NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

There are newly increased offers available on both of the Wyndham Rewards Visa cards — with the $75 annual fee card offering up to 45,000 points and the no-fee version offering up to 18,000 points. This post originally only had the 45K offer and no landing page — the link on our Best Offers page has now been updated to direct to a landing page for both offers. These offers come and go, but the $75 fee offer is nice at what amounts to three free nights at any Wyndham hotel worldwide, with the no-fee option offering enough points for one free night after a single purchase – not a bad signup bonus for a no-fee card.

The Offers

Wyndham Rewards Platinum-level ($75 fee)

- Earn up to 45,000 Wyndham Rewards points: 30,000 points after first purchase and an additional 15,000 points after spending $2,000 in the first 90 days

- This offer applies to the version of the card with the $75 annual fee

- You can find a link on our Best Offers page

Key Card Details

- Earn 5x at Wyndham properties

- Earn 2x on gas, utilities, and at grocery stores

- Earn 1x everywhere else

- 6,000 bonus points every anniversary

- This card provides Platinum status

- $75 annual fee is not waived

Wyndham Rewards – Gold Level (no annual fee

- Earn up to 18,000 Wyndham Rewards points: 15,000 points after first purchase and an additional 3,000 points after spending $1,000 in the first 90 days

- This offer applies to the version of the card with no annual fee

- You can find a link on our Best Offers page

Key Card Details

- Earn 3x at Wyndham properties

- Earn 2x on gas, utilities, and at grocery stores

- Earn 1x everywhere else

- This card provides Gold status

- No annual fee

Quick Thoughts

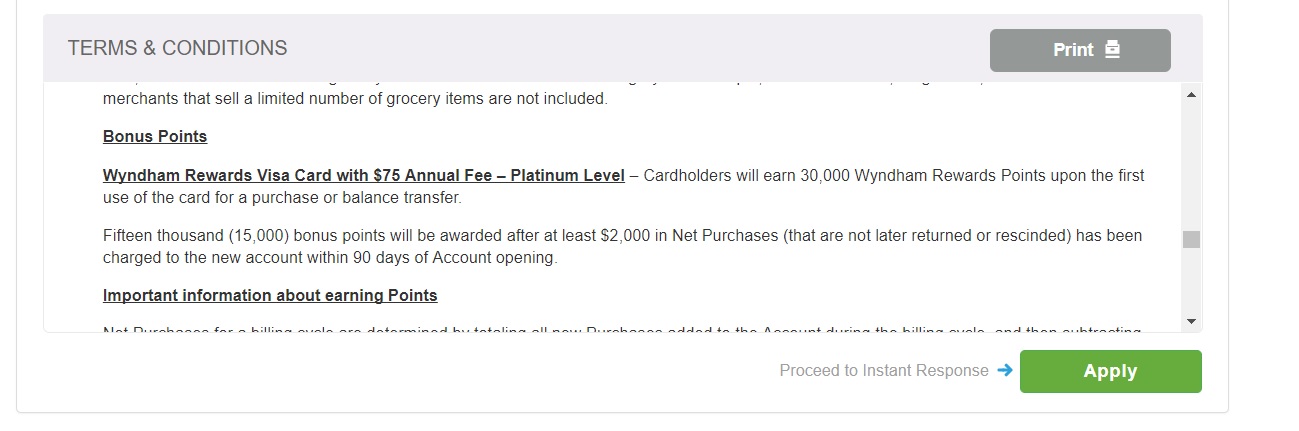

Unfortunately, there is no landing page for this offer. However, you can find a link on our Best Offers page. When you scroll through the terms and conditions in the application, you should see this:

Update: There is now a landing page as pictured above. See the link on our Best Offers page. You can also still find the offer details in the card terms & conditions on the application page as pictured below.

Wyndham Rewards is an under-rated and often-ignored program. That’s due in large part to the fact that many of their properties aren’t exactly aspirational, with some Super 8 / Travelodge / Knights Inn / Howard Johnson locations being pretty run-down. However, on the other end, Wyndham has some resorts and properties in more expensive locations — and all hotels cost the same 15,000 points-per-night for an award stay. There are also partnerships with Cottages.com and Wyndham vacation rentals that allow for redemption at some much nicer-than-Travelodge properties. Earlier this year, I was able to hop on a promotion (with Cottages.com) to book a 9-bedroom, 6-bathroom English countryside home for 15K points per night with points I had leftover from a signup bonus. This property normally costs 15K per bedroom — which may not be worth it for a 9-bedroom property, but there were many 2- and 3-bedroom properties in Europe that looked decent for 30K or 45K per night.

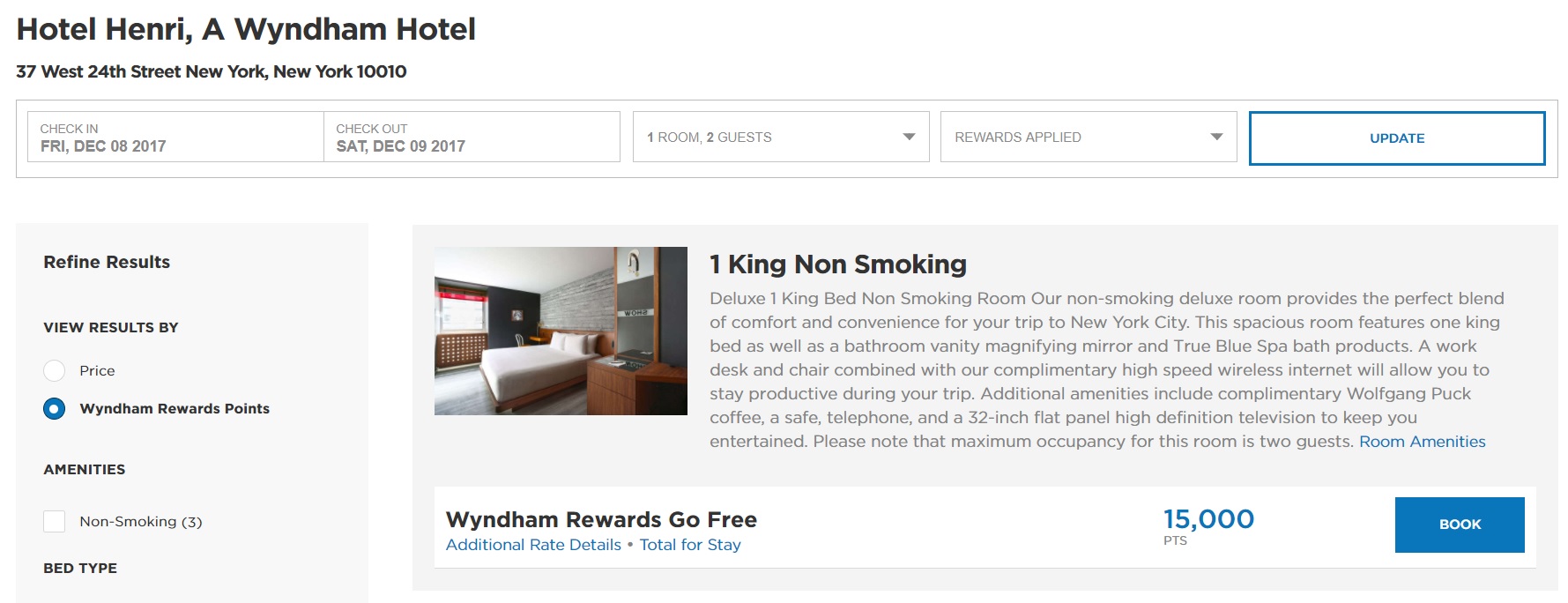

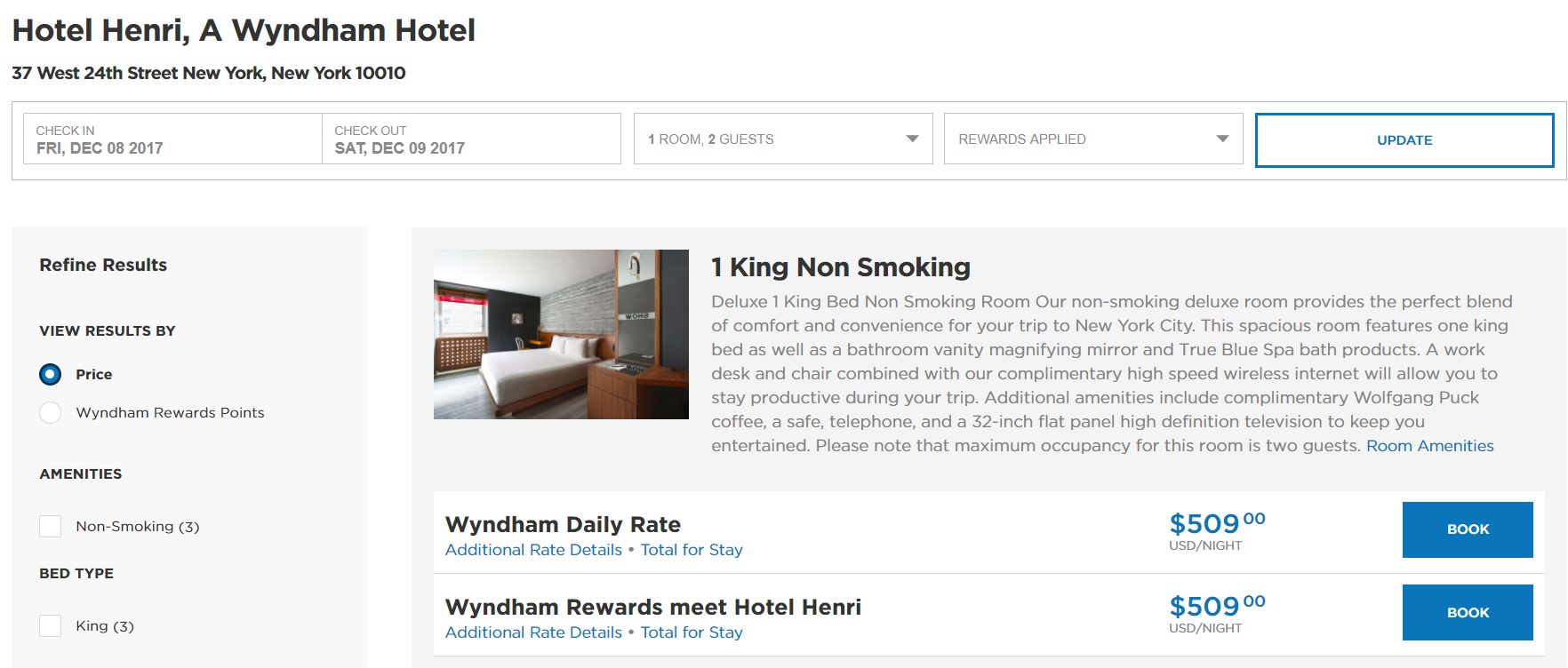

This newly-increased signup bonus would be enough for three free nights at any Wyndham hotel in the world, or could be enough for a rental with some of their partners. Domestically, Wyndham Rewards can be a great deal for stays in expensive cities like New York. For example — this Friday night, the Hotel Henri in New York City is available for 15K points:

That compares pretty favorably to the cash rate for the same night:

Big cities aren’t the only good use of Wyndham Rewards points. A few months ago, Travis at One Mile at a Time wrote about the terrific value available at the time for hotels in the path of the eclipse. It’s nice to have points lying around when there is a big event and the Baymont Inn & Suites in Evansville, Wyoming is charging $1500 per night.

Combine those types of redemptions with the easy promotions they have been running — whether the current Visa Checkout promotion to earn 15K bonus points after 3 stays or the now-expired Masterpass promotion that only required 2 — and Wyndham seems like a nice niche program in which to bank some points for those unexpected opportunities.

Bottom line

As noted above, this offer comes and goes — but it seems that it is back for the moment. If you’ve had this card on your radar, the increased signup bonus would certainly make it more attractive.

H/T: Reddit user payyoutuesday for the landing page

[…] Update: both 45K & 18K Wyndham offers return (Expires 1/15/18) […]

How available are the more aspirational Wyndham properties. I remember reading in past years that the better properties are rarely available by points.

I’ve not had trouble finding availability at the more desirable properties in New York City. I haven’t regularly checked the others, but I often hear people talk about getting great value out of the all-inclusives (I believe we had some Facebook comments from readers who have had good success with those), so I don’t imagine it’s all that tough. But pick the property that interests you and search some dates to test.

Since I normally booked airbnb for all of my travel, so I don’t know much about hotel credit cards nor it values. For this particular promotion, can I apply for both Wyndham credit cards and eventually cancel the card with the annual fee after a year? If yes, can I park my points over at the no-fee card if there are still points left on the fee card?

Theoretically you could apply for both at once. I don’t know of any data points in doing it off the top of my head.

Your points don’t exist in either card — they are Wyndham points. With a hotel or airline card, think of it this way: at the end of the month, the bank deposits Wyndham points in your Wyndham Rewards account. Whether you have the credit cards open or closed, the points are with Wyndham. You could close both cards and your points are still with Wyndham — the points aren’t on the credit card itself.

Of course, the points will expire 4 years after you earn them or they will be cancelled/forfeited if you have 18 months of inactivity. That is to say that if you cancel both credit cards and you do not earn or redeem Wyndham points for 18 months, you’ll lose the points. If you have one credit card open, you could just purchase a pack of gum once every 18 months to keep the points active — but the points expire if you don’t use them within 4 years.

Thank you so much Nick for an extremely thorough explanation. Looking forward to read more of your blogs

[…] Wyndham credit card 45,000 point signup bonus is back […]

I got the email too and was very excited about the 45K offer! I don’t have any plans for Wyndham stays anytime soon, so I was a little hesitant to pull the trigger on a non-waived annual fee, but $75 for three free nights anywhere is an absolute steal! Granted, they don’t have as many aspirational properties as a lot of other chains, but the Wyndham New Yorker, for example, retails for about $700 total (incl. taxes and fees) for two nights in May, so getting that for essentially $50 is literally dirt cheap.

Perhaps you could make a post about some of Wyndham’s most aspirational properties? It would certainly help to have a list, since you can’t decide which ones are the best based on ‘category.’

I would also add that the Viva Wyndham all-inclusive properties can represent some good values at $400+/night. https://www.wyndhamhotels.com/wyndham/viva

[…] HT: Frequent Miler […]

[…] Frequent Miler, the Barclaycard Wyndham Rewards credit cards have limited-time increased sign-up bonus […]

I was reading the points earning options and see that, since I own a Wyndham timeshare, I could earn 5X points for my maintenance fees. I’m currently getting 3X on those by using my Sapphire Reserve, so that’s effectively .045 per dollar, if I’m doing the math correctly.

If I spend $3,000 per year on timeshare fees, (I don’t spend that much, but it’s an easy number for calculations), with Chase, I’d get $135 cash value. With the Wyndham card, I’d get 15,000 points, or one night for $75, (the annual fee). Depending on where I use that free night, it seems to me I could get much better value.

As an example, the Days Inn Maui Oceanfront for 1/22-1/27 prices out at $985 total via Kayak.com. On the Wyndham site, the same dates run $90 per night plus 3,000 points. (Strange that they don’t have the free night for 15K points, but I think this is a better deal, right?)

Each night, that’s a $107 savings per night. Over five nights, the cost would be $450 plus the $75 annual fee for a total of $525. That works out to saving $460 over a direct booking. Am I figuring this correctly?

If i was approved for JetBlue this morning, this should combine right? Not sure if this is considered same day. Any Barclay rules I should be concerned about outside of Barclays being inquiry sensitive?

They should, yes. If you applied this morning, it’s still the same day right now (as of 10:22pm Eastern time). I’ve read that it is possible to get approved for two cards in a single day, but it’s not always easy (if not instant, you’ll need to call recon…and I don’t know if you’ll get someone at this hour).

Turns out the Barclays no longer combines HPs if done on the same day. Nbd for me, but good to know

How do you know it is the 45,000 offer without the page showing that?

Also, I have two Barclay cards…should I lower my credit lines before applying?

See the screen shot and explanation directly under “Quick Thoughts” in the post — it’s in the terms & conditions.

However, I just updated the link with a landing page and I’m about to update this post to say that as well — now if you click the link on our Best Offers page, you’ll see the landing page.

I currently have the card in my drawer. Is this churnable? If yes, do I need to cancel my existing card first?

I’m not sure. Barclay’s used to have no problem approving people for multiple instances of the same product, but reports lately indicate that may not be the case anymore. I haven’t heard any reports specific to this card apart from the fact that this one is pretty easy to get an approval on.

Beat me to the punch (by a few minutes) 😉

😀