NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday I detailed my latest application spree. I applied for 10 Bank of America cards. Four were instantly approved and the rest are pending. At the end of the post I mentioned that I had applied for one more card — a Chase card. Why did I do it? Which card did I apply for? What was the outcome? Here’s the story…

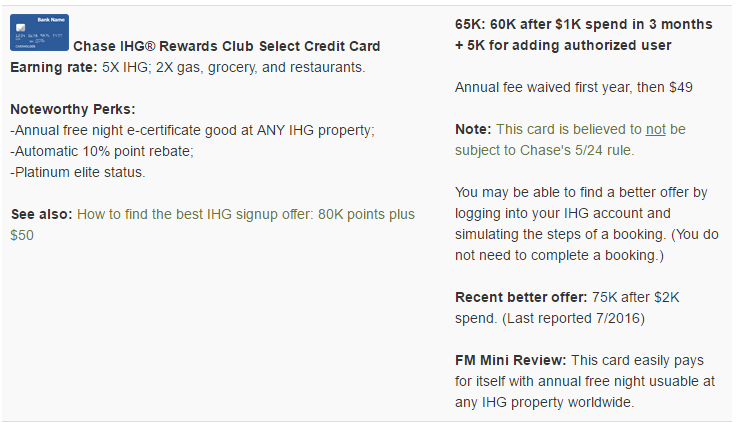

Almost two years ago I reported that my wife and I were considering cancelling our Chase IHG cards (see: Canceling my favorite cards). Of all of the cards out there with annual fees, the IHG card is probably the easiest to justify paying for year after year. For only $49 per year, the card offers IHG Platinum status, a 10% rebate on point awards, and a free anniversary night at any IHG hotel worldwide. The free night is redeemable at Intercontinental Hotels & Resorts, some of which usually go for $1,000 or more per night. To be clear, I wouldn’t recommend using this card for spend — you can do much better with other cards. But, it’s a great card to keep in a drawer for its benefits.

The reason we were thinking of cancelling was that I wanted to line up our anniversary nights. Our card anniversary nights were almost exactly 6 months apart. I figured that it would be easier to manage free night expirations and plan weekend getaways if our anniversary nights were aligned. If we cancelled the cards and signed up later and at the same time, we would get new signup bonuses and align our free nights.

I cancelled my card, but my wife never cancelled hers. That was OK because I could still align our free nights by waiting until the right time to apply again. I should have waited two more weeks to align our dates perfectly, but I was a little concerned about the many new accounts that would soon appear on my credit report thanks to the new Bank of America cards. Chase has become increasingly stingy about credit card approvals for those with many new accounts on their credit reports. I knew that if I applied right away, Chase wouldn’t see those new accounts because they hadn’t yet been reported to the credit bureaus. So, I decided that having our cards aligned within 2 weeks was probably good enough.

As shown in the Chase Hotels section of my Best Offers page, the best current public offer for the IHG card is 60,000 points after $1K spend + 5,000 more for adding an authorized user. The info Best Offers page includes a note saying that the IHG card is believed to not be subject to Chase’s 5/24 rule. That’s good because my Chase Private Client status appears to no longer be an effective workaround to that rule.

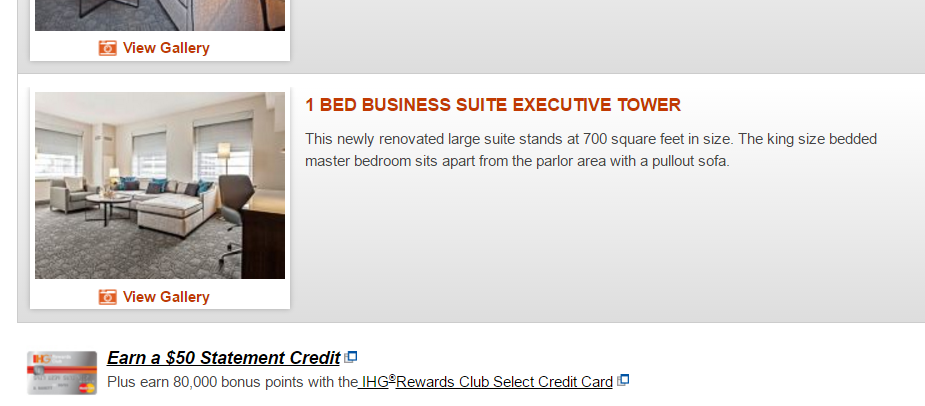

Also shown on the Best Offer page is a link: How to find the best IHG signup offer: 80K points plus $50. There are two tricks described in that post: 1) Logging into an IHG account with elite status leads to an 80K offer; and 2) Going through the steps of booking a hotel night at IHG.com can lead to an offer with a $50 statement credit. I somehow still had IHG Gold status, so I logged into my account and searched for a paid hotel night. The desired 80K offer with $50 statement credit showed up at the bottom of the search results:

Also shown on the Best Offer page is a link: How to find the best IHG signup offer: 80K points plus $50. There are two tricks described in that post: 1) Logging into an IHG account with elite status leads to an 80K offer; and 2) Going through the steps of booking a hotel night at IHG.com can lead to an offer with a $50 statement credit. I somehow still had IHG Gold status, so I logged into my account and searched for a paid hotel night. The desired 80K offer with $50 statement credit showed up at the bottom of the search results:

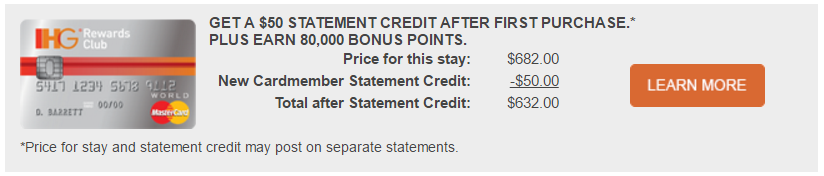

After selecting a room, the same offer appeared again:

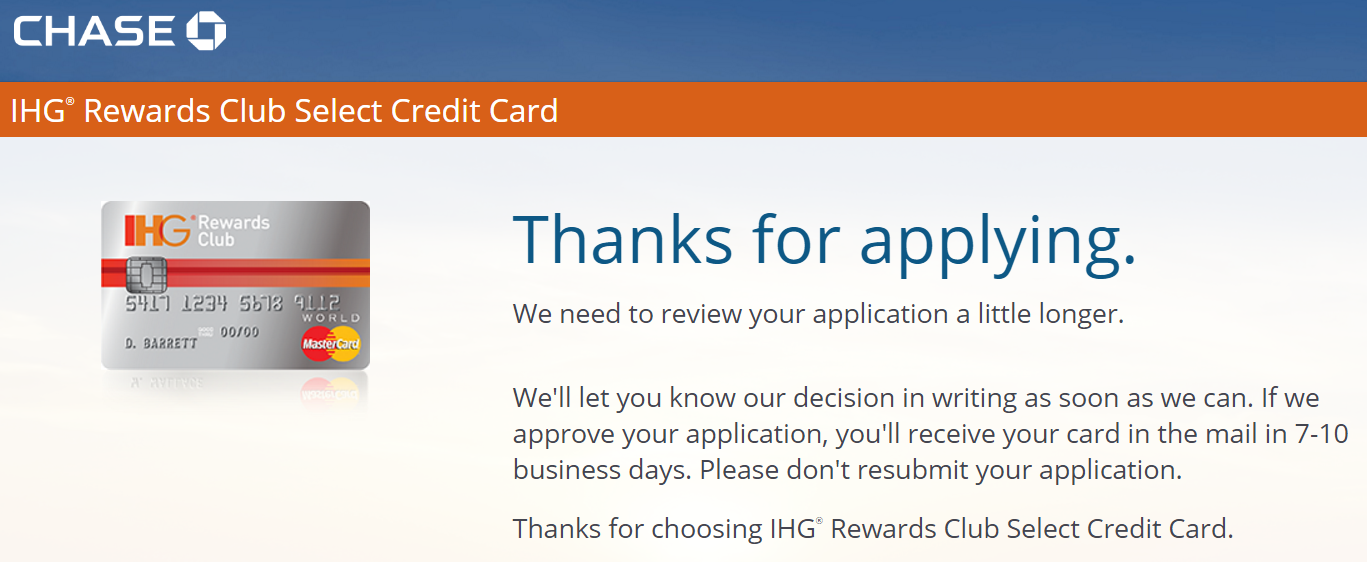

I applied, but didn’t get the hoped for instant approval. The application went pending:

Chase calls and approves

Later that evening I received a call from Phoenix, Arizona. It was a Chase analyst. He told me that the card would probably be approved after a few days if I wait for them to extend additional credit. Or, he could move credit from another card and approve the card on the spot. I chose the latter. Done. That was easy!

[…] of my wife’s cards was closed? Do you remember how I recently signed up for the IHG card in order to align my account with my wife’s so that we w…? Yep, they closed her IHG card. Ironic, isn’t it? So, next year, around the same time, […]

Any reason why you did not call the reconsideration line immediately.? It seems that less people are doing that. Has something changed?

When you call recon, you give up on a chance to get automatically approved off-line. There’s usually no advantage to calling until you get a negative decision — unless you’re impatient.

[…] Chase IHG was the +1 at my application spree party – Applying for the IHG card, getting the best offer and why timing is everything. […]

When will they publicly offer the higher initial sign up bonus of 70k or 80k?

I don’t know if/when they’ll increase the public offer

Do you think it would be possible to keep the old IHG open and apply for the second IHG card ?

No, I don’t think so

I am not quite to Gold this year. Tried a dummy booking and got the 80k plus $50 for $2k min spend. I am right at 5/24 (hopefully that is irrelevant). Will go for it. Any recommendations on calling vs waiting on this one if, as I expect, it goes pending?

Success! Instantly approved for 80k plus 5k (AU) plus $50 statement credit

Interesting that the 80k showed up when logged in to my account but the $50 more offer showed up when I tried to make a booking.

Also surprised I was instantly approved since I have been maxed out in terms of credit limit with Chase for quite some time (CSP, CSR, Hyatt, SW Plus, UA Mileageplus)

FYI: there is also a targeted offer (with an invitation code) for this card for 100K after $2K spend in 3 months + 5K for adding an authorized user. Annual fee is not waived in the first year. It does not appear to fall under the 5/24 rule, as I got an immediate acceptance. I have no idea what triggered getting the invitation, but it finally persuaded me to sign up for this card — planning ahead for a big 2018 trip!

Thanks, yep I forgot to mention that one. I wasn’t targeted but it’s a great offer if you can get it.

Hi Greg, how much is the min sp. for the 80K + $50 offer? I have recently applied for 60K + $50 with $1K min sp. and I am wondering if it makes sense to secure message Chase and ask for a match…

$2K. If you try it I’d be interested to hear the results.

Chase would match the $80K with $2K min sp. *but* without the $50 statement credit… are 20K points worth more than $50 statement credit?

Yes, that’s like buying IHG points at .25 cents each. Great deal.

How far apart does Chase IHG gives the same bonus again? I had the card, have thought the bonus is once per life time.

You have to wait 24 months after the last signup bonus was issued for the same card.

“wait 24 months after the last signup bonus was issued”. I have the card for over three years so I can cancel then reapply since the sign up bonus I got was over 24 months ago?

Yes

Once per lifetime = AMEX

this is not the first time I see that the IHG card is supposedly not exempt from the 5/24 rule, but when I applied, I got denied, with an explanation from the recon. folks that I have too many accounts opened recently. Is there a trick?

sorry, meant to say “is exempt”

I was also denied for the IHG card for the same reason and that was before the 5/24 rule was in effect, then applied again after it was in effect and was approved. In your case, too many new accounts is a reason, not a rule. I didn’t get any (or at least very few) new cards for about 6 months before I reapplied and was approved. I still would have had about 15 in the previous 24 months but very few in the last 6 months.

Interesting, thanks for the feedback. I’m about 4 months now without new cards, will reapply in about two again then and see what happens.