| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

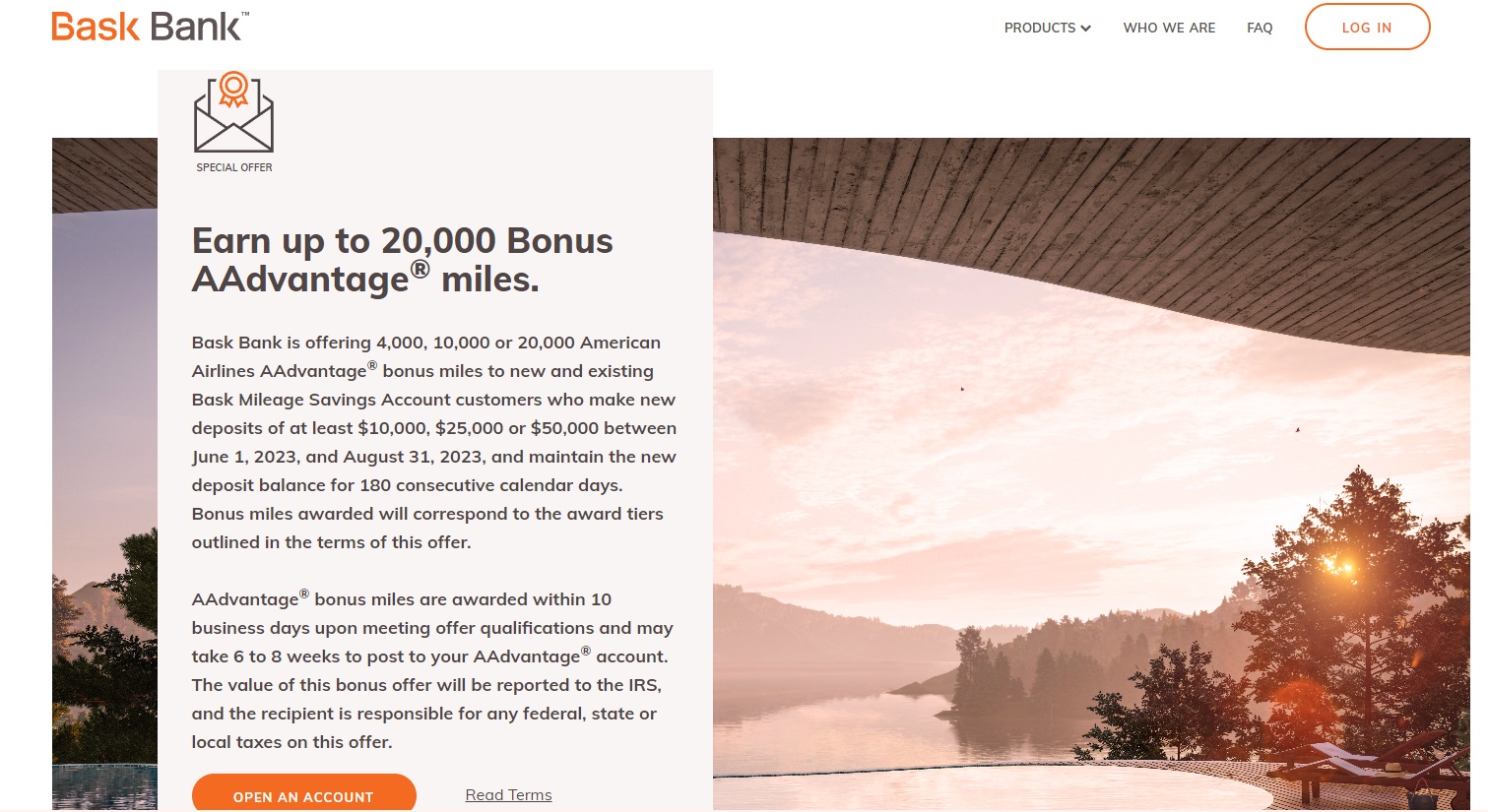

View from the Wing recently reported on a promotion being run by Bask Bank that gives both new and existing customers the opportunity to earn up to 20,000 bonus American Airlines miles. Gary makes the case for the math working out on this and it certainly might be a good opportunity for those who value American Airlines miles.

The Deal

- Bask Bank is offering up to 20,000 bonus AAdvantage miles when new or existing customers make one of the following new deposit thresholds by August 31, 2023 and maintain the new deposit balance for 180 consecutive calendar days:

- Deposit $10,000 to $24,999.99: Earn 4,000 bonus miles

- Deposit $25,000 to $49,999.99: Earn 10,000 bonus miles

- Deposit $50,000 or more: Earn 20,000 bonus miles

- Direct link to this deal

Key Terms

- Funds transferred from an existing account with Bask Bank or Texas Capital Bank will not qualify as new deposits.

- New Customers must (i) meet Bask Bank’s qualifications to open an account; (ii) complete the online account opening process between June 1, 2023, and August 31, 2023; (iii) fund the account within fifteen (15) business days following the initial account opening; (iv) make Award Tier qualifying deposit(s) during the June 1, 2023 – August 31, 2023 Promotion Period; (v) maintain the Award Tier qualifying deposit balance for one hundred eighty (180) consecutive calendar days following the date on which the qualified deposit range is reached; and (vi) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account.

- Existing Customers must (i) have an active Bask Mileage Savings Account in good standing; (ii) make Award Tier qualifying deposit(s) during the June 1, 2023 – August 31, 2023 Promotion Period; (iii) maintain an aggregate account balance equal to or greater than the combined qualifying deposit and the account’s ending balance on May 31, 2023 for one hundred eighty (180) consecutive calendar days after the date on which the qualified deposit range is reached; (iv) provide Bask Bank with an AAdvantage® account number in the same name as the subject Bask Savings Account.

- The maximum possible award for this offer is 20,000 miles. The 180-day Holding Period will begin once an Award Tier I, II, or III new deposit threshold is achieved during the Promotion Period. Customers may graduate to higher Award Tiers if additional new deposits are made during the Promotion Period. If a customer’s balance increases to a higher Award Tier during the Promotion Period, the customer will be awarded the Award Tier miles maintained for 180 days. For example, if a customer deposits an Award Tier II deposit of $25K on June 1, and subsequently makes an additional $25,000 deposit on July 1, the customer would receive the 10,000 mile Tier II award 180 consecutive calendar days after the first deposit, and the remaining 10,000 miles of the Tier III award 180 consecutive calendar days after the second deposit. Conversely, a customer may downgrade to a lower Award Tier if withdrawals are made, as long as an Award Tier qualifying balance is maintained for the entire 180-day Holding Period. For example, if a customer deposits an Award Tier II deposit of $25,000 on June 1, and subsequently withdraws $15,000 on July 1, the customer would still qualify for a Tier I Award so long as the Award Tier qualifying balance is maintained for the remainder of the 180-day Holding Period. Any deposits made after the Promotion Period will not have any impact on Award Tier qualification.

- See full terms for more detail

Quick Thoughts

For those unfamiliar, Bask Bank offers a savings account that earns American Airlines AAdvantage miles instead of interest. The current earning rate is 2.5 miles earned per dollar saved per year. In other words, if you save $50,000 in a Bask Bank account for one year, you’d earn 125,000 American Airlines miles (and that can repeat year after year). You do receive a 1099, but since Bask has only valued the miles at 0.42c per mile, this could be a better deal than earning interest in cash (provided that you value the miles more highly).

The current bonus offer is for customers who meet the following deposit thresholds by August 31, 2023 and maintain the funds in the account for 180 consecutive days:

- Deposit $10,000 to $24,999.99: Earn 4,000 bonus miles

- Deposit $25,000 to $49,999.99: Earn 10,000 bonus miles

- Deposit $50,000 or more: Earn 20,000 bonus miles

The bonus miles here should post within 10 business days after all conditions are met — so in other words, expect to receive the bonus around 10 business days after you’ve reached the 6-month mark since depositing your funds.

If you deposited $50,000 and left it not only for the 180 days required for the offer but for an entire year, you would end up with 145,000 miles. That’s enough miles for a round trip business class ticket to many parts of the world on American Airlines partner airlines. For instance, that would be enough miles for a round trip ticket in business class to Europe, Asia, or the Indian Subcontinent.

Assuming Bask keeps up the 0.42c per mile valuation, you’d owe tax on $609 (how much tax varies with your federal and state tax rates). That seems like a pretty good deal to me if you’re planning on holding $50,000 in cash during that time period anyway (and it obviously may make sense at amounts greater and less than $50K, I just used that number as an example).

I can certainly understand that some will prefer high-yield accounts and/or investing in the market, etc. However, for fans of American Airlines who will keep a cash balance on hand anyway, this could certainly be appealing.

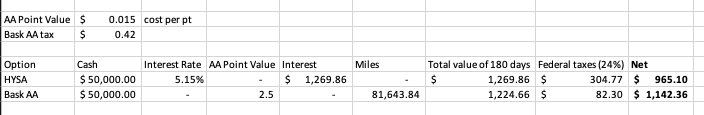

I felt like a commenter in view from the wing had the most straightforward math. Even if you have a worse tax rate, buying AA points for anything near RRV doesn’t make sense to me since it’s speculative at best. Note that Bask Bank Interest Savings is currently yielding 4.88% as well.

TexasTJ says:

Option 1: Deposit $ 50,000 for 6 months in a High Yield Online Savings Bank yielding 5 % APR, gross proceeds of $ 1250, less marginal Federal Income Tax of 24 % = $ 950

Option 2: Deposit $ 50,000 for 6 months in a Bask Bank Mileage Account, at 2.5 AA Miles per Anum & 20,000 mile bonus yields 82,500 AAdvantage Miles. If these are valued at $ 0.013 per mile that’s $ 1072.50 gross proceeds, but the marginal Federal Income Tax of 24 % is based on Bask’s reporting at $ 0.0042 per mile, so net Tax this would equal $ 989.34

Based on straight financials Option 2 is marginally better, but it’s clearly no screaming deal. It’s close enough that the case could be made either way.

I value AA miles at more then 1.3 cents per mile. A lot more.

But would you buy them at “a lot more” valuation?

well…as a matter of course, I don’t buy miles except in very limited circumstances. don’t remember the last time that was. I think I will open a Bask Bank account, never heard of them until this article.

I’ll just do $10k for 29k AA miles over 1st year, then evaluate. My AA balance is zero now. P2 has 45k miles or so. Is 29,000 AA miles worth more then $550 (5.5% in MMA or CD) to me?

well…can anticipate using them in 2025 with more Latin America travel. No need this year or next. For long haul mostly only fly business awards these days. Looking at probable 2025 routes…I do show on select dates routes at ~55-60k miles/way = $2000 – $3000 USD in business one way.

So 29 + 25 (2nd year, no bonus) = 54,000 AA miles. Let’s call that close enough. Opportunity cost (at today’s rates) of $1,100. Effectively…paying that for these miles. Maybe interest rates rise a little. In any case…getting 2x the value, up to 2.5x at most. So it’s like buying a future business class flight for 50% off at least?

of course…maybe AA eliminates such low priced awards (I’m flexible with their dynamic system)…or I end up not flying AA or OneWorld routes in 2025.

OR…maybe apply for one of those 100k Citi Exec AA cards…then won’t need these AA miles….but recent Citi Premier denial for P2. So not sure about that. Or maybe try for Barclays Aviator card again.

OR maybe I use SEA-Japan current price for almost any date in August right now as a measuring stick. Business flights are showing as $12,000!! or 60,000 miles. Of course…I’m sure it’s available for much less on another carrier – not sure why AA is showing some ridiculous price.

hahhahaha

[…] they are offering a tiered bonus depending on how much new money is deposited, up to 20k AA Miles ( h/t FrequentMiler ). This could be an easy way to accumulate miles for a special trip down the road. Note that Bask […]

Do these miles also count as loyalty points towards status?

No. But at one point they had a Loyalty Points promotion happening. Unsure if it’s still around.

Nope. Not Loyalty Points.

Assuming 32% marginal tax rate (bad case), 5.3% interest on treasuries as an alternative investment, keeping $50k for a year in this AA earning account would make those 145k miles cost $2000 ($50k*5.3%*0.68 for the lost interest on treasuries and $609*0.32 for tax on 145k miles).

So, it’s like buying AA miles for 1.38cpp. Not too bad I guess, but not a no-brainer either.

Bingo!

AND based on this example, you are buying these 1 year from now. I have no confidence AA will have access to “GENEROUS” awards 1 year from now!

The motto of this space is earn and burn. No one should have a one year horizon with AAdvantage. You are playing with fire. But, yes, as Gary’s grandfather would say, it’s better than a hole in the head.

I’m not following your math. Are you not taking taxes out of the interest you’ll earn on treasuries? Why not?

I am. That’s the 0.68 multiplier on $50k*5.3% (32% taxes). The amount of interest minus taxes is what I’m losing compared to getting this AA account.

“If you deposited $50,000 and left it not only for the 180 days required for the offer but for an entire year, you would end up with 145,000 miles.”

Don’t you have to leave the $50K for a minimum of one year to get the 2.5 mile per dollar earning?

The payout of miles is based on average daily amount. So $50,000/365days×2.5miles/day=342.47 miles/day. 342.47miles/day*180 days=61,645 miles (rounding). Add on the 20k bonus for a grand total of 81,645 miles in 180 days.

Thanks. But, it might be important to clarify that you would not get 145,000 miles after 180 days as originally posted. Only 81,645.

I would agree.

What do you mean? The text you quoted explicitly says to keep it “for an entire year.”

You are right. My bad.

In the post I mention that the 20K bonus only requires leaving the money for 180 days, but that if you leave $50K in there for one year, you would end up with 145,000 miles. I thought I was clear about it – no?

You are right. I was reading it wrong. In the spirit of the late Gilda Radner……….”never mind.”

My math says it’s close, depending on how you value AA RDM (miles). With FM’s RRV for AA of 1.3, it’s nearly break even vs. a 5.15% HYSA/money market fund (albeit an “easy” way to earn a good chunk of AA miles).

I typically value AA miles at least at 1.5c per point, so it’s a slight win in that case (+$177 over 6 months).

If you can use the 80,000 miles earned over 6 months on something like a Qsuite and otherwise don’t have the miles, then of course it’s a mega win.

From my spreadsheet: