NOTICE: This post references card features that have changed, expired, or are not currently available

I guess good things come to those wait. Last week, we wrote about an increased 50K-point offer on the Barclaycard AAdvantage Aviator Red Mastercard. In that post, I mentioned that my wife intended to sign up for the card based on the previous 40K bonus but had been procrastinating. The new 50K sign-up offer came out at just the right time. After that card, my wife next intended to go after a Citi AA card as both the Citi personal and business AAdvantage Platinum cards are featuring limited-time 60K sign-up offers. Then, over the weekend, I got a picture of the following envelope (addressed to my wife) thanks to my USPS Informed Delivery:

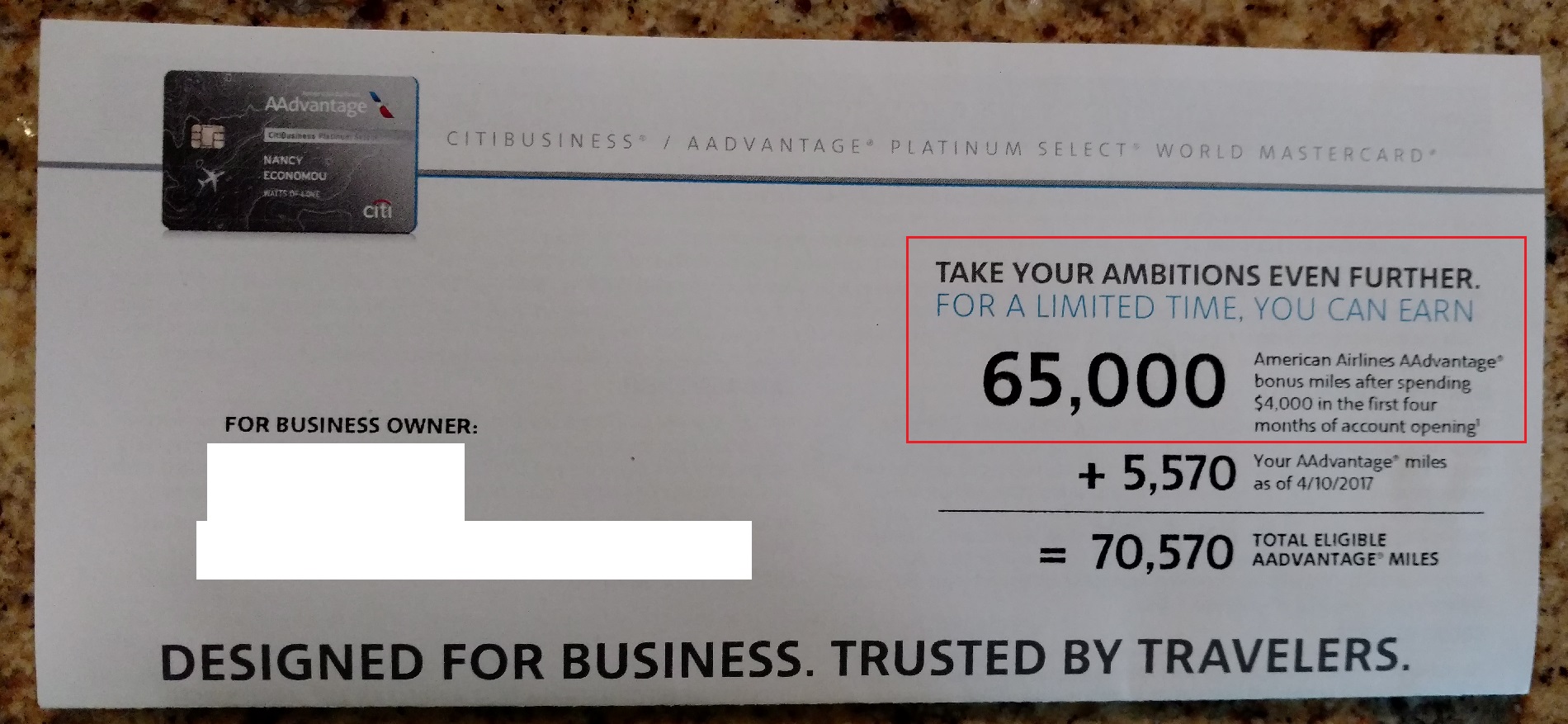

I expected to receive the offer on Saturday, but it didn’t come in the mail that day. That’s now happened to me a couple of times with informed delivery — a few items have come a day or two after I receive the scans. I’m not sure if those items are mis-delivered to a different address or just get caught up at the post office for one reason or another. At any rate, my wife held off on applying knowing that a 65K offer was coming. Sure enough, it showed up today:

Citibusiness AAdvantage Platinum Select World Mastercard

Citibusiness AAdvantage Platinum Select World Mastercard

The Offer

- 65,000 American Airlines AAdvantage miles after $4,000 in purchases in the first 4 months

Card Benefits

- 2X at certain telecommunications and car rental merchants and at gas stations

- 2X on American Airlines

- 1X everywhere else

- Spend $30K or more in a calendar year and get an Anerican Airlines Companion certificate (see our Complete Guide to Travel Companion Tickets for more information on this)

- Preferred Boarding (I believe this is Group 5)

- No foreign transaction fees

- $95 annual fee is waived the first year

Quick Thoughts

This offer requires $1,000 more in spending than the current public offer of 60K for $3K in spending. That boils down to an extra 5X on that extra $1K in spend — which is a deal I’m happy to take. Also of note, the offer contains no 24-month language, though this wouldn’t be an issue for my wife anyway. Several other readers have reached out to us about receiving the same offer; this offer may be widely targeted. Between the no-minimum-spend Barclaycard offer and this Citibusiness offer, my wife will quickly pick up a total of 119,000 American Airlines miles (including only 1x on the minimum spend on this card) for $4,000 in spend and the Barclaycard annual fee. While American miles are not particularly useful for travel on American Airlines flights (where saver availability is rare), that 119,000 miles is enough for one-way partner travel in first class to any region in the world — or round trip in business class to Europe, etc. That’s not a bad deal. Of course, the current public offers are just about as good — if you’re not targeted, 60K on this card is still a good offer in my opinion. On the other hand, you might be able to get matched to the offer by sending a secure message to Citi. See reader Tom’s comment below. See more about that and the other best public offers on our Best Offers page.

Have you received a similar targeted offer for the Citibusiness card? Let us know in the comments.

My husband applied for and received the CitiBusiness Platinum Select Mastercard with the 65K bonus and $4000 spend. He received it in mid July and we completed the $4000 spend within days–on a planned purchase.

However, the miles aren’t showing up in his account. I called and they said there are no miles associated with that card or something like that. I double-checked before we applied for the card. He didn’t get a targeted offer but we found the link online through millionmiles or a similar site. There was no mention of the 24 month rule. The person on the phone asked if he had opened/closed a card. I have to check and see if he did, but since there was no mention, shouldn’t he be receiving the miles?

Pamela, I would wait until the next statement posts and see what happens. Can you please post your findings?

[…] now that the public signup bonus is 75,000 miles. That’s a nice signup bonus, though with targeted 65K bonuses floating around on the $95-annual-fee Citibuisness and Citi AA personal cards and a 50K bonus […]

[…] HT: Frequent Miler […]

[…] Hat tip to Frequent Miler […]

Isn’t there a 24 months rule on this card?

Yes, there usually is. But like I said, the targeted offer we received did not have that 24-month language. YMMV, but it’s worth reading through the paperwork if you receive the offer.

My husband got the 65k AA offer for a personal card. I’m planning to apply my husband to a Citi Hilton reserve card. Which should I apply first in your opinion?

That’s a tough call. My first reaction was to say the American Airlines card since it’s a limited-time offer. However, with the announcement that Amex is going to be the sole issuer of the Hilton credit cards, I don’t know when the Hilton Reserve offer may go away. I don’t suspect that will happen very soon, but your guess is as good as mine. I guess you have to choose the offer that’s more important to you to get. You certainly can get approved for both as long as you wait 8 days between applications, but obviously the second one isn’t guaranteed. I don’t think one is any harder to get approved for than the other. I guess I’d say choose the card that’s more important to you and apply for that one first. I know that seems like a cheap answer that would be correct in all situations, but I don’t think there’s one clear answer this one.

Thanks Nick! I appreciate your response.

If you haven’t yet seen this, you should definitely make the Reserve the first app and do it sooner rather than later. Guess my second career as a fortune teller is on hold.

https://frequentmiler.com/2017/06/06/last-call-citi-hilton-cards/

You can also message them to match the offer. I got the business card about 2 months ago, got 50k bonus, and message them a week ago to match 65k offer without any problem.

@Tom That’s only if you were targeted right?

@Nick Reyes I’m with you man. All in on AA as everyone else seems to be jumping ship. Still great for redemptions to Asia which is what I have my eyes set on.

The telecommunications category seems to be quite vague though. Would it cover cell providers and internet/cable?

@Tom — I wondered if that might be possible. I’m going to add that to the post, thanks!

@Chong — I’m not sure on the telecom category. I would assume the answer to that is yes, but I’ve always used my Ink Plus for 5X on those expenses. And totally agreed on redemptions to Asia.