It’s quite the big news day, with Chase releasing details of a revamped Sapphire Reserve card and the launch of the Sapphire Reserve for Business card. Greg’s covered the former here, while Nick will be sharing more details about the new business card shortly.

For now though, we wanted to highlight some important news regarding redemptions for not only the Chase Sapphire Reserve card, but select other cards too. At the moment, Sapphire Reserve cardholders can redeem their Ultimate Rewards points for 1.5 cents per point of value for bookings through Chase Travel℠, while Sapphire Preferred, Ink Business Preferred and Ink Business Plus (no longer available for new applications) cardholders can redeem Ultimate Rewards for 1.25c.

That option will be going away in stages, replaced instead by a feature that Chase is calling Points Boost.

Launch of Points Boost

Let’s start with Points Boost, because understanding how this new feature will work will also help you understand how 1.5c and 1.25c redemptions will proceed for existing cardholders over the next couple of years.

Starting on Monday June 23, 2025, Sapphire Reserve, Sapphire Preferred, Ink Preferred and Ink Plus cardholders will gain access to Points Boost. These will be select flight and hotel options for which you can get better than 1c of value when redeeming your Ultimate Rewards.

The rates differ depending on which card you have:

- Sapphire Reserve & Sapphire Reserve for Business – Up to 2c

- Sapphire Preferred, Ink Preferred & Ink Plus – Up to 1.5c for select hotels and select flights on select airlines, and up to 1.75c on premium cabin flights with select airlines

Note the key inclusion of “up to.” Points Boost offers won’t always be as high as 2c or 1.5c/1.75c respectively, so it’ll be important to check the value that you’ll be getting for those kind of redemptions. The exception will be hotel bookings at The Edit properties which is Chase Travel’s version of Amex Fine Hotels + Resorts; those will always offer a guaranteed 2c redemption rate for Sapphire Reserve cardholders. It seems likely that premium cabin flights will be on the higher redemption end while economy flights will be on the lower end of the boosted redemptions.

When you see this feature on your account, there’ll be an option to toggle on ‘Points Boost’ to only display flights or hotels for which you can redeem your Ultimate Rewards at a higher rate.

It remains to be seen quite how useful and widespread Points Boost redemptions will be. Chase has advised that there’ll be tickets bookable in economy, premium economy, business class and first class. Some of the airlines that’ll be featured at its launch will include Southwest, United, Air Canada, Emirates, Singapore Airlines, Qantas and more, with those options potentially changing in the future.

For the most part that’s not a surprise seeing as most of those airlines are Ultimate Rewards transfer partners, although I am a little surprised to see Qantas mentioned seeing as they’re not currently a transfer partner – perhaps that’s on the horizon?

End of 1.5c & 1.25c redemptions

1.5c and 1.25c Chase Travel redemptions aren’t going away immediately for existing cardholders. In fact, you will, to a certain extent, still be able to redeem your points at those values – or at a higher value – for more than two years. It’s a little convoluted though, so here’s a quick explainer.

For existing cardholders and those who apply – or upgrade – before June 23, 2025, the points you earn through October 25, 2025 will still be redeemable at 1.5c for Sapphire Reserve cardholders and at 1.25c for Sapphire Preferred, Ink Preferred and Ink Plus cardholders through October 26, 2027.

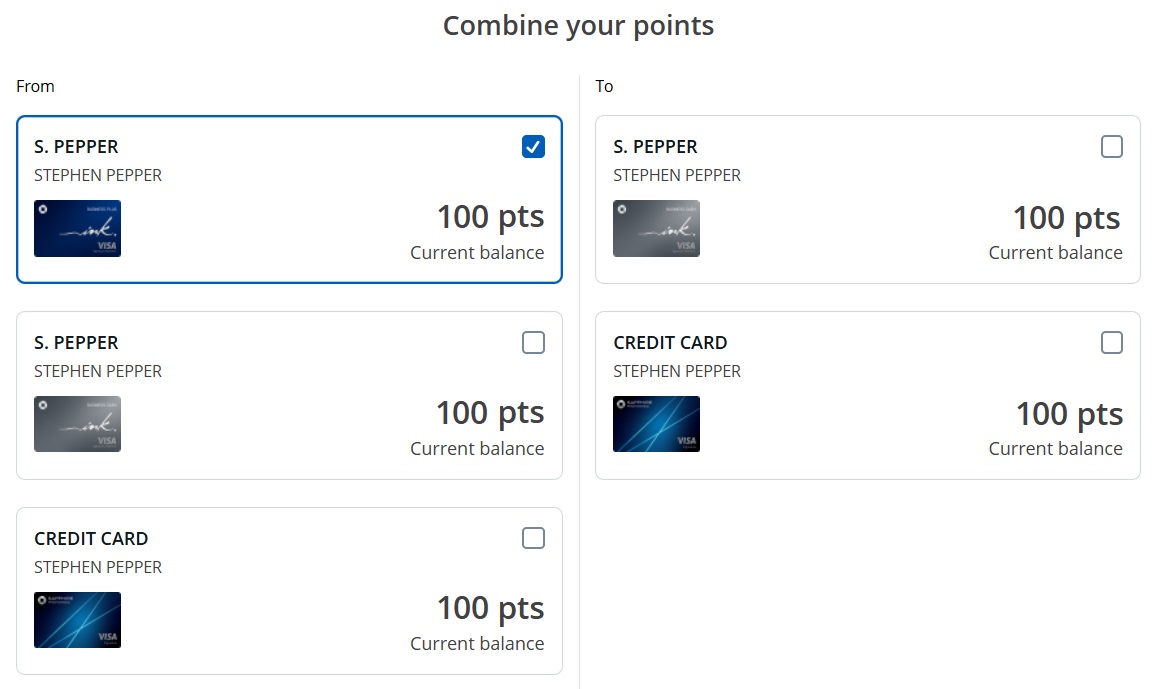

If you have multiple Ultimate Rewards-earning cards, you might have those points spread across a variety of cards. Chase has a useful ‘Combine Points’ feature that lets you move those points from one card to another. They’ve confirmed that if you combine your points to your eligible card (most pertinently a Sapphire Reserve if you have one) by October 25, 2025, those points will also be redeemable at the historical 1.5c or 1.25c rate through October 26, 2027.

For points earned by October 25, 2025, you’ll automatically receive the best redemption rate, whether that’s at 1.5c or 1.25c through the historical redemption option or at a rate higher than 1.5c or 1.25c via Points Boost.

Quick Thoughts

Eww.

Eww again.

Slightly Longer Thoughts

To be honest, I’m a little dumbfounded. Chase has taken what was once a great all-in-one travel card that was potentially fantastic for even somewhat infrequent travelers and is turning it from a no-brainer to a brain-hurter.

One of the standout features of the Sapphire Reserve for your average cardholder was the ability to earn 3x on all travel and dining, then redeeming those points through Chase Travel for 1.5c, effectively getting 4.5c of value for every dollar spent in those bonused categories. Easy to earn and easy to redeem because it was easy to understand.

Granted, you can get better value than that by transferring to travel partners such as Hyatt. However, for your average person who doesn’t want the perceived stress or confusion of transferring to Hyatt, United, etc. – or who doesn’t even realize that transfers to participating loyalty programs are an option in the first place – it was a really simple redemption option that’s going to be taken away from them. In some cases – such as booking Southwest flights – it could make more sense to book via Chase Travel than transferring the points regardless.

In its place will be something far more confusing, especially for existing cardholders who are used to its current setup. For example, my mother-in-law has had a Sapphire Reserve card since it came out in 2016. She’s not a points and miles aficionado, but it’s always been easy for her to understand and get good value from it. Now if I want to explain it to her, the conversation might go something like this:

You’ll now earn 4x points on flights and hotels booked directly with airlines and hotels but only 1x on all other travel rather than 3x on all travel like you always did in the past and you can redeem the points you’ve earned in the past as well as the points you’ll earn in the next few months for 1.5c but only through late October 2027 or you might be able to redeem the points at a better rate if a Points Boost option is available in the meantime but points earned from October 26, 2025 onwards can’t be redeemed at that 1.5c rate unless there’s a Points Boost option available for better value but if there isn’t then you’ll be redeeming your points at 1c of value if you want to book your travel via Chase Travel and you’ll now have the privilege of paying for all of this with a $795 annual fee rather than $550.

That’s hardly an elevator pitch for the Sapphire Reserve.

I do appreciate that Chase is ensuring that cardholders will automatically get the best redemption rate for the next couple of years for points earned by October 25, 2025 without having to jump through any hoops. If a Points Boost option is better value, you’ll get that. If a 1.5c or 1.25c redemption is better value, that’s the redemption that’ll be applied.

There’s no denying it though – this is a major bummer for your average Sapphire Reserve cardholder who isn’t interested in transferring their Ultimate Rewards to travel partners like Hyatt, United, Southwest, etc.

I’ve focused more on the impact for Sapphire Reserve cardholders above seeing as 1.5c Chase Travel redemptions were solid redemption options for almost 10 years. They weren’t spectacular redemptions, but it was a high value floor that other transferable currencies haven’t replicated on such an easy-to-redeem basis, plus it was always easy to understand.

These changes are slightly less of an issue for most Sapphire Preferred, Ink Preferred and Ink Plus cardholders as I imagine that there are fewer people redeeming their Ultimate Rewards for only 1.25c via Chase Travel, but perhaps I’m mistaken on that.

Either way, it’s a disappointing development going forward that’ll probably have a not-insignificant number of cardholders reevaluating whether to renew their card(s) or cancel them.

Question

Will this (eventual) ending of 1.5c and 1.25c redemptions affect whether you keep or cancel your card(s)? Are you optimistic about the value you might be able to get via the new Points Boost feature? Let us know in the comments below.

[…] needed; value varies and legacy 1.25–1.5¢ rates are being phased out. (Chase Travel, 2025-07; Frequent Miler, […]

I do not have either the Chase Sapphire Preferred or Reserve at the moment, although I did have the Preferred a month back after which I downgraded it to a freedom (wasn’t planning on travelling this year).

If I sign up for either the reserve or the preferred at this moment, will I be eligible to get the 1.5 or 1.25x multiplier? I’m a little worried as I have a lot of UR points pooled up.

Does anyone have a suggestion for the great travel insurance and rental car to replace the csr?

Forbes said chase lost a lot of money on the csr card so doubt it will ever be this great card ever again

Definate cancel for me. All travel will go on chase ink when my renewl for sapphire comes up. Worried about losing the great trip insurance though. Unsure if ink provides this and amex p not as good of coverage as chase.

[…] For more details on the changes to Chase Travel portal redemptions and the “Points boost” system, see this post. […]

What about business preferred. Is Chase taking away the 1.25 rate too?

I’m afraid so

Total crap. Wrote chase to tell them so. I have 1m+ cc spend with Chase and im gonna switch if they go through with this.

CSR has been my go-to card since it came out in 2016. These changes make it much less appealing, and will have me looking to spend my 1.2 million points between now and October 2027. I’ll prob keep the card until then – even with the higher fee – but these changes definitely devalue it. I particularly hate the AMEX-like “your bonus is $300/year . . . but you have to redeem it as $150 every 6 months.” And I do wish Chase would let me decide where to spend my $300 traveled credit each year instead of just applying it to the first $300 of spend. I want to select which charges I want it to apply to because some of the charges on my card are corporate.

I’m probably going to move out of the entire UR points ecosystem with these changes.

I’ve used the 1.5 redemption quite a bit on international hotels and a huge portion of my point earning has been on cruises and rail travel.

Having one card for high earning for all travel and premium travel insurances along with the lounge perks was THE selling point for me of the entire system. Without that card (CSR) it doesn’t make sense for my travel.

I will probably go Green/Platinum card for future depending on upcoming Platinum changes.

I’ve had the CSR since day 1 and have only redeemed my UR points a few times, maybe 250k worth total at 1.5x for airfare. Probably redeemed another 200k at 1.5x for the pay yourself back during COVID years. Anyway it was nice to know that was a floor for all my UR points earned both for my business and personal cards. I have CSR, CFU, Freedom, Ink Unlimited and Ink Cash, and about 80% of my spend goes on one of those cards. I always viewed it as earning 1.5x whatever the multiplier was so since my base earning generally was 1.5X on either Unlimited card, I justified it as earning 2.25% back everywhere at a minimum which was better than a 2% cashback card. So my Fidelity 2% card has basically been untouched for like 8-10 years. Now that this is ending it’ll be harder to justify putting personal spend on one of these cards unless getting at least 2X. While I have and do a lot of transfers to partners, with young kids (7 and 3) I’ve done a lot less luxurious international trips so have built up a UR stash of 1M+ points. Hence the 1.5x was a good use and a great mental floor. Definitely wish I’d cashed out a lot more at 1.5X PYB.

This removal will make my UR earning decline for sure. Had they just raised the fee and made all other changes except this, I’d probably be a long term holder, but now have a serious decision when my next higher renewal occurs in August 2026.

I won’t be renewing my CSR come renewal. Does anyone know if I am eligible for the card and the welcome bonus if I apply for the CSP now while I still have the CSR?

[…] 上面只讲了CSR信用卡,但是其实同一时间CSP和CIP的兑换也一起变更了:以前这俩卡是 1.25 cpp 的固定比例兑换,6.23之后也将引入 “Points Boost”,兑换比例是 up to 1.5 cpp。(source: FM) […]

The coupon book was bad enough, but now that they’re taking away the 1.5cpp on the UR portal, I will be cancelling. I use the portal quite a bit to book lodging.

When does 3x for all travel end????

Oct 26 for cardholders who had their card or applied before June 23

*applied before June 23

Thanks fixed

Question for anyone who may know. If I have CSP now and either PC it to a CSR or apply for a CSR outright after 10/25/25, will the points I’ve earned with CSP (banked before 10/25/25) be grandfathered?

No, you’d need to upgrade the CSP to a CSR by October 25, 2025 in order to have those points be redeemable at 1.5c.