Update 9/26/25: Doctor of Credit is reporting that Citi is granting one-month extensions for meeting the welcome offer minimum spend to folks whose accounts have been locked due to a 4506-C request. That reporting is based on this reddit thread where one person said that they were automatically given a one-month extension without asking. There are numerous other data points in the same thread from folks who say that they were not given an automatic extension.

That said, I personally know one person who reached out to Citi after reading the DOC article and was given an extension upon request. If you’re in that boat, it might be worth a shot.

~~~

Doctor of Credit has reported on a concerning development for many new Strata Elite cardholders: Citi is locking the accounts of many recent Strata Elite cardholders and is requiring cardholders to mail in a 4506-C, which is a request for Tax Transcript form.

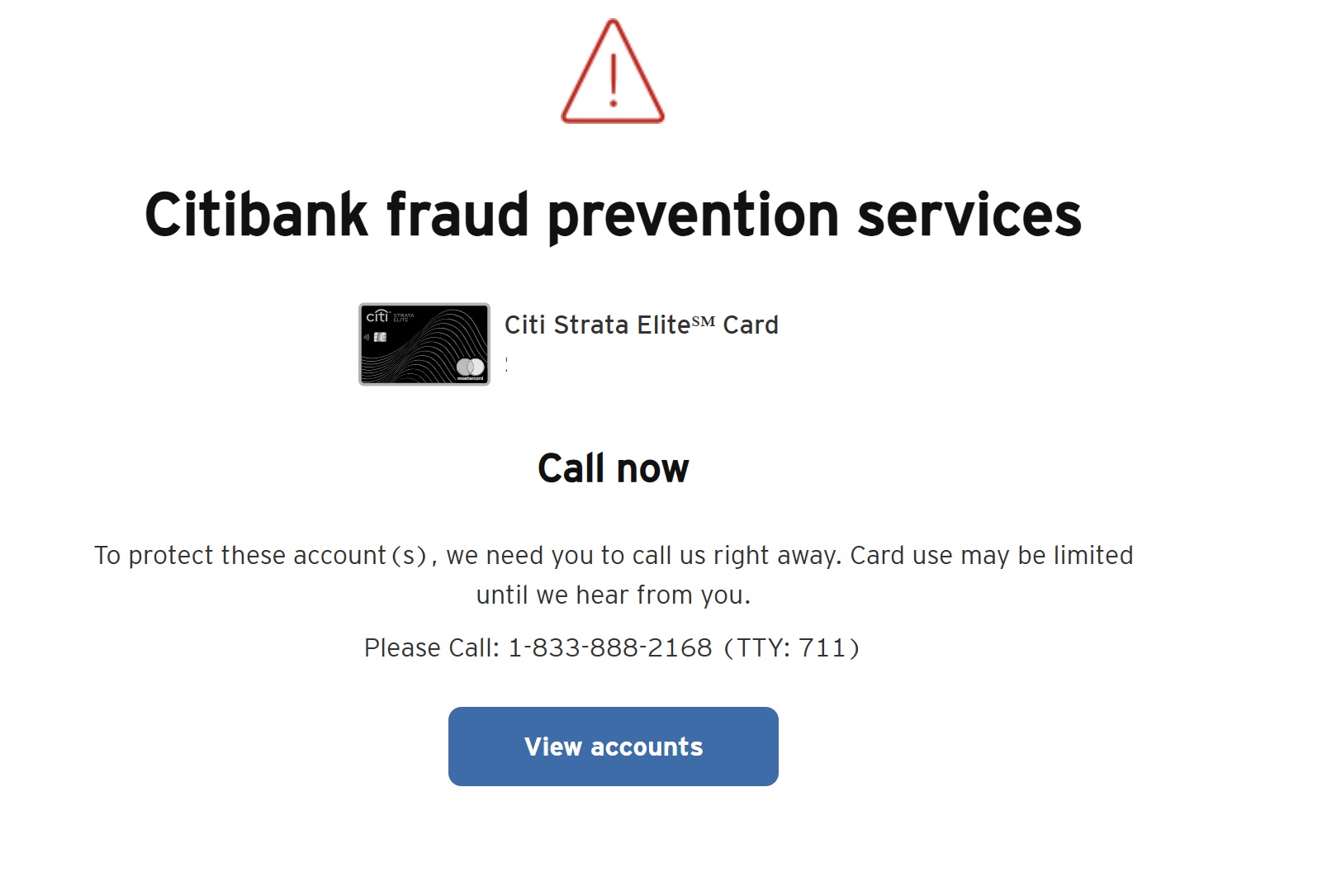

Reports started spreading around reddit last week that some cardholders were logging in to a message that their accounts were locked for fraud concerns and to call Citi for more information. Initial speculation had been that this was only affecting those who used an online link to apply for the Strata Elite 100K offer rather than going through a banker (some links had surfaced via reddit and Doctor of Credit that bypassed the need to visit a bank branch or call a banker to apply; some people had worried that those links were the trigger causing a review). However, we have seen data points both from people who applied online and in-branch who have had their accounts locked with a request from Citi for more information.

Amex is another issuer that occasionally requests a form 4506-C to verify income when they do a Financial Review (which typically happens when Amex wants to see proof that your income matches what you stated on the application and that you are capable of paying your bills). However, while not unprecedented, Amex Financial Reviews are not incredibly common. I certainly can not think of a time when there has been such a seemingly broad spate of them at one time as what we are currently seeing from Citi with regard to new Strata Elite cardholders.

As far as the tax transcript is concerned, it is obviously a method for Citi to be able to verify your stated income in order to accurately gauge their risk. It is obviously a heavily flawed method in the sense that your income at the time covered in your most recent tax return might not match your income today, you may have access to funds that aren’t included in your income, etc. Some people find the invasion of privacy to be a step too far. On the flip side, I would expect that those whose annual income at the time of last tax filing matches their stated income would likely be able to get their accounts unlocked by providing the form (though this is early in the process, so we don’t yet have a fuller picture as to the resolution). If you do not provide the form, it seems likely that Citi will close your account.

One thing I don’t know is how the ability to redeem points will be affected if you choose not to provide the form. New York State residents have some legal protection regarding the redemption of rewards for 90 days after account closure, though I believe there is a provision in the law related to points that were fraudulently earned. I don’t know where an account closure for refusal to provide the tax transcript would fall.

Further exacerbating things is the fact that folks who had opened the card but had not yet completed the spend likely do not yet have the points. It sounds like Citi is mailing tax transcript request forms to those who call in, though I’ve seen some data points that you may be able to find and download the form within your secure message center if you’re able to log in to your account. Either way, with Citi’s requirement to complete this process via snail mail, there is the potential that the window in which to meet minimum spend requirements will be severely impacted for some folks.

Overall, this is frustrating and concerning for new cardholders. Hopefully, Citi can clean up this mess with minimal impact to those whose accounts are ultimately unfrozen. Unfortunately, those who do not provide the form are likely to burn a bridge with Citi, so you’ll want to consider your options carefully.

My daughter applied for the 100K offer, instant approval, she tried to use the card and was told she needed a tax verification. She didn’t do it, Citi send an email about 1 month later and said turn i the tax form and we will waive your first year annual fee and give you the 100K SUB with no spend!!

This situation is absolutely absurd the way they’re handling it… I got locked up and spent about 20-25 minutes on the phone with them while at a store trying to be able to check out. After all that all they would say was that I’d be receiving a letter in the mail in a week and then after responding to that I might be able to get my account turned back on like 30 days later.

1) If this was/is important, they should’ve asked for it upfront before approving the card application.

2) If they meant to do the tax transcript as a pre approval check and just really goofed up, send letters out and tell people they need to respond, but give them several weeks to actually do so before their cards get frozen…

3) Mass freezing cards right in the middle of SUB periods feels almost like a dirty trick and actually makes me slightly wonder if that was in anyway intentional to reduce the SUBs they have to pay.

Curious if the folks getting locked are the ones that called a branch or used a link online to get the 100K offer. I wonder if that offer was only supposed to be made to folks with a certain income level and random emails and links didn’t verify that. Could be wrong, but that seems at least plausible.

P1 and P2 used that shetchy chinese link from DOC to get 100k. Neither of us had the issue

Has anyone applied rcently and not got this 4506-c request?

I just had my 5 Citi accounts finally unlocked yesterday.

Rep told me yesterday they are reviewing 50,000 strata accounts due to an application issue on Citi’s end which was fixed by mid September. This is a team of 50 that normally gets a few calls per day per rep and now this is all they do all day every day and are not having fun haha.

https://www.reddit.com/r/churning/comments/1n8f77t/citi_strata_elite_4506c_alert_megathread/

Both P1 and P2 applied using 100K link. P1 no issues, P2, not so much.

We used the (semi) pre-filled form they sent in mail, but the included instructions were inadequate and incomplete. The credit management rep we spoke to stated that we needed to check box 6a, enter 12/31/2024 in box 8, and make sure to check the signatory attestation box above the signature box. The form will be rejected if this isn’t done. If married filing jointly only the person getting flagged needs to be included on the form. If anyone tried to sign electronically, I would call to verify if that’s acceptable.

The rep also stated that, despite the wording in the instructions, this is NOT for income verification. If that were the case the system would have flagged the application at the outset. I asked specifically about that because I assumed that the income number for tax year 2024 was going to be different than current. By sheer coincidence the number we put in the application was within $400 of the income on our 1040 for 2024.

Also, assume that you will get more mail demanding an SSA 89 form (SSN verification) if you have co-branded cards from retailers like Macy’s. Happened to P2

I was told the opposite: that the exercise was for income verification, not identity verification. Someone in the media needs to push Citi to be transparent.

The fact that we got a letter requesting an SSA 89 form makes me think that this is probably “know your customer” related. I just wonder if someone at Citi saw something and hit the KYC panic button or if it was an automated/programming process that precipitated this cluster. Regardless, it’s costing them dearly.

Happened to me as well. All I want to do now is close the account. Away from home and they will not send form anywhere else. Great ‘premium’ card. I guess you can’t travel if you have it. Garbage.

Quite. They also seem to want to have the form returned to a PO Box, so anyone travelling who somehow does get the form and wishes to return it has no address that can be used for Fedex/UPS or similar.

This must be the worst launch of a “premium travel card” that already had its issues.

The bigger issue is that they lock and threaten to close all your card accounts because of whatever the issue is (which seems likely to be Citi’s own failure).

CFPB complaint may, at least, get some transparency.

What CFPB?

If Citi is a garbage bank, I can see that you wouldn’t want to business with them. And, I can see that all you want to do now is close the account. You ought to call Citi and do just that. You don’t need them. Spare yourself the trouble.

Jack, There’s a reason why it’s own employees refer to it as “Shittybank.”

I have now had all of my Citi cards locked since my Citi ES was first locked last week. I overnighted the form today, have been told that one form is sufficient for all accounts. Process will take up to 30 days to complete.

I would love to know how much money Citi is losing from swipe fees with this fiasco.

Only a fool would take a Citi or AMEX card as their goto card when travelling abroad. Nothing like a good account lockdown to make your day if you are on extended vacation overseas.

Oh I still use my Strata Premier as my go-to card internationally because of the excellent bonus categories. I always carry backup cards from other banks, but I would do that anyway.

Most in this community know it’s best to have at least 3 cards (I bring 5) from different issuers (Chase, Bofa, Amex) and using different networks (Amex, Mastercard, Visa) but there are a lot of people who don’t follow this community and have just 1 credit card they bring.

Annoying? Yes.

Overreach? Yes.

Bunch of liars on their income? Also yes.

Can someone please post the address and information that Citi puts on its forms so that I can use the IRS form? I am out of the country and want to upload a signed form to the CFPB. Thank you.

What CFPB?

I just got off the phone with a Citi rep. I called the 800-695-5171 reconsideration line and had my Citi Strata Elite application approved (just needed to verify myself via a phone call-back). I expressed my concern that people who got the Strata Elite card have reported having their Citi accounts locked. He said, paraphrased: “I’m aware of that. The situation has been resolved. Although, we may still be in the process of unlocking some of the accounts that were locked. I’m not able to give more details.” I pressed further, asking if there’s a chance I’ll be required to do tax return verification, he said: “No, that situation was resolved. It shouldn’t happen to you, unless something very weird comes up.”