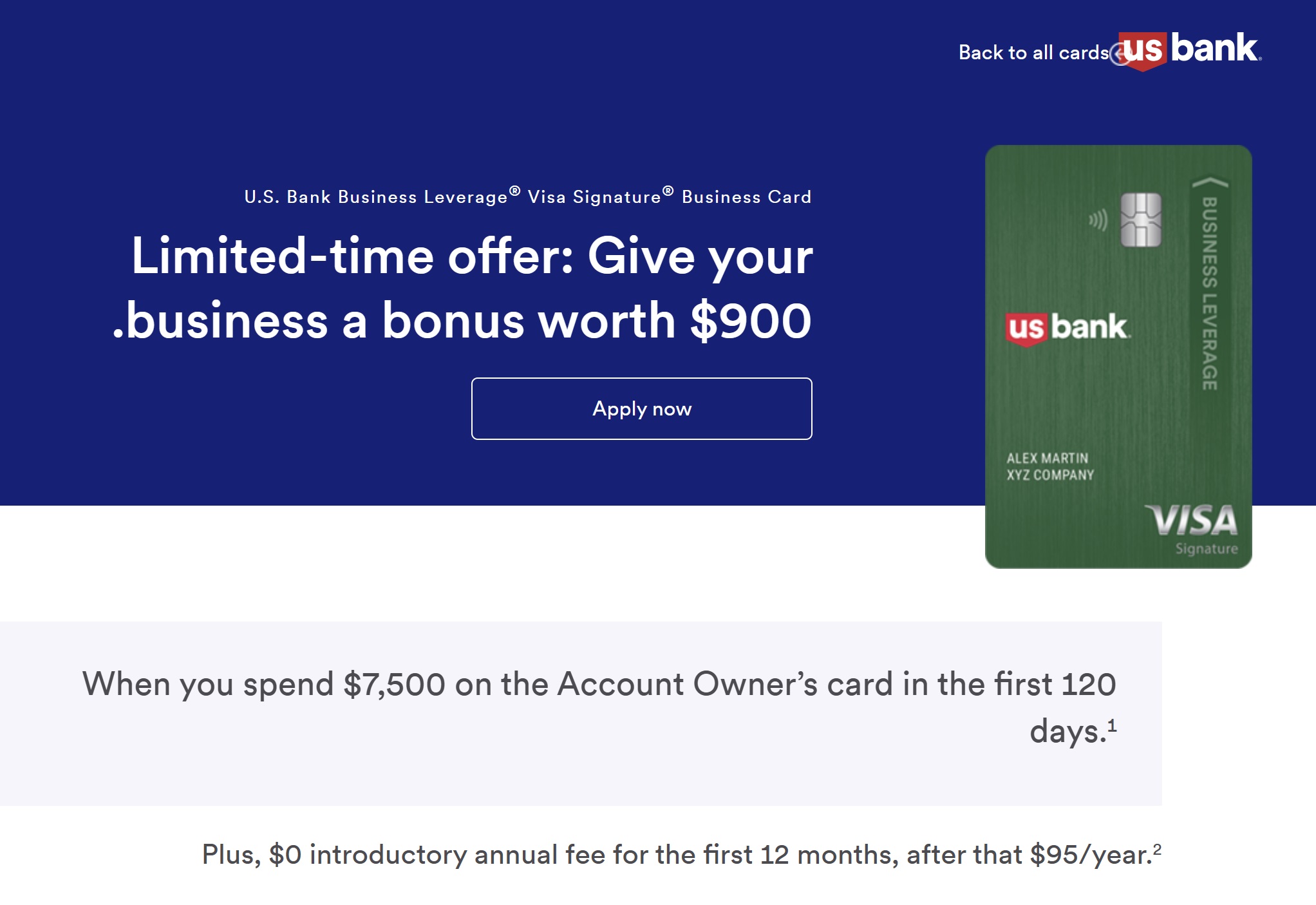

The US Bank Business Leverage card has an increased welcome offer available that yields $900 back after spending $7,500 in the first 3 months. That’s an excellent offer for those primarily seeking cash back and since this is a business card, it shouldn’t impact your ability to get cards from other issuers.

The Offer & Key Card Details

Click the card name below to go to our card page, where you’ll find more information and a link to apply.

| Card Offer and Details |

|---|

ⓘ $593 1st Yr Value EstimateClick to learn about first year value estimates 75K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 75K (worth $750 as a statement credit or deposit into eligible account) after $7500 spend in first 120 days$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Since the points are worth 1c each, this card isn't terribly rewarding for ongoing spend. Note that points can not be combined with the Altitude Reserve. Earning rate: 2x on top two categories where you spend the most each month. Base: 1% Card Info: Visa Signature Business issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: Earn 2x in the two categories in which you spend the most each month. Full list of categories can be found here. |

Quick Thoughts

The US Bank Business Leverage Visa Signature card is one that doesn’t often get a lot of attention because the card is light on benefits and ongoing rewards. However, a $900 welcome bonus is enough to raise an eyebrow even if it may not be the most exciting card on the market.

For ongoing spend, the card just earns 2% back in your top two categories each month out of a list of qualifying categories and 5% back on prepaid travel booked through US Bank (and 1% back everywhere else). That makes this card not very competitive with other top business credit cards on the market — and that’s before considering the $95 long-term annual fee (which is waived for the first year).

However, the 90,000 points that you’ll earn by spending $7,500 in the first 4 months are worth $900. That’s 12% back — and it could be stacking for a total of 14% back if all of your spend is in those top two qualifying categories.

Speaking of those two categories, I believe that this is the list of eligible categories (which I got from this page):

- Advertising Firms

- Airlines

- Apparel and accessory stores

- Auto rental and transport providers

- Automotive dealers

- Automative parts stores

- Automotive repair shops

- Cable, satellite, TV, and radio providers

- Charitable, civic, and religious organizations

- Commercial and home furniture stores

- Commercial equipment, parts and supply

- Computer service providers

- Computer stores

- Construction material suppliers

- Dental, lab, and medical equipment providers

- Department, book and novelty stores

- Direct marketers

- Discount stores and wholesale clubs

- Drug stores and pharmacies

- Durable goods providers

- Entertainment places

- Florist, nursery, and garden stores

- Freight and transport services

- Funeral homes and crematories

- Gas stations and fuel dealers

- Grocery stores and supermarkets

- Healthcare providers

- Home improvement service and supply

- Hotels

- Industrial suppliers

- Insurance providers

- Membership organizations

- Non-durable goods providers

- Non-medical testing labs

- Personal service providers

- Pet supply stores

- Plumbing and HVAC suppliers

- Postal and courier service providers

- Professional service providers

- Publishers and printers

- Restaurants

- Schools and government

- Stationary and office supply stores

- Telecom equipment suppliers

- Telecom service providers

- Utility companies

- Veterinarians

- Wholesale goods providers

That’s quite a long list of options, so it should be pretty easy to earn a nice added bonus by spending mostly within two of those categories.

Keep in mind that there is no way to combine points to an Altitude Reserve card for higher redemption value. That said, a large cash bonus could certainly be nice — and since this is a business card, it shouldn’t add to new accounts that would prevent you from being able to be approved at other banks with specific rules regarding number of newly-opened accounts.

H/T: Miles Earn and Burn

Is there a better redemption for these points than statement credit?

Hi Nick, do you have thoughts on exactly when to close the card to avoid the fee the second year?

Us bank biz card links are all dead

Alive again

Do we know if giftcard purchases towards minimum spend is safe with U.S. Bank?

How can you redeem the points? Is it a straight up statement credit like the Venture X or old Barclay Arrival? Or can you only redeem the points through the US Bank travel portal?

My upcoming HVAC replacement will easily meet the $7500 spend, so this is a big win. As Nick wrote, 14% cashback is to be celebrated! Thanks for writing about this card–I’d never heard of it until this post.

I thought the same thing. Mine just arrived in the mail this morning — seemed like too easy a win to pass up!

H Nick, it asks for a DBA. Any way to get around this if I’m just sole proprietor? We’ve been mostly doing chase biz cards so far and haven’t run into this. Thanks!

I just put my name in the DBA because I applied as a sole prop for this one also. That was no problem.

Thanks so much for the quick reply! Here I go!

Are there any cards that you can combine the points with the altitude reserve?

Nope.

How easy is it to churn these cards if you have or have had one or more? I’ve had sevearal and I think P2 keeps getting rejected.

I understand that it’s fairly easy, though I don’t know the hard limits.

Fine print says “Offer available exclusively in branches, through your banker or following the links within the flyer. Applications made through usbank.com, U.S. Bank Mobile App, U.S. Bank Online Banking or other direct mail channels are not eligible to receive this offer.”

Nick, are you sure that you are not misleading people with this offer?

The link has a banker code and banker name attached to it (the name shows up on the application page). We’ve seen this kind of thing with US Bank before — I’m confident enough that it’ll work fine that my wife opened both a Leverage card and a Business Altitude Connect (same type of link on that offer). Note that you could alternatively just Google “US Bank Business Leverage 90,000” and the second result on Google is also for this $900 offer. It still has a banker code in the URL, but no banker name on the application page.

Either way, it says $900 on the landing page and has an “Apply Now” button. I always take screen shots, but I wouldn’t anticipate needing them here as I expect US Bank will honor it automatically.

I just got the card a week ago. Do you know if US Bank will likely match the current bonus? Thanks.

I know that they won’t match it if you don’t ask them to match it (which is my way of saying that it’s always worth asking). I don’t know that they will, especially because this one appears to come from business relationship managers at US Bank, but if you ask and they say no, the result is no worse than if you don’t ask. I’d at least give them an opportunity to give you more money.

Any word on them matching this offer?

I have not tried.

I already have this card from last year, any idea if you can get multiple bonuses year after year?

My understanding is that you can.

Thanks, will give it a try!

Instantly approved! Thanks for the post, Nick.

Nick, FYI – the US Bank Business Connect and Triple Cash cards also have elevated bonuses of $750 and $600.

Yes, we know and we updated our best offers page with those earlier. We’ll have separate posts about those.

any idea if a number can be made immediately available (taxes)?

I recently got the card and there was no option presented for getting an instant number, so I think the answer is no.

Thank you!