NOTICE: This post references card features that have changed, expired, or are not currently available

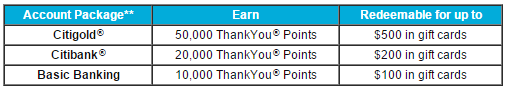

Citibank is offering 50,000 ThankYou points to select customers who open up a Citigold checking account and meet certain requirements.

Offer Details & Terms

To get the bonus, simply visit the Citi website and input the special offer code 42ERCZ42PY. You must currently hold a ThankYou Preferred, ThankYou Premier or Prestige card to be eligible. This offer expires on December 31, 2015 and requires you to perform 1 bill pay in each of two consecutive months. You can find the full offer terms here.

Note: There is also an offer for 50K AAdvantage miles.

Monthly Fee & Downgrade Options

The Citigold account does carry a $30 monthly fee that is waived the first 2 months. After the points post you may be able to downgrade to a Basic Banking account where the fee is waived by a simple direct deposit and bill pay. Note that the points may have to be transferred out before downgrading or closing the account or you will most likely lose them.

Fund With Credit Card

Citi does let you fund your checking account with a Visa or Mastercard up to $100K. To do so, you must either mail or fax in an authorization form. Doctor of Credit has collected a number of data points regarding which credit cards work without being charged a cash advance fee.

Possible 1099

Citi uses the following language regarding a 1099:

“Important Tax Information: Offer limited to customers who are either citizens or resident aliens of the United States (U.S.) with a valid Form W-9 on file and the account must not be subject to backup withholding. The value of the rewards from redeemed ThankYou Points may be reported to the IRS as miscellaneous income on Form 1099-MISC in the year received, if the value of the award plus other taxable miscellaneous income awards received from Citibank, N.A., is in the aggregate $600 or greater for a calendar year, as required by applicable law. Customer is responsible for any applicable taxes.”

If you receive more than $600 worth of value from these points, then you most likely will receive a 1099. If you redeem them at $.01 each for gift cards, then you shouldn’t have anything to worry about.

Citi Prestige Cardholders

If you are a holder of the Citi Prestige card, opening a Citigold account should also lower your annual fee by $100 to $350.

For more detailed information and analysis, see this Takeoff With Miles post.

Never miss a Quick Deal, Subscribe here.

[…] Citigold Checking 50K ThankYou Points Bonus […]

I applied under he AA however as an FYI to everyone. They sent the kits which was only the checks. So I called the 800# after 2 weeks and they said I had to request the debit card but could only send me the ATM version now. They said the account had to be open for 30 days before I got the debit card. Has anyone else had this experience?

[…] PNC? $15. US Bank? $16. Luckily I had recently opened a CitiGold checking account (to get 50,000 points, of course). Citi normally would charge a fee, but not to CitiGold customers. Cool. Citi told me to use […]

[…] H/T: FrequentMiler […]

I applied for this account and was approved, After receiving my kit I contacted customer support to check my eligibility, she told me even though I got approved I am not eligible for this offer as I did not get the promotion from citi. Not sure what I should do now , any guidance will be appreciated

My application (10/3) was denied. Is it possible due to I opened 4 credit cards last month (9/1)?

Should I go to Citi branch and try again?

Any suggestion is appreciated.

Thanks

mine got declined too (10/14). I also applied 3 cc on 10/06. I called them, and being told that I will receive the letter in one week. Did you receive your letter from Citi?

What was the message on the screen when you were declined? Why would applying for credit cards have anything to do with applying for a checking account? Doesn’t one check your credit report(s) while the other checks your Chex report?

Yes, I received letter from Citi said:

” Due to information we received from the consumer reporting agency (Equifax), we are unable to open an account for you at this time”

Wow, so banks do check our credit reports when we attempt to open a checking account? Was it a soft or hard pull?

I thought it should be soft, however, the description looks like hard pull.

I bet I will get the same letter. Thanks for sharing. I am going to try it later, like December.

I have a way and would like to know if its going to work.

I will open up the citi premier card now which has 3000 requirement to get 50 k points. After opening that I will be eligible to open this Citigold account so another 50k points. If I fund my Citigold using newly opened premier card would that count towards the minimum spend of cc?

Thanks

[…] posted by FrequentMiler, there are currently two Citibank Citigold offers worth taking advantage of if you can. Once is […]

I just called up citi for this offer and he told me its targeted and I am not eligible for this offer. I have Prestige, premier and thank you preferred cards. Couldn’t do IT online becaz i live in GA.

Any data points suggesting you can receive the bonus if you already have a checking acct with them?

I don’t see anywhere says ” $30 monthly fee that is waived the first 2 months”. Can you let me know where it is?

Thanks

James

mmmmm…. This one is even easier than the AA miles offer, to bad I already click the “submit” button on the other one.

So on the 1099 concern, is this in aggregate across all Citibank products (including Credit Cards)? Or is it limited to banking?

In other words, if I get a Credit Card with a 50,000 point signup bonus and this account in the same calendar year, am I all-but guaranteed to get a 1099 or is it limited to the Citigold account?

Long as we’re on this topic, if I get multiple Credit Cards (but no bank account) am I in danger of getting this 1099 on those products as well? I’m just now getting into Citibank with their AA card and would be good to know if I’m risking a 1099 or should back off their product line…

I always suggest contacting your tax professional, but the 1099 relates to bank accounts. So any bonuses earned for singing up along with monthly ThankYou points earned for using the account would count towards the $600 total.

In the past credit card bonuses have generally been considered rebates and haven’t normally been taxed. With that said, I cannot provide professional tax advice, so I have to recommend consulting your tax professional. There is a lot of information regarding credit card rewards and taxes on the internet that may or may not be helpful.

I signed up for Citigold under the 40k offer on 9/28. Just sent them a SM asking to be matched to the current offer. Fingers crossed.

Can these points be transferred to transfer partners or must they be used to buy tickets directly?

^ Ditto this question

No unfortunately not. There is more information on the restrictions with these points here.

http://milestomemories.boardingarea.com/citi-thankyou-restricted-points-transfer/