NOTICE: This post references card features that have changed, expired, or are not currently available

When the new Barclays Arrival Premier launched last week, I took some heat from readers who thought I wasn’t negative enough about it. To be clear, I don’t think the card is for everyone — and in fact don’t think it’s a fit for me at this stage for reasons I’ll include at the end — but I think that the value can be pretty good if you can take advantage of transfers to Japan Airlines. Will that appeal to everyone? Absolutely not. Does it make the Arrival Premier a hot new player in the transferable points game? I definitely wouldn’t say that. But is it interesting in terms of generating JAL miles? I think so. Here’s why.

JAL earnings by comparison

In last week’s post, I mentioned that the Arrival Premier earns an effective 1.18 Japan Airlines miles per dollar spent up to 1.76 miles per dollar spent if you spend exactly $15K or $25K per year (due to the spending bonuses when you reach those thresholds). That’s because the Arrival Premier earns 2 Arrival miles per dollar spent and those Arrival miles transfer to Japan Airlines at a rate of 1.7 Arrival miles to 1 JAL mile. The Arrival Premier includes a 15K Arrival mile bonus at $15K spend and an additional 10K bonus when you reach $25K in total spend, meaning that if you spend exactly $15K or $25K, your earning rate is 3x Arrival miles per $1 spent.

At first glance, it sounds like the default earning ratio of 1.18 Japan Airlines miles per dollar is worse than the SPG credit cards, since 20,000 Starpoints can transfer to 25,000 Japan Airlines miles — making for an effective rate of 1.25 cents per mile. But that’s misleading. It turns out that the Arrival Premier is a better option for picking up Japan Airlines miles at almost any level of spend, assuming that you are only earning Starpoints at a rate of 1x via the credit card. If that’s the case, compare the following:

- If you spend $14,999 or less, you would earn:

- 14,999 JAL miles with an SPG card (1:1 transfer ratio)

- 17,645 JAL miles with the Arrival Premier (2x Arrival miles per dollar / 1.7)

- If you spend $15,000 exactly, you would earn:

- 15,000 JAL miles with an SPG card (1:1 transfer ratio)

- 26,470 JAL miles with the Arrival Premier (2x Arrival miles per $1 + 15K bonus / 1.7)

- If you spend $20,000 exactly, you would earn:

- 25,000 JAL miles with an SPG card (20K:25K transfer ratio)

- 32,352 JAL miles with the Arrival Premier (2x Arrival miles per $1 + 15K bonus / 1.7)

- If you spend exactly $25,000, you would earn:

- 30,000 JAL miles with an SPG card (20K:25K, then 1:1 transfer ratio)

- 44,117 JAL miles with the Arrival Premier (2x Arrival miles per $1 + 25K bonus / 1.7)

- If you spend exactly $100,000, you would earn:

- 125,000 JAL miles with an SPG card (assuming you transfer in 20K increments)

- 132,352 JAL miles with the Arrival Premier (2x Arrival miles per $1 + 25K bonus / 1.7)

- If you spend exactly $200,000, you would earn

- 250,000 JAL miles with an SPG card (assuming you transfer in 20K increments)

- 250,000 JAL miles with the Arrival Premier (2x Arrival miles per $1 + 25K bonus / 1.7)

I included the last two tiers just to demonstrate that it takes a lot of spend before the SPG cards out-earn the Arrival Premier in terms of Japan Airlines miles. You would have to spend north of $200K in a year for the earning rate on the SPG card to exceed that of the Arrival Premier.

There is a difference in annual fee to consider as the ongoing annual fee of the SPG card is $95 vs $150 for the Arrival Premier. At the time of writing, the first year fee on the SPG cards is waived, but the Arrival Premier’s fee isn’t. That can make a difference in the math, as shown below.

A couple of key exclusions

Keep in mind that this analysis is ignoring a key factor: the Arrival Premier has no signup bonus. That’s disappointing. The SPG cards each come with welcome offers, and if you include those bonus points in the calculations, the SPG cards will come out ahead. If you’ve never had one of the SPG cards, they would be a smarter choice for JAL miles when you consider the intro offer bonus points. Additionally, we know that with the Marriott/SPG merger, the SPG cards will eventually become unavailable, making them more compelling in the here-and-now if you haven’t had them. However, if you have or have had the SPG cards before, the welcome offer won’t be available to you again, so my comparison here is just based on regular spend.

Another key exclusion is the fact that in addition to earning 1 SPG point per $1 spend on the SPG credit cards, you can also earn SPG points from hotel stays. Whether you stay with Starwood or Marriott, you’ll earn points for your hotel spend plus 2x when paying on the SPG card. There are also occasionally targeted spending bonuses on the SPG cards. There are more ways to earn SPG points that can definitely tip the scales. Comparisons below only consider unbonused spend.

To be clear, I’m not saying that the Arrival Premier is a better card. The variety of airline transfer partners with SPG (at least for the time being) and the possibility to use points for strong value at such a wide range of hotels between Starwood and Marriott make it far superior in terms of flexibility. If I had to choose one card to hold and use, it wouldn’t be the Arrival Premier because of its limited number of partners. However, if you’re doing even a relatively modest amount of MS, it’s conceivable that you have a couple/few thousand dollars per month in bandwidth to dedicate – and in that case, the Arrival Premier might make sense as a tool in your belt.

The cost of generating points

In my post about The cost to MS a month in New York City, I used a baseline MS cost of $10.89 per thousand dollars in spend. See the “cost per thousand points” section of that post for how I came to that number. As noted there, your actual cost may be a bit higher or lower depending on your methods. Comparisons below will use that baseline cost of $10.89 per thousand in spend. Keep in mind also that while I’m using the SPG cards as a point of comparison because they are the only other kind of points that are directly transferable to Japan Airlines, the Amex war on gaming is in full swing, so generating SPG points could become harder without notice.

Also keep in mind that there is always an opportunity cost. Consider your potential earnings if you did the same spend on a cash back card and your time spend generating spend in addition to the numbers below. Of course, there are also signup bonuses on other cards to consider. I’m assuming that your spend on the Arrival Premier does not come at the opportunity cost of earning signup bonuses as it probably wouldn’t make sense to put $20K+ spend on any single card at the cost of earning multiple signup bonuses.

A JAL Sweet spot: Business class to Japan

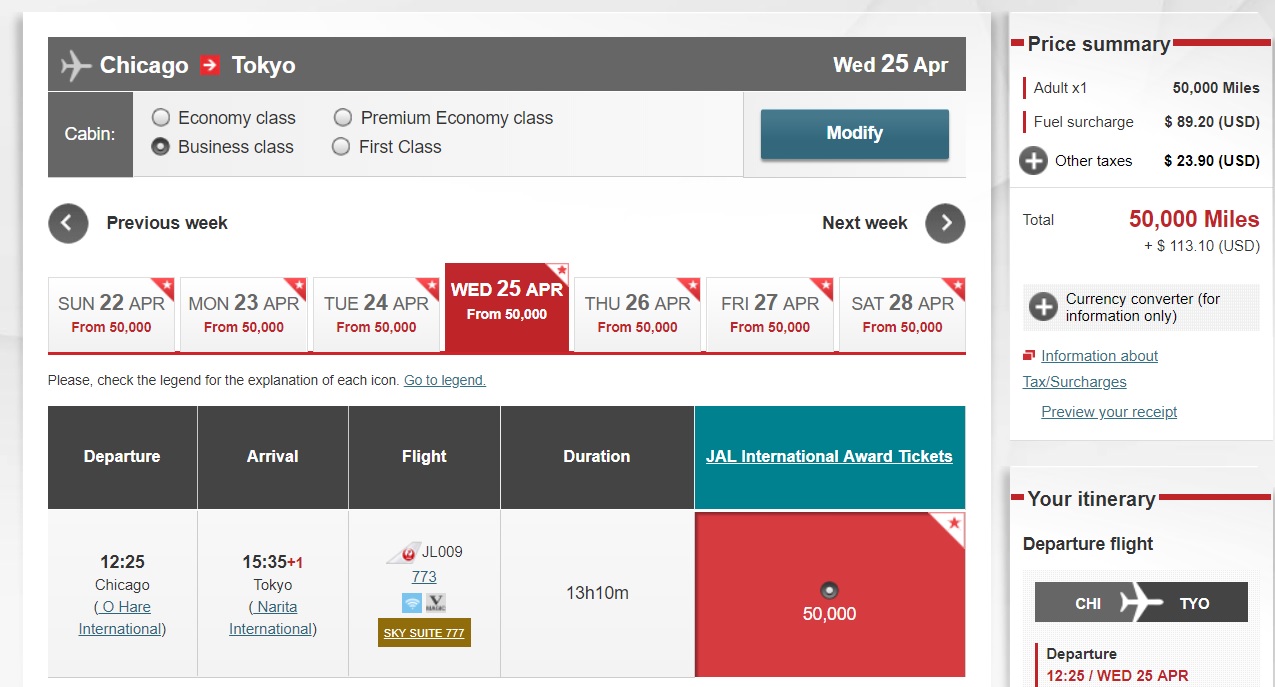

Japan Airlines has a pretty nice award chart for flights on Japan Airlines. They charge just 50,000 miles for one-way business class between the US and Japan.

Assuming you were using the Arrival Premier to generate those miles, it would require $30,000 in spend. At a cost of $10.89 per $1K in spend, that’s $326.70 in MS cost. Add in the $113.10 in taxes and fees shown above and you are at a grand total of $439.80 for a one-way business class flight to Japan in comfort.

Using an SPG card to manufacture points for the same flight would cost you a bit more since you would need to spend $40,000 in order to earn 40,000 SPG points. You could then transfer those SPG points to Japan Airlines with a 5K bonus for each 20K transferred for 50K JAL miles in all. At a theoretical cost of $10.89 per $1K in spend, your total is $435.60 plus $113.10 in fees for a grand total of $548.70.

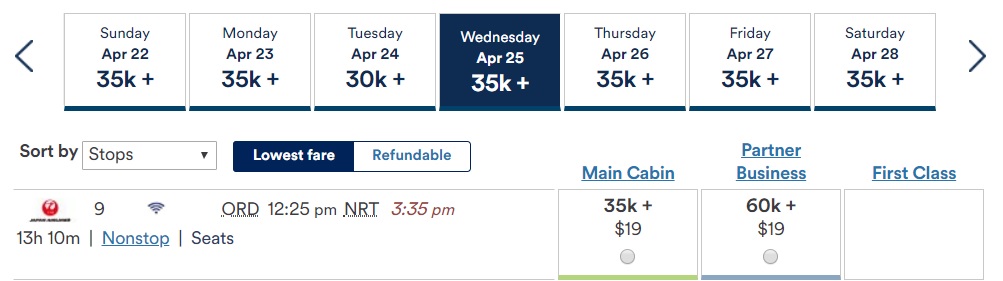

As a point of comparison, Alaska Airlines charges 60,000 miles and $19 for the same flight.

While at first glance, the lower fees might make it look like a better deal, it isn’t. Using the SPG card to generate 60K Alaska miles would require $50K in spend, which will more than make up for the difference in taxes and fees.

Update: As pointed out by Sri in the comments, the difference in annual fee should also be considered here. If you are a new SPG cardholder, the annual fee is waived for the first year at the time of writing. You’ll want to add $150 to the cost of using the Arrival Premier, which would tip the balance in favor of the SPG cards. On the flip side, if you are an existing SPG cardholder paying a $95 annual fee, the $55 difference in fee still gives the advantage to the Arrival Premier — though it does slim the margin.

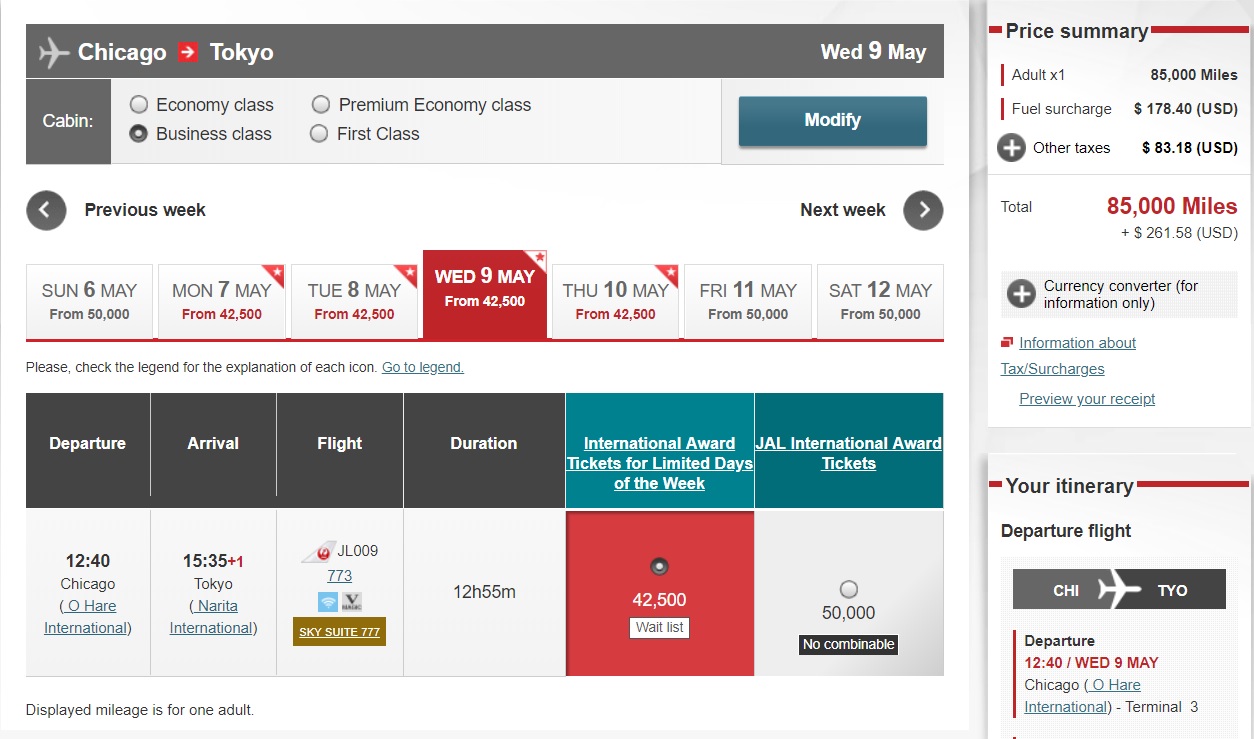

If you’re willing to depart the US Monday through Thursday or depart Japan Tuesday through Friday, an even better sweet spot in the JAL chart is that you can fly to or from Japan in business class for 85,000 miles round trip. That would require a whopping $59,750 in spend on the Arrival Premier or $70,000 in spend on an SPG card. That’s a lot of spend – though if you can do it at a reasonable cost, it can still come out to less than the cost of an economy class paid fare.

The partner chart is is also worth a look

The Japan Airlines partner award chart is also pretty interesting since it is distance based and offers 3 stopovers and 6 sectors, including an open jaw.

Japan Airlines is a member of the Oneworld Alliance, but they additionally partner with Air France, Alaska, Bangkok Airways, China Eastern, Emirates, Korean, and Jetstar Japan. You can put together some pretty awesome round-the-world itineraries with this chart. Around the middle, an itinerary up to 20,000 miles will cost 100K JAL miles, which could be an amazing value depending on how you put it together.

Earning 100K JAL miles has always required a lot of spend. You would have to spend $80,000 on an SPG card and transfer them in 20K increments — or spend $72,500 on the Arrival Premier. There is no doubt that is monster spend, but you could have some fun imagining trips that could fit within the band.

Bottom line

The Arrival Premier isn’t the most exciting card on the market. I hope that they eventually offer a signup bonus. The niche transfer partners won’t appeal to everyone. The annual fee makes it a poor choice if your main goal is cash back. There are plenty of reasons why it isn’t a good fit for many people.

On the other hand, the card offers a great ratio on transfers to Japan Airlines, and JAL has some great values for award tickets. If you’re interested in learning more about maximizing Mileage Bank awards or the booking process, Richard Kerr at TPG and Scott Mackenzie at Travel Codex have both written up guides that are worth checking out:

- Everything You Need to Know About Japan Airlines Mileage Bank

- How to Book Award Travel with JAL Mileage Bank

Personally, I’m not in the market for Japan Airlines miles at the moment since they charge the same for an infant or child ticket as an adult ticket. Furthermore, we won’t be doing a 20,000-mile-around-the-world in the next year with an infant. For those reasons, the Arrival Premier isn’t in my plans any time soon.

I wouldn’t recommend the Arrival Premier as a primary spending card nor would I replace an SPG card with it. However, I maintain that it can be an interesting option for those who do a fair amount of spending and take the time to study Japan Airlines Mileage Bank.

[…] class to Europe for 63,000 miles. What I like most about this award is that it makes me look even less crazy. It sounds like availability is tough to come by, but it might be worth the hunt at such an […]

I don’t think you are crazy I still see more value in SPG for all the ancillary benefits (Marriott Gold, more transfer partners, Marriott travel packages, frequent bonuses in various programs for transfers from hotel programs). That said SPG is not long for this world. If/when SPG/MR dies or effectively gets undesirable and I am looking to reallocate non-bonused spend I may reconsider this card among some others.

Quick question – have you found how much miles JAL charges for award flights on Hawaiian airlines with their new partnership? I haven’t found any info googling. I think that might also be good for trips to Hawaii and inter-island hopping.

Good write up. Thanks

Nick, I appreciate the effort trying to justify in its current form. JAL does have an amazing award chart, I’ve used it to book a multi stop trip and a cheap flight on Bangkok airways.

But in its current form, SPG card is so much better than this Barclays card because:

1) it has 25k-35k sign up offer

2) you can transfer to almost every program.

I’ve transferred 2k to LH to top off a small redemption, 17k to Asiana to book LH F, 20k to LATAM to book flights in Latin America that aren’t available to partners.

It’s that flexibility that makes it special. Oh and you can book hotels. Although SPG card is going away, but let’s talk about that when it happens.

As it stands now, this card is only appealing to high spenders who are interested in JAL miles, which I can bet it’s less than 5% of general public, probably closer to 1% to be honest. A very niche segment of customers (us), and it’s even not appealing to us. Not to mention the transfer ratio isn’t easy to understand. As a brand new premium credit card that hopes to capture some premium customer, its criticism is well deserved.

And if the person knows about the JAL sweet spot, he is probably a seasoned credit card holder and probably already owned better no annual fee cards such as AMEX Business Blue Plus or Freedom Unlimited.

My intention here isn’t to justify getting the card, but rather why I find it interesting. Like I said, it doesn’t make any sense as an either/or proposition – and I noted in the post that the flexibility makes the SPG cards “better” – but not better for earning JAL miles. I wouldn’t get and spend on this card instead of other cards, but rather in addition to. You’re totally right that this only appeals to probably 1% of the general public….truthfully, that’s the case with a lot of the miles & points hobby.

No doubt that the Blue Business Plus and Freedom Unlimited are great cards with much better transferable points programs — but neither earns points that transfer directly to JAL. I think the Arrival Premier primarily appeals to high MSers who value JAL miles (and truthfully, who other than big MSers are into JAL miles? It’s always required a lot of spend on the SPG card to take good advantage of their chart). People in that category may also be maxing out the $50K/yr on the Blue Business Plus and may also appreciate the opportunity to continue to earn Flying Blue miles at 2x with the Arrival Premier….though with that program becoming revenue-based, I’m not sure that angle will make much sense moving forward.

Good post u alert people to what’s out there . I’m shocked i have the $450 Citi p card if it wasn’t posted 10x before I NEVER wouldn’t paid that . I need the 4th Free or I’m Done …..

Fine Website ..

CHEERs

Write a comparison between SPG-Marriott travel package earnings (alaska and aa 120 k) and this arrival card earnings. Also do a comparison between JAL points used for oneworld and aa / iberia points .

When writing about these niche programs, (jal, KE, ana), please make people read between the lines. AMS-MEX space dried up over the last ~36 hrs, I was a bit confused as there were plenty of dates open 2 days ago, and now almost nothing. The useful award space for these niches is scarce, and if people start calling Korean Air to get their “surcharge free” 80k r/t J ticket from USA to Greece, etc, it won’t last. I’m not saying don’t write about it, just do the opposite of spoon feeding.

I hope the mustache guy uses discretion when he posts about ANA. Would like for that to stick around.

If SPG transfer to miles function is killed, this card maybe the best one for JAL miles.

If the SPG program is going away, is this a good time to sign up for it? If I do sign up, and the program goes away, what happens to the points that I have?

Good analysis. My key takeaway though is that the entire argument for there being any place for this card in the market whatsoever is premised on JAL miles and they could eliminate the sweet spot redemption on a whim.

Did the same math a few days ago to compare. However, in its current form, my SPG Card is too important to get rid off. So, the Barclays card will have to be an addition which means the annual fee should come into consideration that can skew the balance.