NOTICE: This post references card features that have changed, expired, or are not currently available

In the recent post, “How to play the Alaska / Virgin America deal,” I argued that the impending Alaska Airlines / Virgin America merger would lead to a conversion of Virgin Elevate points to Alaska Airlines miles at an attractive 1 to 2 ratio. I believe that Virgin Elevate points are considered to be twice as valuable as Alaska Airlines Mileage Plan miles for the following reasons:

- Transferable points programs transfer 2 to 1 to Virgin America whereas they transfer 1 to 1 to Alaska.

- Marriott Rewards offers twice as many Alaska Airlines miles as Virgin Elevate points when converting Marriott Rewards points to miles.

- Virgin America sells their points for almost twice the price that Alaska Airlines sells their miles.

In the aforementioned post, I discussed opportunities that may arise for converting transferable points to Alaska Mileage Plan miles thanks to the merger. In the comments, though, reader P asked “How would you play it from a credit card perspective?” Good question! If you believe that points will eventually be doubled when converted to Alaska miles, then it’s worth taking a look at the Virgin America credit cards to see if they offer extra value in this light…

Virgin America Elevate credit cards

Virgin America currently offers two different cards through Comenity Bank:

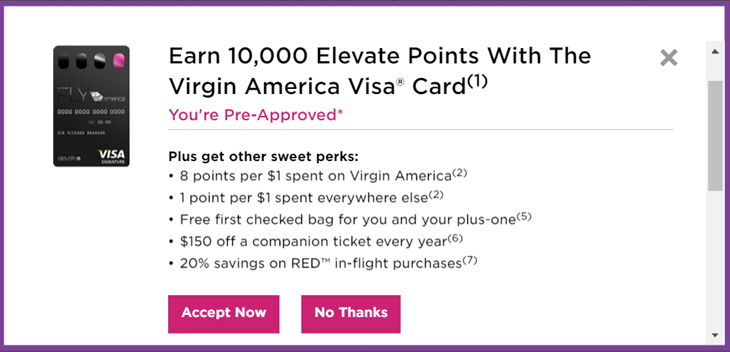

- Virgin America Visa Signature Card (direct link): 10,000 bonus points after $1K spend in 90 days.

- Benefits: Free checked bag; $150 off a companion ticket every year; 20% off in-flight purchases.

- Point earning: 3X Virgin America, 1X everywhere else

- Annual fee: $49 (not waived first year)

- Virgin America Premium Visa Signature Card (direct link): 15,000 bonus points after $1K spend in 90 days.

- Benefits: No change or cancellation fees; 15,000 status points; Free checked bag; $150 off a companion ticket every year; 20% off in-flight purchases.

- Point earning: 3X Virgin America, 1X everywhere else

- Annual fee: $149 (not waived first year)

As you can see above, the main advantages of the $149 card over the $49 card are:

- Free changes and cancellations

- 15,000 status points

- A larger signup bonus (15,000 points instead of 10,000).

Better Offers through the Shopping Cart Trick?

Last year, Julian described how to use the “Shopping Cart Trick” to get better Virgin America signup bonuses (see: Bet You Didn’t Know: A $50 credit on the Virgin America card using the shopping cart trick). Basically, the idea is to sign into your Elevate account and then go through all of the steps towards booking a flight. As you get near the point of actually committing to the purchase, you should see a credit card offer. Julian wrote about getting an offer with an extra $50 statement credit. I tried the approach yesterday, but just got the regular offer:

Note: The part that says “8 points per $1” is a bit misleading. The credit card offers 3 points per dollar for Virgin America spend, and then they’re adding in the 5 points per dollar you always get when flying Virgin America regardless of which credit card you use.

Are the cards worth getting in light of the possible doubling of points to Alaska miles?

If you’re just looking for a signup bonus and nothing else, the 10K offer for the $49 card isn’t terrible, but it’s far from great. Even if the points do get doubled to 20,000 Alaska miles down the road, it’s still not a very impressive signup bonus. Same with the 15K offer.

It is likely, though, that Comenity will increase the signup offers before the Elevate program gets swallowed into Alaska Mileage Plan. So, I recommend waiting for better offers unless you want/need the other perks that go along with these cards.

Possible 2X everywhere

Where things get really interesting is the possibility of indirectly earning 2 miles per dollar for all spend. While there are several cards that offer 2 “miles” per dollar for all spend, these aren’t real airline miles. For example, the Capital One Venture card offers 2 “miles” per dollar for all spend, but the points earned are not airline miles. They are fixed value points that are worth exactly 1 cent each towards travel purchases. Unlike real airline miles, there is no way to get outsized value from these points (sorry Jennifer Garner).

The best card right now for earning true airline miles for unbonused spend is the Chase Freedom Unlimited card which earns 1.5 points per dollar everywhere. When this card is paired with a premium Chase Ultimate Rewards card such as the Sapphire Preferred or Ink Plus, points can be transferred into real airline miles: United Airlines, Korean Airlines, Singapore Airlines, and more.

Now, though, there’s a new possibility. Virgin America cards offer 1 point per dollar for non-bonus spend. If I’m right about the eventual conversion ratio of Elevate points to Alaska miles, then those points will eventually be worth 2X Alaska miles. In other words, for those willing to take a risk and play the long game, the Comenity Bank Virgin America cards may be 2X everywhere Alaska Mileage Plan cards.

Is it worth the gamble?

No.

Two weeks ago, the idea of a credit card that offers 2X Alaska Mileage Plan miles for all spend would have been exciting. Then, Alaska suddenly and without warning raised award prices on Emirates flights. Now, Alaska Mileage Plan miles are still worth a lot for use with other partners, but for how long? It could be years before Elevate points can be transferred into Mileage Plan miles, so I think it would be extremely risky to assume that Alaska miles would be anywhere near as valuable then as they are today.

Plus, I could be wrong about the transfer ratio. One Mile at a Time thinks that Elevate points are worth between 1.2 and 1.5 Alaska miles. Only time will tell.

Summary

Alaska’s takeover of Virgin America means that the Virgin America credit cards may lead to a couple of unique opportunities. For one, the signup bonuses may end up becoming twice as many Alaska Mileage Plan miles. Secondly, the cards may be a way to indirectly earn 2X Alaska Mileage Plan miles on all spend.

I don’t recommend going after either opportunity at this time. I recommend waiting for the likely appearance of better Virgin America credit card offers. And, I think that banking on earning 2X Alaska miles though spend is risky: I may be wrong about the 2X conversion ratio and, worse, Alaska may further devalue their mileage program before allowing this conversion.

It is possible that a higher bonus opportunity may come along later but one loses the time to put lot of spend on the card. You can get the card now and put loads of spend and maximize the miles you collect before the mileage is merged. It’s not like they will offer 50K to 70K instead of the current 10K and 15K.

Yes but putting spend on the card has lots of risks as detailed in this post

I will not sign up a credit card just because of the assumption that the Elevate miles will be converted to AS miles in a 1:2 ratio. Such a high risk. I would wait and see. And I will want to burn my 113K AS miles first because I don’t which partner redemption rate will become the next devaluation, I think it’s gonna be Cathey Pacific.

Is that offer for 20,000 elevate miles after your first airbnb hosting still available?

It is now after 5 hostings: “Treat yourself to a getaway. Become a Host on Airbnb and earn 20,000 Elevate points after you complete your 5th night hosting.” Found here: https://www.virginamerica.com/cms/elevate-frequent-flyer/partners/hotel-partners/airbnb-booking

Are the sign-up bonus once in a lifetime?

I don’t think so

The most likely scenario by far is that the conversion ratio will be 1:1. Mergers don’t happen to benefit consumers.

Exactly

I see Virgin America points worth about 1.3 times what Alaska miles are worth. I’d be very, very surprised if we see a conversion rate other than 1:1 when the combination of Mileage Plan and Elevate is finalized.

Why not just get a bunch of Alaska airline cards if they still let you do that?

They’re not as easy to get as they used to be, but yes you might as well get those too while you can.

Those are downright horrible offers.

Not that you need my blessing but I agree with your opinion.

My plan is to wait for better sign up offers and then pounce. Mostly due to the fact that this is from a non-main stream bank #burningbridges.

The credit card company will be forced to dump elevate miles like previous banks involved with Continental and U.S. Airways had to do . So I expect even higher offers down the road .