Whether you’re saving for a child’s future education or paying off your own student loans, it is now possible to earn rewards while doing so! The process is simple: Use a rewards earning credit card to buy Gift of College gift cards, then apply the value of those cards towards a 529 plan or a student loan payment.

I’ll walk you through how this works…

Step 1: Make sure your 529 Plan or Student Loan is supported

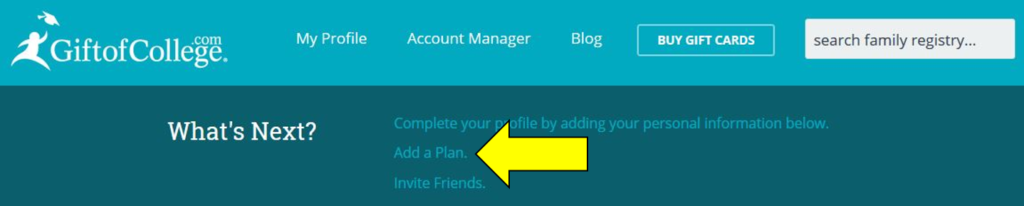

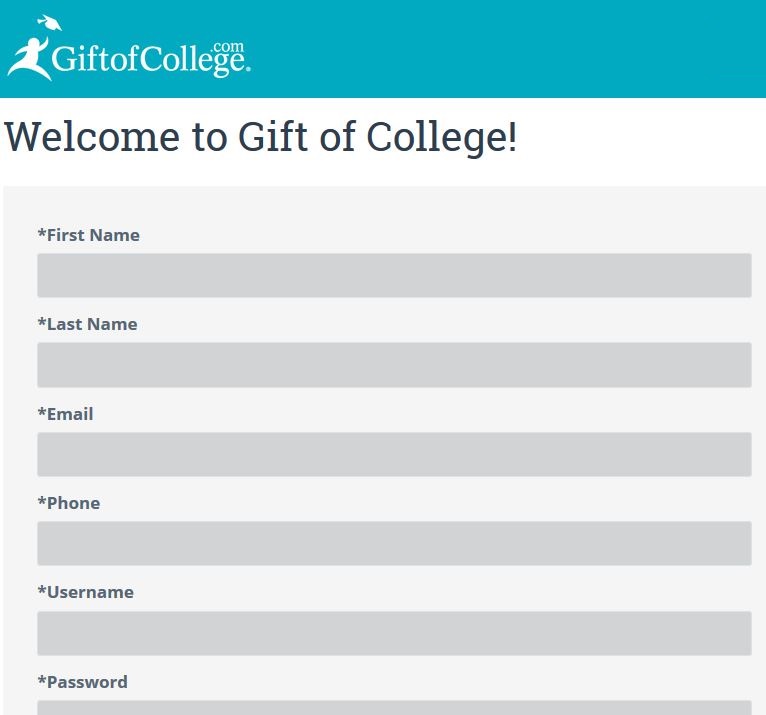

Browse to GiftofCollege.com and log in or create a new account.

After filling out your profile, you can then click “Add a Plan“.

On the next screen, you’ll see a see a drop-down selector titled “Savings Plan or Student Loan Account“.

Click the selector and scroll down to see if your 529 plan or student loan is available. If so, select your plan and fill out the required information (Beneficiary Name, Name on account, Account number) to link that account to your Gift of College account.

Step 2: Buy gift cards and earn rewards

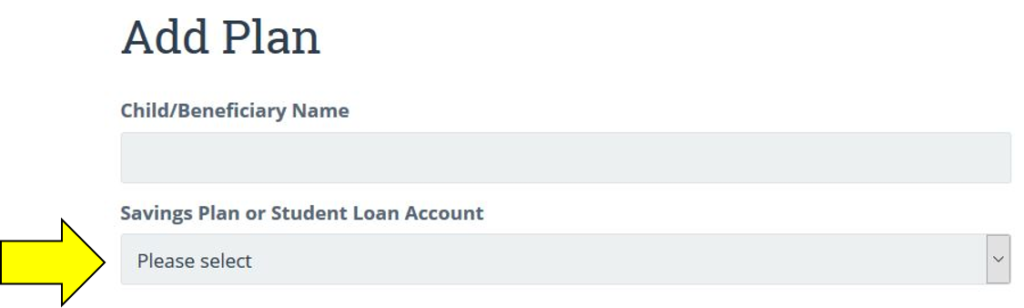

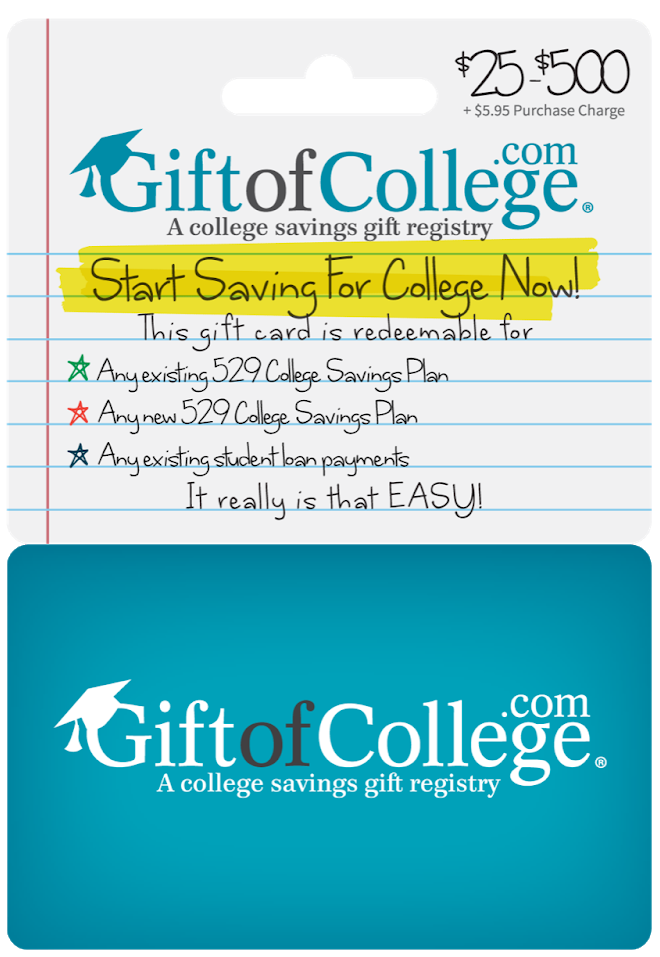

Gift of College gift cards are available to purchase with a credit card in-store and online. When buying in-store, here’s what to look for:

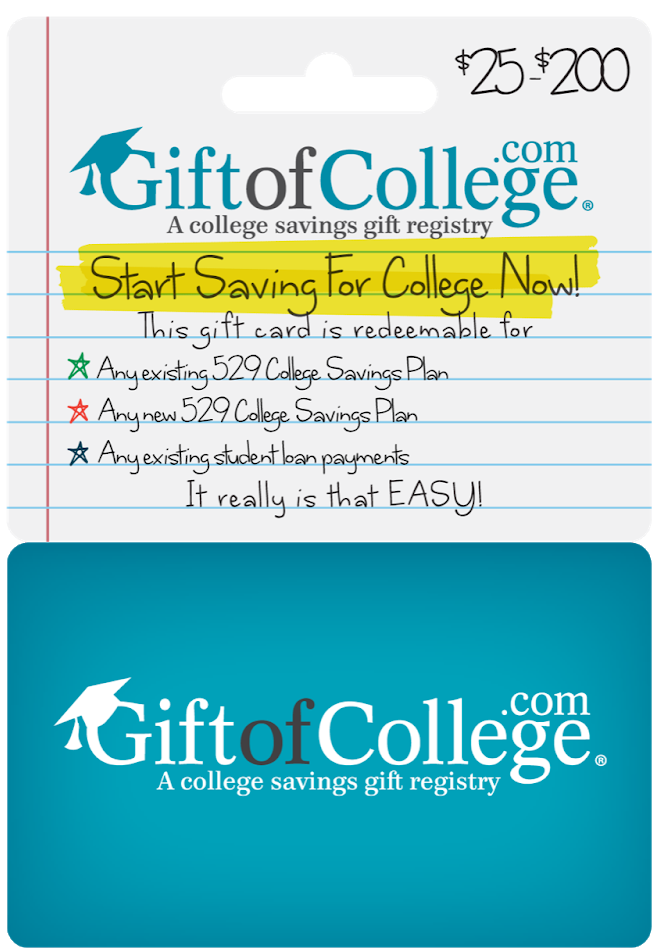

Avoid cards that aren’t loadable up to $500. Some are limited to $200 or less, like this one:

Buy in $500 increments in-store

The standard fee for in-store Gift of College gift cards is $5.95 per card. When you take the card to the register to buy it, you’ll be asked how much money you want to load to the card. I recommend always buying these in the largest denomination possible ($500 in-store). In this way, the fee becomes a small percentage of the overall price.

When you purchase a $500 gift card, the $5.95 fee is 1.19% of the card’s value. If you pay with a credit card that offers better than 1.19% in rewards, you’ll come out ahead. Depending upon which credit card you use and where you buy the gift card, you may be able to earn far more than 1.19% in rewards.

For details about where to buy Gift of College gift cards and which credit cards offer the best value, please see: Best options for buying Gift of College gift cards.

Step 3: Apply the gift card to your account or student loan

Once you have a Gift of College gift card in-hand, you’ll want to apply it to a 529 account or student loan. To do so…

- Log into your GiftofCollege.com account

- Click on the “Plan” that you’d like to add the money to. Gift of College lets you setup multiple plans within your account. This is useful if you are saving separately for multiple children or paying off multiple loans. If you have only setup one plan, it is most likely listed as the beneficiary’s name.

- Click “Redeem Gift Card”

- Fill out gift card details (gift card number and PIN) and click submit

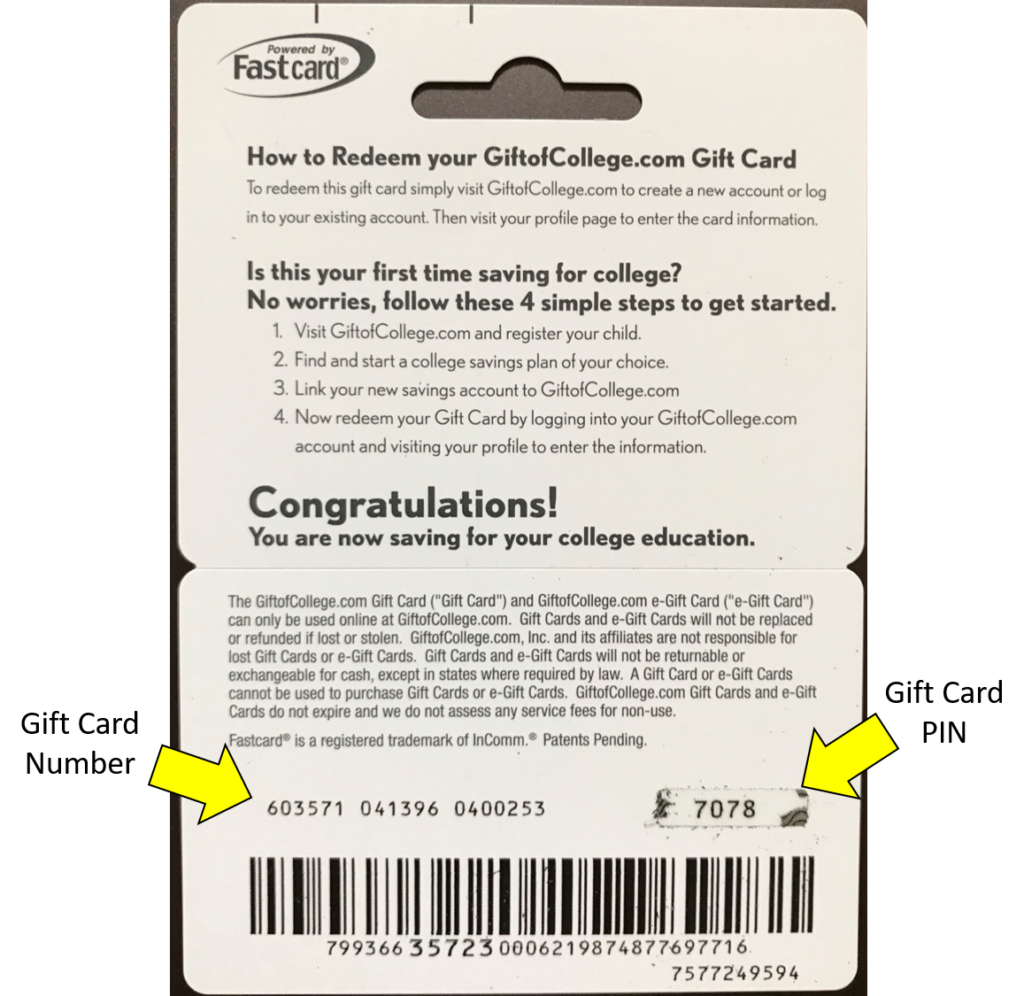

If you are using a store bought gift card, the details will be found on the back after you scratch off the silvery stuff which covers the PIN. It should look something like this:

Once you apply the gift card, the full gift card value ($500, for example) will be sent to your 529 plan or student loan. There are no fees other than the initial purchase fee.

Step 4: Wait for funds and rewards

Funds apply in approximately 14 days

Expect it to take 10 to 14 days from the time you apply a gift card online to the money appearing in your 529 account or as a payment to a loan.

Rewards apply after statement closes (usually)

Credit card rewards usually show up soon after your credit card statement closes each month. Some may take longer depending upon the issuing bank and the particular rewards program involved.

Summary

Thanks to Gift of College gift cards it is easy to earn miles for college. Whether you are saving for college through 529 plans or paying off a student loan, the same techniques can be used to earn miles, points, or cash back.

For more information, please see: Best options for buying Gift of College gift cards.

If you use the Amex Gold to purchase a few thousand dollars of these at grocery stores every month, what is the likelihood of triggering a financial review/having your acount shut down?

I think that’s unlikely

It’s obviously more lucrative if you have stores that sell gift cards near you or if giftcards.com actually carried larger than $75 cards but as I was just playing around with my sons gift of college account..I found I could make a contribution with a credit card directly to his gift of college account. $15 fee (3%) for $500 contribution. Could even use Amex. Obviously missing out on the portals etc but for those of us that don’t have an easy way to get the gift cards and have thousands of tuition fees…this is a super easy way to pay for college and meet some spending requirements..especially if your kids school doesn’t accept credit card payments!

Good info, thanks!

Is there a way to use GCs on the GiftofCollege website to directly pay monthly student loan payments? Or do they go straight to the principle as additional payments?

Great question. I’m not sure as I’ve never made student loan payments through this.

How does this parse out how to apply tax breaks for funding the 529? For instance, if I were buying these GCs and putting it towards a 529 I manage, then I should get the tax benefits from it, right? Conversely, if a rich relative gave me these GCs to put into my 529, the tax benefits shouldn’t apply, right? I’m a bit puzzled.

The tax implications are exactly the same as if you contributed directly to the 529. Your wealthy relative can use to Gift of College website to contribute to the 529 you manage (and then they’ll get the tax advantages, if any) or if they give you the gift cards it’s just like they gave you cash and so you would get any tax advantages that apply

what if i make direct contribution under my gift of college account in comparison to make gift card contribution?

I don’t think there’s a way to earn credit card rewards if you do it that way

There is an option for contribution with credit card.

Oh right… Yes that will work but I believe there’s a significant fee

Can a person buy the GoC gc using VGC or MCGC?

You probably have the answer already, but I’ve been testing lately. That depends on the store, like if they accept credit cards, PayPal or Google Pay to buy gift cards.

One interesting part was that the GoC website accepts Amex e-gift card online. (Vanilla Visa didn’t work.) The fee is 3% on a $500 contribution, but if you get an Amex offer to buy Amex e-gift card at a big-enough discount, the math can work in your favor. No Amex points/rewards back for buying an e-gift card though.

Will this count toward your sign-up bonus purchase?

I don’t know what you’re referring to when you say “this,” but buying GoC gift cards counts towards a SUB. But, because I’m paranoid, I don’t do it with Amex SUBs, despite reports of no issues.

I don’t think buying Amex e-gift cards with an Amex card counts towards an Amex SUB.

If you buy these at a gas station – about to take a trip to somewhere that finally as these – can you buy with Amex or too risky?

you probably already figured this out, but i have purchased $500 GOC gc’s at cumberland farms when on vacation, no more than 1 per day and i went to different CF stores. no issues or clawbacks besides the cashier looking at me weird. I used it when i had a 10x gas offer on amex platinum sometime ago.

Does the gifting of these Gift of College gift cards count against the annual gift tax exemption?

[…] about Gift of College Gift Cards and how they can be used to fund college savings. See the post Miles for College for a full rundown. The short story is that you can buy Gift of College Gift Cards at select stores […]

[…] Gift of College gift cards can be used to save for college through 529 plans, or to pay for college by paying student loans. For everything you need to know about this option, please see: Miles for College. […]

[…] Miles for college: Earn miles saving for college or paying for college. […]

How do you get money out of these 529 accounts? Are they payable to the college or to me? How often can you make a withdrawal? Can they do a wire to my bank? This could be a good MS alternative to the WM route.

You can withdraw to your own bank account and pay your college separately, or setup college to withdraw payments from the 529 account. Keep in mind that there are penalties if you withdraw and don’t have matching eligible education expenses. Also, when people rapidly load and withdraw I’ve heard that the 529 plans are quick to close their accounts.

How long should one wait before withdraw is considered safe?

[…] why you want to purchase these gift cards, I’d recommend reading this excellent resource by Frequent Miler. Keep in mind a lot of these stores are grocery and as such some cards earn at a high rate on these […]

[…] why you want to purchase these gift cards, I’d recommend reading this excellent resource by Frequent Miler. Keep in mind a lot of these stores are grocery and as such some cards earn at a high rate on these […]

[…] Gift of College gift cards are available in-store and online. These gift cards can be a great way to earn credit card rewards while saving for college or when paying student loans. To learn about how this works, please see: Miles for College. […]