1

United MileagePlus Overview

The United MileagePlus program has changed pretty significantly in recent years, from the introduction of the valuable excursionist perk to the abolition of award charts (which has led to a series of stealthy-ish devaluations) and a decent suite of credit cards.

The key strength of United miles is the simplicity of redeeming miles for partner flights. United does not pass on fuel surcharges, which makes it easy to choose the most convenient partner for an award flight. Furthermore, their 2-month award availability calendar makes it easy to see which days have premium cabin availability, which can make award searches a relatively easy process.

In terms of elite status and benefits, United’s program offers less choice than Delta SkyMiles but offers what some would consider greater flexibility for confirmed upgrades for top-tier elites.

United Airlines MileagePlus Pros and Cons

Pros

- No fuel surcharges on award tickets

- Miles are easy to amass thanks to plenty of credit card options, particularly those which earn Ultimate Rewards points (which can be transferred 1:1 to United MileagePlus)

- Premier Platinum and Premier 1K members earn PlusPoints that offer some flexibility in how a member chooses to distribute confirmed upgrades (for example, a Premier Platinum member could their 40 PlusPoints to upgrade a round trip short-haul flight within the US from economy to business class or choose to upgrade a one-way international flight from economy to business class)

- United Airlines now offers family seating. When children under 12 years old are part of a booking, they will be seated next to their adult family members free of charge. This even applies in basic economy. If adjacent seats aren’t available, it allows a free change without a fare difference.

Cons

- No award charts: this makes it hard to plan for future award travel and makes incremental devaluations harder to see.

- Elite status benefits are generally weaker in comparison to Delta

- Premier-qualifying points are limited when flying with partner airlines

How to earn United Mileage Plus miles

United/Partner Flights

Base members earn 5 miles per dollar on United marketed flights. Elite members earn more, depending upon their status level, as follows:

- Premier Silver: 7 miles per dollar

- Premier Gold: 8 miles per dollar

- Premier Platinum: 9 miles per dollar

- Premier 1K: 11 miles per dollar

Exceptions:

- Certain unpublished, consolidator/bulk, group, tour and opaque tickets where the fare you paid is not provided to United (like with vacation packages, cruise packages, consolidator fares, etc.) are considered “exception fares”. With these flights, you’ll earn miles based on the distance flown and fare class. Details can be found here.

- Partner flights that are not marketed by United earn miles based on the distance flown. Details vary by partner. Details can be found here.

United Airlines credit cards

Miles can be earned from both credit card welcome bonuses and from credit card spend. In general, while we recommend earning lots of miles through new-card welcome bonuses, spending on United credit cards is not usually a good idea due to poor earning rates. There are many other cards on the market that offer much better rewards for everyday spend. More information about the United credit cards can be found below:

| Card Offer and Details |

|---|

50K Miles + 1,000 PQP ⓘ Non-Affiliate 50K miles + 1,000 Premier Qualifying Points after $5K spend in first 3 months.$450 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: While pricey, the Chase United MileagePlus® Club Business Card is a great choice for those who want a United club membership Earning rate: ✦ 2X United ✦ 1.5X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 1,000 PQPs per calendar year: 25 PQPs per $500 spend Noteworthy perks: United Club membership ✦ Unlocks complimentary elite upgrades on award tickets ✦ Priority check-in, security screening, baggage handling, and boarding ✦ Get one year of complimentary Dash Pass (Must activate by 12/31/24) ✦ Free 1st and 2nd checked bags ✦ Primary auto rental collision damage waiver ✦ Hertz Gold Plus Rewards® President's Circle® |

Limited Time Offer - 30K Miles ⓘ Affiliate 30K miles after $1K spend in first 3 monthsNo Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: Expired 8/11/22: 30K after $1K spend Earning rate: 2X United ✦ 2X gas stations ✦ 2X local transit and commuting Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Improved economy saver award availability (only when downgraded from a card with an annual fee) ✦ No foreign exchange fees ✦ 25% back on United in-flight and Club Premium drink purchases |

Limited Time Offer - 90K Miles ⓘ Affiliate 90k miles after $5k spend in first 3 months$525 Annual Fee This card is available to you if you do not have any United Club card and have not received a new Cardmember bonus for any United Club card in the past 24 months. Recent better offer: Expired 1/27/23: 100K after $5K spend FM Mini Review: While pricey, the Chase United Club Infinite Card is a great choice for those who want a United club membership and other perks like a 10% discount on saver awards. . Earning rate: ✦ 4X United ✦ 2X dining & travel Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 10,000 PQPs per calendar year: 25 PQPs per $500 spend Noteworthy perks: ✦ United Club membership ✦ Unlocks complimentary elite upgrades on award tickets, including companions on the same reservation ✦ 10% discount on saver level economy awards within the continental US and Canada ✦ Up to $100 for Global Entry, TSA Precheck or Nexus fee credit ✦ Priority check-in, security screening, baggage handling, and boarding ✦ Free 1st and 2nd checked bags ✦ Hertz President's Circle Elite Status ✦ Primary auto rental collision damage waiver |

Limited Time Offer - 70K Miles + 500 PQPs ⓘ Affiliate 70K miles and 500 PQPs after $4K spend in the first 3 months $250 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 6,000 PQPs per calendar year: 25 PQPs per $500 spend Noteworthy perks: Up to $125 in statement credits for United purchases each cardmember year - terms apply ✦ Two 5K award flight rebates per cardmember year ✦ First and second checked bag free for cardholder and one companion when you purchase your tickets with the card and include your Mileage Plus number ✦ Up to $100 Global Entry, TSA PreCheck or Nexus reimbursement ✦ 25% back on United inflight or Club Premium drink purchases |

Limited Time Offer - 60K miles ⓘ Affiliate 60K miles after $3K spend in 3 months.$0 introductory annual fee for the first year, then $95 This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: Expired 8/11/22: 70K after $3K spend FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn up to 1,000 PQPs per calendar year: 25 PQPs per $500 spend Noteworthy perks: ✦ Improved economy saver award availability ✦ Free first checked bag for primary cardholder and one travel companion when you pay with the card ✦ Unlocks complimentary elite upgrades on award tickets ✦ Priority boarding ✦ No foreign exchange fees ✦ 2 United Club passes per year on you anniversary ✦ One year of complimentary Dash Pass (Must activate by 12/31/24) ✦ Primary auto rental collision damage waiver ✦ Up to $100 Global Entry,TSA Pre-check or Nexus credit ✦ 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card |

75K Miles ⓘ Affiliate 75K miles after $5K spend in first 3 months.$0 introductory annual fee for the first year, then $99 After clicking through, be sure to click the link at the top that says, "Are you a small business owner?" to see the business card offers that include this card. You are not eligible for the bonus if you have received the bonus on this card within the past 24 months. Please note that the United EXPLORER Business card (no longer available) is a different product and does not affect your ability to get the bonus on this card. FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. Earning rate: 2X at restaurants including eligible delivery services , gas stations, and office supply stores ✦ 2X United ✦ 2X on local transit and commuting, including taxicabs, mass transit, tolls, and ride share services Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $100 annual United travel credit after 7 United flight purchases greater than $100 ✦ Earn up to 1,000 PQPs per year: 25 PQPs per $500 spend Noteworthy perks: ✦ Improved economy saver award availability ✦ Unlocks complimentary elite upgrades on award tickets ✦ Free first checked bag ✦ Priority boarding ✦ No foreign exchange fees ✦ 2 United Club passes per year at anniversary ✦ Free DashPass for one year (must activate by 12/31/24) ✦ Primary auto rental collision damage waiver ✦ 5,000 bonus miles at anniversary when you have this card and also a personal Chase United credit card. ✦ 25% back as a statement credit on United in-flight and Club Premium drink purchases |

Transfer from other rewards programs to United MileagePlus

Chase Ultimate Rewards

Chase offers a number of cards that earn more Ultimate Rewards points per dollar than their United cards earn in MileagePlus miles. This is particularly interesting here because Chase Ultimate Rewards points transfer 1 to 1 to United. Even if your main goal is to earn United miles through spend, you would most likely be better off earning Chase Ultimate Rewards points first. Then, you’d also have the great benefit of being able to use points for other purposes besides United.

Bilt Rewards

Bilt Rewards offers the chance to earn miles while paying rent as well as through its Bilt dining program, a partnership with Lyft, monthly games to earn points, and more. Additionally, the Bilt Rewards Mastercard offers 3 points per dollar on dining, 2 points per dollar on travel, and 1 point per dollar on all other purchases so long as you make at least 5 purchases in a billing cycle. Rewards on credit card purchases made on the 1st of the month (other than rent) are doubled. Points transfer 1 to 1 to United, which might make the Bilt card a competitive card for dining and a particularly attractive card for dining and travel spend that can be done on the first of the month.

Marriott Bonvoy

Marriott points can be transferred to many airline partners at a rate of 3 Marriott points to 1 mile. However, when you transfer 60,000 Marriott points at a time, you get 10,000 extra miles (in other words, 60K Marriott points converts to 30K airline miles).

Earn United Mileage Plus miles through shopping and dining

Online Shopping

United operates a shopping portal: United MileagePlus shopping. Start your online shopping at their portal and click through to your favorite retailers to earn miles per dollar spent. Keep an eye out for shopping portal promos for chances to earn additional bonus miles for shopping.

In-person shopping

United also offers card-linked offers for in-store shopping where you can earn bonus United miles at some stores when shopping in-store with a credit card linked to the program (this can be any linked card, it is not limited to being a United credit card). See our card-linked programs resource page for more.

Gift Cards via MileagePlus X (MPX app)

United’s MileagePlus X app (called MPX for short) offers the ability to buy gift cards instantly and earn bonus miles. The idea here is that you could presumably use this app to buy gift cards for in-store purchases while standing in the checkout lane (in many cases you are able to buy an exact dollar amount to cover your purchase to the penny), but this also works for buying gift cards to use for online purchases.

Miles per dollar earned varies by retailer and Chase United credit card holders get a 25% mileage bonus no matter what credit card they use for checkout. As noted on our Instant Gift Card Deals page, credit cards with bonus categories often (but not always) award bonuses based on the gift card bought. For example, if you buy a restaurant gift card then it is best pay with a credit card that offers a bonus for restaurant purchases.

Marriott Vacation Club

Marriott vacation club owners can exchange points for miles, starting at 500 Vacation Club Points for 8,000 miles. After that, additional points can be transfered in increments of 250 Vacation Club Points for 4,000 miles, up to 40,000 miles per member, per year. See more at this page.

United MileagePlus Dining

Like many airlines, United offers a dining program (called United MileagePlus Dining) that allows you to earn miles when you dine at a restaurant and pay with a card linked to the dining program. This works like other in-store card-linked offers and is stackable with any card category bonuses and may be even be stackable with other card-linked programs. See our Card-linked offers resource page for more.

Book hotels, cruises and rental cars with United partners

United has a number of other partnerships that allow for the opportunity to earn miles with partners on cruises, rental cars, hotel stays, and more. See more details here.

How to use United MileagePlus miles

Book award flights with United MileagePlus

Award bookings are easily done online via United.com for both United flights and its many Star Alliance and non-alliance partners. On United.com, simply check the box to “Book with miles” when searching for flights. United defaults to showing results for a week at a time, but you can also select “Flexible Dates” on the home page search to see a calendar view of 2 months at a time.

Based on our most recent analysis, the value of United miles have quite a bit of variance but one can reasonably expect to get around 1.3c per mile for domestic US and international economy flights. For international flights in premium cabins with partner airlines, the value one can get per mile can be substantially more.

Here are a few tips:

- United no longer has an award chart. Prices can be especially variable for flights operated by United, but partner awards have also become increasingly unpredictable.

- Leverage the excursionist perk on round trip bookings. Unlike Delta, United doesn’t offer a price advantage on round trip bookings, but they do offer the ability to get a free one-way flight in another region when your trip starts and ends in the same region. See Maximizing (and understanding) the United Excursionist Perk for more detail.

- No fuel surcharges means that there is typically no monetary advantage of one partner over another apart from the difference in taxes that you may pay based on the country(ies) that you transit.

Best uses of United MileagePlus miles

United no longer has an award chart and rarely has the lowest award price for any given region pair, but the lack of fuel surcharges and ease of amassing United miles can make them an easy choice. See our best ways to get to guides to see how United miles stack up against other programs for the best options for booking awards to various regions.

The best perk of the MileagePlus program for award bookings is the ability to utilize the Excursionist Perk. At a base level, the idea of the Excursionist Perk is that you could fly from the US to a foreign region and get a free one-way within that foreign region, later returning from a second destination. This theoretically allows you to visit 2 destinations on one award ticket for no additional award cost. For example, you could book a round trip to Europe where you fly from New York to Munich, visiting Germany for a few days, then fly from Munich to Paris and enjoy a few days in the city of lights before you return home flying from Paris to New York. In that example, the flight from Munich to Paris would be free as part of United’s excursionist perk. However, the benefit can be maximized in much more complex ways. See Maximizing (and understanding) United Excursionist Perks for more detail as there are additional ways to leverage the perk with varying levels of complexity.

United MileagePlus airline partners

United has many partners via the Star Alliance as well as additional non-alliance partners. All should be bookable online via United.com.

Star Alliance Partners

- Aegean Airlines.

- Air Canada.

- Air China.

- Air India.

- Air New Zealand.

- ANA (All Nippon Airways).

- Asiana Airlines.

- Austrian Airlines.

- Avianca.

- Brussels Airlines.

- Copa.

- Croatia Airlines.

- Egyptair.

- Ethiopian Airlines.

- EVA Air.

- Juneyao Airlines (a connecting partner).

- LOT Polish Airlines.

- Lufthansa.

- SAS.

- Shenzhen Airlines.

- Singapore Airlines.

- South African Airways.

- Swiss.

- TAP Air Portugal.

- Thai.

- THAI Smile (connecting partner).

- Turkish Airlines.

Non-alliance Partners

- Aer Lingus.

- Air Dolomiti.

- Airlink.

- Azul.

- Boutique Air.

- Cape Air.

- Edelweiss.

- Emirates.

- Eurowings.

- Eurowings Discover.

- Hawaiian Airlines.

- JSX.

- Olympic Air.

- Silver Airways.

- Virgin Australia.

- Vistara.

United award change & cancellation fees

United charges no change or cancellation fees for award flights. No-shows require a $125 fee to have the miles redeposited.

United MileagePlus Elite Status

Most airlines offer extra benefits to their most valuable customers. This is usually handled through elite status. If you fly enough with an airline, you can become “elite”. Of course, not all elites are equal and most airlines have multiple elite tiers to differentiate their valuable customers from their really valuable customers. And, of course, airlines offer the best perks to their highest tier elites.

United does the same. They offer elite tiers ranging from Premier Silver status to Premier 1K status. Silver status perks are only slightly better than those you get from holding a United branded credit card. Premier 1K perks can be quite nice.

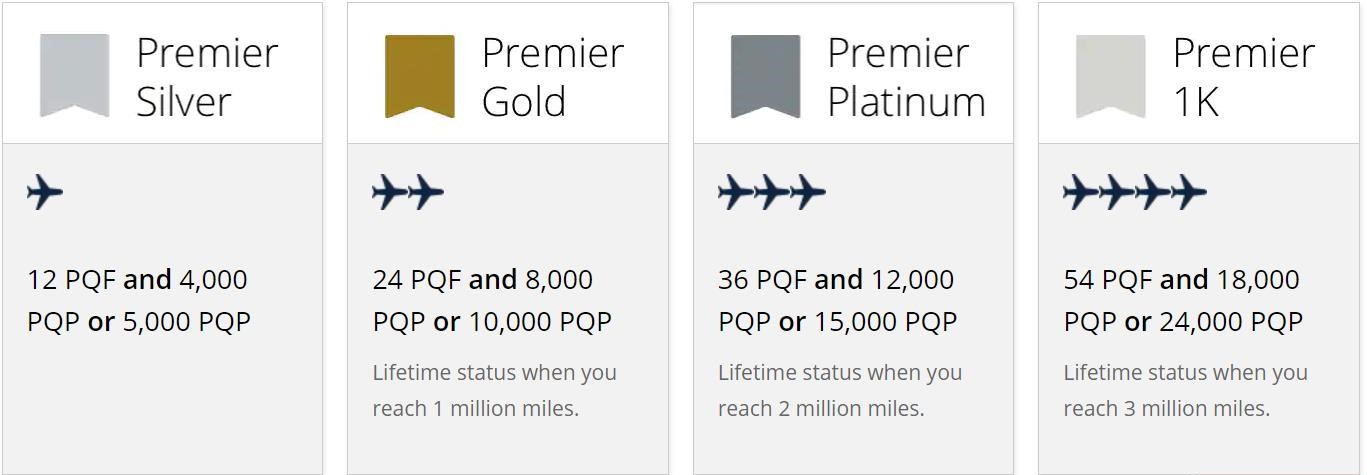

United elite status requirements

- PQFs: Premier-qualifying flights. Essentially, this means flight segments. At least 4 must be flown on United or United Express. Award flight segments do count as PQFs.

- PQPs: Premier-qualifying points. These are points awarded based on how much you spend on United flights. PQPs are earned based on the base fare and carrier-imposed surcharge of flight purchases, along with seating purchases and paid upgrades.

- Preferred partner PQPs: Award miles divided by 5

- MileagePlus partner PQPs: Award miles divided by 6

- Preferred partner:

- Max of 1,500 PQPs for first/ business

- Max of 750 PQPs for economy/premium economy

- MileagePlus partner:

- Max of 1,000 PQPs for first/business

- Max of 500 PQPs for economy/premium economy

United MileagePlus elite benefits

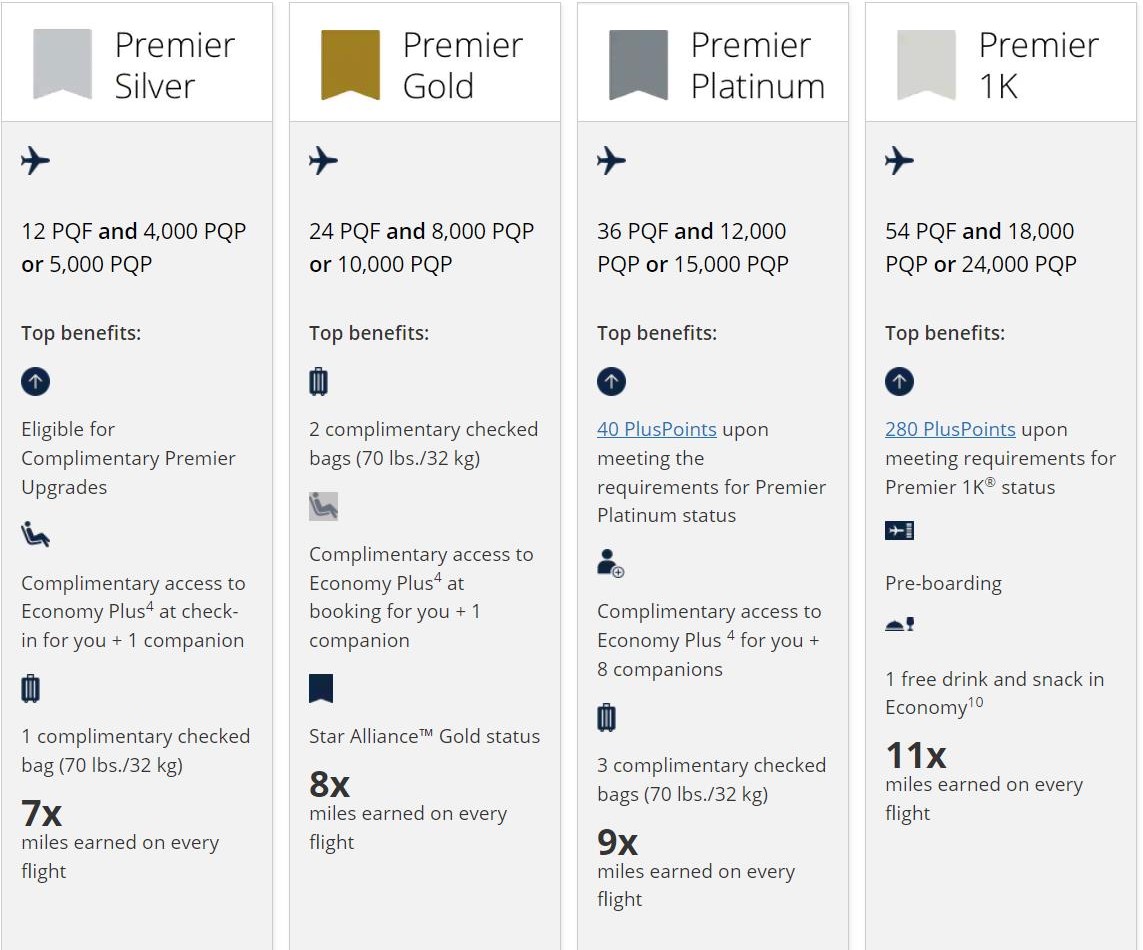

(Image Courtesy of United)[/caption]

A full list of United's elite benefits can be found here. The most salient benefits are:

(Image Courtesy of United)[/caption]

A full list of United's elite benefits can be found here. The most salient benefits are:

- Premier Silver: Free economy plus seating at check-in for member + 1 companion, 1 free checked bag up to 70lbs, 7x miles earned on paid flights

- Premier Gold: Free economy plus seating at booking for member + 1 companion, 2 free checked bags up to 70lbs, Star Alliance Gold (access Star Alliance lounges but not United Clubs), 8x miles earned on paid flights

- Premier Platinum: Free economy plus seating for member + up tp 8 companions, 3 free checked bags up to 70lbs, 40 PlusPoints (which can be used for upgrades), 9x miles earned on paid flights

- Premier 1K: Premier Platinum benefits with 280 PlusPoints, pre-boarding, 1 free drink and snack in economy class, 11x miles earned on paid flights

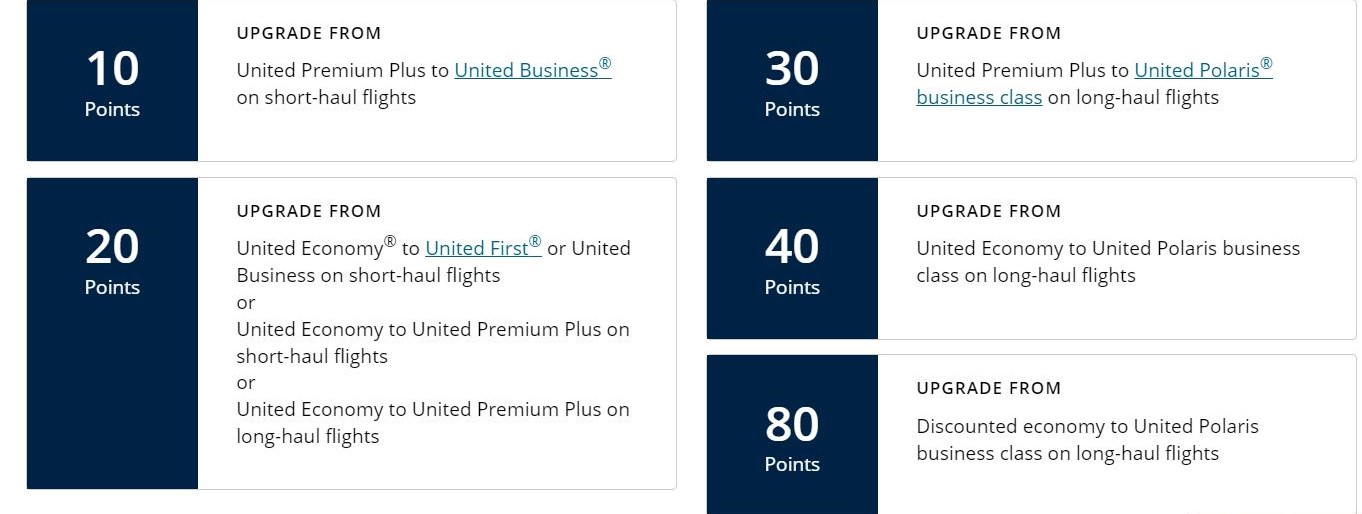

Elite Upgrades

PlusPoint upgrade grid (Image courtesy of United)[/caption]

Generally, economy to business class costs 20 PlusPoints each way on short-haul flights or 40 PlusPoints on long-haul flights (though discounted economy fares cost 80 PlusPoints each way on long-haul flights).

Short-haul is defined as:

PlusPoint upgrade grid (Image courtesy of United)[/caption]

Generally, economy to business class costs 20 PlusPoints each way on short-haul flights or 40 PlusPoints on long-haul flights (though discounted economy fares cost 80 PlusPoints each way on long-haul flights).

Short-haul is defined as:

Short-haul flights are flights without United Polaris business and include flights within the U.S., including Alaska, Hawaii and premium transcontinental service; flights between the U.S. and Canada; Bogota, Colombia; Central America; Caribbean; Mexico and Quito, Ecuador; flights between Guam and Honolulu, including island hopper service; and intra-Asia flights.Long-haul is defined as:

Long-haul flights are flights with United Polaris business, including flights between the U.S. and Africa, Asia, Australia, Europe, the Middle East, New Zealand, South America, and Tahiti.See this page for more information on PlusPoints.

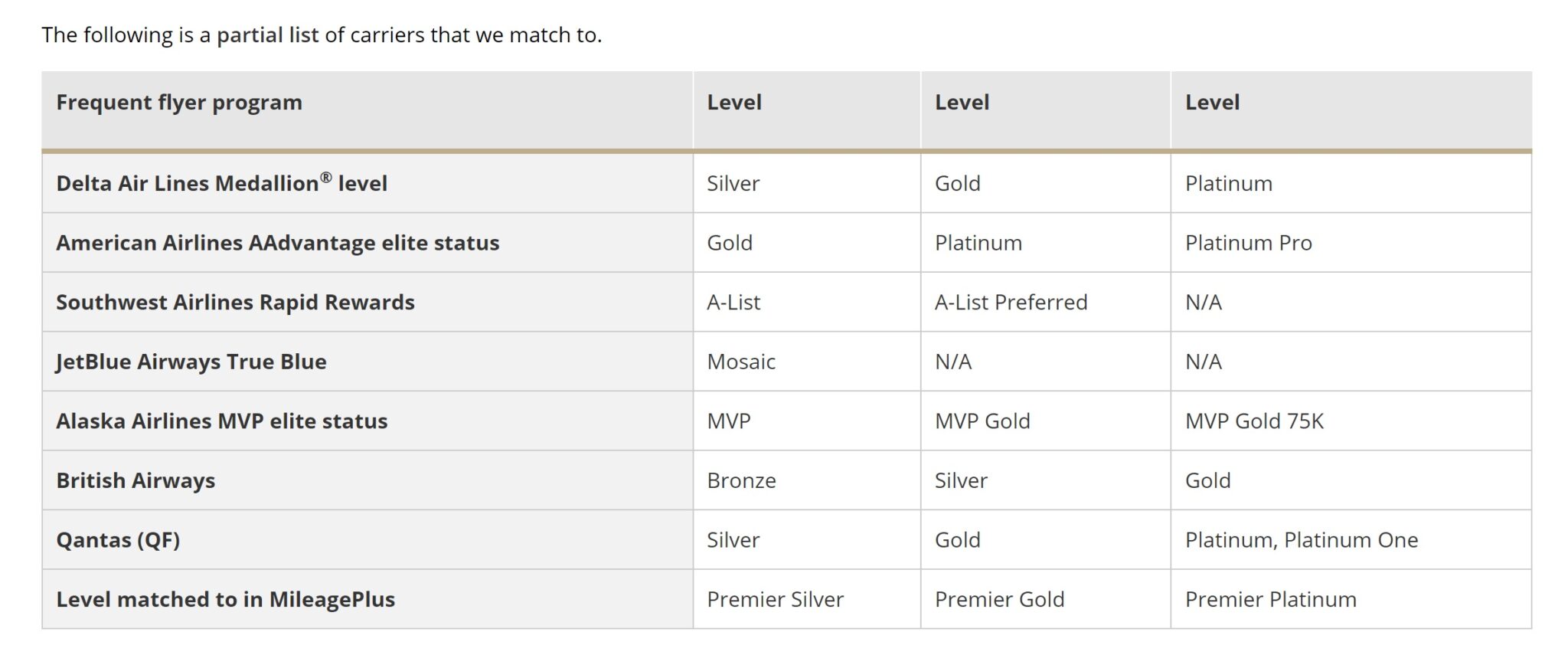

United Mileage Plus Status Match Challenge

If you have elite status with another airline, you may be able to qualify for United’s Status Match Challenge. This will give you 120 days of United Premier status plus the ability to earn a full year of status with fewer PQFs and PQPs than normally required.

Note that this match is currently scheduled to run through December 20, 2024, though you can start the 120-day challenge period no later than September 3, 2024 (even if you match after that date).

- Premier Silver: 4 PQFs and 1,300 PQPs

- Premier Gold: 8 PQFs and 2,600 PQPs

- Premier Platinum: 12 PQFs and 4,000 PQPs

Note that for the purposes of the challenge, all PQFs and PQPs must be earned on United or United Express-operated flights.

Full details of the United status challenge can be found here.

You should mention Mileage Pooling- families (or friends) can now create a pool and add their miles together . Just used it to combine children’s miles to get enough for a free flight.

One good use is booking awards with segments on both United and a partner. Because United releases such little award space to partners, other better Star Alliance booking options are seldom available for such awards. Mixed awards can also offer solid value.

I’m done with United and their cards. I’ve switched all my spending to flexible points with Amex and Chase, and I’m converting all my United-branded cards to $0 annual fee cards (or cancelling them).

Between us, my wife and I have 200,000 nearly worthless United miles that I’m trying to figure out what to do with. 🙁

The trick is to be flexible. I often find something for tomorrow that is Business class, 2 Polaris seats together, non-stop to Europe. I want to go to Portugal soon.

I just looked: 2 seats on 777, SFO-LHR @ 80K each. Or 50K each for Premium Economy) in a week. I think that’s pretty good.

Maybe I’ll take them up on it … 🙂

It appears your Marriott Bonvoy transfer calculation needs to be changed. 32,500??

There are no sweet spots.

United has gutted their MileagePlus program (May 2023) and United miles are now nearly worthless.

Blogs cried and whined about the devaluation, but they all (including this one) have completely missed (or purposely ignored) the worst of the devaluation.

It’s true that the program devaluation did raise prices (some prices increased a bit, many doubled, tripled or more). But the price increase was not the worst of it.

The worst of it was the loss of most (nearly all) decent international partner award redemptions in business class. Pre-devaluation, one could reliably find decent partner J awards (they weren’t cheap but at least they existed). Now those are all pretty much gone. Not just doubled or tripled in cost, they’re just no longer offered, at any price, even if you were willing to throw a million miles at it.

United’s program went from the industry’s best to the industry’s worst overnight.

If you don’t believe me, go look and try to find a decent business class international award flight that you wold want. One without having to overnight in one or two United hubs, without multiple long layovers. Most of United’s partner awards (in business class) are just gone, no longer offered, period.

If all you want is to fly to Orlando in coach, maybe United will work for you. If you want an aspirational award, in a partner business class cabin, get ready to be disappointed. You’ll only find multiple, long layovers in United hubs, coach legs, and miserably long routings that nobody wants.

I think failing to mention the crippling of United’s program a few weeks ago is pretty disingenuous. But that’s how blogs roll. Gotta push those credit cards to pay the bills. Suckers.

partner award availability has nothing to do with United though..

Correct, and by the same token, United (just like Delta) miles is much better for domestic travel than long-haul (since neither releases a lot of non-stop domestic economy award space to partners). Plus, if you have a United credit card, you get access to additional economy award seats.

Yes, but I imagine there’s a reciprocation factor. Given how terrible United is about releasing availability to partners, it’s amazing they have as much partner availability as they do.

For Status Match, United will also match to their Premier 1k, from AA Ex Platinum for 18 PQFs and 6,000 PQPs. I haven’t seen a DP if they will match to Global Services level

No sweet spots to mention?

Question: Is there any recourse available when two Business Class seats from Newark to Warsaw on LOT (booked with United points) are changed at the gate (supposedly two broken seats) to Premium Economy? If so, any advice?

Had a problem with a LOT flight booked with UA miles last Nov. DH’s business sseat assignment was changed and he was put in a biz seat that was totally nonadjustable. UA said our issue was with LOT, since that is the carrier for the flight. LOT had a claim form to use. Despite multiple go rounds, LOT only offered future LOT flight discount claiming DHflew in business class so it wasn’t a downgrade Despite zero adjustment for the seat.

You could at least claim downgrade but compensation may not be what you hope for. Form should be accessible on LOT website.

Good luck and hope you get a favorable outcome.

Is your CC chart correct that the United Club Infinite card and the United Business cards are not subject to Chase’s 5/24 rue?

Both United and Delta ought to move to a simplified tier status system like AA’s Loyalty Points.

[…] Complete Guide To United Miles: United MileagePlus is an incredibly useful loyalty program for several reasons. United has a large footprint. Star Alliance partners are very useful. Also, there are no fuel surcharges for partner awards booked with United miles! […]