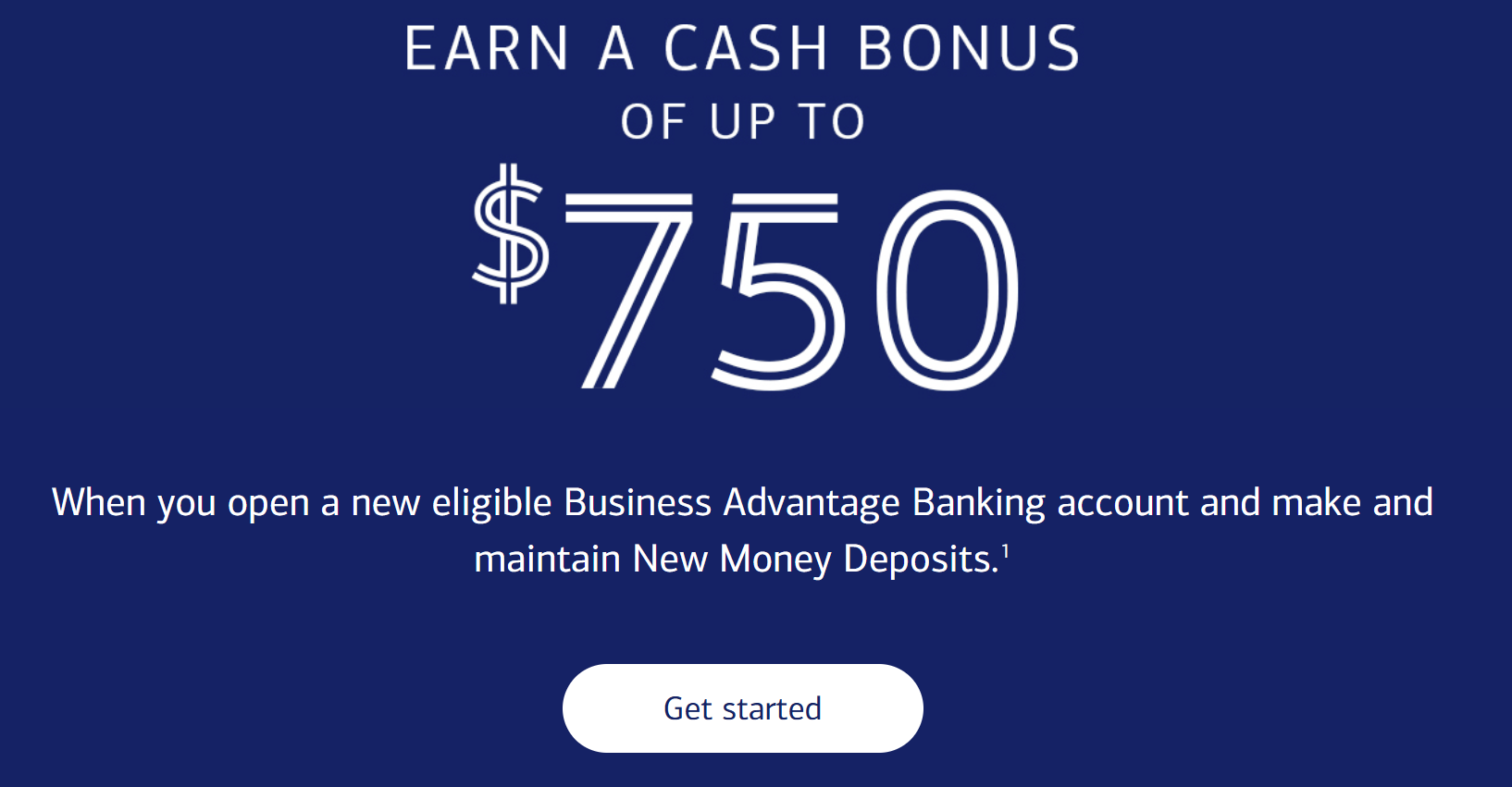

Bank of America is running another promotion for new business checking accounts that offers up to a $750 bonus with fairly simple requirements.

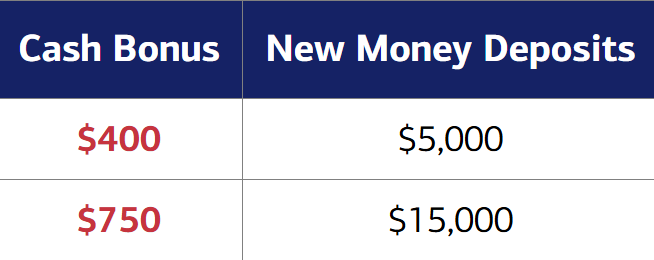

Deposit a total of $5,000 into the account within the first 30 days, maintain a minimum balance of $5,000 between day 30 and day 91 from account opening, and you get $400. If you deposit a total of $15,000 within the first 30 days and maintain the same $15,000 balance between days 30 and 91, you get $750.

Depending on what tier you take advantage of, this effectively works out to an interest rate of ~20-30% on the money while it’s there…which is pretty good.

The Deal

- Bank of America is offering a bonus of up to $750 with a new business checking account.

- Requirements to receive a cash bonus:

- Open a new Business Advantage Relationship Banking or Business Advantage Fundamentals™ Banking account by December 31, 2026.

- Deposit new money directly into that new eligible Business Advantage Banking account within 30 days of account opening (“Deposit Period”). At the end of the Deposit Period, all New Money deposits will be totaled to determine which Cash Bonus you are eligible for (see chart below)

-

- Maintain the same average balance (or more) during the Maintenance Period** into the new Business Advantage Banking account (days 31-90 from account opening).

Key Terms

- This offer is intended for new customers only; you are not eligible for this offer if you were an owner or signer on a Bank of America Business Advantage Banking account within the last twelve (12) months. Bank of America employees are not eligible for this offer.

- Only one Business Advantage Banking account bonus ($400 or $750) offer per business owner, regardless of the number of businesses owned or operated by the customer. Bank of America may change or discontinue this offer at any time before this date without notice.

- Offer expires on December 31, 2026, and all qualifying activities must be completed within the stated time frames. This offer may not be combined with any other offers. You must meet all requirements of this offer to receive the bonus. Only one Business Advantage Banking account bonus ($400 or $750) offer per business owner, regardless of the number of businesses owned or operated by the customer. Bank of America may change or discontinue this offer at any time before this date without notice.

- Requirements to Receive a Business Advantage Banking Cash Bonus:

- Open a new Business Advantage Relationship Banking or Business Advantage Fundamentals™ Banking account online through this offer’s webpage by December 31, 2026, to be enrolled in this offer. If you open your account by any other means, you may not be eligible to earn the cash bonus.

- Deposit New Money* directly into that new eligible Bank of America Business Advantage Banking account within thirty (30) days of account opening (“Deposit Period”). At the end of the Deposit Period, all New Money deposits made directly into new eligible Business Advantage Banking account will be totaled to determine which Balance Requirement you have met and which corresponding Cash Bonus Tier you are eligible for (see Bonus Chart below).

Bonus Chart Balance Requirement Cash Bonus Tier $5,000 $400 $15,000 $750 - Maintain a daily balance in that new Business Advantage Banking account that meets the applicable Balance Requirement (see Bonus Chart above) during the Maintenance Period**. During the Maintenance Period, if your daily balance drops below the minimum of the Balance Requirement listed for a corresponding Cash Bonus Tier, you will no longer be eligible for that Cash Bonus Tier but may be eligible for a lower tier (as applicable, based on the lowest daily balance during the Maintenance Period). If your daily balance drops below $5,000, you will no longer be eligible for a cash bonus.

- New Money is new funds deposited into your Business Advantage Banking account that are not transfers from other Bank of America accounts or Merrill investment accounts. A transfer done via ATM, online or teller, or a transfer from a Bank of America account or brokerage account, such as a Merrill account, is not considered new money. A cash withdrawal from an existing Bank of America account and deposited into the new Business Advantage Banking account is not considered new money.

- The Maintenance Period begins thirty-one (31) calendar days after account opening and ends ninety (90) calendar days after account opening.

How to get Fees Waived

- To avoid the $16 Monthly fee after the first 12 months, meet one of the following requirements during each checking statement cycle:

- Maintain a $5,000 combined average monthly balance in eligible linked business deposit.

- Use your Bank of America business debit card to make at least $500 in new qualified purchases. Spend $500 or more in new net purchases each statement/billing cycle using a linked Bank of America business debit card. Purchases must post to that card account to qualify. Purchases must be made on only one of the debit card accounts; purchases on any combination of debit cards cannot be aggregated to reach the monthly spend. See Business Schedule of Fees at bankofamerica.com/Business_Schedule_of_Fees for an explanation of how the monthly fee waiver is applied and how the card spend is determined.

Quick Thoughts

The nice thing about this business checking account bonus is that it is very simple: deposit the money within 30 days of account opening, leave at least $5,000 in for another two months, and collect a nice bonus.

Just make sure that you leave the required deposit amount in over the next two months, because if your balance goes below that, even briefly, you’ll lose the bonus. I’d actually leave a slightly higher amount (an extra $40-$50), just in case there are any unexpected fees or charges triggered by accident.

I’ve done several BOA Business Checking bonuses over the years, and they’ve all been straightforward and quick to pay out.

am I eligible for this offer if I have a BOA business credit card already?

In the application process, it askes “Do you have an offer code? If I check it, it shows an entry that is empty. Do I need to enter an offer code? If yes, what is the code?

I faced the same situation. Now my account is opened. I called them to make sure that my account is enrolled for the bonus but they said it didn’t. So I explained how I opened the account but there was no promo code to enter on the offer page, etc. Now they will review my account and want me to wait for 7-10 days to let me know the bonus is valid. One good thing is that I didn’t transfer any funds to this account. Hope this helps some one in any way.

You mention that no direct deposit is required. Am I missing something that business checking account would require direct deposit? It seems like direct deposit would be for a personal account getting in a paycheck or something similar.

I assume this will also help establish a relationship w/ BoA for the purpose for qualifying for an Atmos Summit card (while being above X/24)? thanks

@Tim Steinke please update, as $15k daily balance must be maintained to get higher payout. Their terms mean if you drop below $5k you’ll get NO bonus, which is easy to misread.

I see conflicting language in the terms about whether you need to maintain $5000 or $15000 in the account to get the higher bonus. In the outline of the three steps, it just says deposit 15K and then maintain at least 5K. But in the small print it says “Maintain a daily balance in that new Business Advantage Banking account that meets the applica‐

ble Balance Requirement (see Bonus Chart above) during the Maintenance Period**. During the Maintenance Period, if your daily balance drops below the minimum of the Balance Requirement listed for a corresponding Cash Bonus Tier, you will no longer be eligible for that Cash Bonus Tier but may be eligible for a lower tier (as applicable, based on the lowest daily balance during the Maintenance Period). If your daily balance drops below $5,000, you will no longer be eligible for a cash bonus.”

To me this suggests needing to keep 15K in the account from days 31-90 to get the higher bonus. Is this how others read it?

Do I have to have a business per se to open this checking account, or is this similar to business credit cards where any side hustle counts?

Can I churn this offer, as in transfer $15,000 for 3 months, wait for the payout, and transfer back to my HYSA and close the account without fees?

I have same question!!

Bank of America has announced that it is reworking its Preferred Rewards program and tiers. The concern is that qualifying for the 75% boost on credit card earnings might require the $1 million asset level. For many, another “all other” card might be in order.