NOTICE: This post references card features that have changed, expired, or are not currently available

First National Bank of Omaha has recently taken over and relaunched the Amtrak Guest Rewards Mastercards. Existing cardholders who had the cards previously issued by Bank of America have been converted to the First National Bank of Omaha cards, which are effectively unchanged apart from the annual fee on the Preferred card. The two Amtrak branded credit cards are the Amtrak Guest Rewards Preferred MasterCard and Amtrak Guest Rewards Platinum MasterCard. Are they worth applying for? Are they worth using? Are they worth keeping? Answers follow…

Basics

World MasterCard

Annual Fee: $99

Standard signup bonus: 20,000 points after $1,000 spend in 3 months (but see the current offer here)

Earning rate: 3X Amtrak, 2X qualifying travel, dining, transit and rideshare 1X elsewhere

Big spend bonus: Earn 1,000 Tier Qualifying Points towards earning status for each $5K spent in a calendar year. Limit 4,000 TQPs per year.

Noteworthy Perks: 5% Amtrak Guest Rewards point rebate on redemptions. Complimentary companion coupon, One-Class Upgrade and a single-day Club Acela pass each year. No foreign transaction fees.

Platinum MasterCard

No Annual Fee

Standard signup bonus: 12,000 points after $1,000 spend in 3 months

Earning rate: 2X Amtrak and dining, 1X elsewhere

Noteworthy Perks: 5% Amtrak Guest Rewards point rebate on redemptions. No foreign transaction fees.

Amtrak Guest Rewards points

Both cards earn Amtrak Guest Rewards points. As of January 24, 2016, points will be worth 2.6 cents each for Acela routes (for fares of $100 or more) and 2.9 cents each elsewhere (for fares of $23 or more).

Are the cards worth applying for?

Quick answer: Yes

12,000 to 20,000 point signup bonuses don’t sound impressive, but with Amtrak’s new program, points are worth up to 2.9 cents each. So, the 12,000 point bonus can be worth up to $348 of Amtrak travel, and the 20,000 point bonus can be worth up to $580. While those numbers aren’t off the charts, they’re pretty good!

In addition to signup bonuses, cardholders of both cards get a 5% rebate on awards. Obviously, the more points you redeem while being a cardholder, the more valuable this particular perk becomes.

With the $99 World MasterCard, you also get a complimentary companion coupon valid for paid one-way or round-trip travel. And, you get a One-Class Upgrade Coupon valid only from Coach to Business class, or from Acela Business class to Acela First class, on a single travel segment or leg.

Are the cards worth using for spend?

Quick answer: Only under very specific circumstances

World MasterCard Earning rate: 3X Amtrak, 2X qualifying travel, dining, transit and rideshare, 1X elsewhere

Platinum MasterCard Earning rate: 2X Amtrak and dining, 1X elsewhere

Putting non-bonus spend on Amtrak cards does make sense for those who like to travel by train since points are worth up to 2.9 cents each towards Amtrak travel (and perhaps a bit more considering the 5% rebate on redemptions). It may also make sense for travel and dining spend — again, assuming that you highly value train travel and intend to use the points at the 2.9c end of the spectrum.

For spend on Amtrak itself, the Platinum offers 2 points per dollar, which matches other travel cards such as the Chase Sapphire Preferred that offers 2x on all travel, but the Preferred MasterCard’s 3 points per dollar is very good. Those with the Chase Sapphire Reserve card (which offerrs 3X for all travel purchases) might prefer to use that card for Amtrak spend for the flexibility of later transferring to many different programs, but if you are interested in more train travel, you can’t beat the Amtrak World MasterCard.

For non-Amtrak travel spend, the Preferred MasterCard offers 2 points per dollar, which can yield as much as 6% back towards Amtrak tickets when factoring in the 5% redemption rebate for cardholders . The return on non-Amtrak travel purchases is great if you have specific plans to use your points for train travel. Otherwise, the increased flexibility of Chase Ultimate Rewards might be preferable.

Is the World MasterCard worth using for big spend?

The $99 Preferred MasterCard offers a reduced path to elite status for big spend:

- Earn 1,000 Tier Qualifying Points (TQPs) towards earning status for each $5K spent in a calendar year. Limit 4,000 TQPs per calendar year.

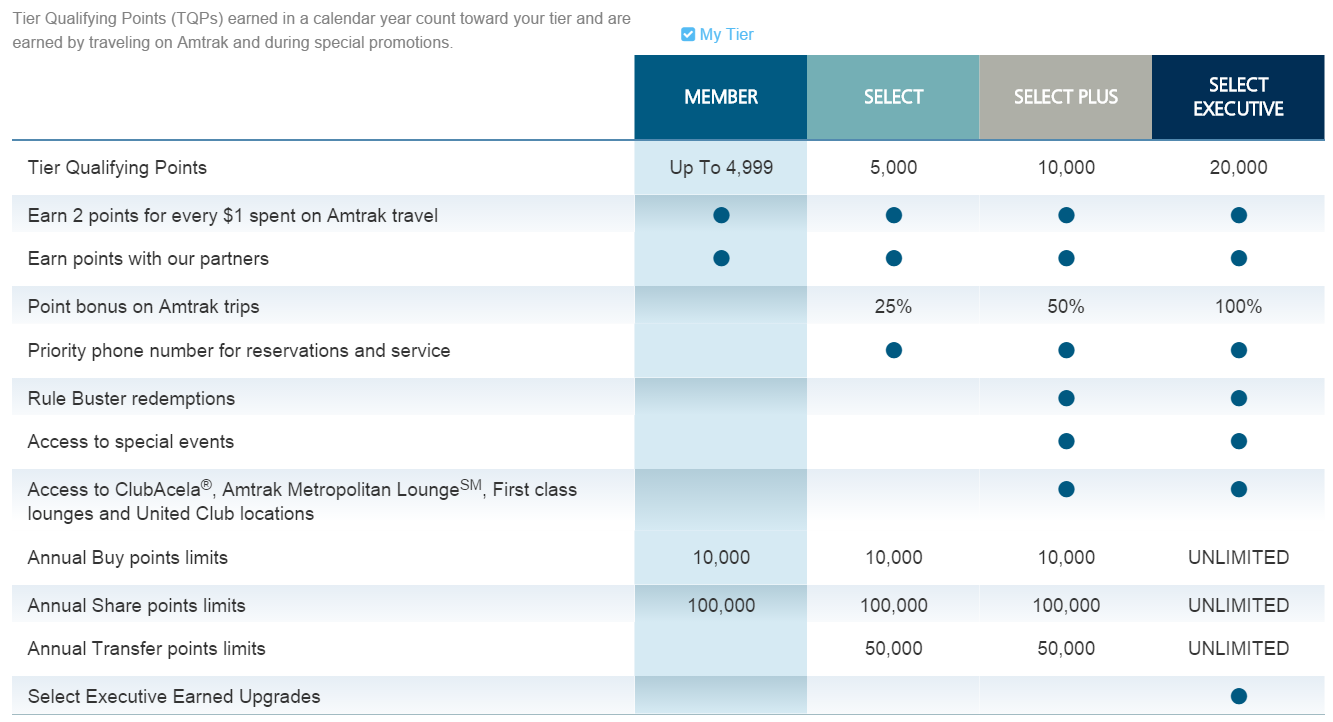

Amtrak offers the following elite status tiers:

- Select requires earning 5,000 TQPs per year

- Select Plus requires earning 10,000 TQPs per year

- Select Executive requires earning 20,000 TQPs per year

Since the World MasterCard gives you 1,000 TQPs for each $5,000 of spend — up to 4,000 QTPs – it’s possible to get within 1,000 TQPs of Select elite status through spend alone. $20,000 worth of spend within a calendar year will result in 4,000 TQPs. You would have to spend another $500 in Amtrak travel within the same year in order to reach that first tier of elite status (Amtrak travel earns 2 EQPs per dollar). Is it worth it?

Here are the elite status benefits as advertised by Amtrak:

Interestingly, the only really valuable perk I see is the ability to transfer points. Specifically, Select status gives members the ability to transfer up to 50,000 Amtrak points per year to hotel programs. Since points transfer 1 to 3 to Choice, that means the ability to get up to 150,000 Choice points.

With the same $20,000 of annual spend on the card, cardholders are given the ability to transfer up to 25,000 points. So, the primary advantage of earning 1,000 additional EQPs through actual Amtrak travel (in order to achieve Select status) is the ability to transfer 50,000 points rather than 25,000 points. Those who are able to take good advantage of Choice points may find that well worthwhile.

Expert tip: it is very likely that there is a sneaky way to earn elite status through credit card spend alone. See this post for ideas.

Are the cards worth keeping?

No fee Platinum card: Yes. Keep for its 5% award rebate.

$99 Preferred MasterCard: Keep if you get more than $99 value from its annual perks (companion coupon and upgrade certificate). Keep if used for its big spend benefits (ability to transfer points, progress towards elite status).

My best guess is that most people won’t get enough value from the Preferred MasterCard to make it worth keeping after the first year. However, those who chase Amtrak status can do well with this card. My recommendation is to evaluate the benefits of the card when the second year annual fee comes due. If you do not feel that you are getting $99 in value, then consider cancelling the card, downgrading to the no fee Amtrak card, or product changing to a different no-fee card such as the Better Balance Rewards card.

Do Amtrak points expire?

Can I have both BOA Amtrak cards?

I think so. Why would you want both?

[…] Amtrak 12K after $1K spend; Same as above. (Note: a 15K offer is now available). I plan to keep this card long term since it has no annual fee, but provides the same 5% point rebate as the other Amtrak card. See: Amtrak Guest Rewards credit card review. […]

[…] For more info on this card, Frequent Miler has an excellent review. […]

I have found out the hard way that the new Amtrak Guest Rewards program is not user friendly and will penalize 10% or more of your points if you cancel or change a reservation, which is certainly not what Amtrak used to do. And calling a “customer service” person? Forget about it. They don’t care. At all. I cancelled a reservation made the Same Day, and the person calling herself a customer service representative was only too happy to tell me Amtrak was penalizing me 5,200 points to make a change to the reservation.

The facts that I have been an Amtrak rider for over 30 years, and a rewards member for many years as well did not mean anything under the ‘new’ guest rewards program. They should have called it the Amtrak Reward Ourselves program, because that apparently all Amtrak cares about now.

So the terms and conditions of the new program do say that and were published in advance of the rollout. However, it’s a 10% penalty of points returned to you either as a result of a cancelation or change. If you exchange and the new ticket is equal or greater points than the original, there’s no penalty, just the difference in points of it’s more expensive. If you want to cancel and redeposit, or the new ticket is fewer points, they’ll keep 10% of the points owed to you. A 5,200 points penalty seems steep, because that should only happen if the ticket was 52,000 points, which is high, even under the new system.

I got the World MasterCard, met the spending requirement, and got my 20,000 points. Now I’m wondering if it’s possible to get the no-fee Platinum MasterCard, spend $1,000, and get 12,000 additional points.

Has anyone done this?

I haven’t done this, but yes I expect it would work

Hey guys, i’m new to the whole points game. Dumb question, but thought i would ask. I will be commuting everyday on Amtrak and will be buying the monthly pass ($1400 per month). At that point it makes sense to get the WMC right? I will use it for the monthly pass and any purchases on the train. But do I use it outside of Amtrak? Or should I just get a chase sapph pref?

It makes sense for you to use the Amtrak card if you want to earn more Amtrak points. It’s possible that you’ll already earn enough points just from traveling so you might be better off with earning more flexible points. Yes, Chase Sapphire Preferred is a good choice. Another great travel card to consider is Citi ThankYou Premier (3X for travel).

The companion certificate is good for a year from date of issue (issued usually within a week of being approved for the card) – and I believe that’s a year to travel. So yes, getting the first one, one year and the 2nd the next would make sense in your situation. However, the companion certificate is only valid on Value or higher fares (refundable) – a non-refundable Saver fare does not qualify, and is subject to holiday times blackout dates (for non Xmas/NYers, if a holiday falls on a Monday, both the preceding Friday and the holiday Monday will probably be blacked out). So do yourself a favor and check some sample, advance purchase fares at different levels to see how much you’re actually saving, although you’d be getting a refundable fare for your troubles. But Amtrak doesn’t charge a fee to change tickets, so if you cancel a non-refundable ticket before departure, the whole value is good for future travel for a year (and that I believe is a year to just book, not needing to travel). You’ll also be getting a free one-class upgrade (for one ticket), but again, only Value or higher fares apply, and you can only confirm the upgrade within 12 hrs of departure, and it’s subject to the same blackout dates. So you could wind up with a higher-than-you’d-like-fare, AND unable to upgrade. And by that point the low non-refundable fares would be long gone. Anyway, both are transferable and would clearly make nice gifts, if that’s something that comes your way.

That said, buying 20,000 points for $79 is an incredible deal. But whether this card is worth the cost each subsequent year is worth a long, hard look at what you’re really getting (a few more points on Amtrak spend, and everything else they mention above).

Hello–Your post seems to imply that it’s always worth it to pay the annual fee for at least the first year to get the 20,000 points because the annual fee is more than made up for by the additional value in the extra points. Is that correct?

And if a couple is applying separately for the platinum cards, is it better to stagger it or wait a year to take advantage of 2 separate companion tickets? (Assuming the companion ticket has an expiration date.)

I ask these questions with the assumption being we take about one trip a year on the Northeast Corridor, and that we always travel together.

I’m on the fence about the platinum for one year vs. the regular card from the outset.

Thanks for your help!

Yes, I think that the additional bonus points are well worth the extra fee in the first year. You can either downgrade to the no fee card after a year, or better yet, cancel the card and separately sign up for the no fee card so that you can get that bonus too.

If you think you might actually use the companion certificate then your idea of having your husband sign up after a year makes sense. Or, he can get the no-fee card now and then he can get the one with the fee later when you know you’ll need the companion ticket.

[…] in using Choice Privileges points, I started thinking about manufacturing points with the new Bank of America Amtrak credit cards. With the Amtrak World MasterCard, $20,000 of annual spend gives the cardholder the ability to […]

Nobody will confirm this, not even amtrak or BOA. Does the 3 points per dollar from the World mastercard stack with the 2 points per dollar earned with regular guest rewards? That would be a total of 5 points per dollar spent?

That has to be right? Otherwise the no annual fee card would be 2 points which is the same as NO card…and other than a few perks and points not expiring, why bother?

Just curious as I was approved for the WMC. $2.1k starting limit, had to do joint application to get approved (really annoyed). Can split into two after 1 year. Scores in the 750’s.

Yes, that is definitely correct. You’ll earn 3X with the World MasterCard + 2X from Amtrak itself.

Wow! I never even thought of the effect of summing the points earned on the card and the points from the Amtrak rewards program… points from card (3) + AGR points (2) = 5. (I know, I miss obvious things sometimes.) Thank you.

The estimator on the Amtrak Rewards Site says I can get 4 round trip saver tickets from DC to NYC for the 12,000 points which would be worth just over $400 for me. I am thinking of getting one of the cards as I am taking my sister and nieces to see their first Broadway show on Broadway this winter or early spring. The program for me is a change for the better as I use Amtrak in the NE corridor and I can now get to NYC at few points if I can get a saver fare.

Unfortunately, there is some evidence that you won’t be able to use points for Saver fares: http://www.flyertalk.com/forum/25345048-post83.html

Uh – that comment on FlyerTalk from Amtrak says the following: …but please note that AGR One-Class Upgrade Coupons will continue to be permitted for use on non-redemption Saver fare tickets, according to the terms of the coupon (e.g. Acela and Northeast Regional).

However, I thought everywhere else it says that Saver Fares don’t qualify for upgrades? And Amtrak GR just told me as much.

So the good news is the Value fare, take DC-NY, at $88, the lowest available to use points instead, comes to 3,036 points (before the 5% back), which is still lower than the 4,000 it is now. And to get Acela for 4,000ish, on weekends I guess, does seem like a bargain.

I am applying for the Platinum Card. Why? Because I am going to use a card for everyday purchases anyway, and if I am going to churn, it might as well be for Amtrak points. When I get the urge for a train ride, I redeem points and ride and enjoy. In my mind, its win – win.

Whether it’s Chase or BoA, I couldn’t care less. Both have way too much fine print which I have no doubt is screwing me royally. If I can work with their float for a month, why not? I should add that I never keep a balance, but make sure to have a zero balance at the end of each billing cycle.

[…] Amtrak Guest Rewards credit card review […]

D.O.A.