NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

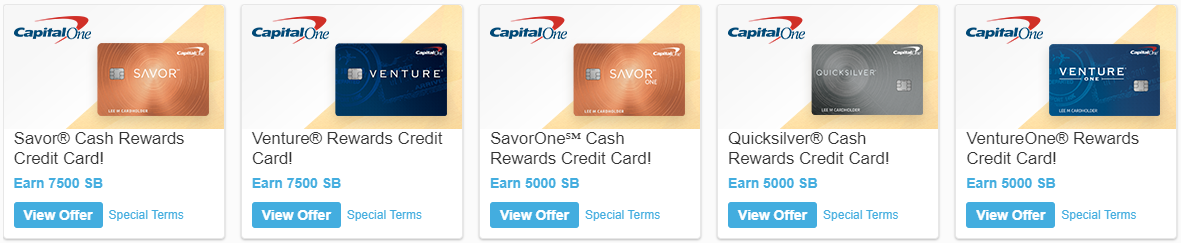

The shopping portal / in-your-face ads site, Swagbucks, is offering 5000 to 7500 Swagbucks (worth $50 to $75) if you sign up successfully for Capital One cards. It appears that only consumer cards are available (see above). That’s a bit unfortunate since the Capital One Spark Miles for Business and Spark Cash for Business cards currently have all time high signup offers for big spenders (200,000 miles or $2,000 after $50K spend), but those offers are set to expire this coming Monday (Jan 28 2019).

If you haven’t signed up for Swagbucks, here’s my referral link (thanks!).

Hat Tip: Doctor of Credit

Greg I signed up for Swagbucks but am having trouble figuring out how to get to the deal. It isn’t a store and there does not seem to be a section for Credit card sign up that I can see? Can you offer a suggestion?

I just looked and I see that the offers aren’t there. That’s likely because Capital One is currently updating their offers. It’s likely that they’ll return to Swagbucks in a few days.

Tempting. Been considering the savor card to replace my downgraded CSR for restaurant spend – decided it wasn’t worth it now due to the three bureau pull and the strangeness of their approvals. $575 for 3k spend would be nice.

I just got approved for the BA premium card and denied for the arrival plus (@6/24, so I knew the risk and knew they hit TU while every one else does Ex). Any idea if Cap1 would see those apps as a major red flag a week later?

No, I don’t know