NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

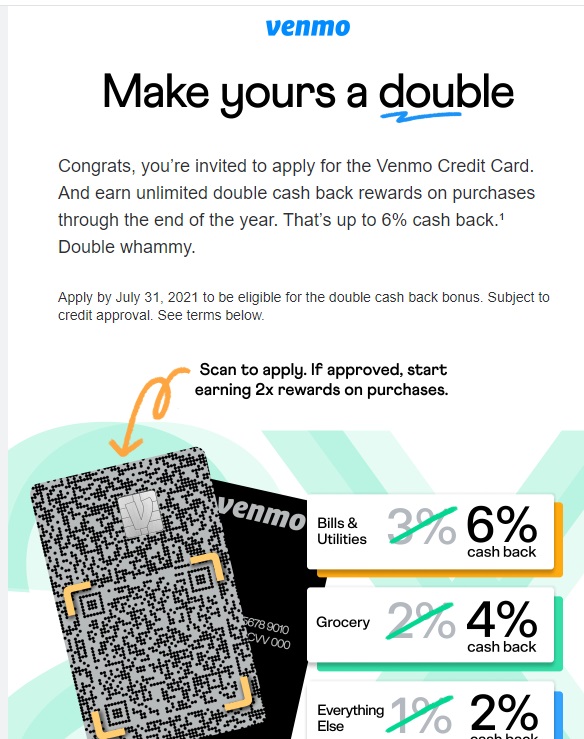

The Venmo credit card came out with an offer this month that may be interesting for those looking for a decent cash bonus on spending in a specific eligible category. This card ordinarily earns 3% back in your top eligible category and 2% back in your second top category each month, but through the end of 2021 they are doubling that to 6% and 4%, respectively. Eligible categories include Dining & Nightlife, Travel, Bills & Utilities, Health & Beauty, Grocery, Gas, Transportation, Entertainment.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler NoneNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 3% on your eligible top spend category ✦ 2% on your second top category ✦ 1% everywhere else ✦ Eligible cateories include Dining & Nightlift, Travel, Bills & Utilities, Health & Beauty, Grocery / Warehouse Stores, Gas, Transportation, Entertainment Base: 1% Card Info: Visa issued by Synchrony. This card has no foreign currency conversion fees. |

Quick Thoughts

If you’ll have a lot of spend this year in one of the eligible categories, this could be a solid deal. Keep in mind that Venmo limits you to earning 3% / 2% (or 6% / 4% during the double period) on up to $10K in eligible purchases per anniversary year. In other words, the most you can earn is 6% back on up to $10K in purchases. However, $600 on $10K spend isn’t an awful return, particularly if it is in a category that isn’t commonly bonused like that. For example, I wonder if health insurance payments may code as either Health & Beauty or Bills & Utilities (or for someone having a baby, I wonder if the hospital bill may code in one of those categories). In the right situation, this could be worth a look.

Note that you can only apply within the Venmo app, but the link on our card-specific page will take you to more information about the card (just click on the card name / information under The Offer above).

H/T: Doctor of Credit

I have to disagree, $300 on $10K as a sign up bonus is very weak. You have to think of the opportunity cost, $300 is just 2x $150 on $500 spend cards that you can open basically anywhere.

Why are charities never a category? It’s my single largest regular category that isn’t covered by other cards. I think these cards are missing a big and attractive category.

I read the language as no cap for the first year. It seems that the $10k cap applies the second year. Language below.

“That exceed, in whole or in part, the annual spend limit of $10,000 in your combined 3% and 2% Spend Categories beginning the first Statement Period following your Anniversary Date.”

Maybe I am missing something?