Update 7/28/25: Savewise has now added support for both Rove Miles (under miles offers) and ShopBack (under cash back).

~~~

I’ve been playing around with a new tool called Savewise (www.getsavewise.com) and I have been really impressed. If you’re an extreme stacker who would love the ability to compare all the major shopping portals and see whether there are card-linked offers available without leaving the site you’re browsing, then GetSavewise is worth a look.

Savewise Overview

`

`

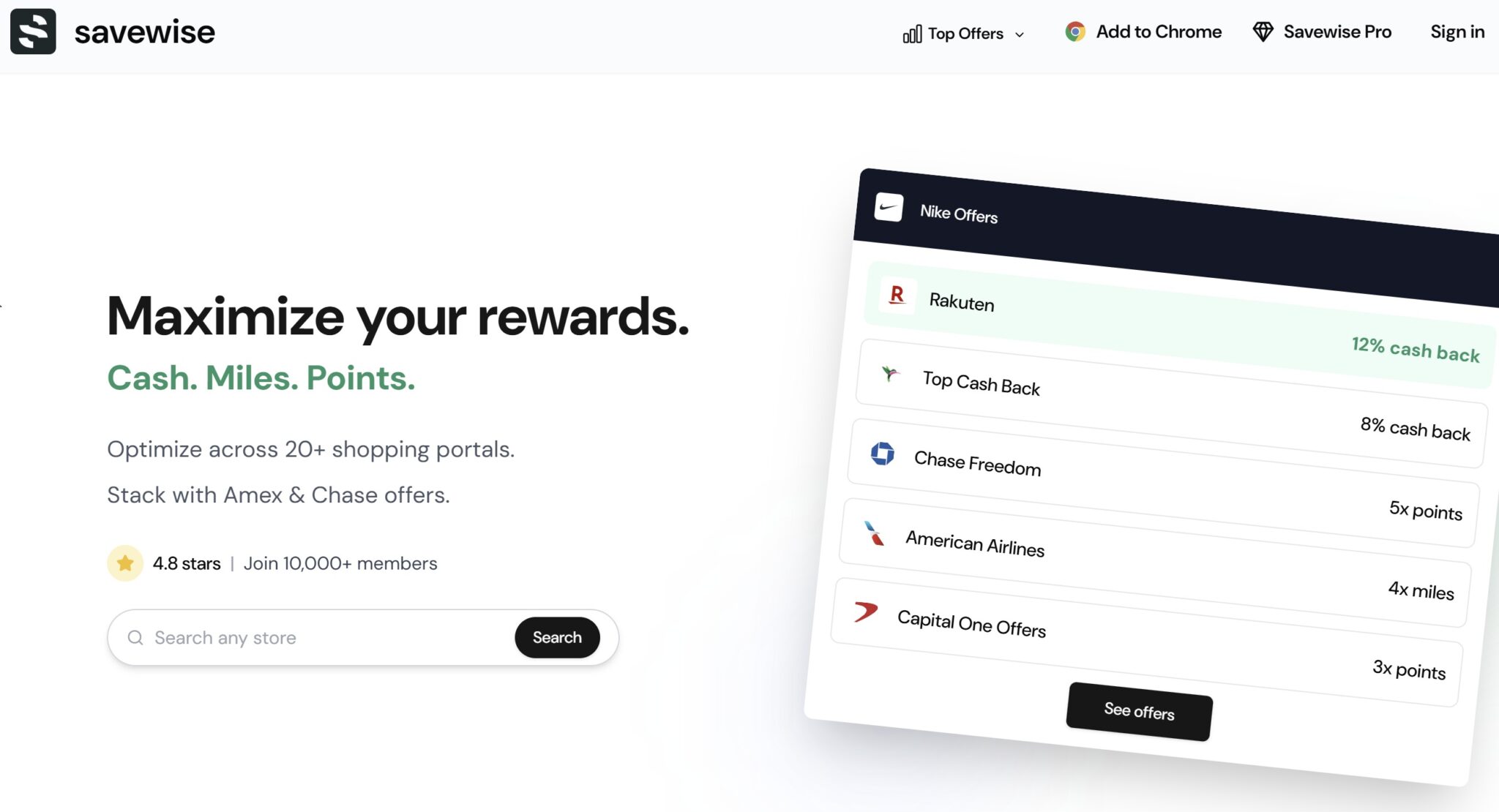

Savewise is a tool for comparing shopping portals and identifying stacking opportunities with card-linked offers. Even the version that you can access without creating a (free) account is a reasonably useful alternative to my longtime favorite portal comparison tool, Cashbackmonitor.

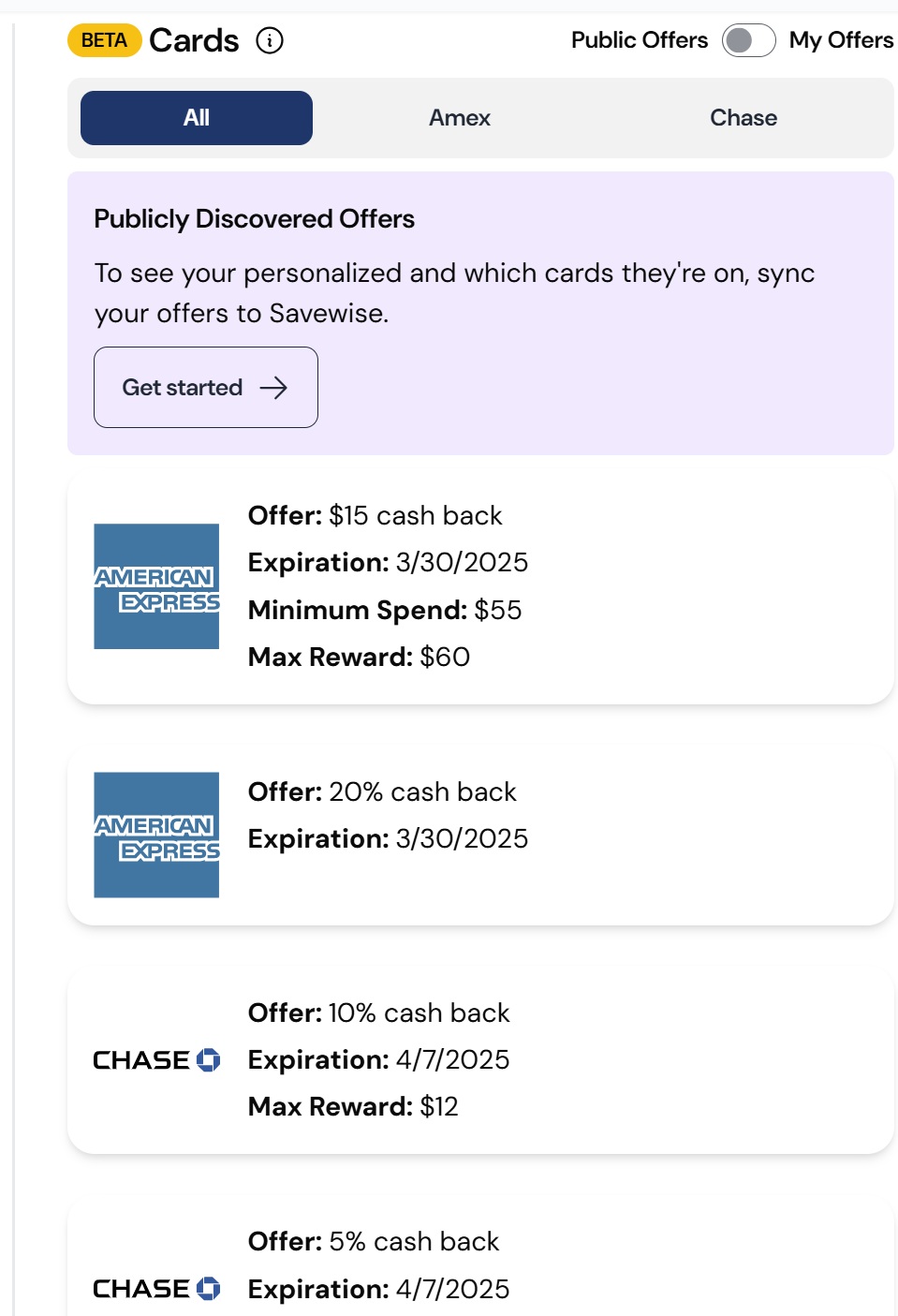

But you will definitely want to at least make a free account to get far more value out of the tool with full access to compare portal rates, identify stackable Amex and Chase offers, or even search for products to compare stacks across stores. You can also choose between viewing a list of “publicly discovered” card linked offers or you can connect with your own logins to see which offers you have on your own cards.

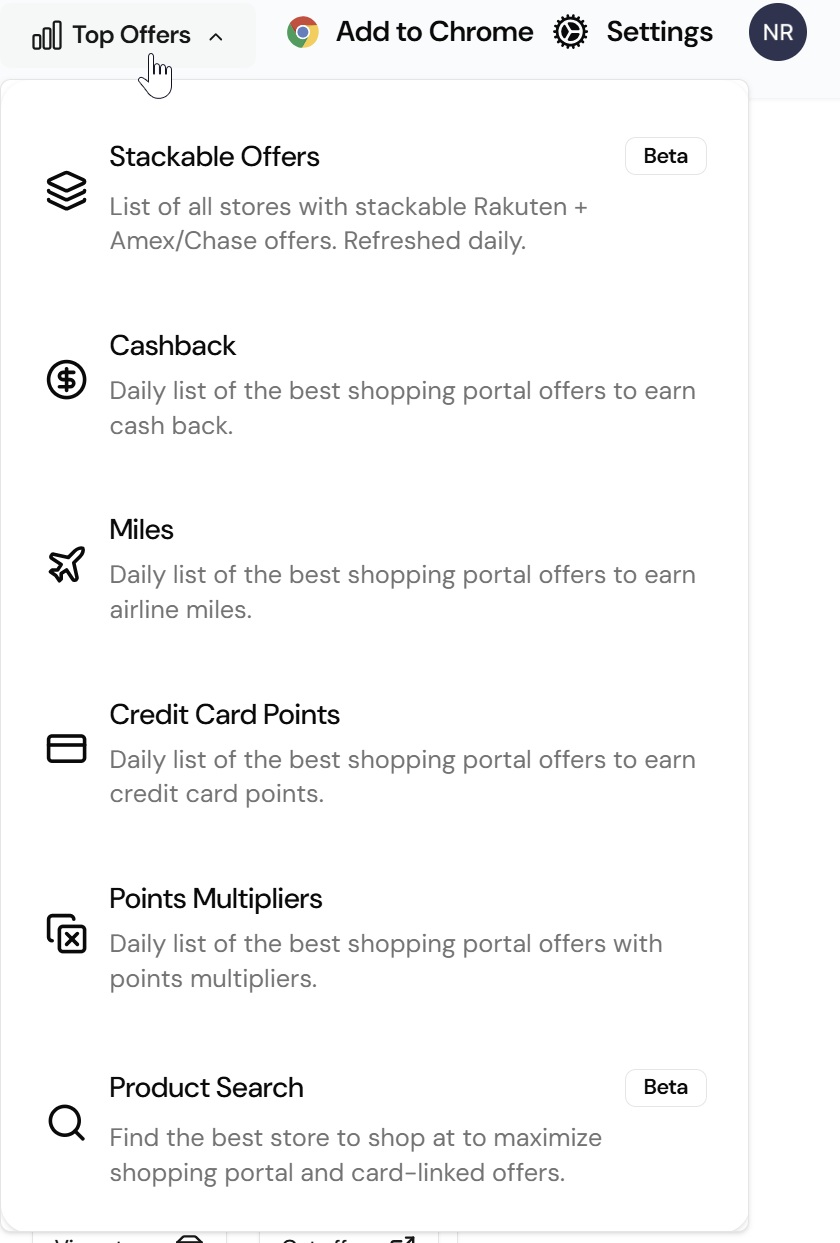

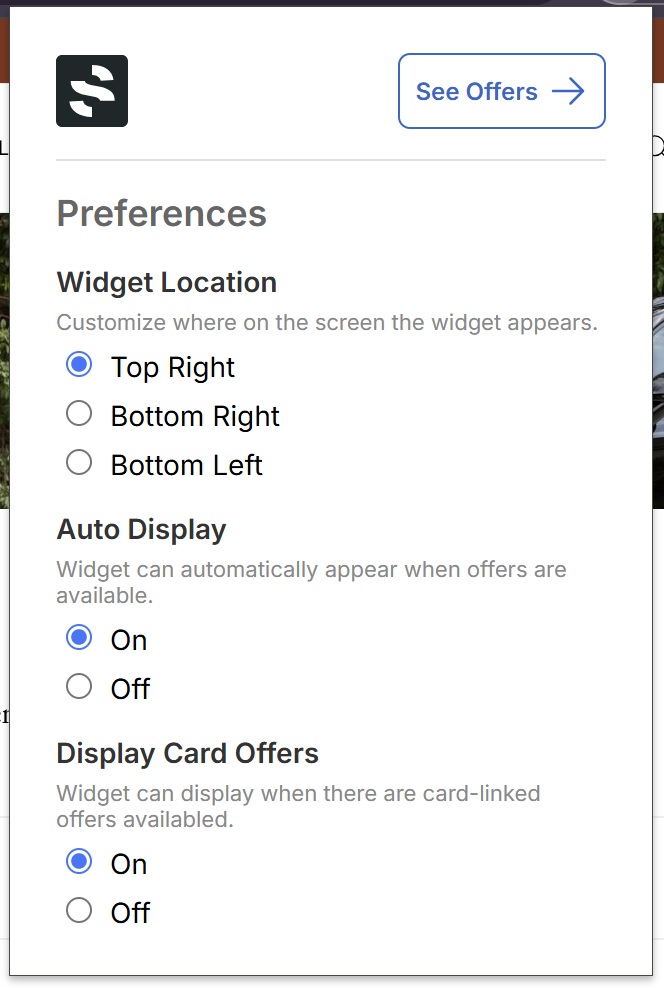

If you install the Chrome extension, it gets more useful yet, automatically identifying when you’re on a shopping website and showing you shopping portal offers as well telling you whether there are card-linked offers available for the store you’re visiting.

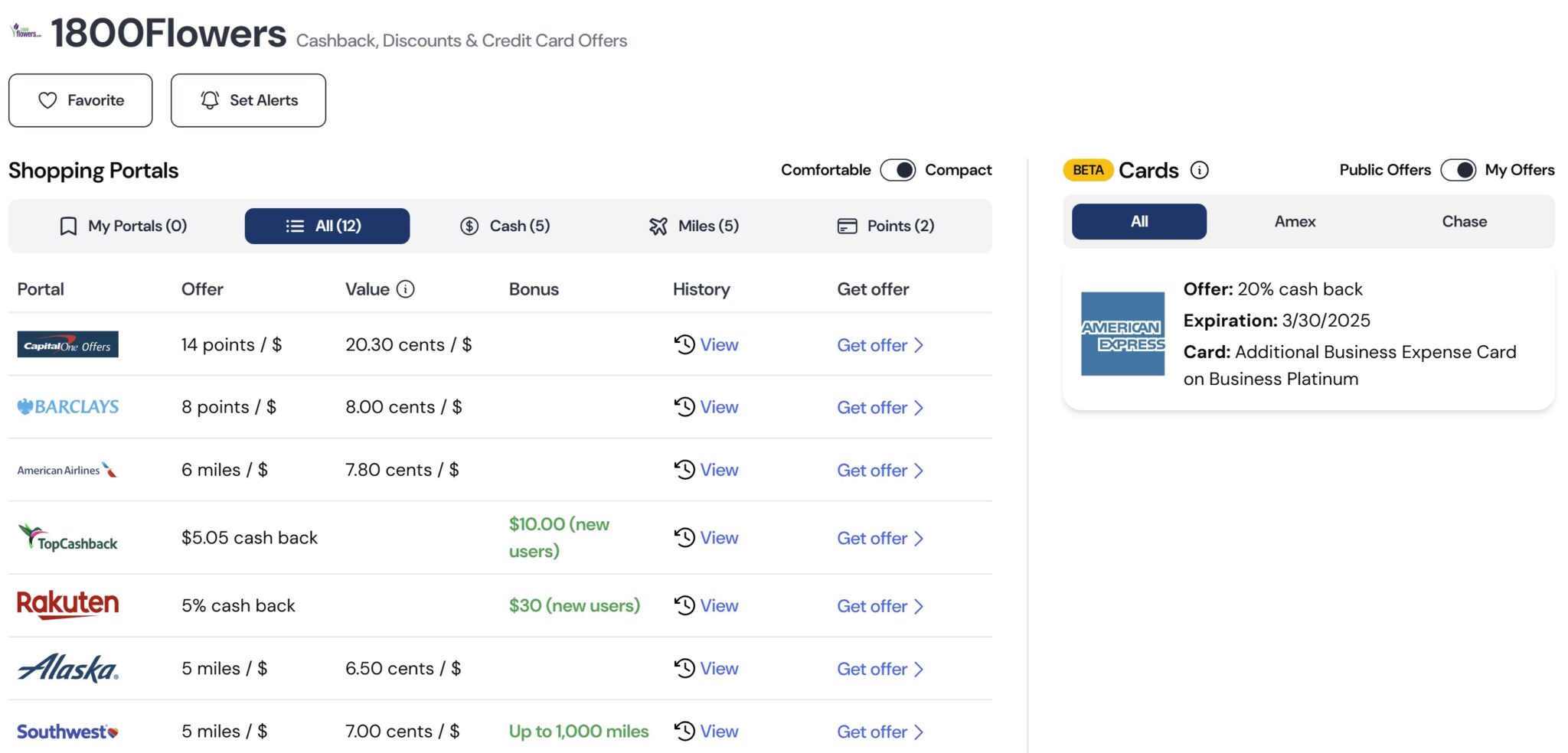

One thing that really stands out about Savewise is that they have some portals that I haven’t seen covered elsewhere, like the British Airways shopping portal. More notably, Savewise lists both Capital One Shopping (the public shopping portal) and Capital One Offers, which are shopping portal-like offers found within one’s Capital One Credit Card login. I noticed some instances where there was a slight discrepancy between the Capital One Offers rates shown by Savewise vs what we saw in our Capital One accounts, but it was often spot on.

Savewise tiers (Basic, Pro-monthly, Pro-lifetime)

Savewise offers one free and two paid tiers:

- Basic (free): Get access to most current (at the time of writing) Savewise features.

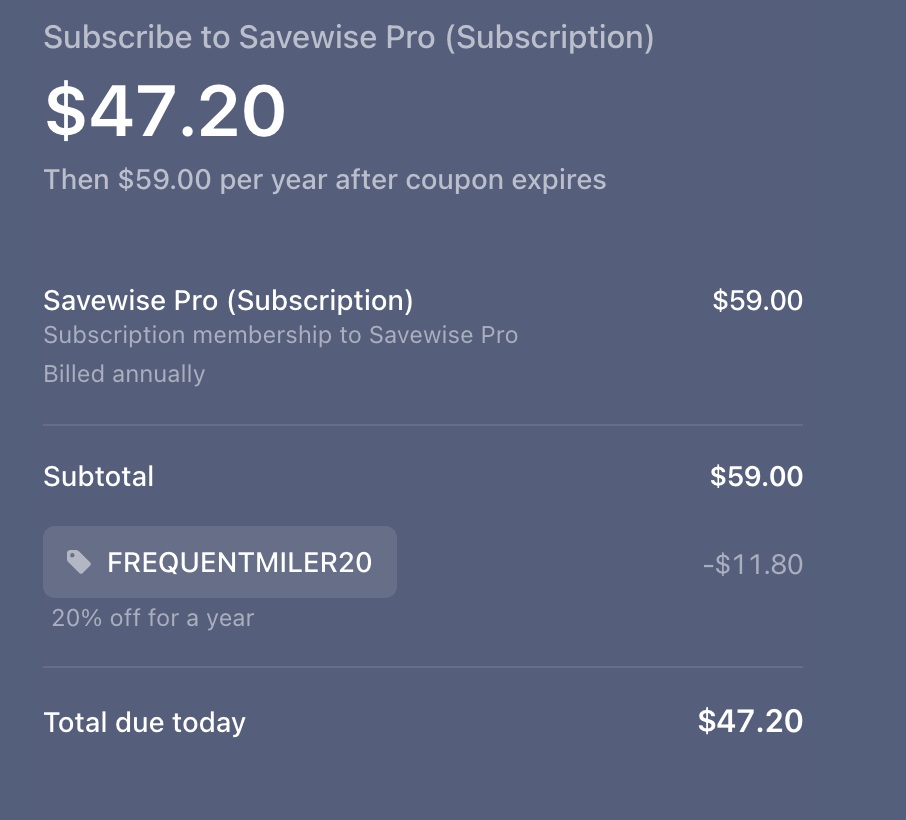

- Pro (monthly, $5 per month / $59 per year): Adds longer offer history, ability to auto-sync offers, ability to set custom point valuations, ability to set alerts

- Pro (lifetime, $119): all of the above plus lifetime access to all pro features

- Frequent Miler readers can save 20% off the first 3 months of a monthly Pro subscription or 20% off the first year of an annual or lifetime subscription with code FREQUENTMILER20.

- You can check out the paid tiers and sign up here ⓘ Disclosure Frequent Miler may earn a commission if you click through from this link and make a purchase.

How Savewise works

There are two main ways to use Savewise:

- Searching offers at GetSavewise.com

- Installing the Savewise Chrome extension.

I’ll give a brief overview of using the desktop site, but after playing with the tool for a while, I think it really stands out as a chrome extension.

Savewise Desktop / Website

Once creating an account at getsavewise.com, you can simply search a store form the main dashboard tool and you’ll be taken to a page comparing shopping portal rates for that store (as seen on the left side below) and any card-linked offers available for that store (shown on the right below). Note that the default view of the shopping portal table is “Comfortable”, but in the screen shot below I have the slider just above the portal rates toggled to “Compact”, which I ironically find to be more comfortable.

You’ll note above that the card-linked offer slider to the top-right of that screen shot is toggled to “My Offers”. You’ll need to install the extension for Savewise to be able to display your offers (more on that in a minute). Without the extension installed, you can see publicly-discovered offers as seen here:

By default, Savewise sorts the value of portal rewards based on Frequent Miler’s Reasonable Redemption Values, though with a pro subscription you can customize your valuations.

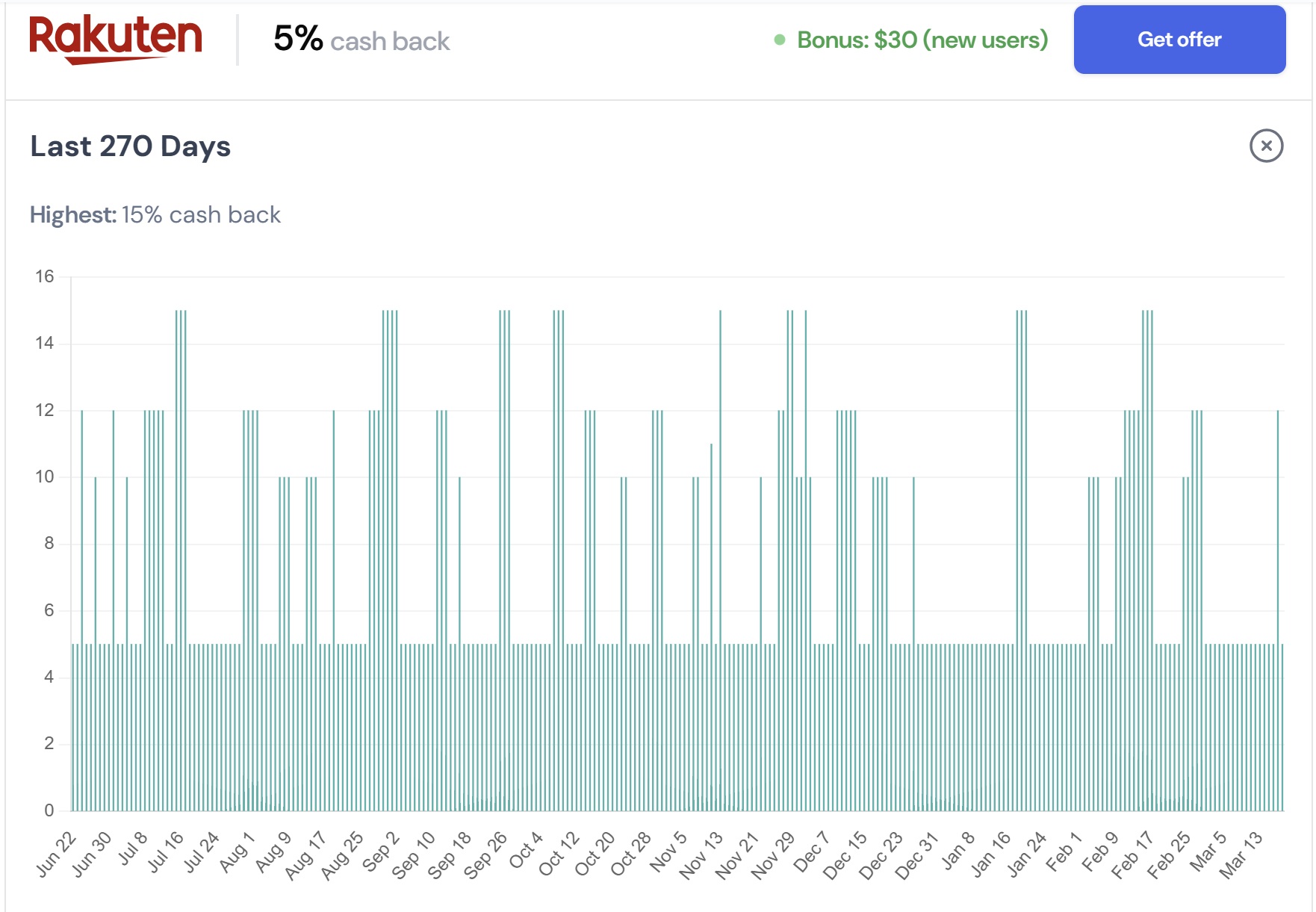

The free version of the tool includes a 14-day rate history for each portal individually (Rakuten 14-day history for Dell shown below).

The Pro version gives you access to 270 days worth of data.

Some folks will find this more useful than Cashbackmonitor for seeing a specific (individual) portal’s rate history for a specific store. Personally, I prefer Cashbackmonitor for rate history because I can see the best rate across all shopping portals and a longer time window (15 months). That longer time window is particularly useful around the holiday shopping period because it means that in early November, I can check and see which portals have historically had increased rates over Black Friday/Cyber Monday and the rest of the holiday shopping period. The shorter time window offered by Savewise rate history would miss that.

Through the “Top offers” drop down, you can see the top cashback offers and top miles offers as you might expect.

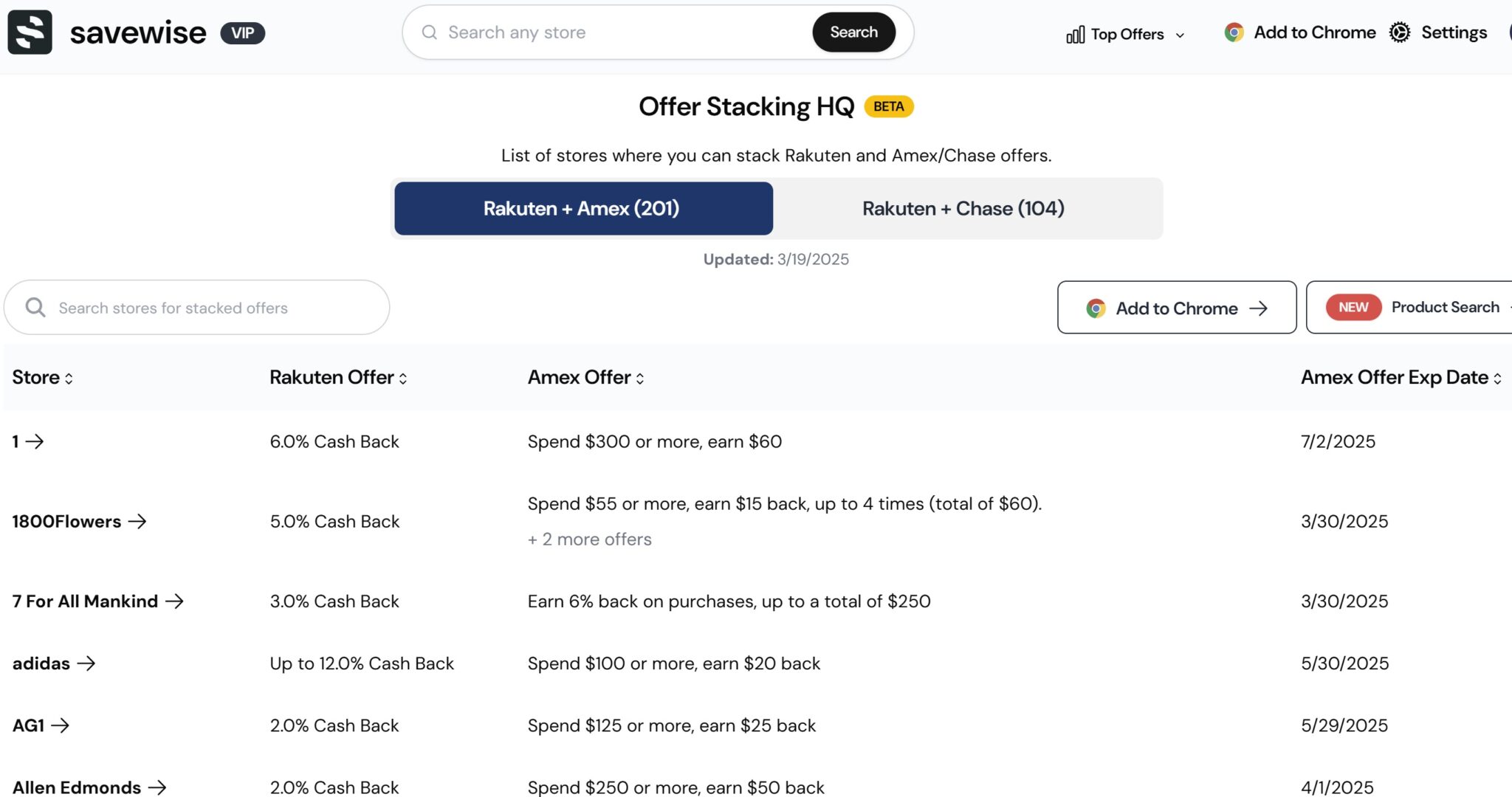

However, frequent shoppers will likely really appreciate the ability to browse top stackable offers between Rakuten and Amex or Chase, with the tool listing at an easy glance the Rakuten offer, card-linked offer, and expiration date.

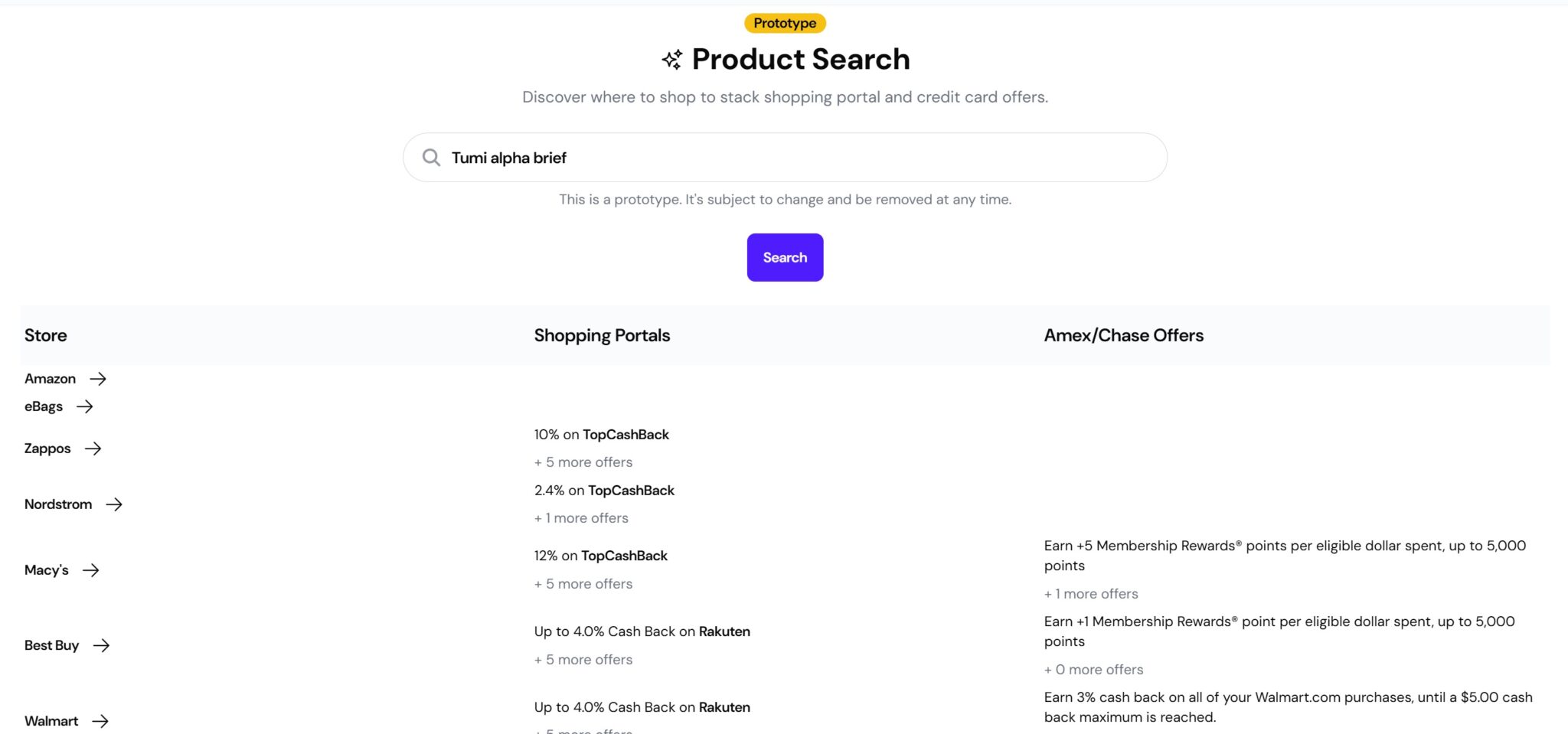

Savewise also offers a product search that’s still in prototype but shows some real promise as it could provide a great way to find a product at a store you may not have considered that could have a great stacking opportunity. For instance, although the price isn’t attractive enough in this instance, I was surprised to learn that Zappos (which I think of as a shoe store) carries Tumi bags. I can certainly imagine identifying great stacking opportunities this way.

New featured added since original publication

Savewise has been busy adding features since we originally published this review. Some of them include:

- Favorited store card offer alerts – If you’ve favorited a store with Savewise and you have a card-linked offer (e.g. Amex Offer) for that store, Savewise will send you an email each week giving you a heads up about that. This is available for Pro users only.

- Public card offer index – This lists all known Amex Offers, Chase Offers and SimplyMiles offers; you can find it here. There’s no guarantee that you’ll have been targeted for specific offers, but it can be handy to know what’s out there.

- SimplyMiles + Rakuten stacking – It’s currently listed on their site as ‘AA + SimplyMiles’ on the tab, but the column heading says ‘Rakuten Offer’ if not logged in to Savewise. I think that might just be a caching issue or something though, because it you’re signed in that column heading does actually say ‘AA Offer’ and displays results from the American Airlines shopping portal in addition to SimplyMiles offers.

- Additional portals added: RoveMiles and ShopBack were recently added. Others have been over time as well.

Chrome extension

I tend to be hesitant to install browser extensions mostly for the fear of those extensions “stealing” a click from a shopping portal (and subsequently invalidating the rewards I intended to earn for my purchase) and because I tend to prefer less tracking as opposed to more. I initially installed the Savewise app in an additional Chrome profile to avoid letting it track more of my browser usage than I’d like, but after getting used to the extension, I feel pretty tempted to toss it in a browser instance that I use more often and I intend to install it in “Player 2’s” browser.

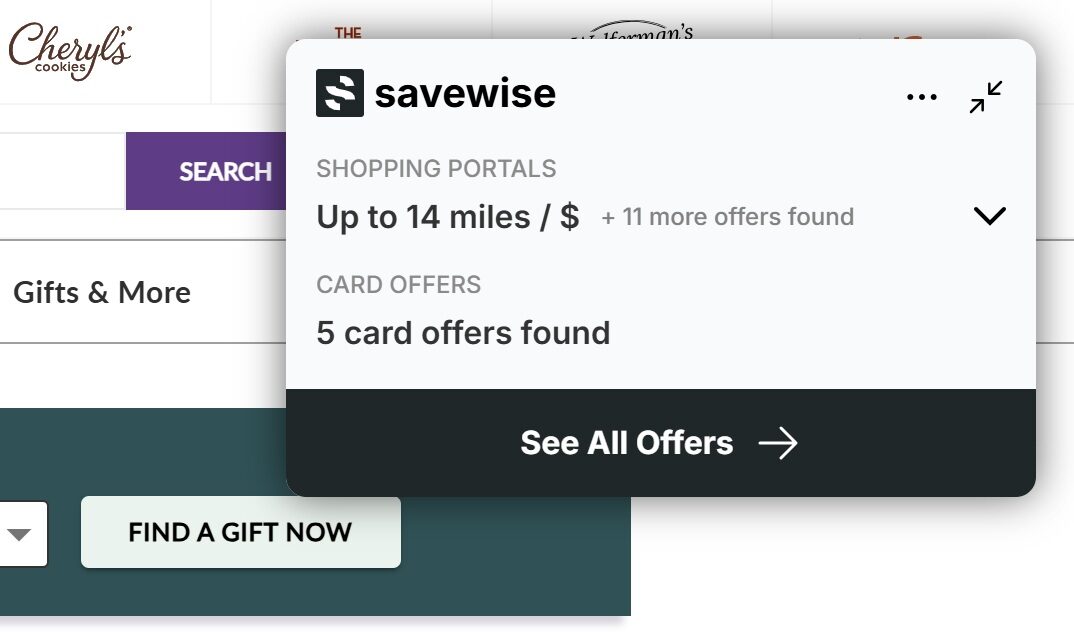

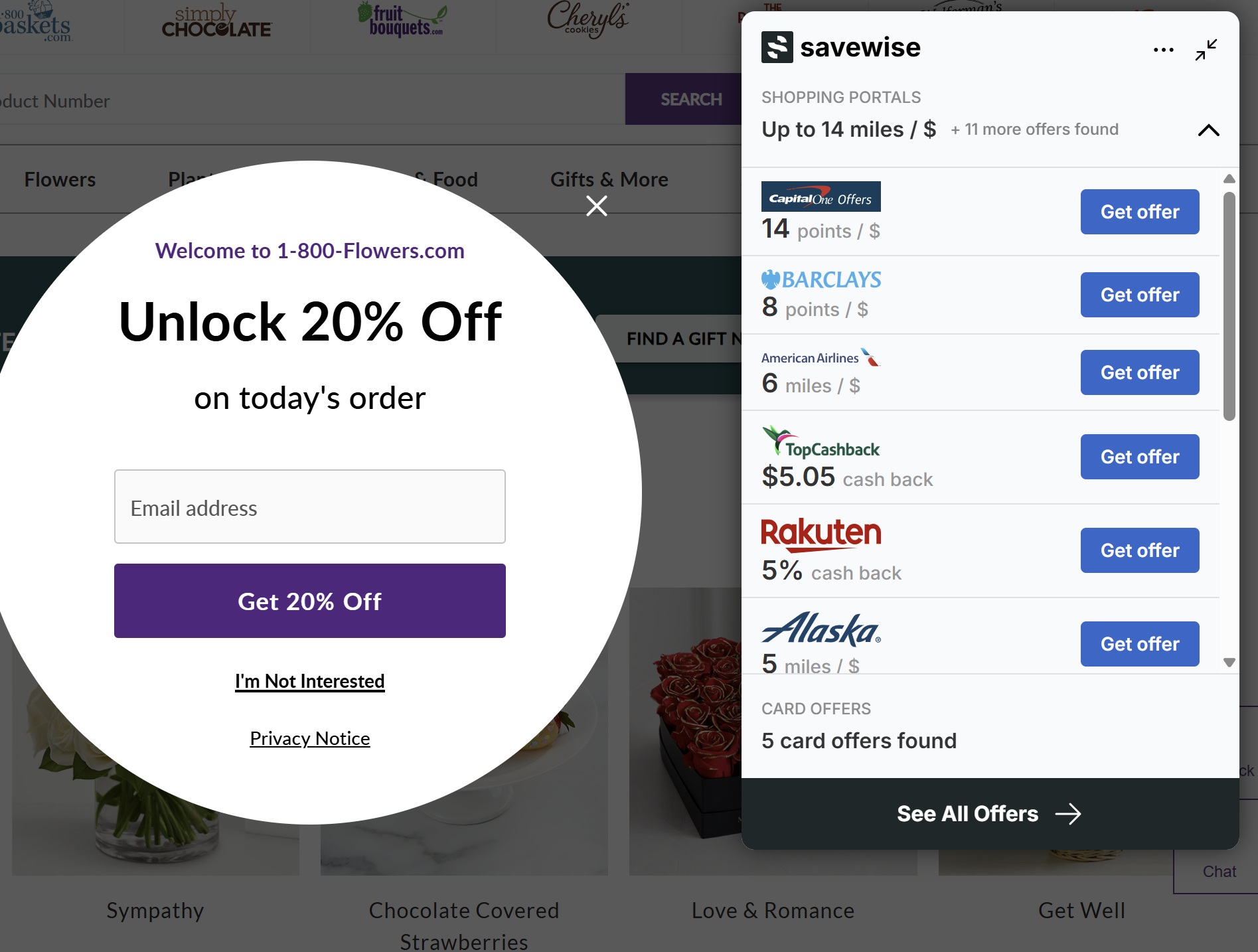

Here’s why: the extension monitors the sites you browse and when you land on a site that has shopping portal offers and/or card-linked offers, the extension pops right up to let you know.

I really like the combination of knowing that there are portal rewards and card-linked offers. I can’t count the number of times my wife has asked me whether one site or another has any card-linked offers available and then I usually have to dig through stuff to answer the question. I love that Savewise could pop up right in her browser. Furthermore, you can easily expand the portal information to see a number of portals and best rates for quick and easy comparison without even leaving the site you’re shopping.

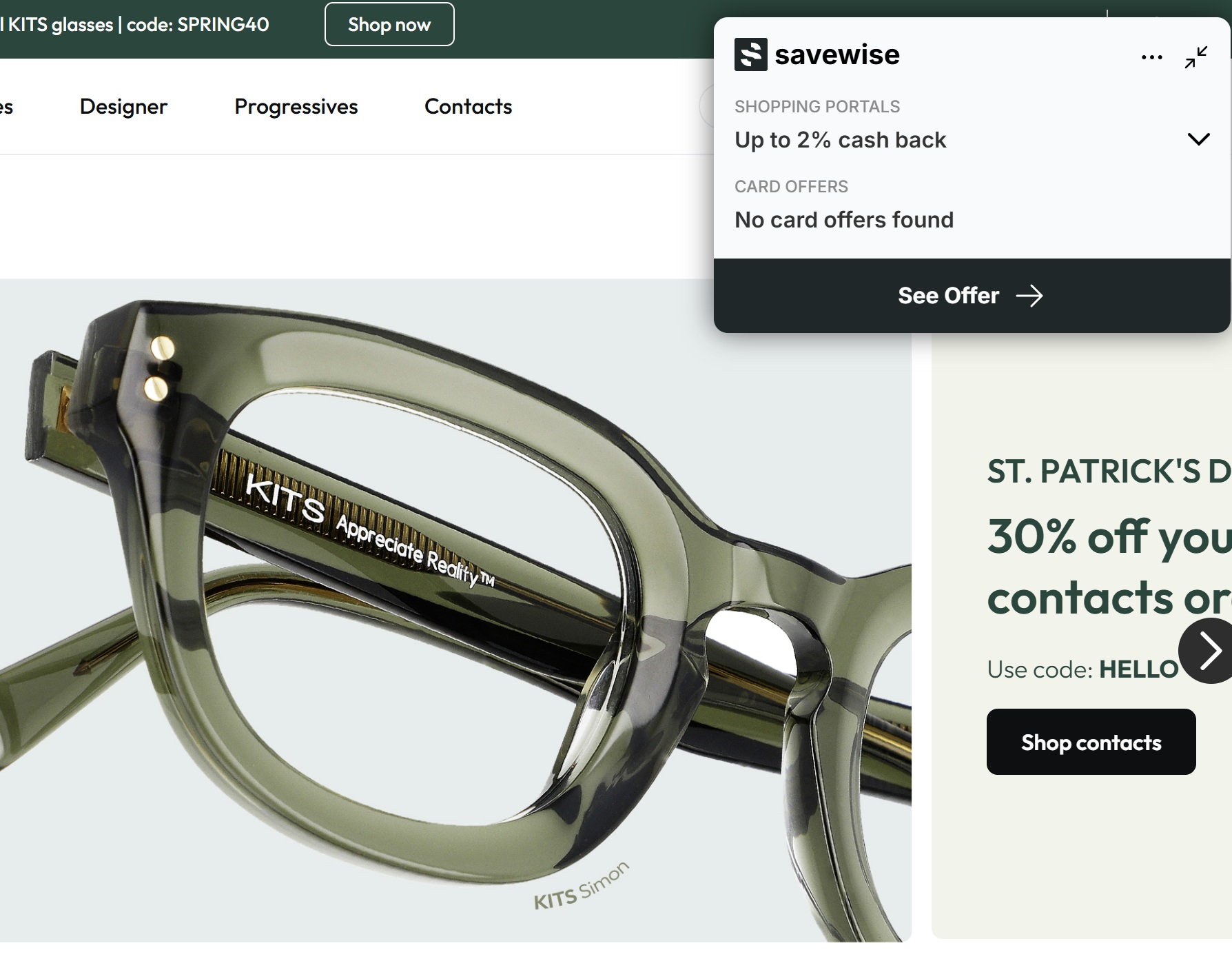

The extension is set to display whether the site you are visiting has portal rewards, card-linked offers, or both. In my tests, it worked automatically with an impressive number of websites. For instance, I prefer to buy my eyeglasses from Kits.com, which I find is much less well-known than other online glasses stores, yet Savewise popped up a moment after landing on the Kits home page to let me know that I could get 2% back via a portal.

That’s really convenient. I love the convenience especially for my Player 2, who sometimes forgets to check for portal rewards before placing a purchase. I find the interface here really slick and easy to compare portals and then to click through to the portal you want to use.

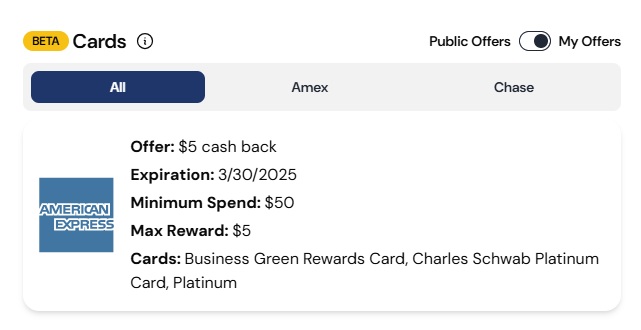

I noted above that it is possible to sync your own Amex Offers and Chase Offers to Savewise. When I logged in to an Amex account in the browser with Savewise installed, I was prompted to sync up my offers. I did that in my test instance and then the website was able to show which offers I had on my own cards. I found it especially useful that it shows which cards have a specific offer so that I would know to skip straight to my Schwab Platinum card or Business Green Rewards card rather than hunting through all of my cards for a particular offer.

I didn’t sync up my Chase Offers yet, so I appreciated being able to view all publicly-discovered offers so that I could also monitor whether I might have other options to check.

Speaking of additional options, I understand that Savewise is going to be adding more to expand beyond Amex Offers and Chase Offers, which I think will make the tool even better.

I should note that I did run into a couple of instances (over dozens and dozens of store tests) where the Savewise extension didn’t immediately find portal or card-linked offers despite those offers showing up when searching the merchant through getsavewise.com. When I contacted support, they told me that when this happens it is typically a quick fix on their end to get those stores to display in the future, so reach out and let them know if and when you’re on a store and the extension only shows this instead of portal rates and card-linked offers.

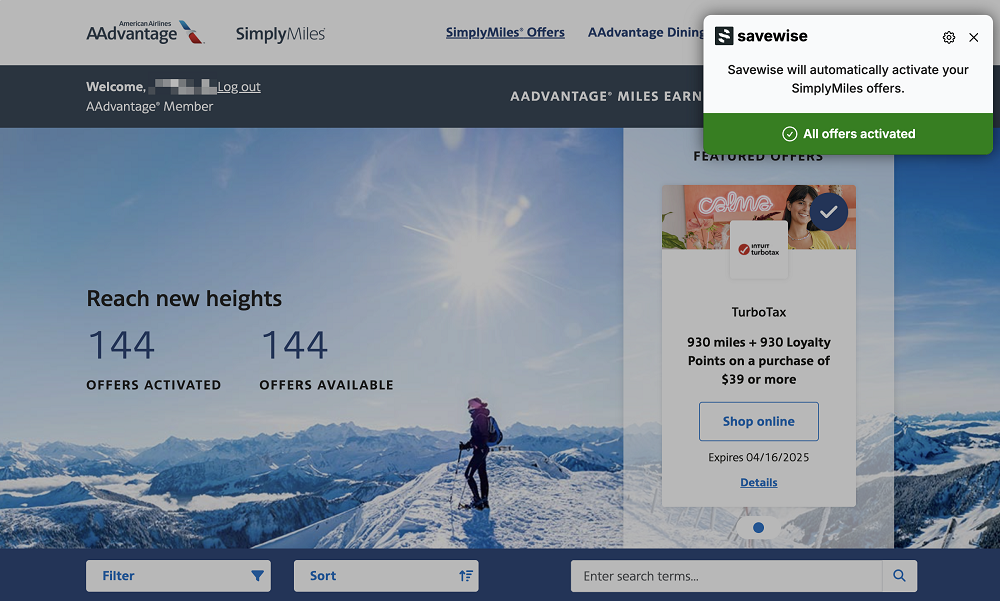

SimplyMiles

At the beginning of April 2025, Savewise added the ability to automatically activate offers on your American Airlines SimplyMiles account. This feature is currently only available for Pro members. To utilize it, you’ll need to install the Chrome extension. Then, when you log in to SimplyMiles, you’ll see a prompt in the Savewise widget to activate the offers.

This is a useful feature, but be aware that if/when Savewise adds support for loading Citi Offers in the future, the two will likely impact on each other. That’s because there are usually corresponding SimplyMiles and Citi Offers for retailers and nowadays you can only load one offer or the other – not both. If you’d rather earn American Airlines miles and Loyalty Points via SimplyMiles, logging in to your Citi account first would load those offers, stopping you from taking advantage of the SimplyMiles deals. That’s a moot point right now though seeing as Savewise doesn’t currently support loading Citi Offers, but we wouldn’t be surprised if that feature is added in the future.

Bottom line

Savewise is a tool that’s been on my radar for a while. I finally got a chance to dedicate some time to using it and I’m loving it so far. I’ve long been a Cashbackmonitor user, but Savewise seems to kick things up a notch with the browser extension and easy integration with a couple of the most popular card-linked offer platforms. If Savewise is able to expand upon its card-linked offer base, I could see this being my go-to tool for shopping that would save me time and effort in identifying the best combinations for savings.

No more lifetime membership being offered?

Looks like they are adding support to for Citi offers. Appears to be in “beta” since

its not yet on their sync offers page, but when I logged into Citi with the browser extension on, the popup came up and asked if I wanted to sync offers. Clicked it and all current offers were activated.

Oddly enough I did get an email saying I had removed my Citi Prem card from AA dining, but when I logged into simplymiles/AA dining and check my cards it was still there, so not too sure what that was about.

I just signed up! I’m optimistic this will pay for itself within a year, but also like supporting a small business.

Since Savewise has been responding here, hopefully they can answer this:

Thanks!

1) Easy. All you have to do is click “Sync”, but not click “Activate”.

2) We have never received a report of the 2 extensions conflicting. That said, we can’t guarantee how extensions not built by us may interact or interfere with Savewise

Got it – thanks! Signing up for the Pro shortly

so FREQUENTMILER20 did NOT work on the lifetime subscription of $99. Was there an expiry date on the code?

It worked for me recently. Maybe try again on a different browser or something like that?

The promo code should still be working – reach out to us if you’re still having trouble and we’ll figure out what’s going on.

This reminder comes at a time when I lost access to CBM due to security issues at the site (I could not connect through any of my browsers due to their security certificate being lapsed). That has happened at least 5 times this past year. I hope Savewise has a better grasp of this issue and continues to keep their site accessible.

Would highly recommend checking out Loyalty Point Hunters if you’re looking for something focused on Status with American Airlines

Does Savewise have access to your logins for loyalty accounts and/or bank and credit card logins? If not that’s great but if so, should they get hacked there would be a huge amount of damaging information in the hacker’s hands and companies are loathe to let people know about hacks until months after the fact.

Savewise does not access or store bank logins, credit card logins, or credit card numbers. It doesn’t even store the last 4 digits of credit card numbers (even though some customers have asked us to).

That makes Savewise vastly more appealing.

Thank you for providing a response.

Then how is it able to determine what cards have which offer? I.e. above Nick mentioned for example was on Charles Schwab Amex?

Is it just generic for Amex – I know that I read about Amex Offers but I don’t always have them on all sometimes just specfic or not at all i.e. Hilton/Marriott doesn’t offer competitive Hotels and Delta doesnt offer orher airline

Thanks – really considering because we have like 30 Amex/Chase Cards and its often worth searching them all to find a vendor that offers 20% CB but its capped at a low dollar amount under $10~15.00

Thanks

Savewise stores the name of the card (e.g. Amex Platinum), but not the card number.

@Savewise – so how does it determine that I have which offer for example this current offer on Amex color charge cards Per/Biz..

Spend $50 @ Amazon for 500 MR up to 3x

Vs.

Spend $150 earn 1200 MR up to 3X

Thanks

I would love if CardPointers had a similar feature. This may push me towards this tool.

Any ideas if can work with UK cards/customers? Cardpointers does do Amex UK – but not great.

Hi Nick: If using Firefox or Safari, do you lose the ability, “automatically identifying when you’re on a shopping website and showing you shopping portal offers as well telling you whether there are card-linked offers available for the store you’re visiting.” Any other downsides to not using Chrome?

Card offer syncing & activation is now available on Firefox

That’s helps make it even more attractive what about Edge (Microsoft) I run my Google Flight searchs in Edge simply because I mainly use Firefox

Becasue Firefox has OneTab extension 100 better than bookmarks.

I can close all tabs to a single tab that has all my past saved OneTab sessions

It great when I have too many open tabs and computer slows down (ADHD)

I have at times had 100+ tabs when I’m running various competitive searches or when working on a long trip or researching activities- but it saves those tabs in a dedicated and detailed list as a session (page name and info) for that session. I can reopen all or just specfic and individual tabs and also delete entries . Its almost like running seperate browsers or profiles but so much more flexible.

The Chrome extension can run in Edge, Arc, Brave, and other Chromium-based browsers

Does anyone know how Savewise works in a 2P household. Example…both my wife and I have a CIBC. If we use the Savewise Pro extension to add offers to our cards and sync with Savewise, will Savewise recognize that we have that offer on two separate cards or will it just see/display the most recently synced card offer?

You can have multiple Amex/Chase accounts and sync them to Savewise. The offers will be synced to the same Savewise account. As long as the nicknames for the cards are unique, you should be good to go.

@Savewise

Is there a way to snooze (alert on a scheduled repating basis- some offers we I know I’m going to use but doen the road) offer (like you can snooze Gmail to pop-up later) – we’re empty-nesters I used to be able to carry so much in my memory and not need to rely on notes or scheduling in Google calendar – That I had such and such an offer on xyz card for a purchase I was planning in store in 2 weeks I just used to be able to be a walking caledar. But sadly no more.

Another example is with streaming we have Paramount+, Peacock, Starz and a few others not covered by Amex Plat – bit Amex and Chase (less so and lower CB) has fairly regularly had $8.99~$12.99 CB on CBS/Paramount+ if i could set an alert to switch payment in 24 days to take advantage of the offer before next bill by switching payment method.

It would be one less thing to juggle.

Thanks

You can set an expiration date on an offer alert, or set it to last forever. We don’t have the “snooze” concept that you suggested. Nobody has ever requested this, so it’s admittedly not high on our list to build, but we’ll continue to re-evaluate all ideas to see if they make more sense in the future.

i cannot get the card offers to work. I’ve followed all of the steps outlined by savewise, and I’ve “synched my offers” with both Chase and Amex multiple times and it still says i have no card linked offers. Not sure if i need to pay for the pro version and “auto-activate” the offers to have them show up, but that would be disappointing. That was the feature I was most excited about because i cannot count the number of times i’ve purchased something and then saw an offer on my amex or chase account and kicked myself for not checking before i purchased.

You don’t need the Pro version to sync, but you do to auto-activate.

Can you shoot us an email: hello@getsavewise.com – we’ll investigate what’s going on

Does Savewise also have the ability to add Amex Offers across multiple cards the same way that CardPointers can?

Yes

What are the FM team’s thoughts on this ability to add offers across Amex cards — when Amex is actively blocking this. Amex made a conscious effort to eliminate this function. Seems like playing with fire, as they might see this as an egregious breaking of the rules. RAT? Shutdowns?

One feature I really wish this or CBM have is the ability to “watch” a shopping site’s cashback rate, limited to the Portals I care about, and they would send me a notification if that portal hits my “threshold” of being notified. Like when Rakuten offers 10x cashback on some site I can be notified instead of relying on bloggers or keep checking each day. Some things I don’t need to buy immediately can wait for that.

You can do this in CBM. Use the green triangle by your name in the upper right to get a drop down menu with options for “Manage My Alerts.” That’s where you set your thresholds, etc.

You can do this on Savewise! If you go to any store, just click “Set Alert”, configure which shopping portals you care about and what your threshold is, and Savewise will email you when that store has offers that meet your threshold

I was all excited to subscribe to the lifetime version but the promo code does not work for that, what a huge disappointment! I hope it’s just a mistake and that they’ll activate it soon, then I’ll gladly pay for it.

Savewise saw comments here and has now enabled the code to work on the lifetime subscription as well.

Thanks for the update, I just bought it!

Nice! This is great news!