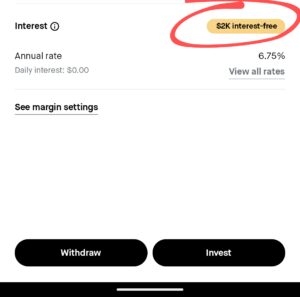

Robinhood Gold costs $5 per month and comes with a number of benefits, including (currently) 5% APY on uninvested cash, a 3% match on IRA contributions, and a handful of other benefits. A while back, Doctor of Credit reported a cool benefit I hadn’t realized: Gold members can access up to $1,000 a month via margin borrowing interest-free. I just noticed an update they did last month that some users can actually borrow up to $2,000 interest-free, and sure enough I see that capability in my own account. That might be of interest to some since one could at least theoretically pull that cash out and put it in a high-yield vehicle to come out ahead of the cost of Robinhood Gold.

The Deal

- Investment app Robinhood offers the ability to borrow up to $1K or $2K interest-free via a margin account for Gold members. The official Gold benefit is up to $1K interest-free, but some members are targeted for up to $2K interest-free.

Quick Thoughts

This looks like an easy way to access some capital in a pinch and/or to come out ahead of the Robinhood Gold fee. There are plenty of accounts that offer an opportunity to earn 5% APY or better these days, so if you’re targeted to be able to access $2K interest-free, it should be pretty easy to find a placer to park the money to earn more than $5 per month in interest.

I’m not sure how they determine who is targeted for the “up to $2K interest-free”. I have had margin enabled on my account for a long time and I have a regular taxable account that isn’t huge but isn’t just a few thousand dollars, either. My wife has a small taxable account with Robinhood and did not previously have margin investing enabled. When she enabled it, the app only showed that she’d get $1K interest-free as a Gold member.

I don’t know whether we’ll go to the trouble of withdrawing the $3K to put in a high-yield account, but at the very least it makes for a nice little buffer if we needed a little extra cash to float something for a month and we didn’t want to have to sell investments to free up more cash. I was contemplating moving some more investments into my wife’s account due to the current 1% match. Maybe if I did she’d get access to the $2K interest-free. The chance to borrow up to $4K interest-free for a couple could certainly be appealing for some.

Keep in mind that margin investing comes with risks, one of which is the risk of a margin call if the value of your investments drops. I expect that they’ve targeted the additional margin bandwidth to users with enough buffet to be unlike to face a margin call, but YMMV.

I’m not sure if Robinhood counts as “fintech” at this point, but I am extremely wary of anything that looks like fintech now after what’s been going on with the Yotta savings accounts.

Just be sure the extra $1K of margin isn’t promotional/won’t expire soon. I have RH gold and use my free $1k in margin (I have BOXX, which addresses LRDX tax concern, but SGOV would be almost the same). I also am being offered $2K in margin but only through August 18 at which point it goes back to $1K and I would be charged interest for the second $1k. Not worth it to me for two months. The real reason to have Gold is to maintain the 3% bonus on transfers to IRA, not the little bit of income from margin to offset the monthly fee.

Hi Nick, I don’t have RH or use margin, but couldn’t you invest that $2k in money market accounts / funds with RH for around the same 5% interest?

It’s not possible to buy mutual funds on margin. You need to buy some ultrashort bond ETFs like ICSH, SGOV, USFR, or BOXX.

Re: “it’s not possible to buy mutual funds on margin” — while perhaps technically correct, you can withdraw this $2K as cash, so you could ultimately buy whatever you want with it (not that I’m recommending you do).

Money market funds are securities, so why can’t you buy them with margin? Robinhood thing? Back in 2005 I was able to margin MMF’s at lower than the MMF rate and double the MMF balance

Because mutual funds are not traded securities. Funds that are traded are called – unsurprisingly – Exchange Traded Funds.

LRDX, MMF’s are absolutely marginable. Your broker may have a house rule against it.

Note: you need $5 *after tax* to offset the gains, as that fee is not deductible. (Only interest – the over-$2000 one – is deductible against investment income. This fee isn’t interest.) With high income and/or in a high state-tax state, no low risk ETF has enough yield for that, there’s no free lunch.

There are numerous high-yield savings accounts offering 5.25-5.5% APY right now. At 5.25%, that $2K earns about $105. Even if you’re in the 37% bracket and also living in a high state tax state, in most states, you’re still ahead of the $60 you’ll spend for Gold (although at a married-filing-jointly income of $731K+ to be in that bracket, I would imagine that you probably wouldn’t care that much about coming out ahead of the $60 Robinhood Gold fee if that’s your situation). The vast majority of Americans would come out ahead with a simple high-yield savings account.

I didn’t say it’s not benefitial to most people, all I said that taxes don’t make it a slam dunk for *everyone*. Also the smaller net earning might not worth the effort for some people.

You don’t need $730k to lose out: “just” $250k single, in CA has a 46.03% marginal tax (32% fed+10.23% state+3.8% NIIT), needs to earn $111.18 pre-tax to offset $5 monthly. That’s 5.56% yield on $2k. ICSH’s yield today is only 5.3%, so that’s a net loss (but ofc there might be other benefits to RH gold). (USFR has 5.6% and state tax free, so that’s still positive.)

BOXX would be taxed as LTCG if you held more than 1 year, even though the BOXX strategy is to use short term index options to extract the interest component of the options. Index options are also taxed 60/40 LTCG if you were to merely engage in the same strategy that BOXX uses. I do .

I’m intrigued. Why do you roll your own box options? What’s the benefit? How can you do better than 0 ongoing taxes and 100% LTCG at sell?