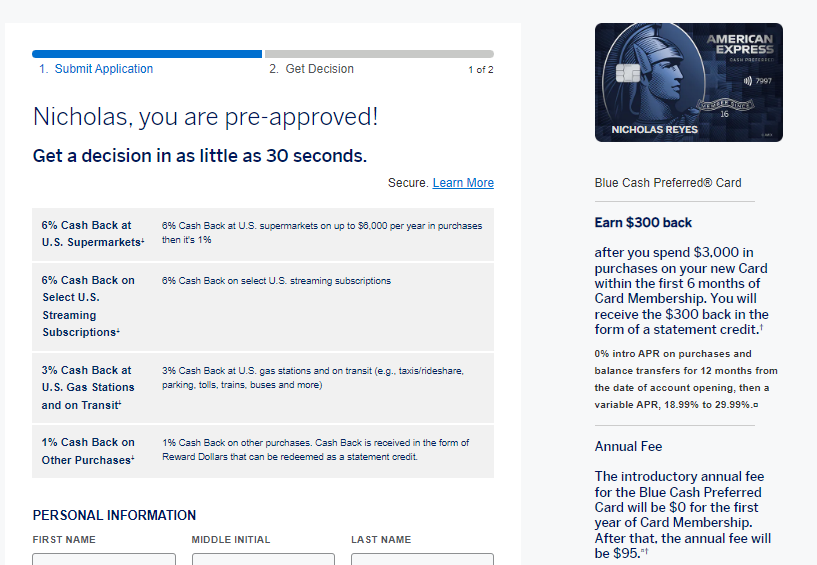

When logging in to my Amex account this week, I’ve been receiving notification that I am pre-approved for an increased offer on the Blue Cash Preferred card. My wife is not targeted for the same offer, so YMMV, but if this is a card you have considered, it might be worth keeping your eye out for a targeted offer.

The Deal

- Amex is targeting some customers with a pre-approved offer for the Blue Cash Preferred card that includes an increased intro bonus of $300 back after you spend $3,000 on purchases within the first 6 months and an introductory annual fee of $0 for the first year and $95 thereafter

Key Card Details

Note that if you click on the details below, you’ll go to our dedicated card page with more information about the card and the current public offer rather than the targeted offer mentioned in this post.

| Card Name w Details No Review (no offer) |

|---|

$0 introductory annual fee for the first year, then $95 Earning rate: ✦ 6% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 6% Cash Back as a statement credit on select U.S. streaming subscriptions. ✦ 3% Cash Back as a statement credit on transit (includes taxis/rideshare, parking, tolls, trains, buses and more). 3% cash back as a statement credit US gas stations ✦ 1% cash back as a statement credit on other purchases ✦ $7 monthly statement credit on Disney Bundle subcription of $12.99 or more. Enrollment required. ✦ Terms apply. Base: 1% Travel: 3% Gas: 3% Grocery: 6% Shop: 3% Other: 6% Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. Noteworthy perks: Terms Apply. (Rates & Fees) |

Quick Thoughts

The Blue Cash Plus is a card that can certainly make sense for cash back enthusiasts given its category bonuses. Personally, I will pass on this pre-approved offer simply because there are so many much stronger bonuses available in the market right now. However, for someone who prefers a lower spending threshold and who wants to focus on earning a good rate of cash back on relatively modest spend, this card could be a good fit.

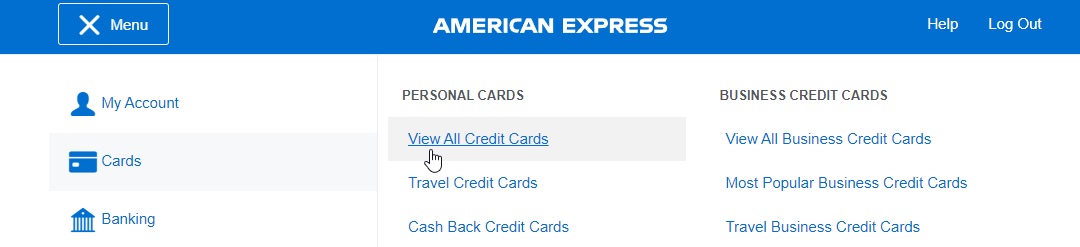

I’ve been seeing this pre-approved offer as a pop-up at the top of the screen when I log in to my Amex account, but I also find the same offer when I go to the menu, cards, and View All Credit Cards.

Most of the offers I see through that section are just the typical offers on the associated cards, but I do have a “Special Offer” listed on the Blue Cash Plus.

Overall, this isn’t the most compelling offer on the market, but it might be a good fit in the right situation.

Never really understood why this card doesn’t get more love, especially for people focused on cash and not MSing at the grocery store. 6 percent cash (yes a limit I know) groceries, 3 percent gas. Then 6% on all your streaming. Its a great card.

I got this card before I really understood the points game. 6% back on groceries (by far our biggest spend) is amazing, IMO.