| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

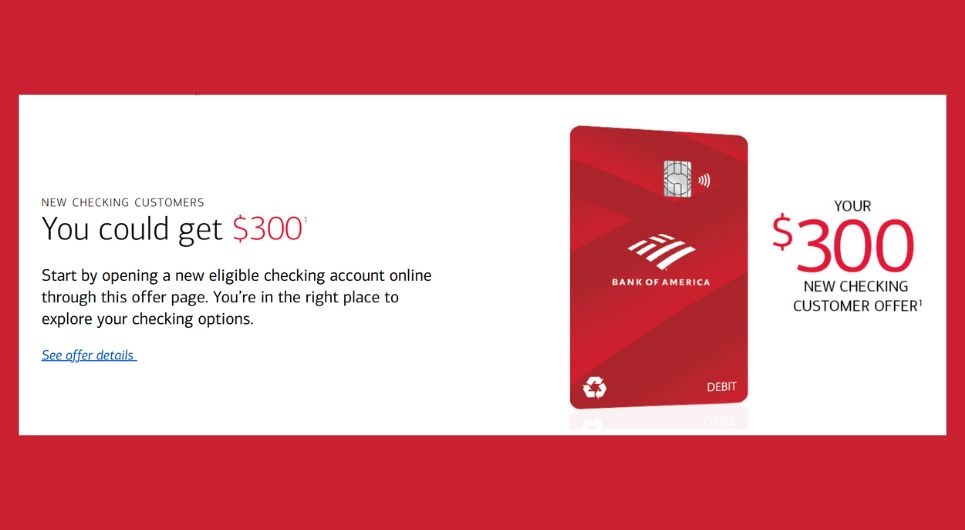

Bank of America is running a promotion for new consumer checking accounts that offers a $300 bonus with a fairly simple requirement: set up and receive $2,000 in direct deposits within 90 days of account opening. As per usual, what’s actually counted as a direct deposit is squishier than you might expect. You can see Doctor of Credit’s list of what’s been successful here.

Perhaps even better for many, having a BOA checking account makes it much easier to get credit card approvals with the bank. Without a deposit account, you normally won’t be approved for a card if you have opened 3 or more accounts, with any bank, within the past 12 months. For those with Bank of America deposit accounts, the rule changes to 7 accounts in the past 12 months. Enforcement seems to vary either way.

The Deal

- Bank of America is offering a bonus of $300 with a new checking account.

- Requirements to Receive a $300 cash bonus:

- Open a new eligible personal checking account online through this offer’s webpage by June 30th, 2025 to be enrolled in this offer. If you open your account by any other means, you may not be eligible to earn the checking bonus.

- Bank of America Advantage SafeBalance Banking®, Bank of America Advantage Plus Banking®, Bank of America Advantage Relationship Banking® accounts are eligible for this offer. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer.

- Set up and receive Qualifying Direct Deposits totaling $2,000 or more into that eligible personal checking account within ninety (90) days of account opening.

- Open a new eligible personal checking account online through this offer’s webpage by June 30th, 2025 to be enrolled in this offer. If you open your account by any other means, you may not be eligible to earn the checking bonus.

- Promo code=PSJ300CIS

Key Terms

- Offer valid through June 30th, 2025.

- You are not eligible for this offer if you were an owner or co-owner of a Bank of America personal eligible checking account within the last twelve (12) months.

- Fiduciary accounts (e.g., trusts), Bank of America Advantage SafeBalance Banking® for Family Banking accounts, and business accounts are not eligible for this offer.

- The new checking account must be owned or co-owned by one or more individuals only.

- Offer limited to one incentive per client.

- Clients must have a U.S. domestic address (this includes Puerto Rico and P.O. Boxes) to qualify for this offer.

- New money is money not currently or previously held in other accounts at Bank of America, Merrill, Bank of America Private Bank, or retirement plan accounts administered by Merrill or Bank of America.

- The value of this bonus may constitute taxable income to you.

Quick Thoughts

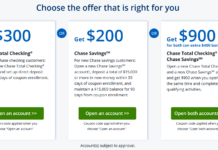

The nice thing about this checking account bonus is that it’s very simple: open an account and receive $2,000 or more in direct deposits within ninety (90) days of account opening. There’s no requirements that the money stays there, although it might be worth keeping the balance at $500 until you receive the bonus in order to avoid the $4.95 fee.

We have seen a Bank of America personal checking bonus of $500 recently, but that came with the requirement to deposit $15K and leave it for a couple of months. This $2K threshold will be easier for many folks, provided that they have an appropriate direct deposit method.

By far, the easiest account to keep fee-free is the SafeBalance. The monthly $4.95 fee is waived if you

- Are under 25

- Maintain a $500 balance

- Have BOA Preferred Rewards

The other two accounts more bells and whistles, but also higher maintenance fees and higher required minimum balances to waives them. In my opinion there’s little reason to mess with them.

Opened the boa checking in Nov 2024 and collected the $300. Kept it open. Below 5/24 and years of no boa card applications. Applied for Alaska biz Feb 2025, no dice due to ‘too many recent cards’. The rule about 7 accounts in the past 12 months is not being honored. Would be interesting to hear experiences from other readers.

Tim, as a newbie to the checking/savings account bonus world….where can I find a clarification of the methods to fund an account with Direct Deposit. I went to your link for AN APPROPRIATE DEPOSIT DIRECT METHOD but I need some guidance here exactly what am I looking at and how to proceed.

Thank You for your response

The Doctor of Credit list is a compilation of anecdotal evidence for what Bank of America has (and has not) counted as “direct deposit.” The list is not a guarantee, as some of the data points are dated and it’s all subject to change, but generally speaking, more positive data points means a given transfer is more likely to be counted.

I don’t know what you mean by “appropriate.” If it works, it works. If you’re concerned about using one of those methods, you could arrange for an existing direct deposit (e.g. your paycheck) to go to your Bank of America account. Of course, that’s not strictly guaranteed to work either…

Can i fund w/ a cc?