NOTICE: This post references card features that have changed, expired, or are not currently available

Acorns is out with its monthly referral offer for its micro-investing platform: get 11 friends to sign up and make their first investment of at least $5 by 11/30/18 and you’ll get $1,100. While it might not be easy to get 11 friends to join the platform, it’s worth trying to get your squad together if you have friends/family interested in making an easy buck. You might even offer to split the cash with Team You so that each person who invests $5 gets a $100 piece of the pie — not a bad return on five bucks in a month. Promos like this have historically been open as soon as you’ve signed up, so if you’re new to Acorns you will likely be able to participate in this after opening an account. In this post I figured I’d also go into more detail about how I’ve done with Acorns in the first year for those curious.

New to Acorns?

If you’re new to Acorns, feel free to use one of our referral codes with our thanks – you’ll get $5 as will we when you invest at least $5:

See full terms of the current referral bonus here. In a nutshell, if you get 11 friends to sign up and invest their first $5 by 11/30/18, you’ll earn an $1100 bonus invested into your account on or around 12/15/18.

Acorns background

For those unfamiliar, Acorns is a micro-investing platform. We’ve written about it many times before. Here are some posts where you can read more about how it works:

- (EXPIRED) Huge $1,000 bonus for referring friends to invest (although the bonus offer in this post has since expired, I wrote comprehensively about Acorns in this post and so it’s a great starter post to read.)

- [Expired] Acorns Promo: Refer 5 Friends, Get Share Of $100,000

- Get Free Money From Acorns Found Money & Boost Your Savings

- 60+ retailers where Acorns Found Money offers the highest cashback (some of these rates have changed, but they’ve also added many new partners since that post was written. Airbnb, Hilton and Zappos are some of the most notable Found Money partners.)

- Acorns: Get $20 For Sam’s Club Membership, Stack For $18.15 Profit

My results almost a year in

I’ve personally used Acorns for almost a year now. I wouldn’t say that Acorns is the best micro-investing platform out there – I’d say it’s good to get started investing and/or for folks who wouldn’t invest at all without some small incentive or help like the round-ups they offer. If you’re just curious about the very basics of how Acorns works, see the first post under “Acorns background” above as it includes more explanation than I’ll rehash here.

The Acorns app shows I’ve posted a net loss this year, though the information is so scant that it’s not immediately clear exactly how my total gain / loss is figured (you have to click around an interpret a bit). That said, I figured it might be worth showing my results thus far for those interested.

Overall, I haven’t exactly lost money even though my portfolio is down — I earned one large referral promotion early this year for a $1,000 bonus (which I cashed out to my bank account immediately without issue) and I have since picked up $5 here and there from readers who have signed up using my link (a gracious thanks to those of you who have!). I have left those $5 bonuses invested as well as dividends I have received ($0.29 here and $0.42 there).

Here’s what my numbers look like starting from January of this year and not including the thousand dollar bonus I cashed out:

- $200: Initial investment

- $220: earned from $5 referrals over the past year

- $5.00: earned when I opened my account and funded with at least $5

- $5.32: dividends earned

$430.32 “invested”

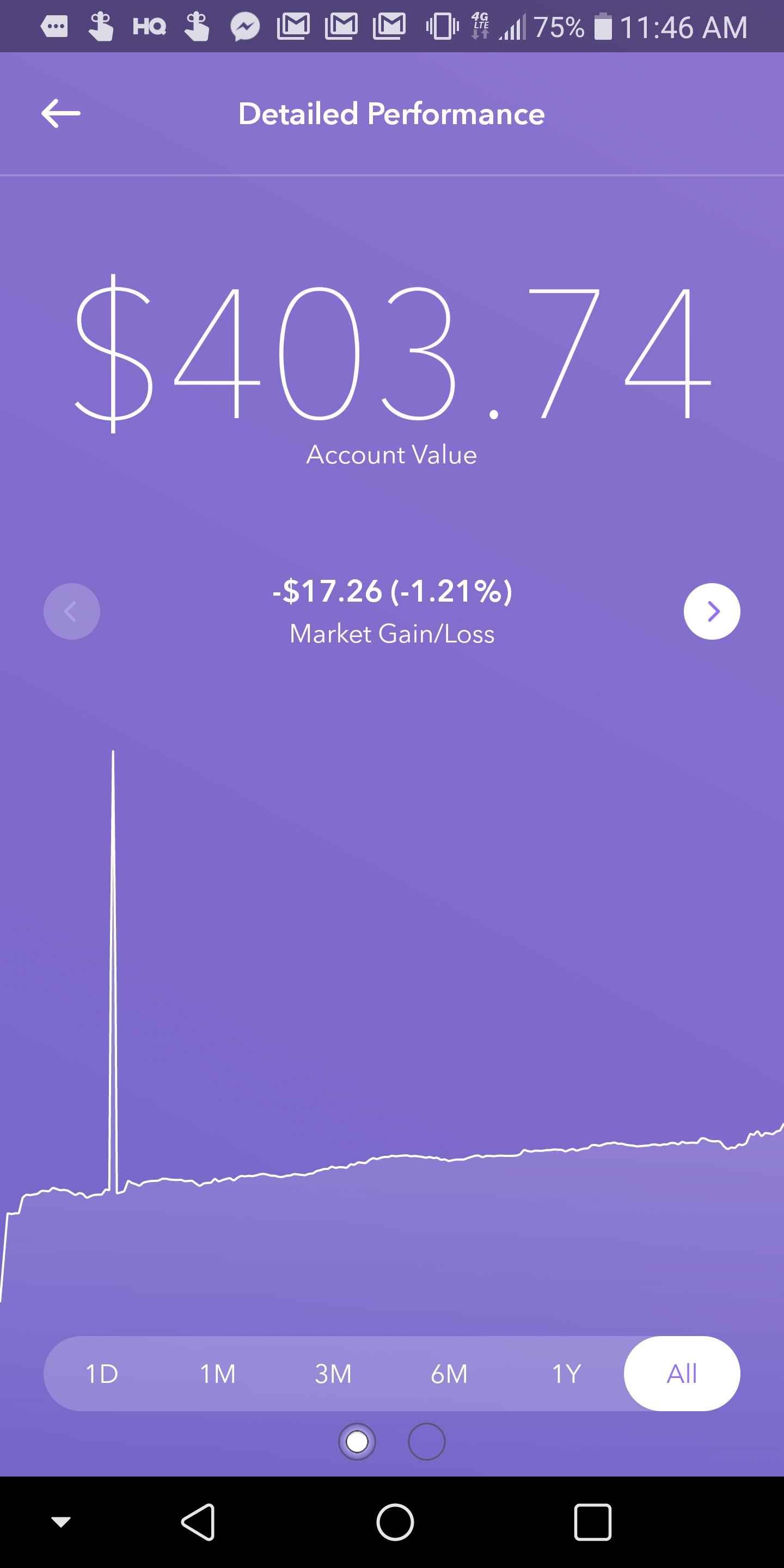

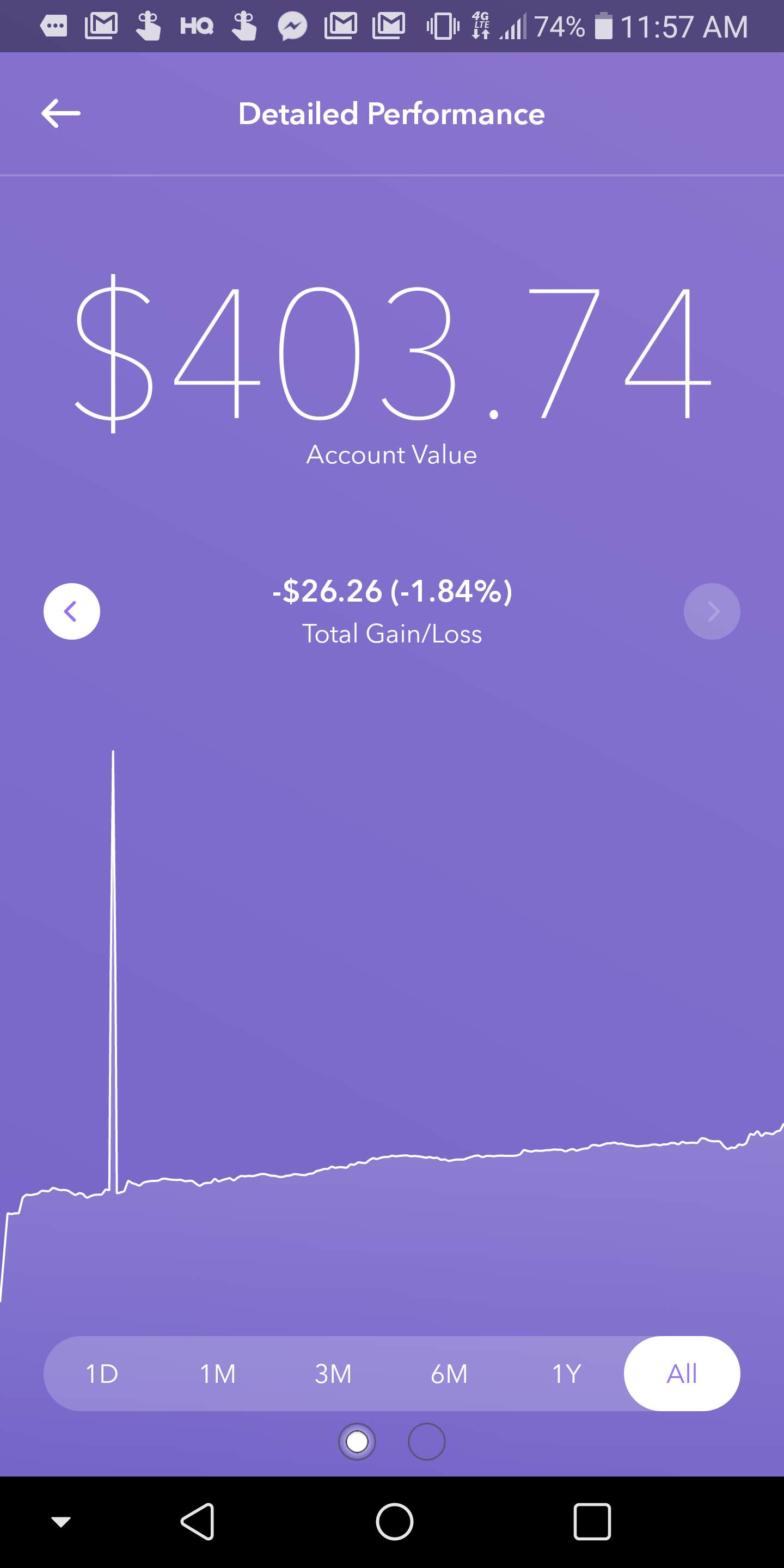

My current total account value is $403.74.

Acorns lists the Market Gain / Loss as -$17.26 (-1.21%).

The “Total Gain/Loss” is -$26.26 (-1.84%) because of the fact that Acorns carries a $1 monthly fee (which is certainly on the high end — but since they gave me $5 when I signed up and I’ve picked up some referrals along the way, I’ve taken the $1 hits without complaint).

The part that makes me cringe a bit is the percentages. While not really inaccurate, they paint a somewhat misleading picture about my investment performance with Acorns. Since I earned that $1,000 bonus at the beginning of the year, Acorns is looking at my porfolio as though there has been a total investment of $1,430.32 and a total loss of $26.26 — which represents 1.84%. That’s certainly true…technically. And it’s why I absolutely can’t complain about the $26 loss — for putting down $200 to start, Acorns has undoubtedly been a huge win for me.

But it’s not really an accurate picture of how my money has performed from an investment standpoint. I withdrew that $1K bonus within days of it posting to my account, so that money likely had no material effect on gains/losses. That means I’ve really lost $26.26 on $430.32. That’s really a loss of about 6.1%. If I ran this analysis a month ago, the result would be worse as I did pick up a few referrals last month. I’m no investment expert, but I’d say performance has been fairly poor when looking at it that way.

Of course, as I noted above, Acorns has been a huge win for me because of their constant referral bonuses — so truth be told, I’m not terribly concerned with the investment angle.

And really, that’s the lens through which I view Acorns: it’s a great platform for earning outsized value from referrals moreso than from investments. It can also be a good platform for earning “Found Money”, whether through card-linked offers or their shopping portal-like offers – Stephen has written about the many instances where Acorns Found Money can present better value than other shopping portal options (see the posts under “Acorns background” above). And if you’re the type who wouldn’t save without round-ups, it can be good for encouraging you to save (I opted out of round-ups). But if your only goal in singing up is to invest regularly and earn money doing it, this app probably isn’t the best for that based on my personal experience and opinion. You can only pick things like an “aggressive” portfolio or a “conservative” portfolio — you don’t have much control or visibility into what you’re doing, so there is no ability to fine tune or adjust really.

But if you have a group of friends willing to pitch in five bucks each, you can essentially cover your losses for a while to see if the found money options or referral promotions work for you. Some months, you only need to refer 5 friends (for a smaller bonus), others you might need to refer a dozen — though even if you only refer 2 here and 4 there (as I have mostly), you could still be well ahead of the game by the end of a year. Most people won’t have an unlimited supply of friends and family to keep referring, but you might be able to take advantage of a bonus or two and then either leave your money as a set-it-and-forget-it situation or cash it out if you prefer. I see Acorns as a winning proposition if you can even occasionally refer friends.

Bottom line

My investment results with Acorns haven’t been terrific, but the returns they offer through referral promotions and Found Money can more than make up for that if you have friends or family you can convince to invest. When you sign up and invest five bucks, they give you five bucks, so it’s an instant double which covers the fee for a few months anyway. At this time of year, you might even try an angle like, “don’t buy me anything for the holidays — just invest five bucks in yourself and double your money immediately”, which isn’t an altogether bad idea . . . .

Here’s an additional tip: If you sign up with a “.edu” email address, you waive Acorn’s fee for 4 years. No catch.