NOTICE: This post references card features that have changed, expired, or are not currently available

In April, Doctor of Credit posted a “New Way To Bypass Chase 5/24.” I was intrigued. I wanted to get Chase’s new Ink card: the Ink Business Preferred for it’s 80K signup bonus and 3X categories, but I was way over 5/24 (Chase won’t approve applications for many of their cards if the applicant has opened 5 or more cards in the past 24 months).

In April, Doctor of Credit posted a “New Way To Bypass Chase 5/24.” I was intrigued. I wanted to get Chase’s new Ink card: the Ink Business Preferred for it’s 80K signup bonus and 3X categories, but I was way over 5/24 (Chase won’t approve applications for many of their cards if the applicant has opened 5 or more cards in the past 24 months).

The trick that Doctor of Credit described was to apply for the card through a Chase BRM (business relationship manager). Some data points at the time suggested that when a BRM filed a paper application the process bypassed 5/24. Cool.

Finding my BRM

I remembered meeting with a Chase banker once regarding my business. Maybe he was a BRM? I searched my email and found that yes indeed he was! I then emailed him to ask if he was still my BRM. The next day he answered no. He had been reassigned to another area. He then contacted my usual go-to banker at Chase to have him find out who my current BRM was. By the next day (April 13th), my new BRM was identified and via email I submitted my application.

The application that wasn’t

Over the next several weeks, nothing happened. I emailed my BRM many times for status, but never heard anything back. Finally I contacted my usual banker who told me that my BRM was out of the office on an emergency medical leave. Apparently she hadn’t filed my application at all. He then hooked me up with a different BRM…

Application Attempt 2

My new BRM wanted to meet in person before submitting my application. We met early in May. He cautioned that it was his understanding that BRM applications did not circumvent 5/24. I told him that I wanted to give a try anyway. He submitted the application.

Chase didn’t pull my credit until May 23rd. Then June 5th, I got my rejection notice from Chase:

- Too many credit or loan accounts have been opened recently

- Not enough time has passed since your last account with us was opened

- Too many recent request for credit or reviews of your credit

- You have too many active accounts or too much available credit

They offered a bunch of good excuses for rejecting me, but most of these could probably be reversed with a reconsideration call or two. The one that is usually not reversible is “Too many credit or loan accounts have been opened recently.” While it doesn’t explicitly say “5 or more in the past 24 months,” I figured that’s what they meant. It appeared that my BRM assisted application did not bypass 5/24.

But, I wasn’t done yet..

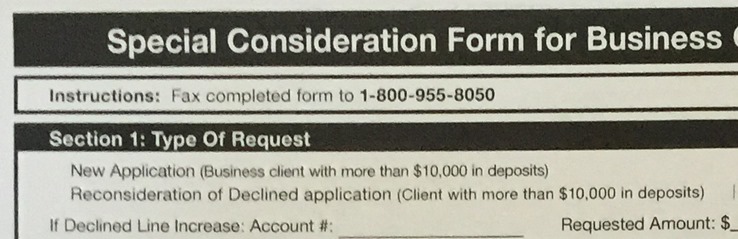

Special Consideration Form

I still had one ace up my sleeve. I asked my BRM to submit a Special Consideration Form (see: Chase Special Consideration for business cards only). In the past, reports have been mixed as to whether this form can effectively bypass 5/24, but I figured it was worth a shot.

Double Denied

Double Denied

In a letter dated June 21st, Chase rejected me again.

Thank you for contacting us about a business credit card. As you requested, we completed a second review of your application. After reviewing your account and credit information, we’re unable to approve a business credit card for you at this time.

How we reached this decision

Our decision was based on the following primary reason(s):

- Too many credit or loan accounts have been opened recently

- Not enough time has passed since your last account with us was opened

- Too many recent request for credit or reviews of your credit

- You have too many active accounts or too much available credit

Why I didn’t bother calling

When credit card applications are denied, it is usually a good idea to call a bank’s reconsideration line. By offering to move credit around rather than get new credit, some analysts will reverse the decision and approve your application.

In this case, though, I was pretty sure that my 5/24 status was the problem. And, I know from many data points that calling does not help unless you can somehow prove that you’re not really over 5/24 (such as authorized user accounts have pushed you over 5/24).

Plus, when I revisited Doctor of Credit’s now old post, I found that he had updated the title: New Way To Bypass Chase 5/24 [Update: No Longer Working]. Oops.

Summary

I completely struck out with trying to bypass 5/24. A BRM submitted application failed, and a subsequent Special Consideration Form failed too. From now on, as long as I’m over 5/24, I’ll stick with non-Chase applications and/or Chase applications that do not fall under 5/24 (such as British Airways, Hyatt, IHG, Marriott Business, Ritz).

[…] and that might have been the cause of the application failures. Here are some recent datapoints: 1, 2, 3, The first comment does a good job explaining what I am talking about as […]

LUKAS, did you have to go in to the branch to meet your BRM to process the application or were you able to do so on phone/email/fax?

Email

Great, how I can msg you to get your BRM’s contact info?

DP: after reading this I applied with 20/24 on my back on was APPROVED. If anyone needs the name of my BRM, message me.

Hey Lukas, I’m looking for a helpful BRM to help with CIP application. Do you mind sending me the contact info for the person who helped you? Thanks.

[…] and that might have been the cause of the application failures. Here are some recent datapoints: 1, […]

Cardholders who circumvent 5/24 to churn will ultimately drive down points bonuses for everyone else. CSR is the prime example. Be happy with the 5 you’ve got.

I SUCCESSFULLY bypassed 5/24 using a BRM…… BUT with a slight difference, which may or may not have made a difference.

A little backstory. Over the past year I went into my local chase branch to apply for the Reserve twice and the Freedom Unlimited once. Got rejected all 3 times due to 5/24.

So after reading about the BRM method a couple months ago, I decided to track down a BRM.

I finally met with one and explained why I wanted to open a Ink Preferred with him and was persistent that it needed to be done the paper method and not online. He agreed to do it, BUT before we got that far, he sweet talked me into opening a Business Checking account and Savings with $100k so that he could bring me into his book of management. Since I had the funds at BofA I could move over to get a little more personalized service, I bit. Also, by having an account under BRM management, I was able to get a 100K pt bonus as opposed to just 80k UR points.

So we did the paper application, and I asked for a $10k credit line since the paper app asks what you want. About 2 weeks later (might have been a little less), my BRM called me and told me that my Ink Preferred app was APPROVED, and it was approved for $20k, double what I asked for.

So I got passed 5/24 using the BRM paper app method. But of course this result is skewed because I had a BRM managed account. So I guess if you’ve got $100k you can move over, you might have a better shot!

So now I’ve got my Ink Preferred that I can put down when I check in at Necker Island next month and get 3x UR points the massages my wife gets!

RCK

I also did the BRM route for the 80K Ink bonus, and was promptly rejected due to 5/24 a week later. Come to think of it, the original post regarding “bypass” 5/24 thru BRM seem more and more to be a fluke than a regular occurence.

[…] morning, Greg posted about his latest attempt to bypass 5/24. In that post, he details the process of applying through a BRM (Business Relationship Manager) and […]

No worries. Something else will come along. Im still waiting for Amex to bring back 2% cb on site for a 2-3k gc.

I have been denied for some of those reasons above with Chase cards that are not under 5/24. Chase has since approved me for those products since initially denying me early last year. I can’t say much changed since then and now. Well, I got recon to overturn denial for SW Plus just before 5/24 hit that card, and then got approved for IHG early this year.

So it could very well be that BRM does bypass 5/24, but Chase denied you anyway for other reasons. That would certainly be my conclusion since any of the 5/24 denials I’ve seen have just that one denial reason listed. I am taking a break on my applications right now since I’m hoping to get the Altitude.

Greg,

I noticed that some BRM are truly not informed of the real process of paper application. Some BRM will give you a paper application and when they receive it, they will on your behalf will fill out their BRM online application to process application. This BRM online application is and will be subject to 5/24. DoctorOfCredit did a good job on explaining also.

I was fortunate to educate my local BRM and he actually did the old fashion paper application old fashion faxing. At first he said he never heard of this and said it won’t bypass 5/24.

DP – I have received my CIP last month and well over 5/24. My father received his CIP last week and is well over 5/24 also.

Decision should take 2-4 weeks. Anything quicker I think they did their method incorrectly.

Hi Brendan,

When did you get approved using this?

I noticed I was in your latest post DoC so I wanted to give an update to this post and answer your question.

My father was approved roughly July 10th. His application was June 26.

I got approved June 15th and my application date was about May 20th.

This is an excellent reply and deserves its own post.

Gregg,

I as commented on your initial post, both a close friend and I were able to get approved first time for the card for ourselves along with the wives all with the same BRM. It took a while as it was maually review (ie…stack of paper). so there was not even tracking as its just a pile of paper. It took 2-3 weeks before decision. I assume due the manual process, its how their review didnt always or didnt at all catch the 5/24. Either

My husband and I are bloggers and we really wanted the Ink Preferred Biz to get 3x points on social media advertising. We spend a lot on Facebook ads every month.

Anyway, we are way over 5/24, and have gotten denied. I didn’t go the BRM route, but I’m guessing it’s hopeless. But they did let us upgrade our Ink Cash to the Ink Preferred Biz last week. No signup bonus, but we’ll earn enough to make up for it with the 3x points in a month or two.

You should call recon. That’s definitely NOT a 5/24 denial. The language for a 5/24 denial specifically says “24 months”. You hit a bunch of secondary roadblocks that can be reconsidered.

I consider this a DP that a BRM does circumvent 5/24 despite your conclusion to the contrary.

Think I’d want to see your source of DPs that says the language is always the same.

The source is that every 5/24 denial includes language that references 24 months. Not a single DP has ever indicated that a 5/24 denial doesn’t include language that states 24 months.

“The one that is usually not reversible is “Too many credit or loan accounts have been opened recently.” While it doesn’t explicitly say “5 or more in the past 24 months,” I figured that’s what they meant.”

Bro, you figured wrong.

you forgot the words, “that I’ve read.” You should include those words after writing, “not a single DP.”

The source is you, and just you. Unless you’ve personally read every data point available everywhere (you haven’t), or have a statement directly from the Chase on this matter (you don’t), we’re just dealing with your opinion here and your opinion alone.

Quite frankly, that doesn’t mean all that much.

“Unless you’ve personally read every data point available everywhere”

I have. You haven’t (clearly). Neither has the writer of this article. There’s no reason to promote incorrect information and I’m not sure why you are defending it.

You have, have you? Wow, I’m really impressed and stand corrected. Ladies and gentlemen, meet the first person to have ever read every comment on every blog or website that has ever dealt with Chase and 5/24.

You’re silly, and your argument is, well, immature. You now have zero credibility. I think I’ll stick with the writer, who, well, does. You’re no longer worth my time.

“You have, have you? Wow, I’m really impressed and stand corrected.”

I’m glad we’re in agreement. It is unfortunately that such ridiculous misinformation would ever be promoted by this blogger.

Folks, I’m reminded to never argue with an idiot. They will only bring you down to their level and beat you with experience.

WOW!!! Thanks for sharing that. I appreciate Frequent Miler for the information.