Bilt Rewards is the core program in which you can earn points by paying your rent and/or using the Bilt Mastercard. We’ve published a number of posts about Bilt, but until now we hadn’t consolidated all of the pertinent information into a single guide. This guide includes everything you need to know about Bilt and will be updated as the Bilt Rewards program evolves.

Bilt Rewards: a points program built for renters

Bilt Rewards is a program designed to enable those who rent their homes to earn points on the rent. This makes the program and associated card unique in offering an easy way to earn points on what is the largest monthly expenditure for those living in many markets.

There are several ways to earn and redeem Bilt Rewards points, each covered below in this guide to both the program and card.

Bilt Rewards elite status

Bilt Rewards offers an elite status program that offers the chance to earn interest on rewards points among other benefits.

You can qualify for elite status by total points earned or through spending via five different channels:

- Bilt Mastercard (excluding rent)

- Bilt dining with a card that’s linked to your Bilt wallet

- SoulCycle classes booked via the Bilt app

- Bilt Travel Portal

- Lyft rides

Elite status thresholds are as follows:

- Blue – anyone enrolled in Bilt Rewards with under 25,000 points

- Silver – 50,000 points earned or $10K in non-rent spend

- Gold – 125,000 points earned or $25K in non-rent spend

- Platinum – 200,000 points earned or $50K in non-rent spend

Benefits as you move up status tiers include:

- Silver and higher

- Earn interest in the form of points to a member’s Bilt Rewards account every month based on average daily points balance for each 30-day period (rate is based on the FDIC published national savings rate)

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Gold and higher

- Bilt Homeownership Concierge: Members who redeem Bilt Points toward a home down payment can get help from a dedicated concierge who will walk the member through the home buying process.

- Platinum

- Members will receive a complimentary gift from the Bilt Collection (apparently some type of home decor / art).

- One free BLADE helicopter ride each time you qualify (or re-qualify) for status.

How to earn Bilt Rewards points

Paying rent (non-cardholders).

You can earn 250 points per month for paying your rent with the Bilt Rewards app even if you do not have a Bilt Mastercard. However, if you do not have the Bilt Mastercard, you’ll need to live in an apartment that is part of the Bilt Alliance in order to earn Bilt points for paying rent. From Bilt’s FAQs:

How do I know if my property is part of the Bilt Alliance?

The quickest way to find out is by asking your property manager / on-site teams. You can also email us at support@biltrewards.com. Note, you should have received a personalized invite from your property manager if you’re renting from a Bilt Alliance Property.

The earnings here won’t be very significant at just 3,000 points per year for non-cardholders paying rent, though together with 100 points for linking each transfer partner program you can possibly put together enough points in the first year for a free night at an off-peak Category 1 Hyatt hotel even without the Bilt credit card. If you live in an apartment that is part of the Bilt Alliance, it probably makes sense to sign up for the app and earn points whether or not you get the Mastercard.

Paying Rent (cardholders). Pay by card, check, or ACH transfer.

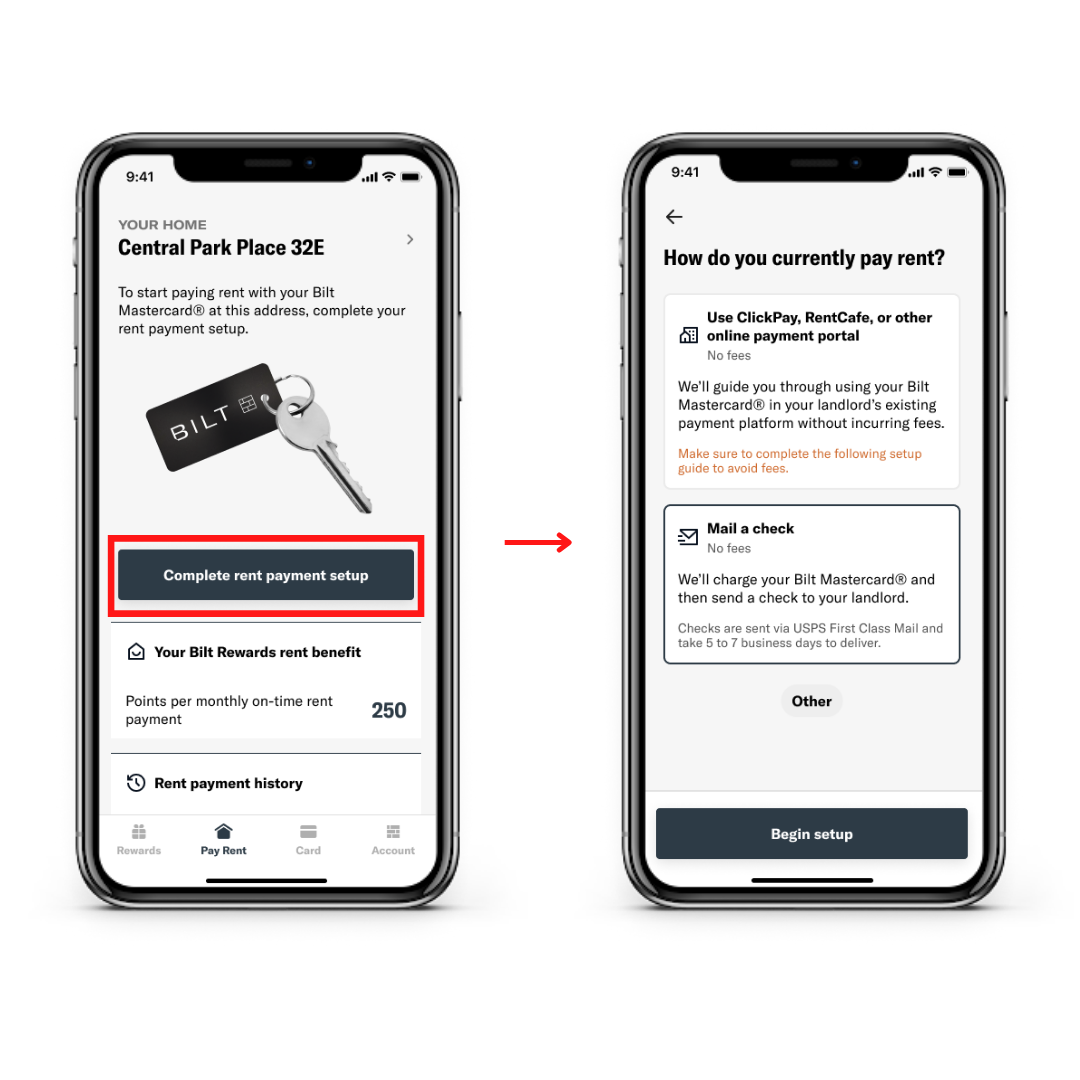

Even if your landlord doesn’t accept a credit card, Bilt Mastercard cardholders can pay rent via check or ACH and still earn 1x points on rent (up to 100,000 points per year). Whether you pay by check, ACH, or with your Bilt Mastercard, you’ll pay your rent through the Bilt app (or use the app to generate ACH account information that can be copied into your online rent payment portal). This makes it very easy for most people to earn 1 point per dollar spent on rent (up to 100,000 points per year). Keep in mind that you’ll need to make 5 total transactions per month with the Bilt Mastercard in order to earn points, so be sure to use it for more than just the rent.

In the Bilt Rewards app, cardholders have the option to send a rent payment by mailing a check or by ACH transfer using ClickPay, RentCafe, or other online payment portals.

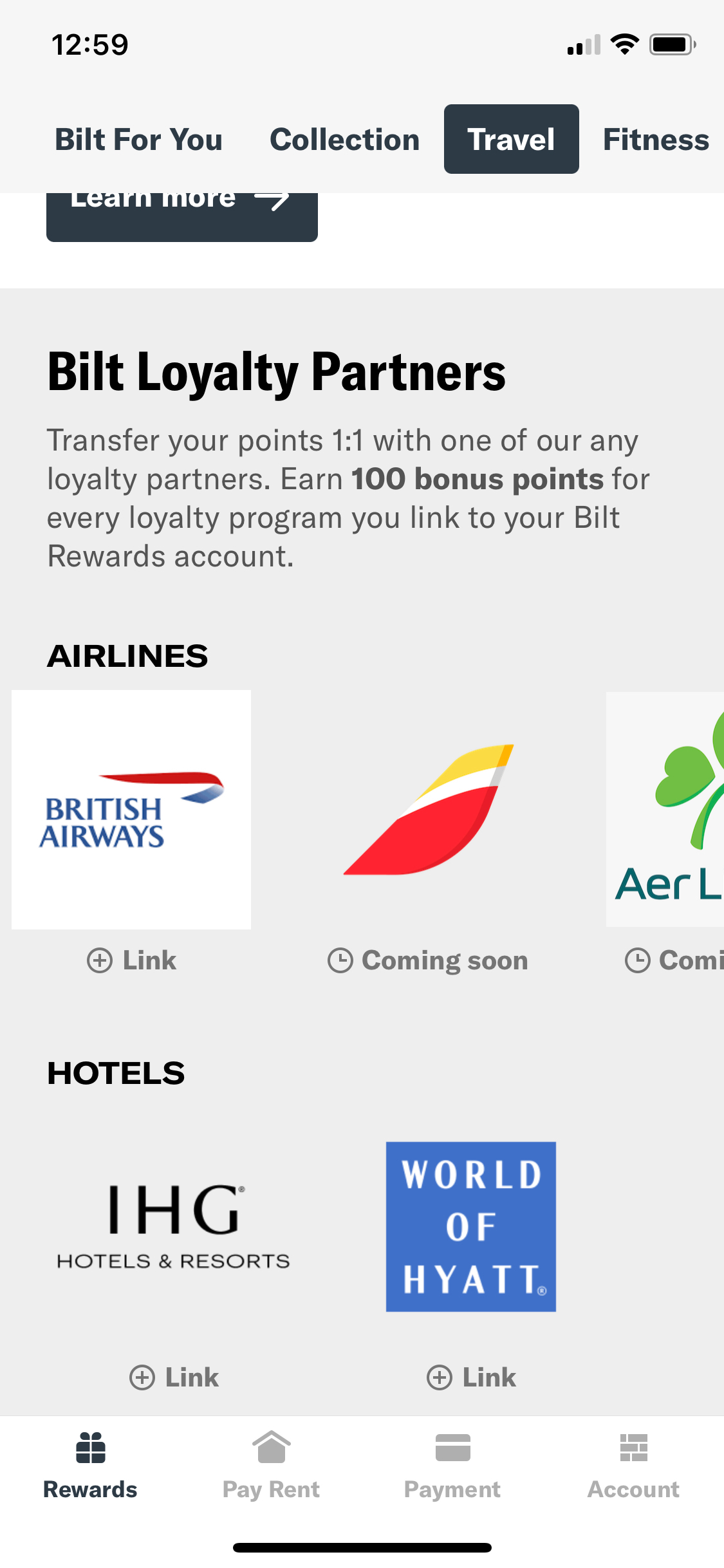

Linking Rewards Programs to Bilt

Bilt Rewards offers 100 points for every loyalty program you link to your Bilt Rewards account. This represents very low-hanging fruit for most members.

Note that Bilt has occasionally run promotions with increased incentives for linking specific programs. For instance, in April 2022, Bilt offered 500 points for linking an American Airlines AAdvantage account (note that the partnership with AA ended in June 2024) and in May 2022 Bilt offered 500 points for linking a World of Hyatt account. Both of those promotions have since expired, but it is worth keeping your eye out for future promotions if you have not yet linked all of your loyalty accounts.

Link your Bilt account to Lyft

Use any form of payment and earn 2X points on Lyft rideshare rides when your Bilt Rewards and Lyft accounts are linked, and Bilt is set as the active loyalty rewards partner. If you are a Bilt cardholder, you can earn 5X total points when paying with a Bilt Mastercard. Find more information in this post: Bilt Offering 2x On Lyft Rides For Members, 5x For Cardholders.

Link your Bilt account to Amazon (caution)

Bilt Rewards points can be used to buy things on Amazon. Don’t do it. It offers terrible value for your points. That said, you can earn 250 Bilt points by simply linking your Bilt account to your Amazon account. Still, I recommend proceeding with caution. I’m always hesitant to link rewards programs to Amazon for the fear of my Player 2 accidentally using points — or, worse yet, having my Amazon account hacked and a thief draining my rewards points. The risk/reward calculation just isn’t worth keeping rewards programs linked long-term in most instances in my opinion.

Using the Bilt Mastercard

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: If you pay rent and haven't been earning rewards, this card is a no-brainer as you can pay your rent and earn rewards with no annual fee. A surprisingly good set of transfer partners makes the rewards for using this for rent worth getting the card for that main purpose alone (as long as you remember to use the card 5 times per month). No Annual Fee Earning rate: Must use your card for 5 purchases per month, then: 3x Dining ✦ 3x Lyft ✦ 2x Travel ✦ 1x rent (one payment per month, up to 100,000 points per year) ✦ 1x on other purchases Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points 1 to 1 to airline and hotel programs (including American Airlines, United, Hyatt, Aeroplan, and more) ✦ Redeem points for 1.25 cents each towards travel booked through Bilt's travel portal ✦ Cell phone insurance ✦ Primary rental car insurance ✦ Purchase protection ($10K/item, $50K/year) ✦ Travel insurance ✦ No transaction fee to pay rent and earn rewards |

The Bilt Mastercard offers rewards in the form of Bilt Rewards points as shown above so long as you use your card for at least 5 transactions per month. If you do not use your card for at least 5 transactions per month, you will not earn points based on your card activity.

Note that even though the Bilt Mastercard doesn’t officially have a welcome bonus, people who sign up for the card report receiving an email from Bilt offering 5x rewards on all charges except for rent for five days (up to 50,000 points max). While that’s not as big of a bonus as you’ll get with many other cards, it can still be significant especially if you have large bills to pay during that timeframe.

2x travel, 3x dining

The Bilt Mastercard offers two bonus categories: 2x travel and 3x dining. While those multipliers do not put it at the top of our list of best category bonuses, they represent good return for a no annual fee card that earns points that can be directly transferred to partners.

Assuming you can meet the minimum transaction requirements, the return on dining and travel spend is respectable for a card with no annual fee given Bilt’s very strong set of transfer partners and even more so when you consider that points can be used not only to transfer to partners but also to book travel at a value of 1.25c per point through Bilt’s portal. While booking through a travel portal won’t always make sense (you need to shop rates), the added flexibility is nice for times when the portal is price-competitive.

1x everywhere else

Unfortunately, the Bilt mastercard does not offer a strong earning rate on everyday spend at just 1x for most purchases, nor does it offer a public introductory bonus. We recently saw a targeted offer where some were targeted for 10,000 points after $1,000 in purchases. In the first 90 days. Those targeted received an email with a personalized link.

Where the card really shines is in offering 1x on rent payments — even if your landlord does not accept a credit card. That’s because cardholders gain the ability to pay not only landlords in the Bilt alliance but any landlord by sending a check or by ACH transfer as outlined above in this guide.

Earning 1 point per dollar on most purchases is not a good return on spend. That said, if you would not otherwise earn points for paying your rent, the overall math may work out well for those looking for a single long-term card. For instance, if you generally have $1500 per month in expenses paid by credit card and you also pay $2,000 per month in rent, you would earn at least 3,500 points per month with the Bilt Mastercard and possibly more if any of those purchases are in bonus categories (assuming you make at least 5 transactions). If you would have alternatively put those $1500 in monthly purchases on a card that earns 2x everywhere and not earned points on rent, you would only earn 3,000 points per month. You could earn far more points by focusing your spend toward excellent credit card welcome bonuses, but the Bilt Mastercard can be a reasonable choice for someone who rents and is looking for a single no-annual-fee credit card.

Bilt has run some spending promotions like 5x everywhere for Black Friday with Bilt Rewards card last year. It’s worth keeping an eye out for similar promotions.

Bilt “Rent Day”

For a 24-hour period on the 1st of each calendar month, Bilt offers a promotion called “Rent Day” where members with the Bilt Mastercard earn double points on all non-rent purchases. Not only does this make the base earning rate 2x, it also doubles existing bonus categories, meaning that cardholders earn 6x dining and 4x travel. (but for one day only). That makes the first of the month a great day to buy a gift card at your favorite restaurant or to book pending travel (though it would likely be harder to plan that specifically for the first of the month given the fluidity of pricing).

Your earnings potential on Rent Day isn’t infinite: you can earn up to 10,000 maximum bonus points on rent day. Still, that’s a fairly high ceiling given that it would take $3,333.34 or more in dining purchases to exceed the 10K bonus point cap (or $10K in non-bonused purchases).

It’s also worth pointing out that you still only earn 1x on rent. The double rewards is for non-rent purchases only. In that regard, remember that you need to make 5 non-rent purchases per month in order to earn 1x on the rent. This double rewards deal on the first of the month should make it increasingly easy for cardholders to meet that threshold.

Bilt also runs additional promotions on Rent Day, in addition to the increased earnings. So far, offers that we’ve seen have included a transfer bonus to IHG One Rewards, a monthly rent giveaway, free SoulCycle classes and even a “Points Quest” trivia contest.

Finally, as part of Rent Day, Bilt usually offers a “Point Quest” game within the Bilt Rewards app on the 1st of every month with the chance to (usually) earn up to 250 points for completing a fairly simple task.

Referring friends to Bilt Mastercard

Bilt offers a referral program for the Mastercard, but the normal rates aren’t stellar. For each person you successfully refer, you get 2,500 points. Every 5th successful referral gets you an additional 10,000 points – up to 2 million bonus points.

Note that you do not need to be a card holder in order to refer friends to the Bilt MasterCard. If you have friends who rent, this could be a way to earn some easy points. You can find your referral code by tapping the invite button in the app.

Bilt now limits you to a maximum of 50 lifetime referrals.

Bilt Wallet

The Bilt Rewards app has a section called “Wallet”. You can link credit cards (i.e. those from other issuers) to the Bilt Rewards app and earn 100 points for each card you link to your Bilt Rewards wallet for up to three cards. At the moment, the reason to link a card or cards in the Bilt Wallet is so that you can earn an extra 5x points when paying at restaurants that participate in the Bilt Dining program (see the next section).

Bilt Dining program

You can earn 5x points when paying with a card you have linked in the Bilt Rewards app at participating restaurants. Bilt Dining is currently available in the following cities:

- New York

- Chicago

- Atlanta

- Boston

- Dallas

Note that the 5x points you earn at these restaurants are in addition to the points earned using your chosen credit card (which does not have to be the Bilt card, but rather must be linked in the Bilt app).

You can read more about Bilt Wallet and Bilt Dining in this post: Bilt Rewards now offers dining program: Earn 5x points when paying with linked card.

How to use Bilt Rewards points

Transfer Bilt Rewards points to airline and hotel partners

Bilt has a very unique set of transfer partner that make the program surprisingly strong. Points transfer 1:1 to partners, with most transfers occurring near instantly. Partner programs can provide opportunities for far outsized value. See our Bilt Rewards sweet spots post for full details on the best redemption opportunities.

Partners include:

Hotels

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 1 (Unknown) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth at least 2 cents each, but they’re sometimes worth far more. Bonus: award nights are not subject to resort fees. | 1 to 1 (~5 Minutes) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (~5 Minutes) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 20K to 25K (~5 Minutes) |

Airlines

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (~5 Minutes) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (~5 Minutes) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (~5 Minutes) |

| Alaska MileagePlan | Alaska Airlines offers decent oneworld award pricing, excellent short-distant pricing, and uniquely allows free stop-overs one one-way awards. Additionally, Alaska allows free award changes and cancelations (although they do have a small non-refundable partner award booking fee) | 1 to 1 (~5 Minutes) |

| Avianca LifeMiles | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (~5 Minutes) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (~5 Minutes) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (~5 Minutes) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. | 1 to 1 (~5 Minutes) |

| Hawaiian Miles | Hawaiian Airlines’ award prices tend to be quite high, but there are some not-terrible uses: fly to neighboring islands for 7.5K miles, fly first class round-trip from Hawaii to South Pacific islands for as few as 95K miles, fly first class round-trip from Hawaii to Australia for as few as 130K miles, or use miles to upgrade paid flights. | 1 to 1 (~5 Minutes) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (~5 Minutes) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 via BA (~5 Minutes) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (~5 Minutes) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. Good uses of miles include United's Excursionist Perk awards and (sometimes) dynamically priced United economy awards. | 1 to 1 (~5 Minutes) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (~5 Minutes) |

Current Transfer Bonuses

If Bilt Rewards is running any transfer bonuses, details will appear here:

| Transfer Bonus Details | End Date |

Integration with Point.me for Partner Flight Searches

Bilt Rewards includes a free integration to search for award space with their transfer partners through Point.me. Point.me is a search again that allows you to search multiple sites for award availability across numerous programs with a single click. A day pass for Point.me typically costs $5 (for 24-hour access) or a subscription ordinarily costs $12 per month or $129 per year.

Bilt Rewards members have access to the Point.me engine to search for available awards with Bilt’s 12 transfer partners (no Point.me subscription required). This makes award programs much more accessible for the average consumer. Note that searches are limited to Bilt’s transfer partners only.

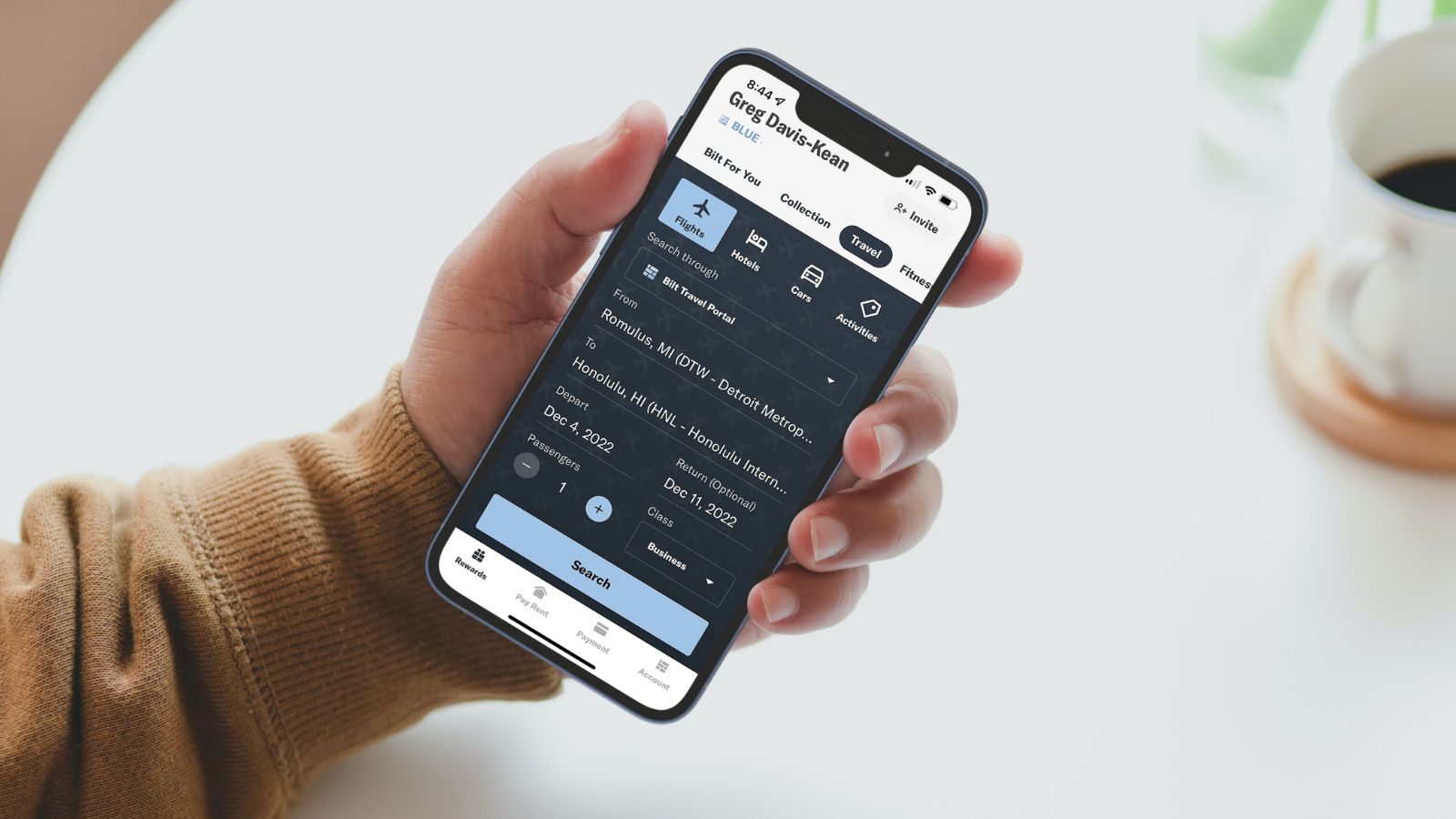

Use Bilt Points to pay for travel at 1.25c per point

Bilt now offers the ability to use points at a value of 1.25 cents per point when booking travel through their new travel portal. The portal is baked into the Bilt app (simply select the “Travel” tab) or members can browse to: travel.biltrewards.com.

Like many other travel portals, Bilt’s portal is powered by Expedia. This means that most flights will probably be the same price that you can find elsewhere, but rental cars, hotels, and activities may cost a bit more. Still, this can be a good way to get decent value for points when booking hotels or certain experiences (like tickets for Disney World).

While you can often get far more value by transferring points to airline and hotel programs, the ability to alternatively get decent value when redeeming for travel directly is a strength for those who don’t intend to learn the intricacies of booking award flights using airline miles.

Redeem points for rent

Bilt allows you to redeem points for rent. The value here is very poor as you will get less than 1c per point. If you intend to use credit card rewards to pay for rent, you would likely be better off with a credit card that earns 2% cash back everywhere and using that cash back toward your rent.

Redeem points for home purchases

Select mortgage lenders that partner with Bilt allow Bilt Rewards members to use points toward their down payment at a value of 1.5c per point when redeemed through participating lenders for eligible home purchases.

Redeem points for fitness classes

Bilt has partnerships with several popular exercise class brands, so you can redeem your points for popular classes like Soul Cycle, Rumble boxing, Solidcore, and Y7. These redemptions generally don’t provide maximum value.

Redeem points for art, home décor and more

Bilt offers the Bilt Collection, a curated selection of limited-edition art and home décor. Redemptions start at 5,000 points. Whether or not these redemptions make sense is a matter of personal taste.

Use points to cover Amazon purchases

You can use Bilt Rewards points at checkout to cover purchases at Amazon.com. This yields very poor value for points at 0.7c per point and should be avoided.

Use points for statement credits

You can use Bilt Rewards points to receive a statement credit towards charges on the Bilt Mastercard. This is even worse than Amazon as points are worth only 0.55c each when redeeming them this way. Don’t do it.

Question for Bilt Experts:

I have barely been remembering to make the 5 monthly transactions for Bilt (because Amex Gold has 4x on restaurants, and I can’t eat so much on the 1st of each month).

So this month I won’t have a Bilt rent payment (because the August check was not cashed, I sent them a second payment, and then both got cashed, so I’m skipping Sept). Will I lose any points if I have no card charges in September or do I still need to have 5 transactions?

Has anyone used the 2x multiplier on Rent day for bigger, clearly non-rent expenses like property taxes, 529 account, insurance bills (up to 10k)? Or on a second HOA bill? Can’t really see the fine print T&C until you get the card…

any way to pay mortgage using this?

Does anyone know if you can transfer points to the authorized users frequent flyer account? For example if I wanted to transfer points to the AU AA account instead of the primary.

I don’t think that Bilt allows that.

I’ve reached out to Customer Service at Bilt a couple times, and haven’t been able to get a straight answer. Does anybody have any experience using the Bilt program to pay for college rent, specifically, sorority payments or dorms?

Yes, you can pay your rent at a sorority house as they give a routing and account number for “rent” payments.

Only the rent portion; no sorority fees.

Regarding the requirement that you make 5 transactions per month to earn points, is that a calendar month or a statement period month?

Statement period month. So on my account I have until the 8th to make my 5 transactions.

Does anyone know for sure whether or not Wells Fargo Go Far points can be transferred to the Bilt card? I don’t have the Blt card so I can’t test this myself. Wells’ point transfer interface just asks for the recipient’s name and “Wells Fargo credit card number”. Bilt is a Wells card and MMS states that point transfer works even if the reward currencies are different. However, that post predates the Bilt card. Wells hasn’t run a good spending promo for about a year now and with a forced conversion of Propel cards coming later this year, if my points are only worth 1 cent each it’s time to redeem them. Just hate to settle for 1 cent, if I could get say Hyatt points instead by getting a Bilt card and first transferring the points there. .

No

Perhaps I’ve missed the discussion, but how can Bilt afford to keep giving away points for rent by check?

I don’t have insight into the actual answer, but my guess would be a combination of factors: they don’t offer a welcome bonus, their target market is mostly new to miles and points and probably largely redeems points in a subpar way (like redeeming them towards rent or Amazon purchase), many of their members probably make a lot of purchases at 1x and redeem at less than a cent per point towards rent or Amazon, etc. I could imagine other factors playing into it as well, but those are some explanations that would make sense to me.

I speculate that there are a few factors above and beyond the usual “breakage” calculation:

1) To some degree they are following the silicon valley style of “spend tons of money as a new market entrant.”

2) It also seems like Bilt (the rewards network, not necessarily the card) wants to become a rental network, something along the lines of a more fully-featured apartments.com. Large management companies likely pay to be a part of the “alliance.” What exactly they get in return seems fuzzy (“better” tenants? More Visibility? Easier revenue management?) but that seems the pitch at least. Their support for non-Bilt Alliance rent payments is probably more about keeping the system simple and universal and since renters are known to move more, maybe when it’s time they’ll start their search with Bilt with all the captured interactions, etc.

3) Wells’ rumored card line revamp from a couple years ago seems to have fizzled after the Autograph and Active Cash, so they seem to be sort of leaning on the Bilt card as well to make it look more like one of their “homegrown” cards and not just some niche cobrand. i.e. they advertise it on ATM splash screens and such like you would expect Chase to do for Sapphires. That certainly can’t hurt to have a big bank treating the card a little better than some Choice Privileges card or something.

Was it Kierkegaard or Dick Van Patten who said, “if you’re not paying for it, you are the product.”

still hoping for a SUB before using up one of 5/24 slots

5x for for the first 5 days for up to 50k

Rent Day bonuses up to 120k per year

No SUB? Are you (stinkin’) kidding me?

Idk if you are trying to make the point that the card is good enough to not have a SUB, but the people here don’t get most of their points through category spend. They get them through SUBs.

It’d take me 5 years of paying my $1,350 rent with the Bilt card to get a comparable amount of Hyatt points to what I just got with the 80k CSP SUB. I don’t even see myself renting 2 years from now. But I bet I could get multiple high SUBs like that in the next 2 years.

Ryan, how does your answer fit into the conversation about points accrual that currently only happens by paying a fee that outweighs the points accrual?

Can this go towards business rent? Because that would be very nice.

Oh I see only residential rent.. too bad.

I wonder once people find loopholes in the Bilt system to earn alot of points, will they start to implement stricter ways to differentiate what is actual rent or p2p transaction. Also I know Bilt is partner with well Fargo, I wonder how long they will continue having this program go for until they start to add in interest charges per transaction or get rid of the program all together. Cheer in your thoughts. Thanks

Weird question… can Bilt be used to pay rent on storage units? Since I own my own home, the rent payments are not an option for me.

No, but even better you can pay your fees on Rent Day for 2x. And if you pay HOA on your home that charges a processing fee you can use Bilt to pay free at 1x.

So, did a test and paid rent via Venmo 4/1 and got the points for it. Had to make another Venmo payment to a friend for a hotel expense a few days ago 4/10. Also got the points for that.

So does that mean I can get 8,000 points months for Venmo-ing to my mom let’s say and her just giving it back to me as a check?

Obviously, the friend also has a Venmo account but does he have a BILT account also? If not, then it would appear that you can get points when you Venmo someone.

How do you get a Venmo account thru Bilt or attach an existing one to your BILT account?

Bilt’s system monitors every ACH payment (they provide you with an ACH and Routing Number for paying rent or HOA thru a property’s portal). I don’t know whether Bilt prevents use (and/or shuts down an account) for other expenses pd thru Venmo or PayPal but it seems like gaming to me considering the intent of their product. Others may have DPs on their results from actually doing this on a repeated basis.

Ahh, thanks. Ignore the question I mentioned to you upthread!

Thanks so much for your assistance!

@Jack Somehow I doubt that Bilt isn’t looking out for that type of behavior.

Noted

Maybe I got lost in the details presented.

you paid two different people through Venmo, and received points for both somehow, even though the two Venmo accounts were not connected?

Did you somehow note them as rent?

Nick,

Questions for you.

You write “cardholders gain the ability to pay not only landlords in the Bilt alliance but any landlord by sending a check or by ACH transfer as outlined above in this guide.”

Must these sort of transactions only be to “landlords” or can they be to any entity that does not accept a credit card payment?

For example, I have many expenses where only checks are accepted:

!). Maintenance costs and fee on my condominium;

2) Monthly fees for my parents apartment in a retirement community; and to a lesser extent,

3). Utility expenses.

Can one earn 1x points on these expenses, and if not, does Bilt forsee themselves getting into these areas eventually?

Thanx.

HVB

1. Yes

2. No

3. No

You can follow-up with Bilt c/s to verify or their T&Cs

Thank you!

You bet, want to clarify if you get their MasterCard and pay on Rent Day, you would earn 2x on both your folk’s retirement home rent and utilities, better than 1x trying to use the ACH/rent bank info anyway and not an issue, either, with Bilt

I thought you said that retirement home fees do not qualify, that only homeowner fees on my condo do? See above.

Retirement home/assisted living/nursing home fees do not qualify under the Bilt 1x Rent or HOA/no processing fee rule. If you have a processing fee on your folk’s retirement home apt, Bilt will not eat that. BUT if you get their credit card, you could pay their rent on Rent Day and earn 2x points (or earn 1x any other time of the month). It may, or may not, make sense to do that though depending on if your parent’s facility charges a processing fee and how much.

I think their rent and fees are all wrapped up together and thus would come under the prohibition you cited above.

However, we do have 2 condominiums with HOA monthly fees — I think you noted one per account, so my wife and I could each pay one, I suppose, right?

Now, are those HOA fees considered “rent” or not rent, and thus subject to the double points structure if paid on “Rent” day?

Does your folk’s retirement community charge a separate processing fee to pay their rent by credit card (vs by check/autodraft)?

Similarly, do your condo payment portals charge a processing fee to pay by credit card (vs by check/autodraft)?

I’m not sure. Will have to check with my wife. Why?

I would find out exactly how your parent’s rent payments are being made – this could represent a nice haul of points for you monthly. I have knowledge of the industry – most long-term care facilities allow credit card payments and some also do not charge processing fees. If they do charge a fee to pay by credit card, though, weigh that against the 2x points you could earn on Rent Day by paying with Bilt (up to $10k). Hyatt/AA valuations are around .015, so you could earn .03 by using Bilt, which may be a wash against any transaction fees, or better, depending on how proficient you are at point redemptions.

Facilities code differently by property and credit card company (some non-profits as “Charitable Organizations” when that used to be a bonus cat on some cards!). Regardless, if you aren’t earning the 1x points/no processing fee on your folk’s apt anyway, you can pay the bill on Rent Day for 2x, or 1x any other day of the month. The Rent Day rule is if you try to otherwise pay an allowable rent expense with no processing fee ALSO on the first of the month in an attempt to earn 2x (instead of 1x). Bilt will only allow you 1x, period, regardless of what day of the month you pay your rent (which doesn’t actually have to occur on the 1st).

If you set up 1 HOA fee pmt under your credit card account and 1 under your wife’s (and neither are commercial leases) you should be good to go. It sure feels nice to finally earn something off HOA, believe me.

(note – I was referring to both you & your wife having a card for a ttl of $10k spend, 20k points ttl/mth. You’ll probably need two cards anyway to pay 100% of facility fees with $5k max/ea spend on Rent Day)

Is there a cap on the number of properties you can pay rent on via the program? e.g. Can you pay rent on a family members behalf to get up to the 100k limit?

Only 1 rent pmt per acct