NOTICE: This post references card features that have changed, expired, or are not currently available

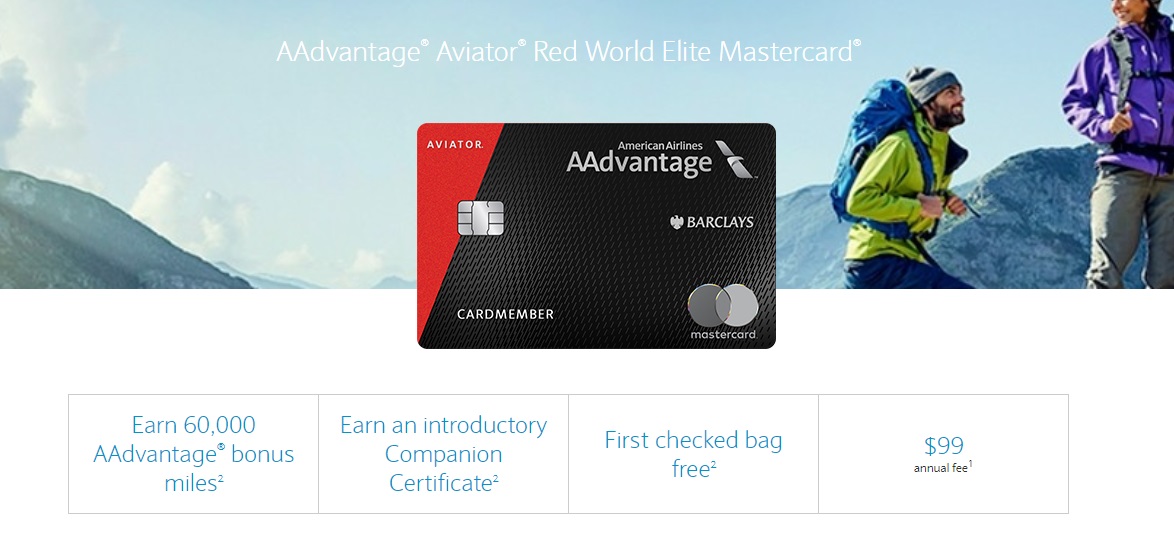

The Barclays Aadvantage Aviator Red World Elite Mastercard is once again offering a $99 Companion Certificate as part of its welcome bonus. Getting both 60,000 American Airlines miles and a $99 Companion Certificate for making a single purchase paying the $99 annual fee continues to be a terrific value for those who can be approved.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

Quick Thoughts

As noted at the top, this card offers an excellent bonus when you consider the fact that there is no minimum spending requirement beyond a single purchase and paying the $99 annual fee within the first 3 months. The miles alone make this card a great deal; the companion certificate is icing on the cake.

That companion certificate is limited to round trip domestic flights in economy class and your companion will pay $99 plus taxes (from a total of $121), so it’s more useful to think of it as a companion discount. Still, there are times when that could come in handy and having it available beats not having it.

For those without an American Airlines credit card, keep in mind that one of the often unsung benefits of an AA credit card is the ability to book reduced mileage awards. While variable pricing means that those awards may not be the value they once were, there are times when you’ll save big with those awards (and in fact once in the last year I forgot about reduced mileage awards and overpaid for an award flight!). Another key benefit here is a free checked bag — and as you’ll see in our Free Checked Bags via Credit Card Complete Guide, you do not need to pay for your flight with your Aviator card to access this benefit (though you do need your AAdvantage number on the reservation — officially 7 days in advance, though I’ve had luck with travel booked within 7 days of departure as well).

Those who have or have previously had an Aviator card are unlikely to be approved. I am not sure how long an Aviator card needs to be closed in order to be approved again, but I’ve heard plenty of negative data points. I’d not expect to be approved if you’ve had the card in the past couple of years.

However, those who are eligible can score an easy win with this offer.

H/T: Doctor of Credit

I just got approved for this card like 5 days ago. Do you think they would match this offer?

I doubt it, but I know for sure that they won’t match it if you don’t ask.

they closed my prior aviator for inactivity 1 week ago, I applied and instant approval

If approved for the card, is there any chance you won’t get the bonus points (if you’ve had the card in the past)? Both my wife and I were approved recently. We both had the card (and bonus) about 3 years ago. Thanks.

READ my Post I GOT THE MONEY !!! This time day after post .

CHEERs

I’ve never heard of Barclays approving someone and not paying out the bonus.

I’m not getting that link to work to waive the AF. I entered 999999 and it goes through but the AF still shows as $99

Applied anyway, and got the “We are currently reviewing the application you submitted. If we need additional information to complete our review, we will contact you using the information you provided us. ” should I call the recon line now to push it through or wait for their decision (which may be “no”)

Well I just called 1-800-307-0341

Choosing option 2, (check on existing application) gives you nothing but a message saying you need to wait or check online. then hangs up

Choosing option 1, (new application) connects with a live agent who basically says the same thing, you just have to wait

I guess I’ll just have to wait!

Mine was old US airways transfer to the Red card, cancelled this Feb. am I still quality since I have applied the “new red card?

*haven’t

No, probably not based on all DPs I’ve heard.

if you’ve had one DEFINITELY don’t waste your time.

How long ago did you have one? I think it has been 2 years for me.

2 or at MOST 3 years ago I used then all on SYD 10/2018..I was surprised Barclays gave it to me but I had a 6 month old Hawaiian CC ..I bet u can call and find out the closing date .I called C1 and they told me the dates I applied for their card . Didn’t help me 3 applies 820 Fico their all watching us now .

Good Luck !!!

Don’t quote me, but I think the last person I talked to about this at the Chicago Seminars had closed over 2 years ago and still hadn’t been approved for a new one. There must be a time when it’s OK to apply again, but I haven’t heard the magic number yet.

Nick

IF he applies and gets turned does he have to @ least wait 6 months like C1 ? I think they had this offer a few times in the last 2 years.I applied as a joke.

CHEERs

At least two years ago. I have tried twice and both times got denied

Got the Hawaiian CC 4 years ago canceled in 11months.

Got the AA cc like 3 years ago canceled 11 months.

Got the Hawaiian CC again like 10 months ago.

Got the AA cc like 3 months ago .

I got instant approval on all . I just got an email from them u get an auto bonus of 5% @ 12 months on ur Spend Hmmmm.

CHEERs

If I have a Citibank aa card can i still get the miles bonus?

Of Course I got both (Citi AA) in one year (147K points) and the second time for Barclay’s AA card . First time a few years ago I went to McD’s and got a $.99 coffee and then Dumped the card in 11 months . I got this card the 2st time may keep both the retention points may be worth keeping them !!

CHEERs

Yes, absolutely.