NOTICE: This post references card features that have changed, expired, or are not currently available

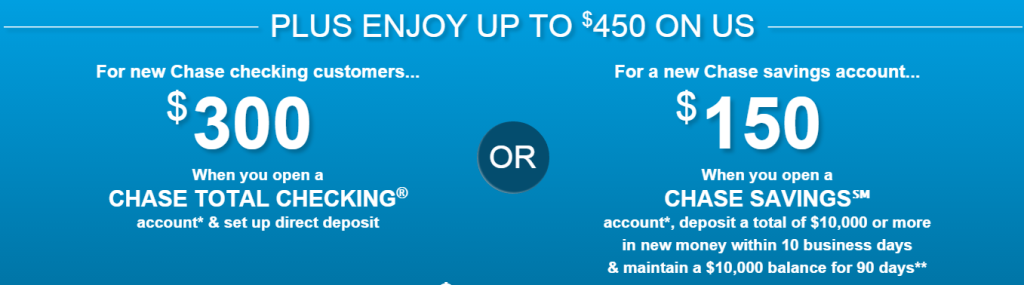

Chase is offering up to $475 for opening both a Checking and Savings account in-branch. There are a couple of forms of this offer:

Checking

- $300 When you open a Chase Total Checking account & set up direct deposit. Expires 5/7/15.

Savings

- $150 When you open a Chase Savings account, deposit a total of $10,000 or more in new money within 10 business days & maintain a $10,000 balance for 90 days. Expires 5/7/15.

- $175 When you open a new Chase Savings account and deposit a total of $15,000 or more in new money within 10 business days. Expires 4/23/15.

Direct Links

To get an offer, click one of the links below and enter your email address. A unique code will then be sent to you. The codes are most likely limited, so it is probably best to get a code now so you have the option of applying later.

- $300 Checking/$150 Savings DIRECT LINK

- $175 Savings DIRECT LINK

For a more detailed analysis, see this Doctor of Credit post.

Never miss a Quick Deal, Subscribe here.

Has anyone tried to open up the saving account and do the initial load of $15,000 with a CC? Does it show up as Cash Advance?

I just opened a chase checking account for my business about a month ago. Does this prohibit me from taking advantage of this offer for my personal account, or can I still use the promotion for the account I just opened?

This relates to a Chase Checking account and is something I am just becoming aware of, so asking in this comment section … hope that is OK!

For the Chase Freedom/Chase Checking Account Bonus in 2015, do you have to sign up or activate anything? I got a Chase Freedom Card in December 2014 and a Chase Checking Account in January 2015, am I automatically qualified?

Are you referring to the 10 UR points per transaction bonus, or the 10% additional points bonus? If so, I believe that program ended sometime in 2014 and the final bonus payout was Jan/Feb 2015. I got mine on my Feb ’15 statement.

If it’s still ongoing, you should be automatically enrolled. I was after opening a Chase checking account.

I have these personally. Would a business account be

eligible?

Thanks,

John

I did the $175 offer for savings, it is a better deal as it has no fine print requiring you to park the $15,000 for 90 days. After receiving the bonus I pulled out all but the $300 minimum to avoid fees and will let it sit there for 6 months before closing….we do this every year to get some kind of interest from banks since chase is only paying .01% on their basic savings and most banks aren’t much better….anyone interested in banking bonuses should check out this site: http://www.maximizingmoney.com/category/banking-bonus-deals/

I got the $300 checking plus $200 savings bonus code in the mail. I currently have cash in high yield savings account ~1% APY. In order to maximize my yield, I’m thinking:

Checking bonus: Deposit $1,500 (the minimum daily balance requirement to prevent fee) and hold it for 6 months.

Savings bonus: Deposit $15,000 in the CHASE savings account for 90 days (3 months). Then drain it down to $300 ish (above minimum daily balance requirement to prevent fee) and hold it for another 3 months (for a total of 6 months).

After 6 months have passed, close both CHASE account and put everything back to my high yield savings account. My rough math tells me I’ll be missing out on about $50 of high yield in returns for the $500 bonus.

What wasn’t clear is if the direct deposit needs to be set up for 6 months continuously to get the bonus or if I can stop it after a few months. Any caveats churning the bonuses?

There is not Chase branch in my state. Will it work if I drive to a neighbor state that is an hour away? Thanks!

I do not see any residency requirements on the offer, however you can always call the local branch before driving down there.

Any idea if this is something that can be done more than once? I signed up for and cancelled a chase account a few years ago

There doesn’t seem to be a hard rule, however you can’t have had an account in the past 90 days and you must keep the account open for 6 months, so at the minimum it would be every 9 months.

Limit of one bonus per calendar year as well.

Is that 1 bonus per account type per calendar year? The flyer says $300 (checking) OR $150 (savings). Although it also says enjoy up to $450. Not trying to over analyze but just want to be doubly sure.

Just a warning, you will receive a 1099 for tax purposes for this as income from Chase. I took up the similar Chase account opening offer last year and was surprised to receive a 1099 for the amounts this past February.

Thanks for the reminder Robert. All bank account (not credit card) bonuses are considered interest and thus are taxable

yes they 1099 you but $300 in interest for having DD for 6 months on a checking account beats any interest rate you can find.

These offers are by no measure nationwide. I’m not going to drive 4+ hours one way to setup a bank account. Please change this post to reflect reality.

I never said the offer was nationwide in the post, however I have added the words “in-branch” to clarify.