Bilt has made a major change to the value proposition of Rent Day. Starting October 1, 2024, Bilt cardholders will only earn double bonus on Rent Day up to 1,000 bonus points per month — down from up to 10,000 points per month. Worse yet, that change was communicated via a terms and conditions link buried at the bottom of a Friday afternoon email from Founder & CEO Ankur Jain that focused on Bilt benefits with no mention at all of this change in the body of the email. You still have two more rent days before this change takes effect, but if you were counting on Rent Day spend both offering you double points and progress toward elite status, know that your capacity for double points is about to drop dramatically.

Part of Bilt’s ongoing Rent Day value proposition has long been double points on Rent Day. That means that cardholders earn an effective 6x on dining, 4x on travel, and 2x everywhere else on Rent Day (the 1st of the month), earning up to 10,000 bonus points each month. That has made the Bilt card worth using even on otherwise unbonused purchases on the first of the month since you’d effectively be earning 2x transferable points, and occasional exciting Rent Day transfer bonuses can boost your effective return significantly.

However, moving forward, you’ll only earn up to 1,000 bonus points per month on Rent Day. Given the double bonus categories, this means that dining out on the first and paying a check of $167 or more ($333 since the cap pertains to bonus points, not base earn) at your chosen restaurant will max out that month’s bonus points long before you’ve earned bonus points from any other purchases. Given Bilt’s core markets and image, it wouldn’t be hard to imagine many cardholders meeting or exceeding the double points cap eating at a restaurant in Bilt’s own Neighborhood Dining program.

This change will be particularly disappointing for those who have made it a point to chase elite status via Rent Day spend. As a reminder, Bilt elite status can be earned at the following thresholds via spend on the Bilt Mastercard:

- Silver – $10,000 dollars spent

- Gold – $25,000 dollars spent

- Platinum – $50,000 dollars spent

Given the chance to earn up to 10,000 points per month via the Rent Day double points promotion, it has been possible for those with $4,167 per month in bills that would otherwise be unbonused to reach Platinum status while also earning an excellent return on spend given the effective 2x earning rate. While many cardholders may not have that much to pay in bills ordinarily, others were surely hitting that number or even more with things like insurance and taxes.

Unfortunately, the math on changes significantly moving forward with only up to 1,000 bonus points per month based on double points for Rent Day spend. While I think Bilt points are a very valuable currency to collect, there is no currency I’m excited about collecting at only 1x given the plethora of 2x-everywhere cards on the market. I wouldn’t consider spending toward elite status if that means only earning 1 point per dollar spent.

All that said, I don’t find the change itself terribly surprising. As I just said, I’m sure that not very many cardholders spend $4,200 per month on Rent Day. The cost of funding that ongoing promotion for those who spend a lot on Rent Day may not make sense if it’s a small percentage of cardholders taking fuller advantage of that promotion. If you asked an average cardholder whether they’d like to be able to earn double points on up to $10,000 in spend on the 1st of every month or [insert flashy Rent Day promotion here], I wouldn’t be shocked if a majority of cardholders would chose the “other” thing.

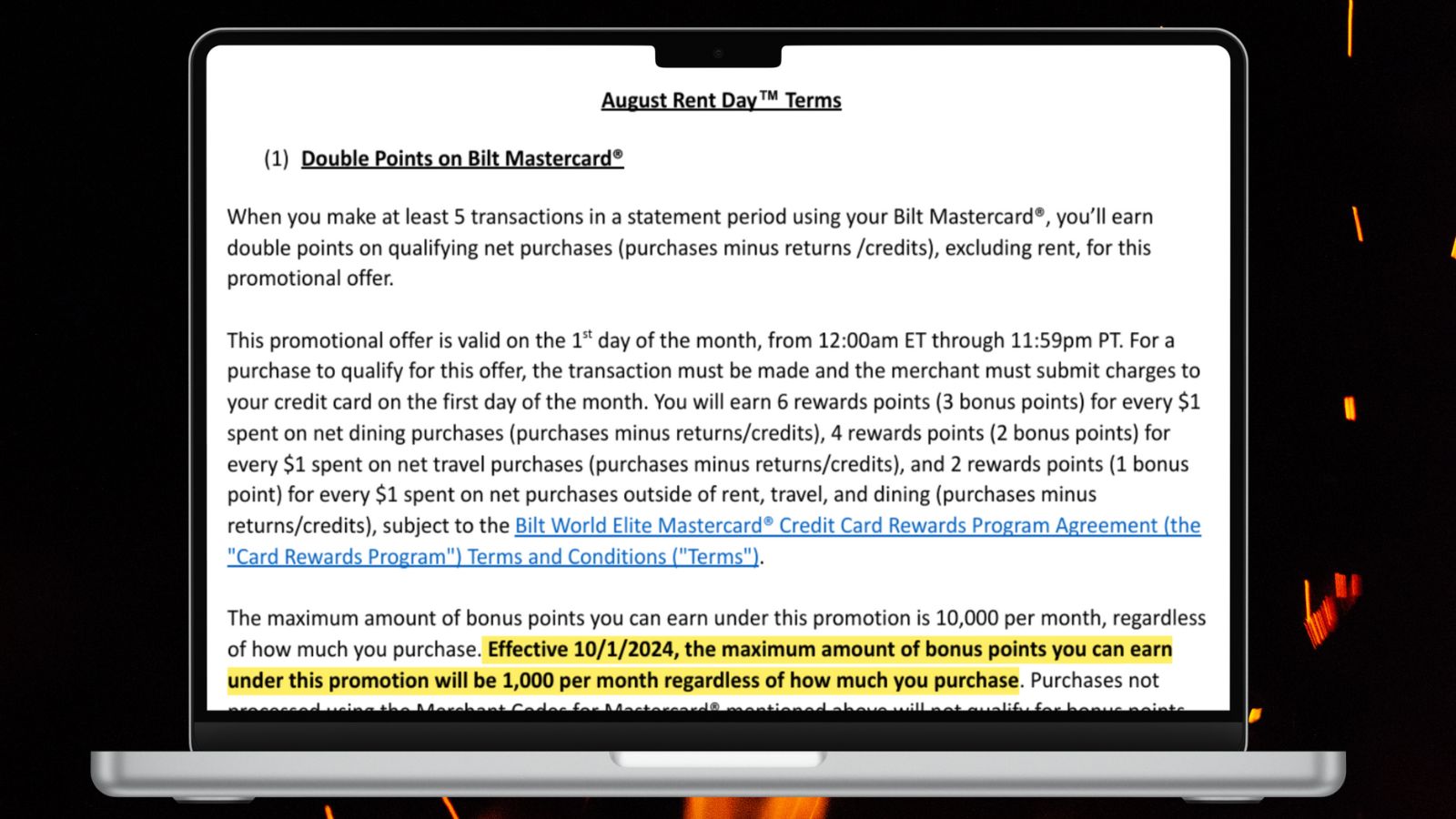

More disappointing here than the change itself is the way in which it was communicated. The lack of transparency is both surprising and disappointing. Ankur Jain, Founder & CEO of Bilt Rewards, sent a Friday afternoon email to Bilt Rewards members. As a Bilt Rewards member myself, that email hit my inbox at 4:04pm on Friday while I was driving to the airport to fly to Europe, so while I saw the message, I initially missed the tiny footnote at the bottom of the email to “Terms and Conditions”. A number of observant readers and some other blogs caught that link (see those terms and conditions here), and in a paragraph found at that link about the Rent Day double points, folks found this passage:

The maximum amount of bonus points you can earn under this promotion is 10,000 per month, regardless of how much you purchase. Effective 10/1/2024, the maximum amount of bonus points you can earn under this promotion will be 1,000 per month regardless of how much you purchase.

It’s disappointing that Bilt buried this important detail in a terms and conditions link at the bottom of a Friday afternoon email rather than clearly and transparently communicating it. Nobody likes to give or receive bad news, but plenty of PR people make careers of spinning bad news in some sort of positive light. Sure, I’d be rolling my eyes at the “program enhancements” announcement that mentioned this change if that’s what had happened, but that would feel a lot different than hiding the change in a way that feels designed to make sure that very few cardholders would see it coming.

If I’m right that Bilt figures that this change won’t be material to the majority of its members, then they should have communicated it clearly. It wouldn’t have changed much for the folks who weren’t spending anywhere near the cap to see that info front-and-center in an email and while it still would have been just as disappointing for those who are negatively affected, that bitter taste wouldn’t have been compounded by the manner in which it was delivered.

I have certainly been legitimately excited about what Bilt has done in this space. It’s been a great rewards currency with exciting transfer bonuses and some innovative promotions. I haven’t loved every Rent Day offer, but many times I’ve seen the market for whom they would be applicable even if that market wasn’t me. But as excited as I’ve been about many Bilt offers, I’m extremely disappointed that they’d make this sort of change and do such a poor job communicating it to cardholders. I continue to root for awesome Rent Day promotions, but I hope that program changes like this one are communicated as transparently as those Rent Day promos.

Oh well – I will only use the card for rent now.

I just love the drama this card creates!

“Glad I never signed up for it”; “not worth a 5/24 slot”, “Doesnt have a welcome bonus”; etc. etc. Never have i seen a card so polarizing – and with no annual fee its kinda comical!

Yes, I’m as disappointed with the rest of you with this move, but its still a no annual fee card, and one that gives 6X Hyatt points on the first of the month on up to $333 in dining spend.

I got this card a few months ago (maybe 4?) so it would be easy for me to think i made a mistake. I have put $16,000 in spend on the card, racked up over 80,000 Bilt points – plus a huge bonus of 25,000 Alaska points. All told, 105,000 points for 16k spend. Even if i never see another point from Bilt – this has been a good “pump and dump” play at the low end. I dont know how people can be upset with that or be “glad” they never got it.

Yes, im going to slow my roll because this is a MAJOR devaluation. However, its still 3X dining everyday. And i can queue up my major bills (i.e. insurance, daycare, etc) for 2X on the first of every month (up to $1,000). Thats as good or better than anything in the chase ecosystem – and it transfers to hyatt as well – so Bilt will remain my dining card of choice hoping to get a 50% bonus somewhere along the way. Thats the real key. If transfer bonuses ever stop for more than ~6 months at a time – I can start off-loading to Hyatt.

Loved the card at first….sad (but not surprised) to see the devaluations…but DO NOT understand all the hate…

still no email…am I unaffected?

So if it’s too good to be true? Yep, Bilt is dead, long live Bilt. Now we’ll see if there are any more too good to be true transfer bonuses. Likely those are dead too

The Bilt chat bot is unaware of the upcoming change:

I must admit to being quite puzzled that instead of being primarily upset the Bilt is horribly screwing over members your primary problem is the way this information was distributed. The how, while very unpleasant, is a lot less concerning than the fact itself. If someone burned your house down (obviously hope it doesn’t actually happen) would your primary concern be the method they used or the fact that they did it?

Obviously the change is negative, but programs change all the time. I can understand that this might not have made sense for them and they had to change it. I wouldn’t like it, but it happens all the time with every program. Hiding the change instead of directly communicating it to members is definitely the part that bothers me. Your analogy comparing a change in bonus points to burning down a house is frankly nonsensical. Yes, the way they communicated the change (or didn’t in this case) matters as someone who does spend big on their Bilt card on the first of every month wouldn’t have known about the change until after they spent on the card and didn’t receive their expected points — some with large balances may not even notice the missing points right away.

They did a similar thing with spending on the Curve card. For several months I put non category, dining, and travel purchases made throughout the month on my curve card. On the 1st of the month I used Curve’s “go back in time” feature to transfer those purchases to Bilt for 2x, 6x, or 4x earnings based on the category and rent day bonus. One month I transferred about $5,000 of travel purchased that would have resulted in maxing out the $10,000 rent day bonus only to not get it and learn that the terms and conditions changed with no notice sometime during the previous month to not allow point earnings using products that allow you to change the date of the purchase.

To be sure, I felt like I was taking advantage of something that although allowed, would probably be shut down at some point as it seemed to fall in the “too good to be true” category. But, how they implemented it was disappointing. No warning, and, even worse, the change in the T&C resulted in me not earning ANY points on that $5,000 of travel spend, not just the 10,000 bonus points. So instead of earning the expected 20k Bilt points I earned 0 points, but I could have easily earned 15k UR points with my Sapphire Reserve or at least 10k Bilt points with their normal travel spend category.

For the average customer the way they changed rent day earnings is more concerning but we’re not the average customer. We’re the FM crowd – the maximizers, the status hackers. I feel for us the actual change is the bigger issue. Thanks to blogs like FM we’ll always find out Bilt changes no matter how they try to hide it.

Yeah, that’s a good point. And chances are we are the folks specifically being targeted with this change. It is irritating (and the way it was communicated stinks), but also all part of the game.

One time on a different forum I pointed out to fellow hobbyists that because our goal is to find loopholes in the system and exploit them that we shouldn’t be surprised if banks and other businesses are working to close some of them, maybe even especially the good ones. It was not well received.

I was just about to wade in to the Bilt system (5/24 held me up). Doesn’t this pretty much gut the best parts of the card?

I think it is still pretty good and for sure worth keeping if you have it ($0 annual fee). If you pay rent I’d say to jump on it for sure. If you have no rent then it’s a toss up. I’m still going to maximize the 1,000 rent day points and use the card for dining (because of transfer bonuses I feel it’s a better solution than the AmEx Gold card’s 4x earning, which I don’t have because the credits aren’t that useful to me and the AF is not offset by the extra 1x earning. I also prefer using Bilt over other 3x dining cards I have since I have other good earning cards in those ecosystems). I may put some travel spend on the card from time to time since transfer bonuses increase the 2x earn to 3-4x, which compares well to my Sapphire Reserve, Citi Premier, etc.

Also, you can pay someone else’s rent for them. That way you can earn miles and even share some with them. Just be sure you trust them to pay you back.

[…] just read this post on Frequent Miler, and the news is very disappointing. Beginning 10/1/24, Bilt has reduced the […]

Well, well, well. I said the WSJ leak was not good news in ST as it had to be WF wanting to change the terms and FM (whom again I respect) was acting like Kevin Bacon in Animal House, “All is well….”

Worse, they didn’t even include the announcement in that email for those of us with an account but not the credit card.

I’ve had an account for a while and was planning to open the card later this year for property taxes. I saw the announcement from others and went back to read my email terms and conditions. Not there at all!

A good way to dupe those who were planning to open a card. 🙁 Now I won’t.

1) cut potential rent day earnings by 90%

2) make platinum status impossible to earn without huge opportunity costs. Turn current Bilt Platinums into future Bilt Silvers.

3) in future years a 100% transfer bonus for platinums will become a 50% transfer bonus for silvers.

4) bury this change in new terms and hope nobody notices.

5) nice job Bilt

See? There’s nothing wrong with the business model. Bilt and WF are doing fine despite the data in the WSJ article

What if they offered 10X points for carrying a balance? Would that make Wells Fargo happy and avoid devaluation?

Is the Bilt card marketed to the general public where they may tick up the number of people carrying a balance?

lol. I’d happily pay a month of interest (say 2% to earn 10x on everything

My interest rate is 24.49% on the card

The Bilt Card is slowly becoming the Chase Sapphire Preferred (sans annual fee). As C Hop notes, the last major differentiator is over-sized transfer bonuses. The questions are: 1) whether they continue at all and 2) their frequency. If there’s not one on October 1st, the next would likely be January 1st. If the next one is January 1st, I’d guess they’re throttling back to semi-annual or annual. And, if there’s not one by January 1st, all bets are off.

If the CSP is sustainable for Chase, the Bilt rewards program is sustainable. Indeed, the Bilt rewards program is profitable. Certainly, it is not a card for hobbyists but it might be for “regular” consumers. I’ve been a strong advocate for the Bilt Card over the past couple years, but I’ll be the first to say its heyday is over. In fact, there were signs at the beginning of the year that some change was afoot. Nonetheless, Bilt has a contract that runs through 2029 and no one should expect it to simply disappear.

Detractors will say the card was never good (and might even say they are glad they did not get the card). But, this is rebutted by the experiences of early adopters, such as my wife and I. We absolutely cleaned up and we are grateful. We wish the same for all.

One factor behind Bilt’s high profitability has been extraordinary high short-term interest rates. Bilt charges Wells Fargo for the rent each month and would earn a float until the rent check is cashed. At 5% the float creates a lot of income for Bilt. But as rates start to fall they are likely to look elsewhere for a similar income stream.

I also believe the sustainability component came from the transfer bonuses, which put the burden of points on the loyalty program rather than on Bilt. They could continue to offer low and slow ways to earn points if they convinced the loyalty programs to double and triple them on their end.

Being relatively early in the points and miles game I never jumped on the Bilt card. It was intriguing to pick up “some day” but I don’t have rent (or a similarly large HOA bill) to pay and wanted to work through 5/24 slots and early big SUB offers. I figured Bilt would have a place as an everyday card for dining and first of month travel bookings & bills in the future, as the elevated transfer bonuses and opportunities to earn status (like Flying Blue) really stand out.

These changes are substantial and overall I’m questioning if the card is worth getting for those without rent spend. Thinking outside of the hobbyist bubble for a minute the answer is still probably yes – even with the rent day bonus cap the card is basically a superior CSP, with no annual fee, a better combination of transfer partners, and occasional large transfer bonuses. Still the best one card solution on the market (Wells Fargo and Citi don’t have enough hotel partners despite their larger range of 3X categories). As a hobbyist without rent I’m not sure if or when I’ll bother getting it anymore.

Richard Kerr posted on X that it only impacts 2% of users and the savings will help fund transfer bonuses. I always thought the rent day bonus was a weird gimmick. Still sad to see it go as this was on my short list of next cards.

https://x.com/KerrPoints/status/1817386262363349092?t=KvHyEMMUKsIinaXr4M65dw&s=19

Thanks for this link. Kerr’s justification makes no sense, until we consider that this is also a way to effectively prevent people from reaching Bilt Platinum, thereby reducing Bilt’s transfer costs even more.

If Bilt wants to boost everyday spend, and I’m sure they do, they should really do the bare minimum of *guaranteeing* at least two 75-150% airline transfer bonuses a year. They don’t even have to tell us which partners in advance.

Put another way, if they’re willing to list transfer bonuses as a status benefit, in theory they expect to offer them regularly. But if they don’t guarantee it, this card is basically just a CSP+ as another commenter mentioned — unsuitable for everyday spend.

Neither my wife nor I received any email from Bilt with this news. Did everyone else get Bilt’s email? Also, pretty useless Rent Day promotion for August.

I didn’t get the email either, despite getting other Bilt emails, and as someone who regularly spends close to the max on Rent Day. Not sure whether that’s intentional or what else is going on, but aside from the small print I wouldn’t know about it all if I weren’t following blogs.