometimes, we save lots of money by traveling. But then, we’re traveling economy all the way, literally and metaphorically. (Which makes it a challenge that we’re going to Japan this summer and spending a couple nights in the Park Hyatt – but that’s another story.)

I couldn’t agree more with this approach. I view this hobby as a way to either subsidize the travel that I’d otherwise anyway do, or to substantially enhance the travel that I’d other do.

The trouble with this analysis (for me), @DMoney, is that I also view this hobby as a way to travel in ways and to places that I’d never have otherwise dreamed. There are tons of places I’d have never visited at all if it weren’t for this hobby — so it’s not entirely a matter of subsidizing travel I’d have done anyway or enhance travel that I’d otherwise do. I love being able to take off for Fiji or go to the North Pole to see Santa or the multitude of other crazy things I’ve done that I’d have not ever even remotely considered were it not for this hobby.

As DMoney’s apparently alter ego, I’d maintain that could come under the aegis of “enhancing” travel you’d otherwise do – by seeing more interesting or farflung places. For instance, instead of spending holidays at Six Flags or Niagara, you can go to Bermuda or Burkina Faso.

DMoney’s theories are a bit distorted in your case since your kid still isn’t in school… you’re getting in your last easy travel before you start having to schedule around breaks.

But I imagine you’d agree (and I’ve heard Greg say) that you shouldn’t let travel dreams get in the way of your actual financial situation. Agree?

@Nick Reyes – I fully agree with you and stand slightly corrected as well. When I say “enhance the travel I’d otherwise do”, what I really meant was get better experiences (fly business vs. coach; go to 5-star vs. 3-star; go to BVI vs. Niagara Falls, etc;) during the vacation that I’d have taken anyway. For example, during the X’mas break in 2022, my family of 5 (me+mrs+6YO+twin babies) could go business class to PVR on direct flights and spend 10 nights at Hilton All Inclusive, all thanks to points. My acquisition cost of all those points was ~US$1,000 and with taxes, fees, and other expenses included, we spent ~$2,000 on the entire trip. If paying cash (which I did 4 years ago for a trip to Cancun where we few economy with a connection, and spent 7 days at a non-chain, non-AI, mid-tier property and spent ~$3k for the trip), I’d probably not choose to go to PVR in peak season, but perhaps go to Europe, where it was off season but still moderate temperature (and still spend more than $2k on the trip). For me, points and miles unlocked the ability to experience warmer weather of PVR during its peak season, get there and back in comfort, and not compromise despite my limited vacation budget. In your case, a lot of your family travel falls in this category. Some of the other travel that you do (e.g. Santa Village at North Pole or swim with Sharks, etc.), comes as a perk of being a travel writer.

I also agree with usernamechuck about having school age kids. Our daughter hates missing school (don’t ask me how’s that possible). So, as much as she loves the travel part (and she’s getting used to lie flat seats), she is very clear that she doesn’t want to miss school or her best friend’s birthday because of “award availability”. Our twin babies bring other requirements for a comfortable trip (direct flights vs. connections, hotels with large rooms/suites vs. small hotels, etc.). Points and miles allows us to work within these constraints and with our travel budget, which otherwise would be very expensive when paying cash and would force us to make compromises on various fronts.

Also: excited to report that Hawaii trip cost just got cut in half. When I tried to use Chase biz card to upgrade me to A1-15, they had to separate my reservation from P2’s to make it happen. Something in that process resulted in my son’s reservation (via CP) getting canceled. They sent no email or message, we showed up at the airport and… nothing. Luckily, there were still 2 seats and they rebooked him (less than an hour before departure). But I complained and they’re sending some LUV our way. 🙂 Marriott is to Southwest as Bonvoyed is to [LUVd?].

I take trips all the time where the alternative in a world where points and miles didn’t exist would be to sit at home that weekend on my rear. Not because the trip was out of reach, it just isn’t necessarily what I would have decided to part with the cash for.

Realistically I’d head to the family cabin a few times a year by either driving or flying, and every couple of years take a trip abroad, with a couple long weekend trips peppered in throughout the year.

If I would have paid whatever it is to do that anyway, I’m not leaving anything on the table by paying essentially about the same and doing more. At some point, after all, pretty much all personal travel, perhaps aside from a funeral or the holidays, is discretionary.

I admittedly do not account for time spent doing research, but it’s a hobby and that’s the point of a hobby to me. That’s probably a salary mindset, but there it is. I also don’t spend too much time thinking about the opportunity cost of cash back, because I know myself… if that was the only option out there, I’d quickly lose interest in the topic and be the guy putting everything on an Amex solely for the protections and customer service.

Therefore my valuations are less about determining “what I got for free” and more a check to make sure I’m not wasting my redemptions terribly (or if I am taking a lower-than-optimal redemption, which I do at times, to prove to myself that yes, I really want that exact thing, value be damned).

I agree with all of the comments. You and Greg have changed our lives. Once I retired, I told my husband I’m going to learn about points and how to fly business class abroad. That’s my new job. That was January 2017.

I have a mathematical mind and greatly appreciate your thinking. I tell myself the same: “… this kind of tortured thought exercise probably isn’t worth the sleep I lose over it.”

A factor that you could put a cost on for those of us not doing this for a living is the unbelievable time spent reading about deals, determining if it is something worth pursuing, thinking through the strategies of which cards to get, then how to best use the points and booking flights.

The only calculations i note are (1) AF costs. I have it down to only 2 cards with a high AF (CSR, AX Plat), both soon to be PC, and 3 cards $95 or less. Many cards no AF.

(2) the cc fees I pay to use cards to meet spending requirements, such as for property tax or income tax.

We are making incredible memories in luxury and comfort. if something happens to curtail our travels, i will cash it in.

I agree 100%. With all the devalues, who knows how long we’ll be able to get these amazing deals. I got to fly first class in Qatar (A380), ANA (new suites), and Etihad this past year. I told my wife we might never be on these flights again so enjoy while you can! It seems like we’re finally coming out of a golden decade of award travel, so I’m burning as many points as I can before even more devalues.

My biggest year was getting $25k of value for $5k. I thought that was amazing. I would say most others years are 50-75% of that.

I agree that this is a thought provoking post. One of the aspects that is hard to quantify with this hobby is the countless hours I spend trying to get the best value from my credit cards miles and points. If I wasn’t in this hobby, I wouldn’t plan which credit card to apply for, how to meet my minimum spend (and track it), how to get all the extras from each credit card, etc before I even consider how to spend these valuable points. Greg’s formula obviously does not take this into account since this varies from person to person. For me, I enjoy the game as much as the incredible vacations I have taken so I know that I am getting great value but I have to balance it with how much of my free time I invest in this hobby. Thanks for all the insights the FM team gives me.

Nick, here’s another term to consider: Lifestyle Enhancement.

You stated that in the absence of points, your norm would be road trips. How much richer lives are your kids experiencing? As your kids progress through school and when they enter the workforce, their experiences and worldliness will attach an aura about them . . . and people (including teachers and bosses) will likely treat them better than others . . . and doors will open for them that would not otherwise have opened. How do you assign a value to that? I’m not certain anyone can.

Meh. I think it’s overblown if you expect kids to become worldly and sophisticated from a few luxury family trips a year. i think the best you can hope as a parent is for great memories together as a family but that could be done on anywhere and on any budget.