Changes are on the horizon for the Bilt card. After news reports (gift article) that Wells Fargo wasn’t happy with how things were working out with regards to its issuance of the Bilt credit card, it’s been clear that the status quo wouldn’t be maintained.

In recent months, Bilt has given the impression that it’s hustling to get something different in place. More details about that emerged yesterday when they shared proposals for not just one Bilt card, but three.

It’s clear that Bilt is modeling all three cards on Chase’s suite of Ultimate Rewards-earning cards, but Bilt’s proposals are sadly less than ultimate. While a couple of the cards could make sense for some people, the proposed Bilt premium card is shaping up to be a dud. There is a feature that could entice new cardholders though – the ability to earn 1x or 1.25x not only on rent, but on mortgage payments too. There are two other unknown factors right now that could also have a significant impact on the appeal of these cards.

Bilt is actively seeking feedback on these proposals, so be sure to share your thoughts in the comments below.

Here are the proposed card options, along with my thoughts.

No Annual Fee Card

The existing Bilt credit card has no annual fee and earns 3x on dining and Lyft rides, 2x on travel and 1x on everything else – including rent.

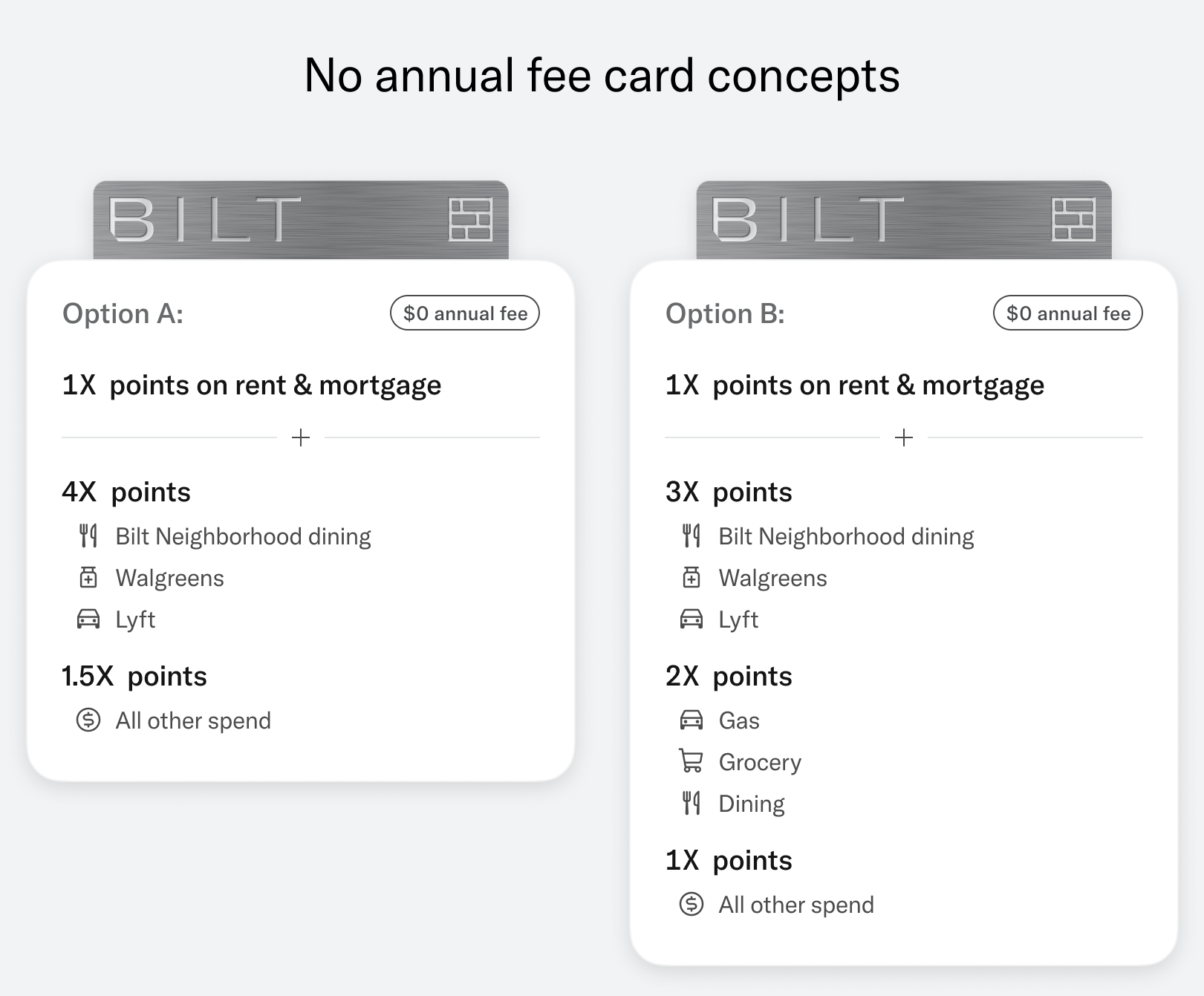

There are two versions of a proposed new version of the no annual fee card:

This seems to be Bilt’s attempt to copy Chase’s Freedom Unlimited card. As a reminder of how the Freedom Unlimited card used to work, you got 5x on Lyft rides (through March 2025), 5x on travel booked through Chase Travel℠, 3x on dining and drugstores and 1.5x everywhere else. For Lyft, it’s now 2% cash back total on qualifying Lyft products and services purchased through the Lyft mobile application through September 30, 2027.

Both of these proposed no annual fee cards from Bilt are somewhat interesting and would certainly have appeal for some, but they’re not inspiring in terms of day-to-day earnings. Freedom Unlimited cardholders earn 3x on all dining which is far better than Bilt’s 3x or 4x on Bilt Neighborhood dining only as that’s a much more limited list of eligible restaurants.

3x or 4x at Walgreens is good, but I’d much rather have the 3x available on all drugstore purchases with the Freedom Unlimited. 1.5x on all earnings for option 1 matches the Freedom Unlimited card’s everywhere else earnings, while option 2 only offers 1x on everywhere else spend. Option 2 does offer 2x on dining, groceries and gas which isn’t any more special than a card like Citi’s Double Cash seeing as that offers 2x everywhere, although at least with Bilt you can transfer to Hyatt, Alaska Airlines, etc.

Probably the biggest draw of this card – in addition to the lack of an annual fee – is the ability to earn 1x on both rent and mortgage payments. For someone with a sizeable monthly rent or mortgage payment, that could make this card a no-brainer for someone who’s not enticed by the two other proposed cards with an annual fee.

$95 Annual Fee Card

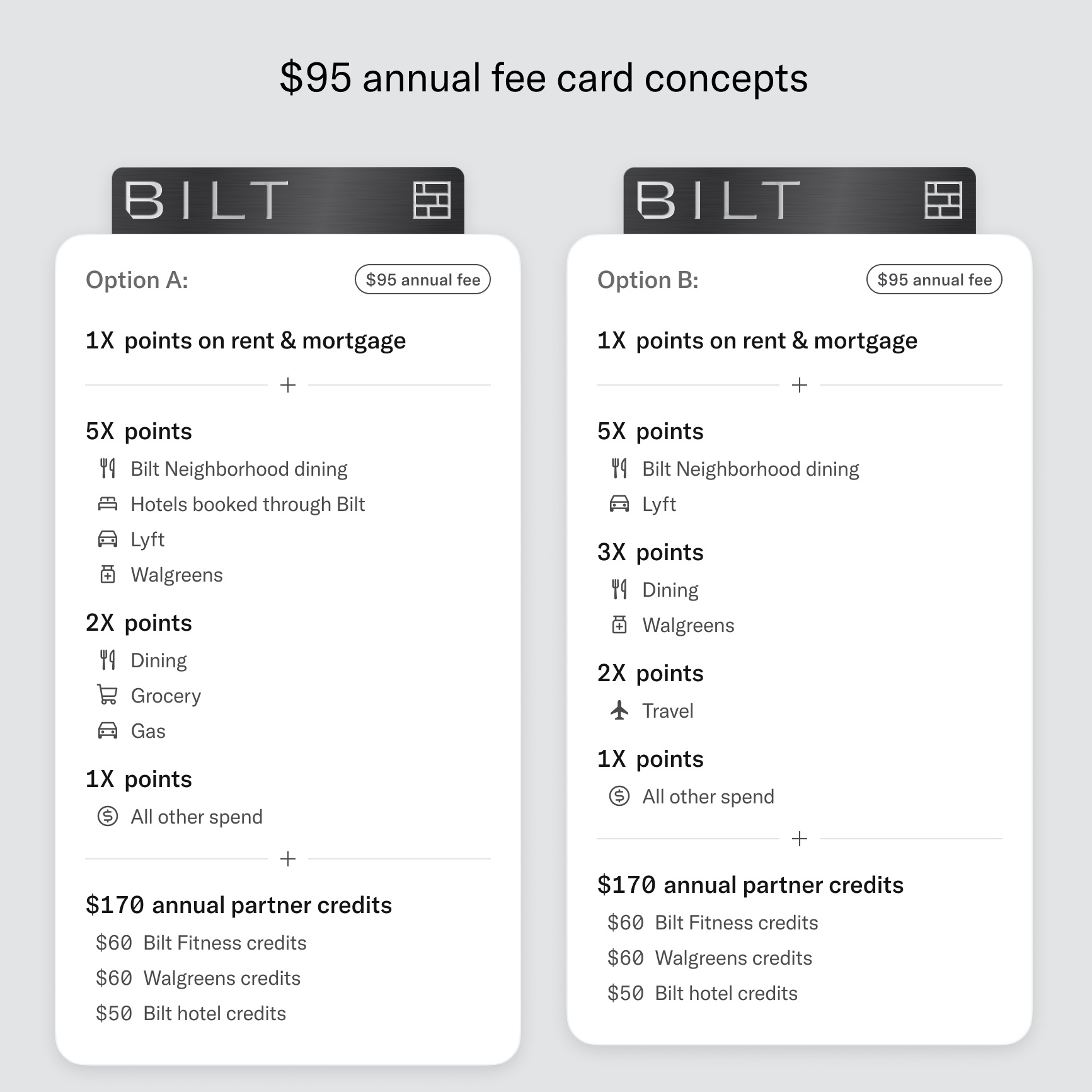

Bilt’s second proposed card has a $95 annual fee and is modeled after Chase’s Sapphire Preferred card:

As a recap, the Chase Sapphire Preferred card earns 5x on travel booked through Chase Travel and Lyft rides (the latter through September 2027), 3x on dining, select streaming services and online grocery, 2x on travel and 1x on everything else. It also provides primary auto rental coverage and you get a $50 statement credit on hotel stays booked through Chase Travel.

Option 1 of the Bilt cards listed above has some elements that match the Sapphire Preferred card – a $50 hotel credit and 5x on hotels booked through their own travel portal and 5x on Lyft rides. Bilt’s 2x on dining, grocery and gas is good, but again – you can get that by default on other cards offering transferable points such as the Citi Double Cash and Amex Blue Business Plus cards.

For option 2, earning 3x on dining and 2x on travel could be appealing, but that comes at the cost of gas and groceries not being bonused.

What could make this card more worthwhile are the other two proposed credits. There’d be $60 in Bilt Fitness credits and $60 in Walgreens credits. Given those somewhat strange amounts, it’s almost certain that those would be $5 credits each month, rather than giving you the ability to spend $60 in one fell swoop to lock in the credits. For someone who shops at Walgreens at least once a month, that won’t be hard to do and it’s nice that you’d also – as things currently stand – also earn 3x or 5x on the rest of the purchase.

Bilt Fitness on the other hand will have far more limited appeal. Right now Bilt Fitness encompasses the following partners:

- Soulcycle

- Y7

- pure barre

- Rumble Boxing

- BFT

- CycleBar

- YogaSix

- CorePower Yoga

If you have a recurring subscription to any of those, getting $5 back per month from Bilt will be as good as cash. If you also value the $5 monthly credits for Walgreens as good as cash, those credits mean the annual fee pays for itself, even before accounting for the $50 hotel credit.

That doesn’t mean the card is a no-brainer though – see the Big Unknown section below for why.

$550 Annual Fee Card

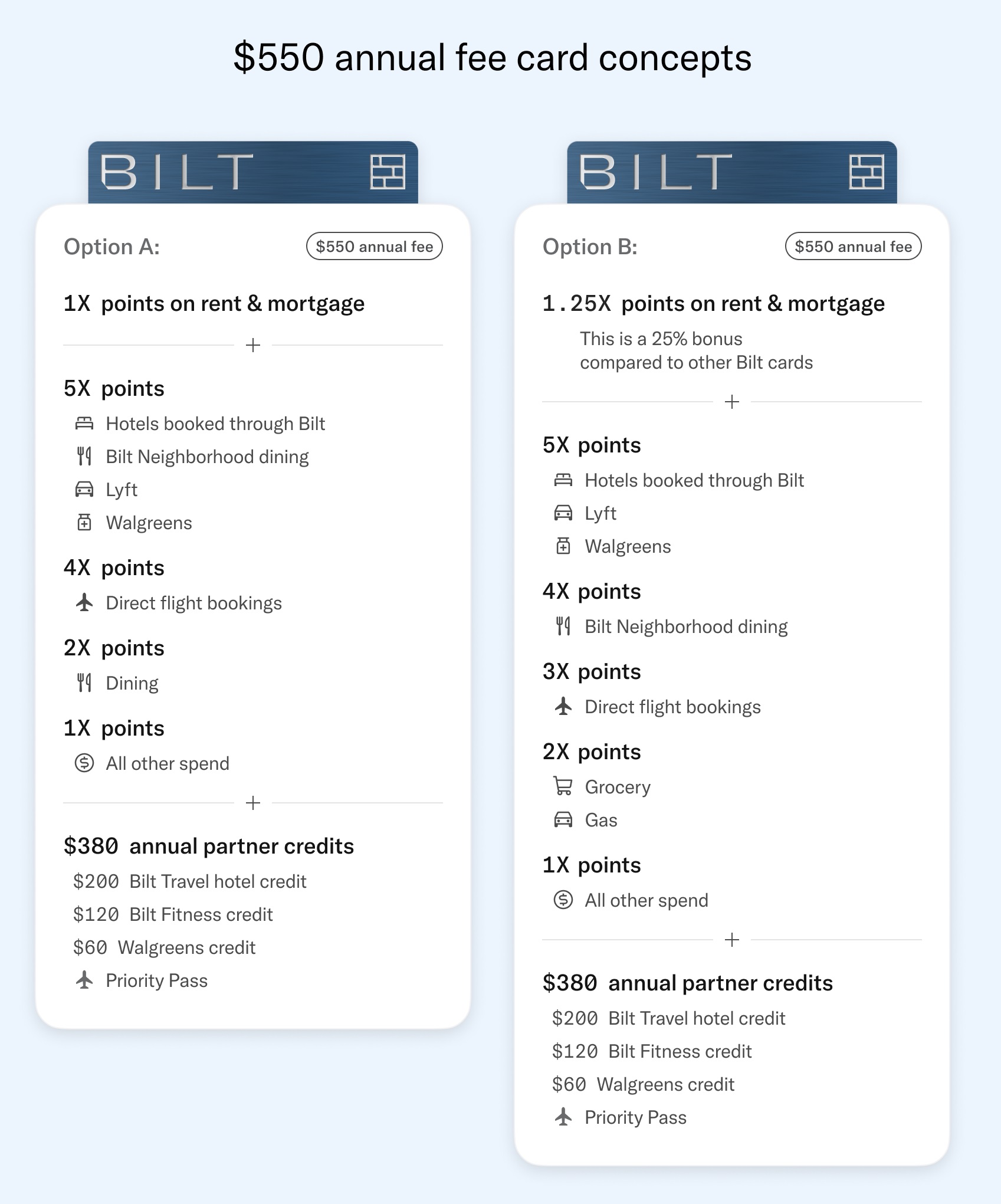

Bilt’s proposed $550 annual fee card takes aim at Chase’s Sapphire Reserve card, which has a $795 annual fee. Bilt’s aim with this card is about as accurate as a Dallas Cowboys quarterback in the postseason though, so the two options are less than compelling.

As a reminder, the Sapphire Reserve card comes with a $300 annual travel credit, $120 Global Entry fee credit, Priority Pass, primary auto rental coverage, 8x on travel booked through Chase Travel, 5x on Lyft rides through September 2027, 3x on dining, Sapphire lounge access, the ability to redeem Ultimate Rewards points for up to 1.75 cents per point through Chase Travel and more. It’s therefore a very well-rounded travel credit card, albeit one with a high annual fee.

Both options for the Bilt $550 annual fee cards come with a number of proposed credits, but in my opinion they’re less interesting than the Sapphire Reserve’s $300 travel credit. That $300 credit is simply to use and requires zero effort – simply spend $300 on travel throughout the year and you’ll get that credited back.

Bilt on the other hand looks like it might be borrowing from Amex’s coupon book playbook. $120 in Bilt Fitness credits gives the impression that you’ll get $10 per month. $60 in Walgreens credits suggests $5 per month. $200 in hotel credits might be appealing, but you’ll have to book it through Bilt Travel which means you’ll have to forgo earning hotel points and elite night credits, as well as not receiving elite status benefits. All those hoops you’d have to jump through will make those $380 in credits worth significantly less than that for most people.

5x on hotels booked through Bilt Travel is half the earning rate of the Chase Sapphire Reserve card, while the Sapphire Reserve card earns 8X on car rentals too. 4x on direct flight bookings could appeal to people who spend a lot on paid airfare, but seeing as you can earn 5x on Amex Platinum cards and 3x on the Sapphire Reserve and Citi Strata Premier cards (among others), it’s not like there aren’t other high-earning options for airfare purchases.

The saving grace for option 2 of the $550 fee card is that it would earn 1.25x on rent and mortgage payments. For people who have significant expenses each month in that category, that extra 0.25x of earnings could add up. That said, you’d need to spend a huge amount on rent or your mortgage to make the 0.25x of additional earnings offset the $550 annual fee versus the no annual fee card, although some of those aforementioned credits would also offset some of the annual fee.

The Big Unknowns

There are a few factors that could have a large impact on the appeal of these new Bilt credit cards.

Unknown #1 – Welcome Offer?

Something key to the appeal of any of these new Bilt credit cards will be whether or not Bilt offers some kind of signup bonus when getting these cards. Historically they haven’t offered an official bonus at all, although many new cardholders get an offer giving 5x for their first five days after activation. I could sadly see them maintaining that on the no annual fee card, but hopefully they’ll offer some kind of compelling offer on the $95 and $550 fee cards.

If not, those annual fee cards will probably be DOA in the eyes of many people because the proposed benefits mean they’re already shaping up to be a poor man’s Chase Ultimate Rewards-earning card, particularly the $550 card. If the accompanying welcome offers are lackluster too, I imagine Bilt will have a hard time finding a market excited to pick up one or more of the cards. For someone primarily wanting to earn rewards on their rent or mortgage payments, they could get that with the no annual fee card, so there’d be less incentive to apply for a card with an annual fee without a bonus when initially applying.

Bilt’s saving grace is that it gives people an opportunity to earn points that transfer to Hyatt which could be useful for someone who’s over 5/24 with Chase. For someone locked out of earning Ultimate Rewards due to 5/24, Bilt is a good alternative. Otherwise, Bilt will need to give people a good reason to give up a 5/24 slot; hopefully – for Bilt’s sake – the ability to earn points on rent and mortgage payments will do that.

Unknown #2 – 3% Fee?

In a recent email to Bilt cardholders, CEO Ankur Jain stated the following:

Waiving the standard 3% card fee on rent payments represents a significant cost to the program—and unique value that we provide to Bilt cardholders. Ensuring this benefit goes to members who genuinely engage with our broader program—rather than those taking advantage of loopholes—will allow us to continue delivering long-term value for our entire cardholder community.

It’s not clear how Bilt will differentiate between cardholders who “genuinely engage” in the program and those who don’t. Will there be a requirement to eat at a Bilt Neighborhood dining restaurant once per month in order to not be charged a 3% fee on your rent or mortgage payment? Will they insist that you attend at least one pure barre class per month as part of Bilt Fitness to have the fee waived? If they find out you get your prescriptions filled at CVS rather than Walgreens, will they give you the stink eye and a sternly worded letter? That remains to be seen and could also have a big impact on whether applying for one of these cards is ultimately worthwhile.

Unknown #3 – Capped Earnings?

In October 2024, Bilt massively devalued potential earnings on its existing credit card by capping double bonus point earnings to 1,000 points on Rent Day (i.e. the first day of the month). The limit was previously 10,000 bonus points per month, so that was a whopping 90% cut. Not only did it reduce people’s potential earnings, but it also significantly limited both the appeal and ability to earn status in the Bilt Rewards program.

Bilt also currently caps points earnings on rent payments to a maximum of 100,000 points per year. Will that level be maintained, or will it be lowered or, fingers crossed, raised? Will Bilt have higher earning limits for rent and mortgage payments depending on what annual fee your Bilt credit card has? We shall see.

Your Thoughts?

I mentioned at the start of the post that Bilt is soliciting feedback on these card proposals, so please share your thoughts in the comments below on what you think of the current proposals and what improvements could be made to make these cards more appealing to you. Also, what kind of welcome offer would be needed to entice you to apply for either the $95 or $550 annual fee cards?

My guess is they will start charging the 3% card fee on the No Annuals Fee cards, and those that prove to genuinely engage with the Bilt program (by paying an annual fee), will likely still get the 3% card fee waved.

Doing that proposed Walgreen’s credit as $5 a month would be a new level of stupid. That wouldn’t cover the cost of driving if it wasn’t already on your way.

I don’t have a Bilt card since I don’t rent. I’ve been waiting for when they bring about mortgage earnings as it becomes a much stronger consideration at that point.

Of the presented options I’d take:

With Bilt offering points on mortgages and rent they simply can’t match the earnings rates on other cards that don’t offer that. They’re already giving out a free 10K – 30K of points earnings which they take a slight loss on to pay via check/ACH. If you put $10K of other spend through a Bilt card at 1X you’d end up with 20K – 40K of points. The same $10K on a Double Cash etc. would get you 20K points. Bilt is giving you more points and in a more valuable currency, while not requiring an annual fee to access transfer partners. To have them bump up to 2X everywhere on a no AF card seems like it has no way to profitability given how much more rewarding that is compared to the Double Cash in this example. Even a $95 AF isn’t going to recoup an extra 10K of points (or more when the card gets hit hard at 2X).

Listening to the podcast Richard Kerr co-hosts I’m not as down on the financial viability of Bilt long term. Yes he’s going to say what sounds better from a PR perspective, but it was very clear that Bilt has a play to offer service partnerships around payment systems and rewards offerings which generate revenue independently of the credit card arm of the business. They want to offer rent payment systems that real estate companies can use to have lower rates of non-payment, partner with Walgreens to offer easier HSA reimbursement to drive more spending at their stores, targeted dining rewards programs for higher end restaurants, etc. That’s why these concepts are floating higher bonuses on spending in their related ecosystems. Bilt should lean more into that and bonus niche areas that could generate interest from those who might see themselves spending in those areas and there aren’t many other options. They need another niche too they can add in. Trying to add in 2X gas and grocery multipliers is a losing battle when so many cards out there offer 3X or 4X (or 8X!) already and they are frequent 5X targets for quarterly rotating categories. It’s too broad.

The area I’d look in? Bonus insurance payments. 2X on all insurance. That would align well with mortgages since you’d also have homeowner’s insurance to pay, mortgage holders are much more likely to be in a suburban setting where they would be paying car insurance as well, and it is has some synergy with the focus on Walgreens and HSA reimbursements for those not paying health insurance through a W2 role. It would drive other large spending charges on the card and it’s an area they could data mine via their customer’s insurance charges to potentially build out another service offering. Maybe something with offering targeted insurance advertising to offer lower rates than a customer has now or a tab in the app to assist in shopping for insurance that would earn Bilt commissions on it.

Keep 3X Dining and don’t try to compete in gas or grocery.

At the ultra-premium end Bilt can’t offer their own lounge network and I just don’t see Priority Pass as a big draw with how many cards offer it now. Gary at VFTW had a good take that Bilt needs to leverage more of what they do uniquely in the travel space, and so far that has been their offerings of elevated transfer bonuses and the potential to earn various status and travel benefits from Bilt status. A fast track towards Bilt Platinum status with the ultra-premium cards, and ongoing offerings of things like the Blade transfers and Air France status match for a year via that Bilt status, seems like a better path. If there was a way to offer status match opportunities to an airline in each of the alliances at a level that provided some domestic benefits, that would be very intriguing. What if you could buy into Alaska MVP Gold (OneWorld Sapphire)? Or Aeroplan 50K (Star Alliance Gold)? The ultra-premium hotel and airline cards draw in customers and spend from directly offering status or giving higher spending multipliers and status qualification point boosts to make it easier to earn status. If Bilt’s ultra-premium cards could cut it down to needing say $20K in spending to earn a worthwhile airline status I think a lot of us would jump at that.

I’m going to echo that Bilt should look another unique travel credit offering or partnership on the high end. As others have said there isn’t much out there for earning or redeeming with VRBO or AirBNB. Maybe offering credits on airport parking could be another unique one.

I took the survey but found it less than useful. It was several binary choices without the option for “none of the above.” Just because I chose one option over the other does not mean that I would in any way hold the card that I chose.

What’s the line from The Grinch? “Stink, stank, stunk”

No fees card is good enough for me personally to take advantage of mortgage payments. The rest are covered by other cards in UR or MR rewards card.

1x Bilt on rent without fees is a fine default unless I need rent to hit a SUB. If they move to charging the rent fees for the NAF card and rent remains 1x earning, there’s little benefit to using Bilt to pay rent versus BBP to get 2x MR or even maybe 1.5x UR on CFU. Alaska miles alone probably aren’t worth that to me. And thinking I’m going to prioritize Bilt Dining isn’t going to happen.

I don’t know. On the one hand, getting about 18,000 points per year on a rent-related expense is much better way of gathering points than messing around with tracking a couple custom cash cards. I also have gotten a lot of value out of Bilt points so far without having to earn a ton of them. Once the Alaska loophole closes with Amex, collecting Bilt points will likely be much more enticing. If Chase loses the Lyft partnership in a couple months, that might also be a marginal feather in their cap.

On the other hand, they have made it pretty clear that they won’t be offering industry leading multiples on the card. Given that they split revenue with WF, this makes sense. Much like the airline cards, the economics of co-branded cards mean lower point returns. But people already use the CFU in lieu of a Venture X because they “love the Chase transfer partners.” Bilt, unlike Chase, has a much better lineup overall because they have superior OneWorld coverage (with Alaska and Cathay) and a good transfer rate to Accor. I can see the no annual fee cards working, and either of the $95 cards are not too offensive. Personally, I would have to think about taking 2x on gas and grocery (I just cannot bring myself to do it with dining).

For me, I currently put a lot of restaurant spend through Bilt, but not much else. Would I be enticed to add more? I think that depends on if we can trust transfer bonuses moving forward and if they beef up the status perks. 1x is a no-go for me, but 2x or 1.5x on some things could be possible. Co-brand airline cards work because of Free checked bag and boarding priority (so you don’t have to gate check your carry on). Is there a version of Bilt status that makes you willing to forego earning a few points on everyday spend in exchange for meaningful perks? So far, they haven’t figured that out.

If we own a couple of rentals (therefore commercial, and not personal use) are we allowed to charge these mortgages on to the Bilt credit cards?

We don’t know yet how mortgage payments will work on the new cards, so I’m not sure if commercial mortgage payments will be allowed, or if it’ll only be personal mortgages. I suspect the latter, but hopefully commercial mortgages for a residential property will work too.

Use one of the cards to focus as a bridge between renting and home ownership to attract new mortgage customers.

Bilt found a niche with the ability to earn points when paying rent, and hopefully soon, mortgages. To attract new mortgages to Wells Fargo,they could offer a credit card focused on those who wish to buy a home. For those who possess this card, include a 1/4% reduction on a mortgage interest rate, the ability to apply points to the closing cost of a home purchase, or as points to further reduce the interest rate.

I thought Bilt was always targeted at the points & miles community. Nobody else gets excited by using cc for rent, or even knows why that’s appealing.

If their goal here is to get those users to spend a lot at less than 2x, that’s just not going to happen.

I thought it was an open secret that everyone was already indirectly paying their mortgage with the Bilt card. I’m pretty sure Eddie and Ricky hinted at it on the pod at one point.

Bilt incentive for me died mid 2024. I’ll hold the card but it’ll get no use and none of these proposed changes will sway me. The cherry on top is that Wells Fargo is just oh so terrible to deal with. And why can’t you schedule a card payment in the app (seriously, you can only make a payment effective once you click submit)??? Bilt was a valiant effort, once the outsized transfer bonuses dried up there’s just nothing left to care about

International rent, please

Strictly a downgrade for me if they switch to either free options.

I use my Bilt card for lunch at work because Amex doesn’t count it for 4x category spend.

If they limit the 2x non-ota travel to only gas then back to the BofA PR.

If they were worried about banana purchases then this would take me from 20+ days of regular spend to bananas only for rent bonus.