Via an email sent to members and a separate press release, Bilt Rewards has announced a change that most folks have long expected: next year, it will be ending its relationship with Wells Fargo.

Wells currently issues Bilt’s Mastercard, but a leak last year seemed to indicate that it was less-than-thrilled with the money it was making (or losing) in the deal. Now, Bilt will be changing credit card issuers for the third time since its inception, this time to Cardless, an oddly-named company best known as the home of credit cards for foreign airlines and (formerly) sports teams.

Bilt says that the change will come in February of 2026 and, as part of it, the company will also be adding a new premium card with an annual fee of $95 and an ultra-premium $495/year card. No details for either card have been announced.

Bilt also indicated that 2026 may be the year that it finally starts providing a pathway to earn Bilt points on mortgage payments. It just raised an additional $250 million in capital, with $100 million of that coming from United Wholesale Mortgage.

Quick Thoughts

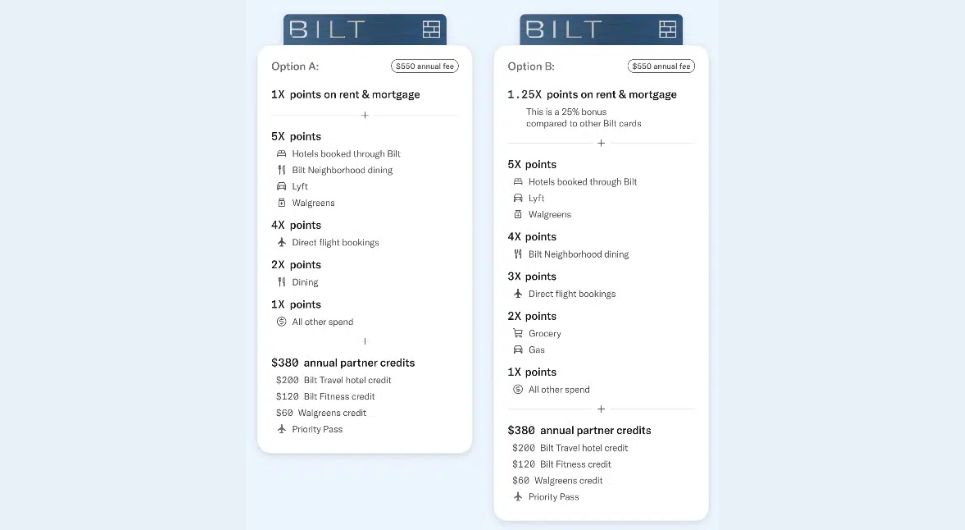

None of this news is terribly surprising. Bilt has been moving towards issuing rewards on mortgage payments since its beginning, and last year sent out a survey teasing a three-tiered card portfolio with two options for what each card would look like.

In the survey, the $95 card had options like:

- 5x points on Bilt Dining, Lyft, and Walgreens

- 3x on dining (or 2x on dining and gas)

CouponsCredits for Bilt Fitness, Bilt Hotels, and Walgreens

The ultra-premium card listed possibilities like:

- 5x on Bilt Hotels

- 4x on flights or Bilt Dining

- $200 Bilt Travel hotel credit to go along with Bilt Fitness and Walgreens credits

- 1.25 points/dollar on rent and mortgage, in comparison to the other two cards’ 1x

- Priority Pass

None of those benefits have been confirmed as of yet, but the structure of each card will likely end up in that “neighborhood.” On their own, I don’t find either one to be incredibly compelling in comparison to the no-annual-fee card, especially given the understandable emphasis on bonus categories and credits going through Bilt Travel, Dining, and Fitness.

That said, depending on how the mortgage rewards program is set up, there could be a terrific opportunity for some folks to double-dip rewards through both Bilt and the Mesa Homeowner Card (if it’s still around), which would be a delicious development.

No one is shocked to see the Wells Fargo/Bilt partnership end; it seemed like a matter of when, not if. Interesting to see Cardless as the issuer, as it’s been a fairly minor player up till now, the Qatar cards are probably the most interesting product for the majority of us. I imagine that Bilt wants to have more say in its rewards program and credit card(s) with less friction, going with an issuer like Cardless probably helps it accomplish that.

When Bilt moved from Evolve to Wells Fargo, current cardholders had to reapply for the same card, resulting in a hard pull and a new account on their credit reports. Hopefully, that’s not the case this time around.

As a renter this card is a nice unexpected bonus with minimum spend to qualify for x1 rent points. Literally you only have to make 5 transactions a month, no minimum dollar amount. I make all of mine on the 1st each month (rent day double rewards). I don’t really see the points being competitive with other rewards cards so it doesn’t get any of my spending the rest of the month.

At the end of the year I basically accrue enough points for a week at a 4 star hotel, which after doing the math is the best value in my experience. So it’s a nice bonus for very little effort or spend. Without more competing rewards they won’t see any more of my money and I don’t see the math adding up for me with either of their annual fee cards.

Why are bloggers spinning Bilt booting WF, this is an insult to our community….we all know what really about……………………Richard?

The Bilt/Blogger relationship has smelled like rotting fish since day one. And no I am not upset I wasn’t invited to that party day 1.

I can’t speak for “bloggers,” but I can speak for this post since I wrote it. There was no attempt to “spin” anything, simply reporting what was happening and what the consqeuences would be for the community, and combine it with a funny-ish image. The WSJ article came out after this post, so I couldn’t cite it.

We’ve reported several times (and did a full podcast episode) on Wells’ disatisfaction with Bilt and the money that they were losing because of it. We also predicted that the partnership would end sooner than later as a result, probably at Wells’ initiation. Regardless of what happened behind the scenes, the results are the same.

I continue to be baffled by the control that some folks seem to think Bilt (or Richard Kerr) have over what we publish. It’s so far from the truth that we literally laugh about it.

Sorry I am not buying it

Totally wrong. WF is ditching BILT after big losses.

https://www.wsj.com/finance/banking/wells-fargo-plans-to-exit-a-credit-card-program-that-gave-rewards-for-rent-336dae4b?mod=Searchresults_pos1&page=1

Ok – I’m getting a little tired of this roller coaster!! I was one of the original Bilt cardholders then had to burn a 5/24 spot to REAPPLY for the WF card – which I got but at less than half the credit limit. If I have to burn another slot to reapply – well I just don’t know. I don’t have a mortgage and don’t know if a mortgage on a second home would apply. Otherwise having rent day bonus points reduced to 1000 is a bummer and achieving platinum status has gotten really hard. This card started out as the golden ticket but keeps losing value.

Agree!!!!!!!! 100%. If they make us reapply again and burn another 5/24 slot I’m going to fudging drive to wherever he lives and pee in Richards rose bushes.

Wells is booting Bilt

Exactly. Finally, someone gets it.

Bilt has been good to me, and the points are super desirable. However, I’m a little concerned about the move to the tiered cards and to Cardless. In the survey, I wasn’t super keen on any version of the card offered at the price point. I’ll likely still be a customer, but I’ve been looking for ways to put more spend on the card that makes sense. The shuffle could make that more complicated. I just don’t see a world where I’m not having to make a hard choice to take a bit less earning to get a type of currency I really desire.

Isn’t Walgreens going out of business? They should replace this with something else.

Rite Aid is OUT of business.

I’m just not seeing anything compelling about the new cards. Are there some decent bonus categories? Sure but nothing that wows me.

I’m a little surprised about the change to Cardless right now. Not because the prior relationship with Wells was going so splendidly but if Bilt was doing so great and Wells only made money through their investment in Bilt then Bilt should have ridden out at least a few more years of their contract. Why ditch a contract that benefits you?

Other than “points on rent” the current card isn’t too compelling. The weird 321 setup they went with doesn’t encourage much spend.

Isn’t the 321 setup more or less a clone of the CSP?

Where I see it struggle with hobbyists is no ecosystem of other cards around it – to your point I put a lot more spend on my Chase Freedom Flex and Ink Cash cards than on my CSP. Bilt seems like their main target is folks who only want 1 – 3 cards and not to think about it too hard. There are readers here who’ve gotten value from their card but I think Bilt as a company could care less if most of the optimizers from FM don’t get a card with them.

yeah. So I if I ever get a BILT card, I can go to Cardless. Frees me to get a WF Journey!

Biggest things for me to watch are requirements/mechanics to earn on mortgage and also if the no fee card gets the 1.5x everywhere option the survey had.

I’ll be curious how similar it is to what’s needed to earn on rent and how rent payments work. Need to make sure it’ll work for us.

Then also, a no-fee 1.5x everywhere Bilt card would be super compelling to me. I think I might value 1.5x Bilt points over the 2x BBP or 2.625% BofA for my go-to “everything else” card. My guess is they won’t go with that option from the survey, but I’ll be very interested if they do.

They said they were looking at extending the 3x rent thing they have with Alaska. To other transfer partners that have co-branded cards. I hope so.

A straight 2x for their basic card like the C1 Venture would be nice.

if it was 2X on rent I would do the $495 card all day

I’m not certain that was one of the choices in the card holder survey.

The Mesa Card keeps looking better and better at this point.

To me, making sure I spend $1,000 every month on that card is not worth earning (for me) around 4,500 Mesa points per month with the mortgage and spend earning (not even accounting for the opportunity cost of the 1x spend). I’m also often spending towards SUBs or other bonuses, and this $1,000/mo to track with everything else in this hobby is just a bit too much for a few extra thousand points a month.

It’s definitely a good deal, just doesn’t feel like the juice is worth the squeeze to me, and there’s so many other ways to earn better transferable points more easily.

Could certainly see it differently though if my spend and mortgage payments were higher. Or maybe if I had some “set it and forget it” recurring non-bonus expense that covered most/all of it. If so, it’d be awesome to double dip with Bilt, that’s for sure.

I have found this isn’t as hard as you may think when you put taxes, insurance, and utilities on the card.

Taxes I’ll give. For the others you may be passing up on some high bonus multipliers or offers from other cards in order to put that (legitimate) spend on Mesa. Wyndham Earner Business gets 5X utilities as do some of the rotating category cards (Discover currently giving 5% on it). Chase bonused insurance at 5X on Freedom cards this year. I seem to get frequent bonuses from US Bank for making two or three insurance/utility payments, get an extra $25 back/1500 points/etc, and have had a couple AMEX offers for 10% back on them.

Now if you’re talking overpaying – that could work if you have a cooperative company. Wouldn’t fly with my utility providers.

But how can new would-be cardholders apply? AFAIK they aren’t letting in new applicants right now.

Daycare expenses for the win in this card.

I don’t intend to apply for the $95 fee card, so I’ll be monitoring the terms closely. As long as I can transfer to partners with minimal spend (call it ~$250 per month non-rent) I’ll keep using the card. But if, for example, they remove the ability to transfer from the fee-free card (making it similar to, e.g., a Chase Freedom) then I’m likely out entirely, using the card only for rent and then using those points to save a few bucks each month on rent.

The kicker will be how widely Bilt will accept mortgage payments. The release says “We’re announcing our expansion into mortgage through direct partnerships with mortgage servicers….We will continue to expand with other mortgage servicers in the industry.” This says to me that they will only only give Bilt points for payments through their mortgage servicing partners. But, Bilt currently allows you to pay any rent (whether or not Bilt has a direct partnership with the landlord) for 1x Bilt points, so I guess they could theoretically do that for mortgages – but I doubt it.

Yeah, will be watching this. My hope is that out of network servicers can be paid via check/ACH. I think that’s how it works with the current card and rent, but I haven’t had the card before.