Frequent Miler's latest team challenge, Million Mile Madness, is happening now! Follow us as Greg, Nick, and Stephen compete to earn 1 Million SAS miles by flying 15 airlines before November 23rd. Who will complete the challenge with the most Speed, Affordability, and Style?

Frequent Miler's latest team challenge, Million Mile Madness, is happening now! Follow us as Greg, Nick, and Stephen compete to earn 1 Million SAS miles by flying 15 airlines before November 23rd. Who will complete the challenge with the most Speed, Affordability, and Style?

Last week I reviewed the Chase Sapphire Reserve card’s travel insurance. I was impressed with how favorably it compared to the lower cost Sapphire Preferred card. But, how does it compare to travel insurance provided by other ultra-premium cards?

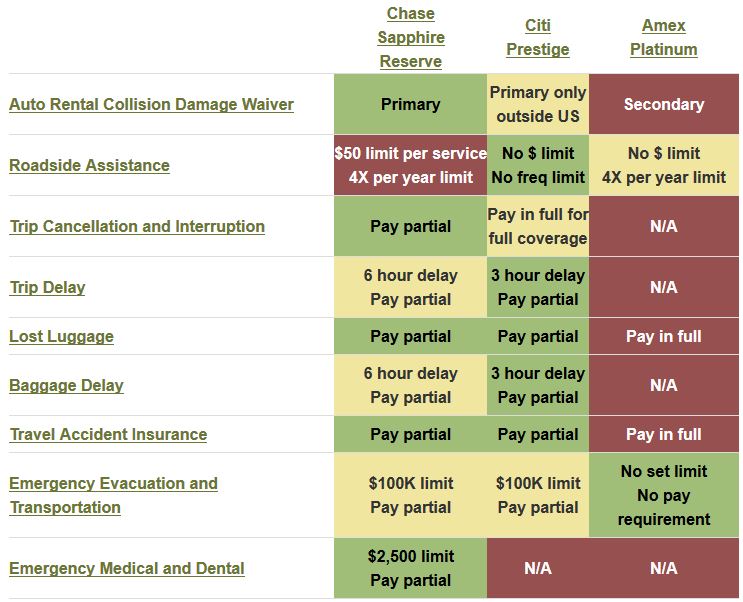

I created a new resource page: Ultra-Premium Credit Card Travel Insurance to answer that question. There you’ll find a side by side comparison of the travel insurance benefits automatically provided by the Chase Sapphire Reserve, Citi Prestige, and Amex Platinum cards. In the future I plan to add the Altitude Reserve as well.

| Caution: I’m far from an expert on this stuff. I did my best to read through the benefit guides to figure out what was covered and when, but I can’t promise that I got all of the details correct. |

At the time of this writing, the comparison chart looks like this (click through for an up-to-date view):

A few things stood out to me as I compiled the data for this page…

The Citi Prestige offers the best all-around coverage

I already knew that the Prestige card offers terrific protection for trip delays and bag delays (3 hours vs. 6 hours with the Sapphire Reserve). But, I didn’t know that the Prestige card matches the Sapphire Reserve’s emergency evacuation coverage, and that Citi often matches Chase’s option to pay in part with your card in order to get full coverage (one big exception is with trip cancellation and interruption insurance which is fully covered when you pay in-part with Chase, but not with Citi).

Additionally, the Prestige card offers the best Roadside Assistance benefit of the three. With Citi, there doesn’t appear to be a limit to how many times you call for a tow, a flat tire change, lockout service, etc. And the cost of the service is fully covered (unlike with Chase were they pay up to $50 per service).

Amex offers the best emergency medical evacuation coverage

Amex hides this benefit under the title “Premium Global Assist Hotline”. All three ultra-premium cards offer travel assistance hotlines, but only Amex’s hotline will pay for any of the services they help you with. Specifically, they’ll pay for emergency medical evacuation and transportation, and repatriation of remains.

Amex’s version of this benefit has two fantastic aspects:

- Unlike with Chase and Citi, there is no cap for this benefit.

- You do not have to pay for your trip with your Amex card. You get this benefit simply for having the card.

Full details can be found at the bottom of our Ultra-Premium Credit Card Travel Insurance page.

It’s possible to mix and match

Let’s say you have all three ultra-premium cards. Which should you use in order to get the best travel coverage? Here are my recommendations for maximizing coverage (but not considering how many points are earned):

If you need:

- Roadside assistance: Call Citi at 1-866-506-5222

- Emergency Evacuation: Call Amex at 1-800-345-AMEX (2639) or Direct Dial Collect: 1-715-343-7979

When paying for travel, use the following cards:

- Car rental: Pay with Sapphire Reserve for primary coverage. The Prestige card works too for primary coverage outside of the US.

- Flight, Cruise, or Train: Pay with Prestige card in order to get 3 hour trip delay and bag delay coverage

- Hotel or Tour: Pay at least in part with your Sapphire Reserve. This will give you full Trip Cancellation and Interruption coverage and $2,500 per person Emergency Medical and Dental coverage. Chase requires that you pay any portion of your travel arrangements to get this coverage, so a hotel or tour charge should count.

What if you want to maximize point earnings?

The Amex Platinum card offers 5 points per dollar for flights purchased through Amex Travel, or directly from the airline (not counting the Business Platinum for this last part). Unfortunately, though, paying for airfare with your Platinum card doesn’t help with your travel insurance coverage. I think it’s worth paying with the Prestige or Sapphire Reserve card (both of which offer 3X rewards for flights) in order to get better coverage (unless you already pay for supplemental travel insurance).

The Citi Prestige card offers 3X for airfare, hotels, and travel agencies. If you book tours, cruises, or trains through other means, you’ll only earn 1X. The Sapphire Reserve meanwhile offers 3X for all travel. I’ve already recommended, above, using the Sapphire Reserve to pay for tours, but what about cruises or trains? If you use your Sapphire Reserve you’ll earn 3X rewards, but you’ll be stuck with 6 hour trip delay and baggage delay coverage rather than the 3 hours that the Prestige card covers. In this case, personally, I’d go for more points over better coverage.

That leaves us with the following recommendations for which card to use and when:

- Car rental: Sapphire Reserve

- Flight: Prestige

- Cruise, Train, Hotel, or Tour: Sapphire Reserve

Wrap Up

Both the Sapphire Reserve and the Citi Prestige offer a nice collection of automatic travel protections when you pay at least in part for travel with those cards. Either card can be used as a substitute for purchasing travel insurance.

If you want more than $100K of emergency medical evacuation coverage, then you’ll also want to carry an Amex Platinum card. You don’t have to pay for your trip with this card, just keep it with you in case of an emergency.

And, finally, if you don’t have AAA and you need a tow, help changing a tire, an emergency gas fill-up, etc., you’re covered with any of these cards. The Prestige has the best roadside assistance terms, followed closely by Amex.

[…] Travel Insurance Breakdown – Platinum vs. Reserve vs. Prestige […]

[…] recently written several posts on travel insurance offered by various premium credit cards (See: Travel Insurance Showdown: Reserve vs Prestige vs Platinum). Many cards offer what sounds like generous protection benefits on the surface, but the key […]

Great article! I am wondering about the benefits of the Altitude Reserve for cruises. I was thinking about getting the Ameriprise Plat since I don’t have Prestige or Sapphire Reserve, but I do have Altitude.

I booked a cruise which included my mother-in-law. Paid initial deposit with Prestige and final payment with AMEX Platinum. She had a stroke 10 days before departure. Got 100% back from both cards although it took far longer and with more paperwork with AMEX, so, chart is wrong as to AMEX coverage on cancellation.

Another point which needs to be emphasized in this thread is that normal medical expenses and some evac costs are not paid by these cc’s. The solution is a “bare-bones” ANNUAL policy which costs about $150 per person per year and ONLY covers medical and evac. This is less than most of the short term policies offered by cruise lines and short duration tour operators and you can get it for the entire year.

Thanks for that info John. I’m curious whether Amex paid it as a courtesy or as part of their purchase protection? They don’t have any documentation online regarding Trip Cancellation insurance that I can find.

I looked back at my paperwork and I am embarrassed that what I initially said was mistaken. One payment was with Citi Prestige and the second was NOT AMEX, it was thru the Chase system, I believe it was a Chase Marriott, definitely not Sapphire. Sorry for the confusion.

for anyone who cares about protecting their family in an emergency situation, i have kept my amex plat for the emergency medi evac reason alone. $550/year is a cheap ass insurance policy. i actually dont care too much about cost/benefit analysis of the plat nor do i care because the insurance policy is too valuable.

want to know more? read this:

http://viewfromthewing.boardingarea.com/2017/05/10/know-benefits-amex-platinum-medical-evacuation-claim-award-ticket-saves-275000

great post Greg,

this blog continues to be one of the best boarding area blogs.

thank you.

[…] Travel Insurance Showdown: Reserve vs Prestige vs Platinum by Frequentmiler. A comparison of travel insurance benefits. […]

So you said “Hotel or Tour: Pay at least in part with your Sapphire Reserve. This will give you full Trip Cancellation and Interruption coverage”

Can you elaborate on what you mean by this. Like lets say we have these two scenarios :

Scenario 1:

-Booked an award ticket using 70K AA miles. Paid for award taxes/fees of $125 on Citi Prestige

-Booked a tour on some other random credit card for $300

-Paid $800 for hotels using CSR

Scenario 2:

-Booked a $1,200 cash ticket using Prestige

-Booked a tour on some other random credit card for $300

-Paid $800 for hotels using CSR

What do you think gets covered in these two scenarios?

Good question. I’m not at all confident about the answer, but here goes…

I *think* that CSR will cover trip cancellation for everything in scenario 1 (flight, tour, hotel). If you lose AA miles, I think they would pay you at 1 cent per mile.

In scenario 2 since you paid entirely with the Prestige card for the flight, the Prestige card will cover your flight cancellation. And I think that the CSR would cover your tour and hotel

As someone who almost never travel time revenue tickets, the distinction and discrepancies are vital.

It varies betwwwn nothing (Amex), everything, or only on points earned from our transfer partners (Chase) for awards.

Don’t know if it’s in the works already, but it would be awesome if you would update the list for how the coverage applies to award tickets for each issuer.

I have many flights booked on my Citi Prestige over the coming year but I still don’t understand what would be covered for me. Two additional dimension on the comparison that would be very helpful are “award flight (fees) vs full fare” and “one way vs round trip.” Regarding the Prestige I’ve heard that only some of the benefits apply to one way flights but I’m not sure which ones.

Also, important to note that CSR provides Trip Cancellation and Trip Interruption up to $10,000 (the legalese is hard to parse but I’m pretty sure this is per person) whereas Prestige is $5,000

You might want to cover whether or not benefits apply when/if you are traveling on an award ticket (like many of us do) and using the card to pay the taxes and fees. We had trouble with Amex and weren’t covered when a certain airline lost our bag because it was an award ticket (fine print: ticket has to be paid in full on the card). Apparently though Citi does offer coverage in those circumstances? Still need to read the fine print on Chase.

What type of trip cancellation coverage does the CSR offer for timeshare (TS) reservations, if any? This basically involves paying annual maintenance fees on the timeshare upfront, so they’re is normally no actual charges to the CSR at time of making a TS reservation itself.