Update: Many readers (and indeed those of us at the blog) have reported being targeted for an even better Platinum card offer than the one mentioned in this post. See: Possible targeted amazing 100K Platinum offer for more on that other offer.

Those who have become entrenched in this game sometimes find themselves locked out of eligibility for new credit cards with some issuers. No rule gets more air time than the infamous Chase 5/24 rule, which dictates that you will not be approved for most Chase credit cards if you have opened 5 or more new personal credit card accounts with any issuer in the past 24 months. So much focus in fact is placed on this rule that there are posts about Flying under 5/24 and which are the best Chase cards to get before you go over 5/24. But over the past few days, it has come to my attention just how blinded many of us in the hobby have become by this rule. As we’ve considered some of the huge new offers to come out this month, it comes to mind that it just isn’t worth waiting around forever hoping to find a dance partner when Amex (or Barclays or whoever is next) is begging for your hand. Stop overvaluing those 5/24 slots. Set yourself free to recognize how much value you could be missing.

What really brought this train of thought to the forefront for me was the killer Amex Platinum offer that we reported the other day. It is by far the best offer I’ve ever seen publicly available on the Platinum card and it easily beats even the targeted 100K offer that people sometimes find via the Card Match Tool. See the post: Amazing Platinum card offer: 75K + up to $300 + 10x bonus categories for a limited time for full details, but the bottom line is that in the first year with that offer you could end up with more than $1100 in statement credits and as many as 225,000 points. It’s nuts.

Caution when applying for the amazing Amex Platinum offer!

In the last couple of days we’ve written a lot about an amazing Amex Platinum signup offer. You get all the usual Platinum benefits plus a 75K signup bonus + 10X earnings at gas stations and supermarkets (for 6 months, up to $15K) + up to $300 back in restaurant purchases.

It’s that last part (up to $300 back in restaurant purchases) that you need to be cautious about. A similar offer is now available through credit card affiliate channels but without the restaurant rebate. The restaurant rebate is available only through the Resy website. You will see the inferior affiliate offer on a number of other websites and it can be hard to tell the difference. Just make sure that you use a link that includes the restaurant rebate! If the link you use doesn’t take you to the Resy website, then it’s not the right one.

As always, we (Frequent Miler) only publish the best public offer. In cases like this, we do not publish our affiliate link at all. As long as it’s the best offer, you’ll find the link to the Resy site on our Amex Platinum page: https://frequentmiler.com/amxplat/#Goto. Kudos also to Doctor of Credit (who never publishes affiliate links), and Miles to Memories for publishing the Resy link.

The reason that led me to think about how we collectively approach 5/24 is that many readers asked some version of the question “Is this worth a 5/24 slot?” about that specific offer.

For the uninitiated, the concept here is that if Chase will not approve you if you have opened 5 or more credit cards in the past 24 months, you have to consider which cards are worth taking up one of those 5 slots. Imagine them as 5 slots in your wallet: fill all five within 24 months and you’re shut out of Chase cards until one of those cards ages beyond 24 months. Every time thereafter that you add a new account, you inch a bit farther from being eligible for Chase cards.

Because of the Chase limitation, many readers wanted to know whether this new Platinum card offer was worth a 5/24 slot.

When one reader in our Frequent Miler Insiders group who I’ll call Mr. T asked that very question, my response was essentially, “If this Platinum card offer isn’t worth a slot, what is?”.

Mr. T said that he was considering the Hyatt and/or IHG cards at some point. Applying for this Platinum card offer would presumably put off his ability to apply for one of those cards.

Listen: both the Hyatt and IHG cards can be valuable cards to have in the right scenarios. The Hyatt card in particular is a perennial favorite among hobbyists. (And Chase has many other good cards/offers).

And hey – I get it. Mr. T has been saving up for the credit card equivalent of a Toyota Camry. It’s reliable, it’s a good value, it’ll get the job done. It’s popular for good reason. I’m a Toyota man myself, so I know I’d be not only satisfied but happy to own a Camry.

But what’s happening right now is the equivalent of a price mistake on a Porsche 911 such that Mr. T is suddenly able to get the Porsche so long as he’s willing to give up on the idea of driving the Camry for a while.

The 911 isn’t going to suit all of Mr. T’s needs. He’s going to have to give up some leg room and fuel economy. He may even be more tempted to engage in behavior that gets him a speeding ticket.

But let’s be honest: is it worth making that trade-off? Of course it is. The Camry isn’t going anywhere. The ability to get the Porsche for the Camry price is the piece of this puzzle that likely is going away at some point (nobody knows when). To not strike while the iron is hot on a huge opportunity like this so that you can have better access to a mediocre opportunity is missing the forest for the trees. How could the value of the Hyatt or IHG card welcome offers possibly compete here? The opportunity cost of turning your back on big new offers like this one (or the 100K JetBlue offers, etc) is too high to justify waiting to be able to get a run-of-the-mill offer.

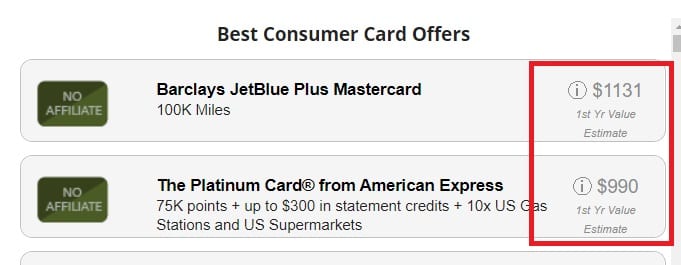

But let’s be more objective about it for a moment. Our Best Credit Card Offers page figures the first year value of each credit card listed on the page. At the top of the page is a list of the “best of the best” personal cards and “best of the best” business cards. Those lists put all of the cards on our best offers page in order based on first year value.

We do not manually choose which cards are on that list and as you’ll likely notice at any given time there are likely cards and/or offers near the top of those lists to which we do not have an affiliate link (indeed at the time of writing, we do not have affiliate links for the 3 cards at the top of the best personal card offers list nor to 2 of the top 5 business card offers, though note that these things change all the time). In some cases, we simply don’t have affiliate links. In other cases, we may have an affiliate link but won’t show it if we’re aware of a better public offer like this Platinum one through the Resy site. All that is to say that the content on the list is ordered in such as way as to be as academic as possible.

To that end, you can read this post that explains more about where we get our first year values. In a nutshell, first year value looks at the value of the welcome bonus points based on our Reasonable Redemption Values minus the opportunity cost of putting the spend on the new card rather than a card that earns 2.5% cash back and minus the cost of the annual fee. We also add value for concrete first-year benefits (though our first-year value calculations are meant to be conservative, so we do not add any value for some benefits that are harder to quantify). For example, on the Amex Platinum card, we value the $200 airline incidental credits at 90% of face value. The same is true with the restaurant statement credits. Since the value of the Sak’s credits and Uber credits could be so variable based on circumstance, we don’t assign any value at all to those statement credits. We don’t assign any value to bonus categories (but obviously 10x gas and grocery will be huge for many people – that’s worth a 15% return to those who value Membership Rewards points at 1.5c each). Furthermore, we only count the airline incidental credits one time though those applying right now could get the $200 airline incidental credit once for 2020 before the end of December and then get a fresh $200 in airline credits in January — meaning that you can get up to $400 in airline free credits in the first year, but we only count on you using $200 and thus value that benefit (at 90% of face value) at $180. We don’t add any value for things like Centurion lounge or SkyClub access, Hilton Gold status, etc because it is impossible to assign a definitive objective value to those things (in other words, SkyClub access may be huge for you if you live in a Delta hub but is relatively useless to me since I almost never fly Delta).

Despite that effort to be conservative, we still have the first year value of the Amex Platinum card at $990 after accounting for the annual fee and opportunity cost. Compare that to the first-year value of the World of Hyatt credit card at $565 or the IHG card’s first-year value estimation of $840 and it’s hard to imagine sitting on the sidelines and missing the Platinum offer even at that very conservative first-year valuation.

At the other end of the spectrum, consider that the Platinum card could be worth much more in the first year considering that you could get all of this in the first 12 months with the offer we’ve listed from Resy:

- 75K points after $5K in purchases in the first 6 months

- Up to $300 back in statement credits for restaurant purchases (20% back at restaurants worldwide for the first 12 months up to $300 back)

- Up to $400 in airline fee incidental credits ($200 each calendar year; apply now and you can get this $200 before the end of this year plus another $200 in credits next year)

- Up to $200 in Uber credits over the next year ($15/mo and $35 in December)

- Up to $150 in Sak’s 5th Ave credits ($50 between January and June and $50 between July and December; apply now and use the credit once before the end of this year and then twice next year)

- Up to $40 in wireless services credits ($20 in November and $20 in December 2020 due to temporary COVID enhancements)

- Up to $40 in streaming services credits ($20 in November and $20 in December 2020 due to temporary COVID enhancements)

- 10x at US Gas Stations and US Supermarkets for the first 6 months on up to $15K in purchases

- Standard Platinum card perks like Centurion lounge access, Delta SkyClub access when flying Delta, Hilton Gold status, National Executive status, access to Fine Hotels & Resorts, and more

In total, that’s $1,130 in statement credits in the first 12 months and 75,000 bonus points. Assuming you met the $5,000 spending requirement over the first 6 months at US gas stations and US Supermarkets (which requires about $193 per week in purchases spread over that six-month time frame), you would have a total of 125,000 Membership Rewards points ($5K x 10x = 50K plus 75K welcome bonus = 125K points). If you’re able to spend the full $15,000 allowance for the 10x categories, you would have a total of 225,000 points on top of all of the statement credits above.

Our Reasonable Redemption Value for Membership Rewards points is 1.55c each. That makes 225K worth about $3,487.50. Note that you could obviously get even more value as compared to the cost if redeeming those points for premium cabin international travel (obviously we don’t know when that will again be common / comfortable / advisable / enjoyable, but there likely will come a time when we all travel again).

If you value the statement credits at 50% of the face value, you’re still looking at more than $4,000 in value in the first year for a $550 annual fee if you’re able to max out the 10x categories. I illustrate that to show that our first-year value estimations are intentionally extremely conservative.

In reality, many people will not ordinarily spend $15,000 at US gas stations and US Supermarkets in six months and thus will end up with something in between: probably more than 125,000 points but less than 225,000 points. I think it is a mistake to look at it as an all-or-nothing spending requirement. As shown above, even doing just $5K in 10x purchases will result in 125,000 total points, which would be a fantastic offer on the personal Platinum card even if you didn’t consider the restaurant statement credits worth up to $300. Note that maxing out those statement credits requires $1500 in restaurant purchases over the first year — that breaks down to a little less than $29 per week on average in restaurant spend over the first year.

To put that in perspective, the Platinum card ordinarily only comes with 60K points after $5K in purchases – no restaurant credits, no 10x bonus categories. The best deal has long been those targeted for an offer of 100K after $5K spend — again, with no restaurant credits and no 10x categories. With this new offer, $5K spend in the 10x categories in the first 6 months yields more points (125K after spend versus 105K after spend) and it also comes with up to $300 in restaurant statement credits and those 10x bonus categories.

That is a pretty amazing offer. Unfortunately, it comes at the opportunity cost of giving up the chance to get referral credit given that the referral offer at the time of writing does not include either the 10x bonus categories or the $300 in restaurant credits. If the referral offer were to pick up the 10x bonus categories, then I think some readers playing in 2-player mode would consider referring the partner applying and picking up 15K-25K referral points in lieu of the restaurant credits (since the points are probably worth more than $300 to most readers).

At any rate, my point is that this Platinum card offer is huge.

By comparison, most Chase card offers lag well behind. The most valuable Chase welcome offers on the market are on their business cards and while our first-year value formula estimates those to be worth more than the $990 estimate we list for the Platinum card, I think a more reasonable middle-of-the-road valuation makes the Platinum card offer stand out well beyond the Chase offers.

When comparing to Chase cards like the Hyatt card for example, I just think you’re giving up way to much if the sole reason you’re not applying for the Platinum card is because you want the Hyatt card down the road. The Hyatt credit card comes with 50,000 points that require a total of $6,000 in spend. According to our Reasonable Redemption Values, the points are worth about $750 (just like with Membership Rewards points, the value here can be higher or lower depending on how you use the points). After figuring in the opportunity cost of $6K spend at 1x Hyatt points and the first-year annual fee, we come to a first-year value of $565. Once again, that estimate is conservative: it doesn’t consider the fact that Chase is currently offering Amazon and grocery spending bonuses (which mean you may complete at least half the $6K spend at 5x) and it ignores the fact that $15K spend in a year yields a free night certificate. It also fails to consider the fact that every $5K spend gives you 2 elite night credits with Hyatt. With some effort, you are likely to get more than $565 in value.

But are you likely to get more than what you can get with the Platinum card in the first year? Again, I showed above that you could get more than $1,100 in statement credits alone on the Platinum card. Are you likely to get far more than $1100 in value out of the Hyatt card in the first year? After you consider earning well over 100K Membership Rewards points also, I think there is just no contest in the value of the offers. The Hyatt card is one that Hyatt enthusiasts will want to have and hold for the long-term, but what cost are you willing to give up to get that? I think that walking away from 100K or 125K or 200K or more Membership Rewards points and a grand in statement credits is just far too high of an opportunity cost.

And that’s where I come to the title conclusion: we need to stop missing the forest for the trees and stop overvaluing 5/24 slots. Sure, a card like the Hyatt or IHG card (or one of those monster new 75K offers on the Ink Cash and Ink Unlimited cards) are potentially awesome to have and in many cases to keep long-term. It makes sense to prioritize Chase cards before you are over 5/24. On the other hand, it does not make sense to prioritize Chase cards so much that you turn your back on thousands of dollars in value.

Again, this isn’t to say that everyone needs to apply for this one Platinum card offer. For sure there will be some people for whom it won’t make sense. One reader noted that the fact that they drive an electric car makes 10x at US gas stations useless to them. Another reader noted that they shop at Costco for groceries and would therefore need to accept a markup at the local grocery store, creating a cost to the 10x points. And maybe you just don’t want to learn about the Membership Rewards program and its many sweet spots. That’s all fine and fair. Very few things in this hobby are one-size-fits-all.

But on the other hand, if you routinely ignore huge offers like this, consider how much you could be leaving on the table. We have recently seen a number of cards come out with strong welcome offers. Competition certainly appears to be heating up in the credit card space and issuers are getting more creative than we’ve seen in years in terms of temporary bonus categories and credits and options for using rewards beyond travel. I expect that we will likely continue to see this trend through whenever the time is that things begin to normalize once again. As we do, please don’t turn your back on big things like the 100K JetBlue offers or whatever comes next simply so that you can hold out for a lesser offer. To be sure, there is some strategy in being choosy and determining how you’re going to get the cards that you want to keep long-term. Just be sure that your strategy isn’t costing you more than it is worth.

![175,000 Membership Rewards points consumer Platinum card offer for some [Targeted] a hand holding a credit card](https://frequentmiler.com/wp-content/uploads/2019/01/Amex-Platinum-Card-in-Hand-218x150.jpg)

> “it easily beats even the targeted 100K offer”

I read through this post and the earlier one about the Resy offer.

Maybe I missed something. I’m not sure why it’s easily better. 25k points is close in value to $300 of dining since they don’t expire and are transferable. I guess it’s a personal decision and can depend on whether you can cash out to an investment account too.

Nick wrote that before the new 100K offer appeared. The 100K offer he was referring to didn’t include 10X for gas and groceries.

Totally agree!

If you are smart, you will get the Chase cards first. If you were like me, greedy going after the largest bonus, I have no way to get Chase card when getting about 10 cards per year (two players).

[…] Stop over-valuing 5/24 slots (On Nick’s mind) […]

Why is the Chase Freedom Flex/Unlimited offer for 5x at grocery up to $12,000 valued at $840 first year if you don’t take into account bonus categories? Seems like you should be able to put a value on 10x MR on $15,000 in grocery on the Platinum offer.

[…] Over-valuing 5/24 Slots: I enjoyed reading this thoughtful post from Nick at Frequent Miler. For me personally, I can’t get approved for Amex cards right now or believe me I’d be […]

My brother’s Whole family just got it tested 2x. Life in the Keys Just like a Cruise Ship no thanks ever.

I got like 5 emails about this cruise, so I could go on as Neine.

THANKs

Biggest reason for me is that over the past two years (all while being lol/24), I’ve received 4 preapproved offers from chase (bypassing 5/24), either in branch or online (picked up two united cards, southwest, and an ink unlimited). I just don’t believe that being over 5/24 significantly blocks you out of acquiring chase cards.

[…] not include the restaurant statement credits that we wrote about the other day (and that I shared more extensive thoughts about in this morning’s post). However, I think most readers would be happy to take the additional […]

Interesting take I was looking over my 5/24 cards and all but a few have been Core Issuer cards and not co-branded (MR UR TYP CAP1 USB ) We normally dance 5/24 +/-1 in P1/P2 modes.

The only Personal card outliers have been Alaska Cards, an Amazon Prime (early days), an Aspires.

All of our Airline/Hotels cards have been business cards AA, AS, DAL, SW, SPG, Hilton, planning on UA biz soon.

P2 can get CSP SUB again next year – in this time we have opened 30+ Biz cards while dancing around 5/24.

I also have no qualms using discounted Hotels.com GC and free night after 10 nights (we are at 8 nights ATM) HT to DoC.

Sometimes a CC hotel footprint/points/FNC/status has little value over cash.

The Cap1 “hotels. com” partnership opened my eyes to loyalty that and DoC POV on “Hotels . com “

Interesting that you said “ you will not be approved for MOST Chase credit cards if you have opened 5 or more new personal credit card accounts…” P2 applied for the 80k CSP on its last day, but she doesn’t fall under 5/24 until December. We assumed she would be rejected but were planning on having her call on December 1st to hopefully be approved. Her application ended up going pending then the card showed up in her chase account 2 days later. Idk why she was approved, but I try to not ask too many questions about good fortune.

Steve had the United card deal like 10 months ago Bless him. Chase didn’t care on 5/24 and I was 8/24 and needed the points and got it.May cancel @ AF I have tooooo many points.

Be Happy !!!!

BLM

You folks in the 808?

No but will be..

I just tried to apply for the link and got the “based on your history with balance transfers, past American Express welcome offer you are not eligible for the welcome bonus at this time”. I’ve only had 2 Amex cards ever and never the platinum. Any work around you can see on this?

The general rule is to put spend on your current Amex cards. Worked for me this past spring.

Thanks. Upon further research I found that to be the case. Unfortunately I closed my only recent Amex (Delta) last summer and I wasn’t travelling as much. Is it worth opening a lesser card with Amex first? I don’t really want to get the Platinum without the bonus.

I would think a big red flag to AMEX, “based on your history with balance transfers…” Also spending is very key like 5 figure stuff. That will get you anything AMEX has to offer.

Love the logics. In addition to the Platinum offer, I think the jetblue 100k is just as huge, and arguably more “affordable”. I mean you can easily get 100k for next to nothing with an easy path to downgrade next year. My only problem with the platinum is that I already have the gold and can’t really downgrade it to anything without fee

Agreed that the JetBlue offer is fantastic for anyone based near an airport well served by JetBlue. I love JetBlue but have only flown them twice in the past 9 years because they didn’t serve my home airport at all for most of that time and then only fly to like 2 cities in Florida directly once they added service and you can’t connect everywhere from there. If JetBlue were more convenient for me, I’d definitely have that offer right up there (especially the business version!). And indeed I think the JetBlue card is in the #1 spot for personal cards on our BO page right now based on first year value (though as I note our first year value on the Platinum is quite conservative).

I’m with you there. I live in the Boston area so jetBlue is one of the best choices for domestic here. With frequent sales like the one they are running right now, you can stretch that 100k point a lot

Honestly, I never really had a use for this card as I tend to carefully consider the SUB but prefer something that offers long-term value as well. That being said, this offer is beyond anything I would have ever imagined. And even though I have a “slim to none” chance of using the statement credits, the points and 10X bonuses make it too tempting to sit this one out.

As someone who earns points entirely through organic spend, those 5/24 slots are holding less and less value these days anyway. Gas and groceries are my primary spend categories, and Chase simply doesn’t cover those well. Additionally, Chase transfer partners are fewer AND less lucrative than Amex. The only real advantage for Chase is that Visa is more widely accepted than Amex in most places, so it might not make sense to abandon them entirely.

My 5/24 slot used to have Freedom Flex written all over it, but I’m crossing that out in favor of Amex Platinum.

One could argue however that not paying attention to 5/24 would preclude you from those two Ink SUB worth 150k UR points with no annual fee or even something like the Marriott 5 nights free promo. Can’t argue the fact that this Platinum offer is deserving of a slot but I think the reason that 5/24 is so talked about is because Chase routinely comes out with good cards with good SUB – ignore that at your own peril. I mean no one talks about the BoA rule or the CITI rule.

I think the one exception to this is if you plan on churning credit cards.

Also do you think that this offer will only be available at Rezy or will we see it via referral? I think Amex just bought Rezy so maybe they are promoting that?

Thanks Nick you make a lot of sense regarding 5/24 paralysis. Regarding the 10x at supermarkets I am factoring at 6x as I already get 4x with AMEX Gold. Still worth it though. Any tips on maxing out at the supermarket? Supermarket specific GC like Shoprite store cards?

Hard to say.

I hold Costco and Sam’s cards. Either I am doing it wrong, or someone lives in an area where groceries are less expensive at Costco. I have done in-depth price comparisons in my area. I have also determined that a rather large percentage of basic grocery needs from Costco are a losing proposition.

I cannot imagine someone buys all of their groceries from a Costco. I have noticed that I actually am able to buy more grocery items from Sam’s at a better value. Realistically though, the local grocery store here provides the best value on most grocery items.

Walmart 1 block away no one there @ 6am and better deals on SMALL orders. Larger meat pkg’s Costco wins I paid $5.50 per lb 5* and Costco $2.50 x 5lb 5*..Just bt a RING $100 cheaper and all my Laptops ect .My freezer is -10F so it keeps but Gas is the best @ HNL $1 cheaper..

I definitely will not shop at Walmart for groceries, but with the clubs locally I have not been able to find value in general grocery shopping. Admittedly, chicken and turkey are usually price points I am happy with at Costco.

I am happy someone is able to find that value in general grocery. It could be due to location as well. Happy shopping.

Citi Costco Biz card is a 0/24 slot. I prefer USB AR 3X with S-Pay and Exec Membership makes it almost 7% back.

But I have considered going to CIC 5X VGC and using at WINCO’s as they have incredible prices but only take Debit cards.

I have the AA biz, and the Costco personal. I have 3/24, but wanting to focus on Chase business in 2021.