Merrill Edge stopped offering new brokerage account bonuses last year, but Doctor of Credit notes that they are back with bonuses again. The current bonus isn’t particularly compelling, but it is nonetheless good to see them offer bonuses again and terms leave open the possibility that you may be able to get a better offer.

The Deal

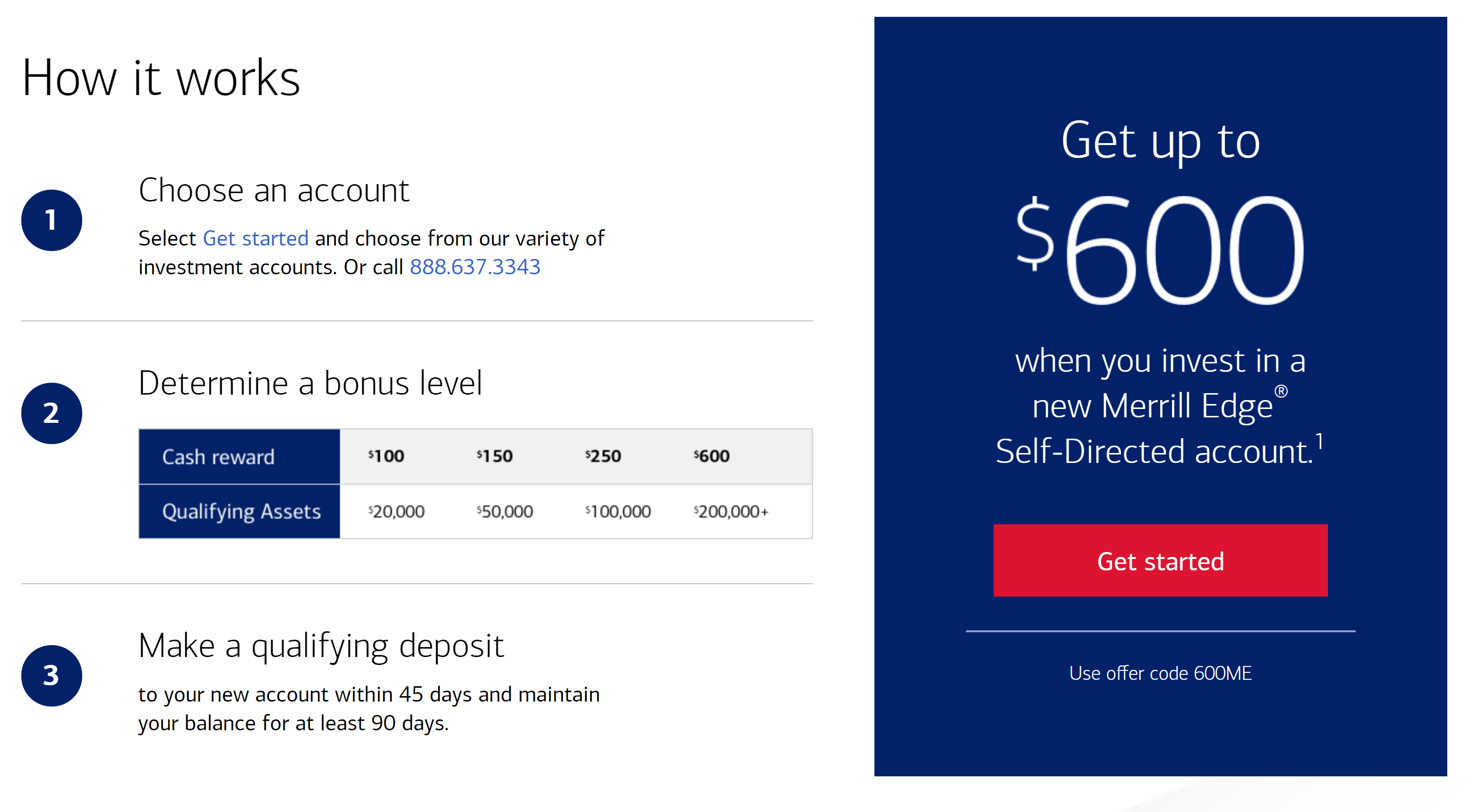

- Merrill Edge is offering the following bonuses when you open a new brokerage account and meet deposit requirements (with cash and/or assets) within 45 days and maintain your balance for at least 90 days:

- Deposit $20K+, get $100

- Deposit $50K+, get $150

- Deposit $100K+, get $250

- Deposit $200K+, get $600

- Direct link to this offer

Key Terms

- Must fund your account with new assets within 45 days of account opening and maintain the balance threshold for 90 days (Assets transferred from other accounts at Bank of America, MLPF&S, Bank of America Private Bank, or 401(k) accounts administered by MLPF&S do not count towards qualifying net new assets)

- You must enroll during account opening by entering the offer code in the online application or by providing it when speaking with a Merrill Edge Financial Solutions Advisor™ at 888.MER.EDGE (888.637.3343) or at select Bank of America financial centers. You are solely responsible for enrolling or asking to be enrolled in the offer. (clicking through the promo landing page should enroll you)

- Offer valid for new individual Merrill IRAs or Cash Management Accounts (CMAs). Offer is limited to one CMA and one IRA, with no more than two enrolled accounts per accountholder. Eligible Merrill Edge IRAs limited to Rollover, Traditional, Roth and Sole-Proprietor SEP only. The Merrill IRA or CMA may be a Merrill Edge Self-Directed account, Merrill Edge Advisory Account or Merrill Guided Investing account. You may be eligible for a different or better offer. Please contact us for more information.

Quick Thoughts

Merrill Edge is the self-directed brokerage arm of Merrill Lynch / Bank of America, so it features no-fee trades on most stocks and ETFs. I switched IRA investments to Merrill Edge last year for the purposes of getting Platinum Honors status for the associated 75% bonus on earnings on cards like the Bank of America Premium Rewards, Unlimited Cash Rewards, or Customized Cash Rewards cards.

However, we have in the past often seen Merrill Edge offer bonuses of 50% more for the same deposit thresholds (or occasionally even a bit more than that). I’d probably hold off waiting for one of those bonuses. On the other hand, we recently reported on some changes coming to the Preferred Rewards program, so if you were looking to get established with Bank of America Preferred Rewards, getting a bonus while doing so sweetens the pot.

Note that you will need to make your deposit within 45 days and must maintain it for at least 90 days to receive your bonus. You can deposit cash or assets held at other brokerages. If you deposit cash, there is no requirement to actually invest the money (and in fact I did not invest it when I did one of these bonuses in the past in order to make sure that my balance did not dip below the required threshold with market fluctuation).

Another point that may be relevant for some is that you can earn bonuses separately for cash management and IRA accounts. For instance, if you move over an IRA account with $50K in it and also open a Cash Management Account and deposit $50K in that account and get a $150 bonus in each account — $300 in total bonuses. That beats the $250 bonus for a single account with $100K.

Finally, I find the last point under “Key Terms” above particularly interesting. On the landing page for this offer, it explicitly says that “You may be eligible for a different or better offer. Please contact us for more information.” It is probably worth reaching out to Merrill Edge directly before applying for this offer to see if you may be eligible for one of the better offers of old. We have seen an offer for up to $900 and one for up to $1,000 in the past, so it may be worth a phone call to inquire about a higher bonus.

Ahh, so I wouldn’t be able to transfer both a SEP and a ROTH IRA to be eligible?

Not a very huge offer to tie up 100 or 200K. This makes sense if you were going to use Merrill anyway and have a BOA bank account but otherwise this is trivial to even market movements within a single day.

what do ya’ll think the req will be for a $900 bonus?

200 or 250k, try calling a financial advisor. They benefit too so they often can help.

Also they will take a mix that adds up to the amount required, like 30% CMA (personal) and 70% IRA (IRA, SEP, ROTH).

My P2 spread hers over 3 accounts, including just adding to an existing account. Basically all it is is how much new money comes in. But call to make sure they code it correctly.

thanks

Another thing: If you do not yet have Platinum Honors elite status with B of A, it is worth it to invest (either $100K or $200K, can’t remember which) if you can, then get that status after a couple of months which gives you effectively 2.65% cash back on their Premier card. They also make it easy in that the status lasts for quite a while (I forget how long, perhaps a year) after you take the money out. That 2.65% is more than the cost of paying the IRS with a credit card. So, I have for yeras had nothing taken out of my paycehck for federal taxes and just pay quarterly with my BofA card for a small profit.

One more advantage: you can get many more B of A credit cards with the Premier status.

I try to move our IRAs from place to place, maximizing the bonuses. It takes some work and you need to keep very good records, but it can be worth it for this “free” money.

As long as you meet the threshold when the cash/investment hits Merrill (as opposed to the value when it left another investment firm) it can fall below the threshold if the investment goes down. As long as you don’t take any cash/investments out you are still covered even if the account loses value.