| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

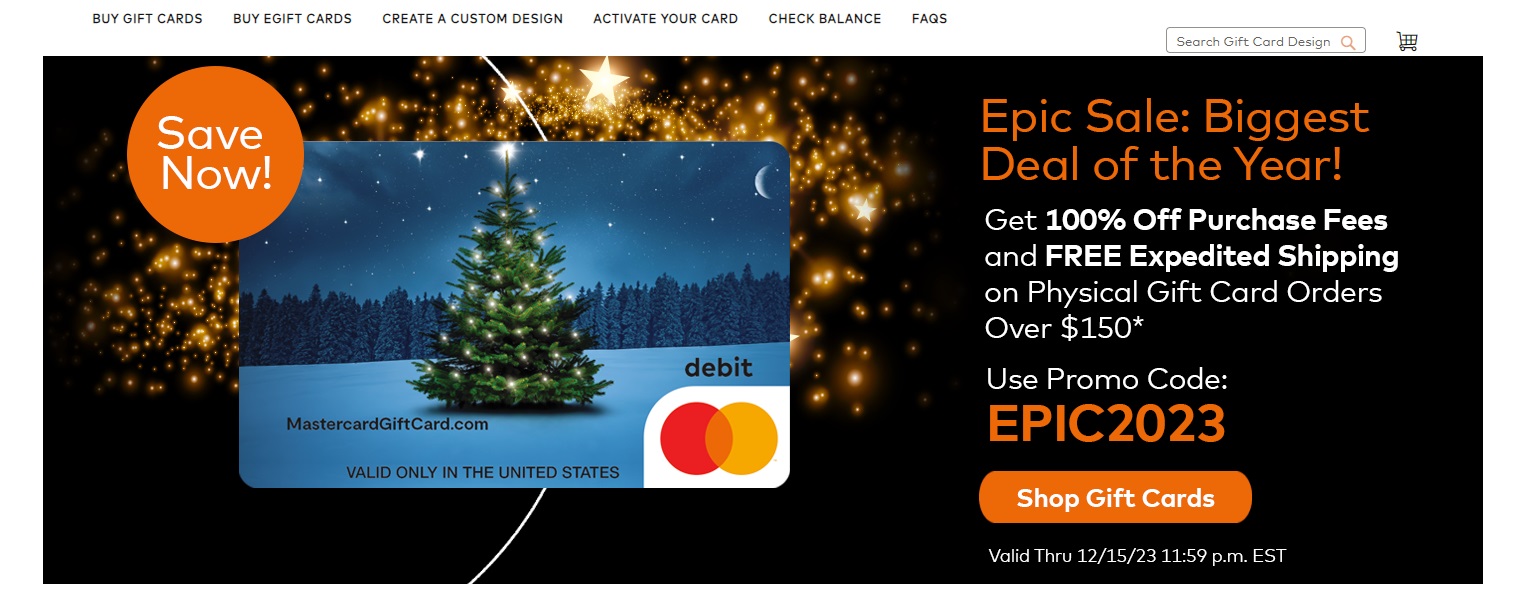

You can currently get 100% off both purchase / activation fees and shipping fees at MastercardGiftCard.com with promo code EPIC2023 when you order $150 or more in physical gift cards. This is a great deal if you’re looking to buy physical Mastercard gift cards.

The Deal

- MastercardGiftCard.com is offering 100% off purchase fees and free shipping on physical gift card orders over $150 with promo code EPIC2023

- Direct link to this deal

Key Terms

- Expires December 15, 2023 at 11:59pm EST.

Quick Thoughts

I’ve not ordered from MastercardGiftCards.com before, but it looks like these cards are issued by Sutton Bank. Again, if you want or need physical gift cards, this could be a nice means of pajama MS or holiday shopping from your couch.

H/T: GC Galore

On another similar note, any idea why Simon Mall not offering any sales on their online VISA gift cards anymore? They used to have monthly promos. Last deal was May I believe.

I’m curious why Amex, Vanilla, and this one all decided to use the same code

Vanilla is EPIC23, not 2023.

But yeah, obv all the same entity behind the scenes.

anyone able to get money order with those cards?

Sure. Very region-dependent what works where you are.

I’m so tempted to use this towards Chase Southwest SUB.

Probably I shouldn’t.

I wouldn’t be particularly hesitant about.

I agree with Nick, @Mist. Chase is as friendly as it gets, provided you aren’t charging more than your credit line in a given cycle.

What happens if you charge more than your credit line with Chase?

If you charge a multiple of your CL paying it off mid-cycle, that can draw scrutiny from Chase, especially if it isn’t established behavior on the account.

Cycling your credit limit is a common factor for account shut downs across issuers. It depends somewhat on your established pattern of behavior, but I’d personally try not to cycle with a bank where I care about the long-term prospects of having their cards.