| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

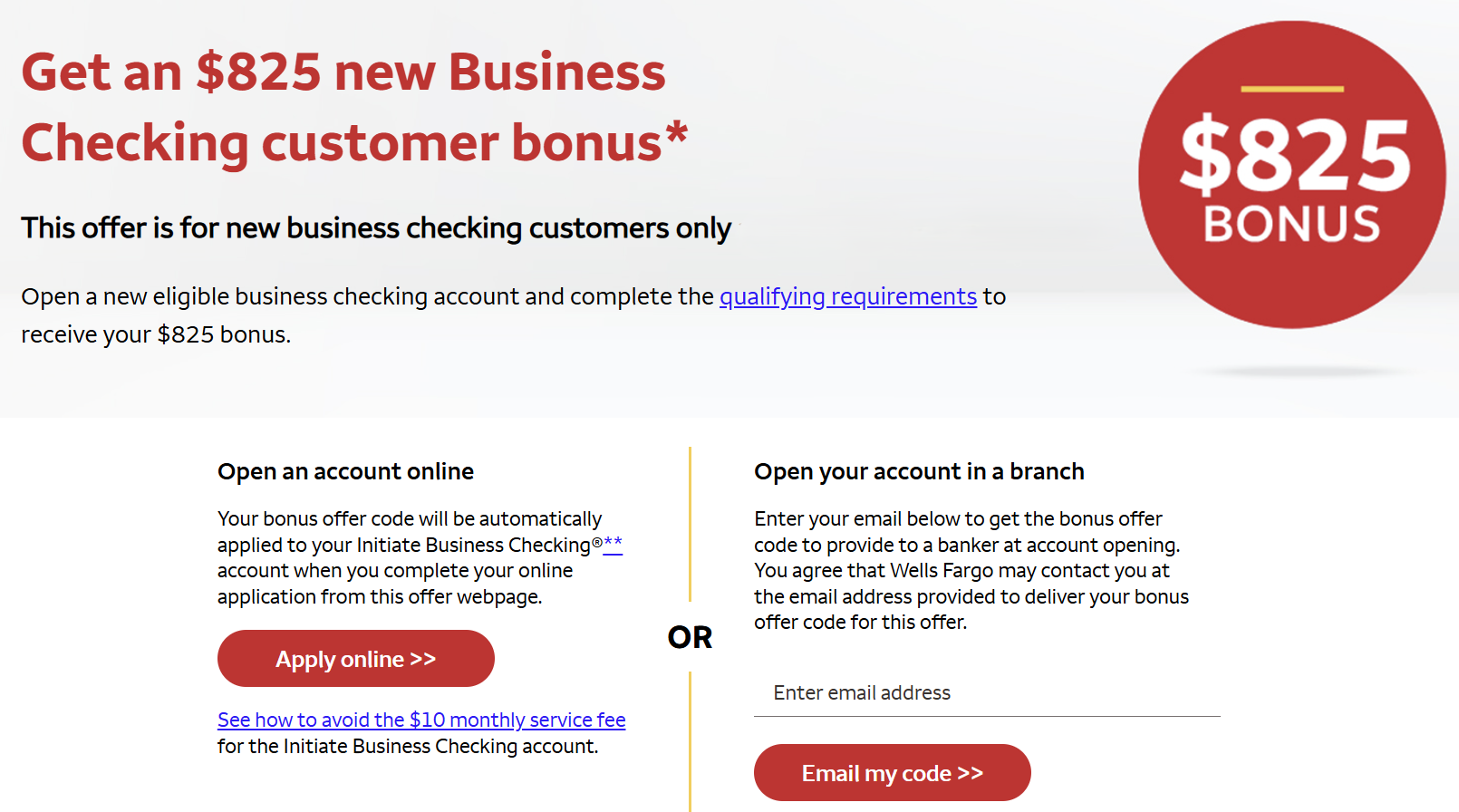

Wells Fargo has extended an excellent promotion for new business checking account customers. There are two offers, and both are available online or in branch. The first offers a $400 bonus when depositing $2,500 and maintaining that balance for ~30 days. The second requires a $25,000 deposit and provides a larger bonus of $825. Both versions expire on 1/6/26.

These are excellent options for folks with cash on hand. This is a deal that I’ll be taking advantage of.

The Deal

- Wells Fargo is offering a $400 bonus when opening a new savings account, depositing $2,500, and maintaining that balance for a minimum of 31 days.

- Expires 1/6/26

- Wells Fargo is offering a $825 bonus when opening a new savings account, depositing $25,000, and maintaining that balance for a minimum of 31 days.

- Expires 1/6/26

In order to receive the bonus, you must:

- Open a new Initiate Business Checking account from the offer webpage or in branch using an offer code by January 6th, 2026.

- Deposit the required amount by day 30 after account opening and maintain that balance until 60 days after account opening.

Terms and Conditions

- This offer is for new business checking customers only. All account applications are subject to approval. Only the business entity is eligible for this offer.

- The bonus offer code must be used at account opening.

- Only a Wells Fargo Initiate Business Checking®, Navigate Business Checking® or Optimize Business Checking® account is eligible for this offer.

- A business entity is not eligible for this offer if:

- The business entity is a current owner of a Wells Fargo business checking account or has closed a Wells Fargo business checking account in the past 90 days.

- The business entity has received a bonus for opening a Wells Fargo business checking account within the past 12 months.

- The business entity is owned in whole or in part by a Wells Fargo employee.

- Once the 60-day qualification period has ended, we will determine if you have met the offer requirements and will deposit any earned bonus into your new business checking account within 30 days.

- The new business checking account must remain open throughout the qualification period and be open at the time we attempt to deposit any earned bonus payment. Please note that an account with a zero balance may be closed by us without prior notice, as further described in the Deposit Account Agreement.

- You are responsible for any taxes due on the bonus. We will report the bonus as income to the tax authorities, as required by applicable law. If you are subject to backup withholding at the time of payment, we may withhold the required amount and remit to the tax authorities. For additional information, consult your tax advisor.

- Offer cannot be paid without a valid U.S. Taxpayer Identification Number (Form W-9 for U.S. persons, including a resident alien). Non-resident aliens signing Form W-8 are not eligible for the offer.

- The monthly service fee for the Initiate Business Checking account is $10. The minimum opening deposit is $25. Avoid the monthly service fee with one of the following each fee period:

- $500 minimum daily balance

- $1,000 average ledger balance

Quick Thoughts

Based on the terms, you only have to leave $2.5K or $25K in the bank for ~31 days to get the bonus. This is because you have to deposit $25 initially and then add the remainder within 30 days from account opening. Then, you have to maintain that balance for 60 days after account opening.

It’s important to note that the net upside is a bit lower than $400 or $825. There are plenty of ways to get ~4% interest right now with savings accounts, CDs, and T-bills, so you’re effectively losing 31 days of interest on the money that you put in. Given that, the opportunity cost is ~$100 for the $25K option (or ~$10 for the $2.5K), making the incremental gain closer to $725 than $825.

That said, the larger bonus still corresponds to a ~40% annual interest rate, an incredible return. At the same time, there’s a minimum time commitment and more flexibility with your money. The smaller version is simply a no-brainer if you have $2,500 that you can free up for a month.

Wells Fargo runs a very similar promotion periodically with its personal Way2Save accounts, but the bonus is only $525 for a $25K deposit requirement, AND you have to keep the money in the account for 61 days instead of 31. This business checking offer is vastly superior.

Do note that there is a $10 monthly fee, which can be waived only with a $500 minimum daily balance (or a $1K average ledger balance). That’s obviously not an issue when you have the required amount in the account, but remember to factor it into the deposit or add $500 initially to avoid the fee being deducted in the first month.

Regarding the $2500 balance. It says “Deposit $2,500 or more to your new business checking account by day 30 and maintain a minimum daily collected balance of $2,500 through day 60 after account opening.”. Does this mean if I deposit $500 on Day 5, and then $2500 on Day 29, will it average my daily balance from Day 1 or only starting on Day 30? In other words, do I need to put $5000 in on day 30 to ensure I have the $2500 daily balance average? Or am I taking the text too literally?

Is the $400 offer for savings or checking? The link is to a business checking, post says savings.

Looks like the $825 offer was pulled early?

Anyone know…does a ACH transfer from a WF business checking account to a SoFi checking account code as a Direct Deposit for SoFi checking sign up bonus requirements. I was just about to open a Chase bus. checking account because I know those do, but a WF account would be easier.

Applied as a sole proprietorship with SSN.

“Based on the info you provided, we are unable to issue a bank account online.”

Ends Jan 6 now.

Are business checking accounts as loose with the definition of business as credit cards are? Definitely interested in the offer, but my novel is still in the conceptual phase 😉

Is CC funding of initial deposit still possible on these? Would pair nicely with a new Ink.

I presume there’s no problem doing this at the same time as the Wells Fargo personal checking $400 bank bonus (just opened that today for P2 and myself). I did receive a Wells Fargo Business bank bonus but that was in 2022 so I assume I’ll qualify for this one

Got a flyer for the $825 bonus when I saw this online too so applied.

I did some Bank Bonuses last year and got tax statements for them. I think the tax law is if over $500 or $600? I’m wandering if going for the $400 one is maybe closer to a better option than it looks if it flies under the tax laws (of course relative to your tax bracket, etc.)

Bank Bonuses are treated as interest. Expect a 1099 no matter how big or small.

Most banks won’t send a 1099 for referral bonuses unless you earn $600 or more in total referrals.

But checking account bonuses always get a 1099. I still find them worthwhile — it’s easy money — but yes, it is taxed as income.

The new $400 bonus offer only requires $2500 deposit and hold, so it’s even better (Not $5000 as described).

Yeah, was just going to write that the $2500 may be targeted. I received that offer.

Wait, aren’t we supposed to be using spare cash to buy the dip in the stock market???