| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

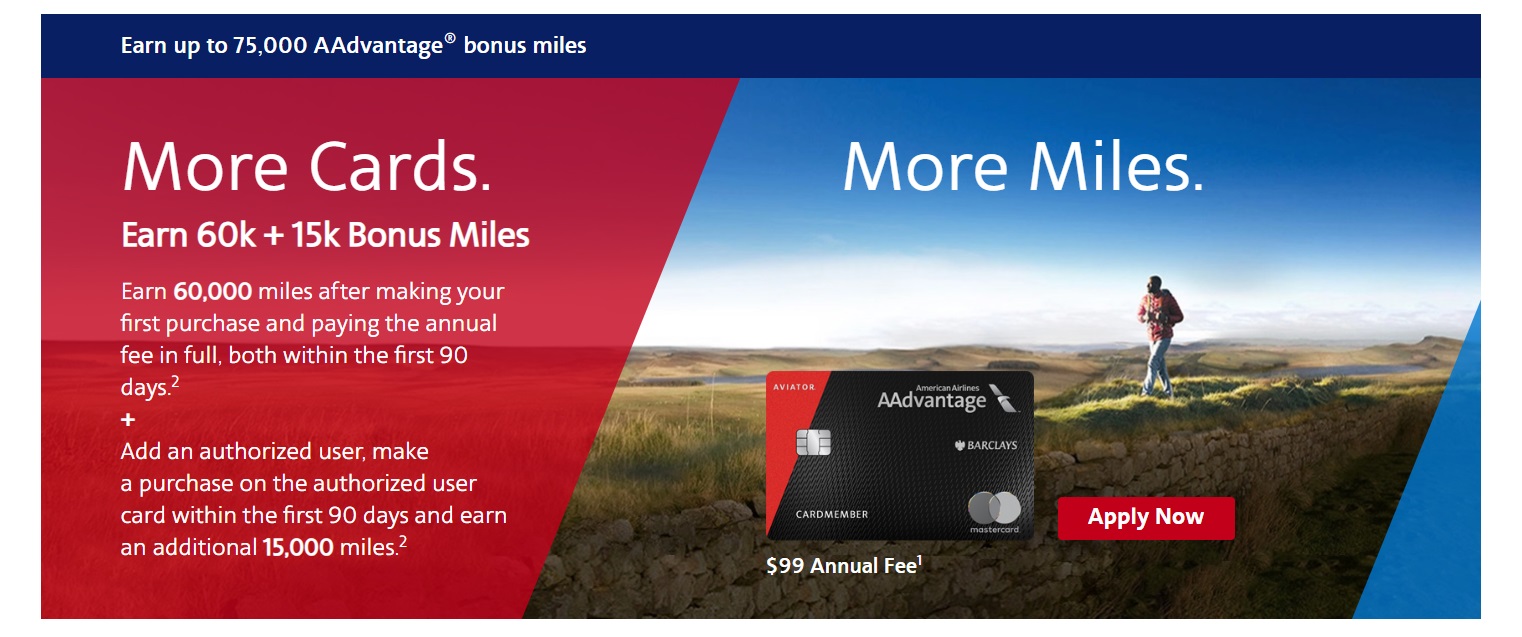

The Barclays Aviator Red recently had a welcome offer that was good for up to 75,000 American Airlines miles — and all it required was two total purchases (one on an authorized user card) and payment of the $99 annual fee within the first 90 days. That’s a great, easy bonus that could quickly give you enough miles to get to a far-flung destination like the Maldives in business class, a round trip economy award to Europe, or plenty of other solid redemptions.

While this offer is no longer available via the public link, it is available via referrals. Because of that, we are featuring reader referrals to this 75K offer on our Best Offers page, since we always want readers to have access to the best publicly-available option. Read below for instructions on how to submit your link.

PLEASE DO NOT LEAVE A LINK IN THE POST COMMENTS – IT WILL BE DELETED BY OUR SPAM FILTERS

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

We want your 75K offer referral links

Here on Frequent Miler, our Best Credit Card Offers page always links to the best available welcome bonus, even if that’s not an affiliate link.

However, we always present the offer that allows new applicants to earn the best available bonus, even when it doesn’t benefit our site through affiliate commissions. We need reader links for the 75K offer.

If you’d like to have your referral link shared on the Best Offers page, here’s what you need to do:

Step 1: Check your referral link

You can find your referral link by logging in to your Barclays account and clicking on the ‘Offers’ link at the top of the page. Note that you might need to change your card at the top of the page so that your Aviator card is selected. Apparently, you need to have held the card for at least 6 months to be able to generate referrals, so if you don’t see it as an option there that’s presumably why.

Before sharing your referral link, please ensure that it generates a link to the offer giving new applicants 60,000 AAdvantage miles after one purchase and an additional 15,000 after a purchase on authorized user card. We don’t know if all Aviator Red cardholders can generate this superior offer, so it’s worth checking first. It may be that it’s the standard referral offer for everyone, but please check regardless.

Step 2: Join the Frequent Miler Insiders Facebook group

If you’re already part of our Facebook group, you can skip this step. If you’re not a member though, you’ll need to join this group. Note that you’ll be asked a question or two (depending on if you try joining on mobile or desktop) to ensure you’re not a bot. Please answer that question(s), otherwise you won’t get admitted to the group in order to do step 3.

Step 3: Share your link on the dedicated thread

We have a dedicated thread set up to share your 75K link, so please only share your referral links here at the bottom of the thread. We’ll then work our way through the links for as long as this increased offer is only available via referrals. We will rotate through links there regularly to try to give as many readers as possible a chance at picking up a referral bonus.

Please don’t share your referral link as an individual post in the group as it’ll just get deleted. Please also don’t share a non-75K referral link as that’ll get deleted too.

Comments on the blog with links automatically get caught in our spam filter and will not post, so do not share your links in the comments here. Instead, that Facebook thread is the only place we’ll be accepting referral links (sorry if you’re not on Facebook).

Quick Thoughts

The Barclays Aviator Red frequently offers a great bonus after first purchase. This time around, they are offering an elevated 60K miles after first purchase on the primary card plus an additional 15K miles when you add an authorized user and they make their first purchase in the first 90 days. Given the absence of any spending requirement, that’s a great deal.

On a recent podcast episode, Greg and Nick discussed this card (jump directly to that section of the show here) and also the Aviator Silver, which is only available as an upgrade from the Aviator Red (and not for all cardholders). Greg went on to determine that the Aviator Silver is probably the best American Airlines credit card overall.

You will have to have the Aviator Red for a year first to have a chance to upgrade and the card itself isn’t bad. The $25 WiFi credit will be useful for some and if you’re interested in spending toward an American Airlines Companion Certificate, this card offers a $99 + taxes companion certificate (valid for economy class travel within the contiguous 48 states only) after $20K spend in a calendar year.

If you are a Hyatt Globalist and you’ve been targeted for an Instant Status Pass to Platinum Pro and you need a way to bump up Loyalty Points to meet the requirements for the offer, keep in mind that welcome bonuses are not earned as Loyalty Points, but you will earn 1 Loyalty Point per dollar spent on the card.

We obviously wouldn’t recommend this card over a number of better transferable points cards on the market (see the top of our Best Credit Card Offers page for a list of the best current offers sorted by first year value), but this is a great offer if you had the Aviator Red in mind specifically and/or need AA miles.

(h/t: DOC)

Does AU get the perks of the card such as free checked bag?

The terms say that it’s the primary card member only. I’ve never heard any supporting or refuting data points.

thank you Tim!

Hi – I’ve got a few questions… I currently have this card. My P2 has never obtained this card on her own, but has been, and currently still is, an authorized user on my account. 1 – Would that prevent her from using my current referral link to sign up for her own card and get the 60k bonus miles? 2 – Assuming she is approved, she would plan to add me as an authorized user on her new card. In order to get the additional 15k miles, is it necessary to add the authorized user at the same time as the initial application? 3 – For the authorized user, does that count against Chase’s 5/24 rule? Thanks very much!

I’ve had this card for years but I don’t see the referral offer. The only offers listed are to upgrade to silver elite card or add a user. Do you know why this would be?

Same! Upgrade, Add a user, promotional APRs – no referral link. Probably had the card 10 years.

How long does it take for the referral to post?

For the authorized user card… Would I have to provide the social security number of the authorized user or do they just want the name of a person?

I’ve been doing this over 2 years now and I still am not sure if AU adds to 5/24. I would like to do this for P2 because she is 3/24, but I am 4/24 and don’t want to go over

P2 and I have 3 Aviator Red cards for over 2 years. No offer codes ever show up on our accounts.

Can P2 be P1’s authorized user, and then at the same can P2 get a card with the bonus and add P1 as an authorized user? You think this is something Barclays flags?

I am wondering the same thing! Hope someone can provide the answer (and also whether that scenario would work)!

DP – I just applied through P2’s referral link and was approved. I closed my last Aviator Red card on August 1, 2023.

I also added P2’s referral link in the Facebook group the other day.

Thanks, FM Team!

Naturally I just signed up for the 60k offer two days ago. What are the chances they’d let me switch sign up offers?

Same here. Unlikely since this is not a public offer. YMMW though.

You had me until FB reared its ugly head. No thanks, hard pass.

Agreed. No offer is worth entering that cesspool.

I guess I’ll just use the referrals on DOC

You don’t have to Facebook to get the offer. It’s in the link in this post. Facebook is where we are collecting referral links.

I understand that. I know where to get the offer and have grabbed it. But no way I’m wading into the cesspool of FB for the “chance” to spread referrals around. You should reconsider being a part of that scummy platform.

I know you do. My comment was directed at the person who replied to you and seemed to think that he needed to go to Facebook to get access to the offer. Completely agree with you…if you’ve made the decision to stay off, there’s no reason to get on for a referral bonus.

Tim,

Can you churn this card? Can I have more than one at a time? If not, what’s the recommended time gap between???

You can’t have two of the same card at the same time, but you can churn them. Generally, it’s thought best to wait 6 months after cancelling to reapply, but I’ve heard of people getting approved before that.

Thank you!

The terms state: “You may not be eligible for this offer if you currently have or previously had an account with us in this program.” Are you saying that generally they don’t enforce this term, because it is worded as “may not”?

Not worth joining FB, sad that there’s no offered alternative.

Actually, it’s possible that only a single transaction is needed. There’s a web tracker which showed 2/1 required transactions for me after a single transaction on both cards, which suggests that the AU transaction might count for the 60k points as well?

Yes but I’m doing an Amazon $1 refill just to be sure.

There’s also a 60K offer after 1 transaction with waived first-year annual fee. Potentially a better offer since it doesn’t take up two 5/24 slots.

AU cards don’t count towards 5/24 (for either person). Occasionally someone ends up getting declined for one, but it’s always reversed on reconsideration when it’s pointed out that it’s an AU card.

Oooo good to know. I’ll delete my other comment