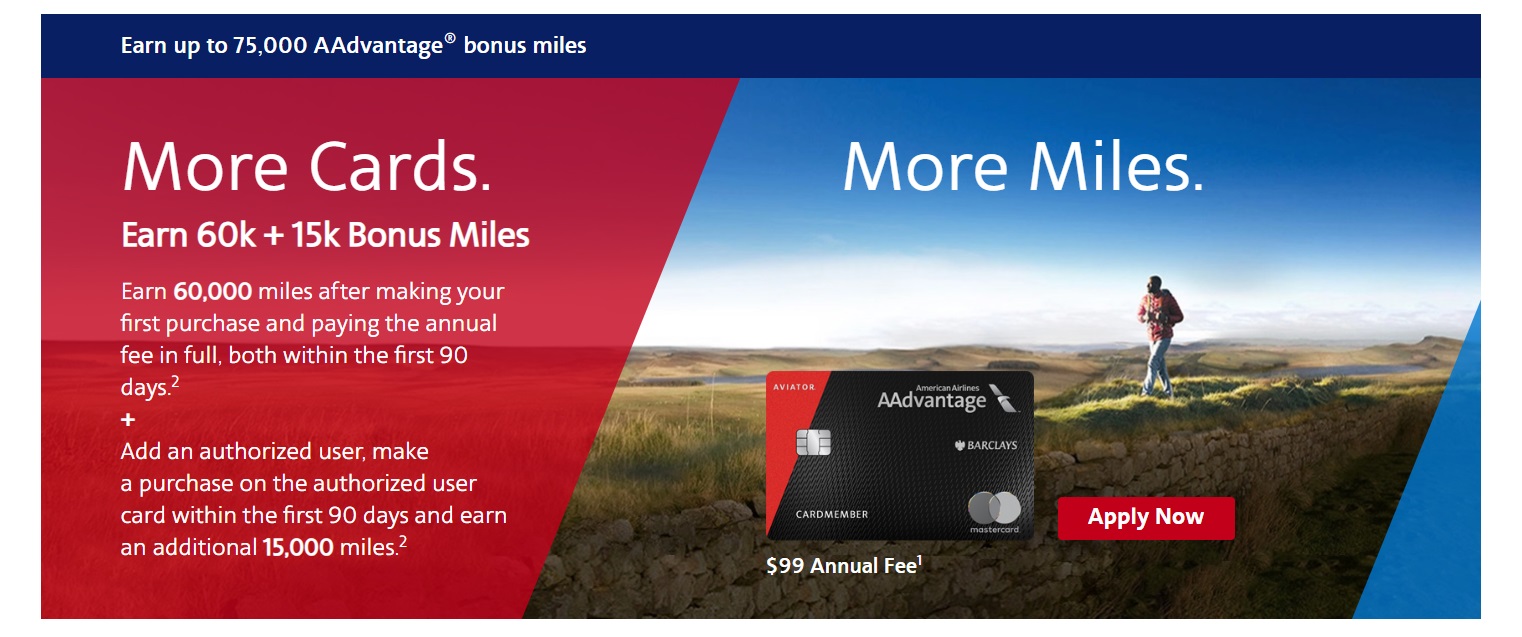

The Barclays Aviator Red has a new offer out good for up to 75,000 American Airlines miles — and all it requires is two total purchases (on on an authorized user card) and payment of the $99 annual fee within the first 90 days. That’s a great, easy bonus that could quickly give you enough miles to get to a far-flung destination like the Maldives in business class, a round trip economy award to Europe, or plenty of other solid redemptions.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

Quick Thoughts

The Barclays Aviator Red frequently offers a great bonus after first purchase. This time around, they are offering an elevated 60K miles after first purchase on the primary card plus an additional 15K miles when you add an authorized user and they make their first purchase in the first 90 days. Given the absence of any spending requirement, that’s a great deal.

On a recent podcast episode, we discussed this card (jump directly to that section of the show here) and also the Aviator Silver, which is only available as an upgrade from the Aviator Red (and not for all cardholders). Greg went on to determine that the Aviator Silver is probably the best American Airlines credit card overall.

You will of course have to have the Aviator Red for a year first to have a chance to upgrade and the card itself isn’t bad. The $25 WiFi credit will be useful for some and if you’re interested in spending toward an American Airlines Companion Certificate, this card offers a $99 + taxes companion certificate (valid for economy class travel within the contiguous 48 states only) after $20K spend in a calendar year.

If you are a Hyatt Globalist and you’ve been targeted for an Instant Status Pass to Platinum Pro and you need a way to bump up Loyalty Points to meet the requirements for the offer, keep in mind that welcome bonuses are not earned as Loyalty Points, but you will earn 1 Loyalty Point per dollar spent on the card.

I’m actually contemplating adding this card in my household in part because my wife and I both have relatively low limits on our Wyndham Earner Business cards and I’ve heard that Barclays, unlike almost any other issuer, is sometimes willing to shift credit limit between a consumer card and a business card. We have therefore been eyeing a Barclays consumer card but I had been holding off in the hopes that we would see an increased offer like this.

I obviously wouldn’t recommend this card over a number of better transferable points cards on the market (see the top of our Best Credit Card Offers page for a list of the best current offers sorted by first year value), but this is a great offer if you had the Aviator Red in mind specifically.

H/T: US Credit Card Guide

Appears to be 50k now

Hi everyone, do you know if the authorized user gets the free checked bag perk? Thank you for sharing

No. Primary card holder and up to four companions on the same reservation. If you upgrade to the silver, it’s the primary card holder and up to eight companions on the same reservation.

Anyone know if you can receive the miles when the first statement hits if you pre-pay the annual fee? for example, if i make a $5 charge on day 1 of having the card, if i pay either $99 or $104 on day 2, will the bonus hit on my first statement (maybe day 20) or would it still be on statement 2 (day 50)?

You will have to wait for the first statement to pay the total of your purchase as well as the annual fee

[…] HT: FM […]

Is the offer dead? I don’t see the same wordings on the Barcalays website anymore.

Any update on this! Was going to apply but didn’t see any writing about this.

Been 3 weeks, still no annual fee posted. Odd….Barclay usually take this long to post an annual fee?

Maybe an interesting DP for someone wondering about this card. I applied and was immediately approved on Oct 03 (I mostly applied because I wanted an AA card to get better mileage return from AA Hotels). I just received the card today Oct 16 (note there was a federal holiday in that span). When I login, it says I still have 87 days to complete the SUB, so maybe they wait until they ship it to start the clock? And it says my $25 WiFi credit is good for the period Oct 01, 2023 until Oct 31, 2024 … so theoretically someone can get close to 13 months from that benefit. Or maybe you could even double-dip next in Oct 2024 between the 1st year benefit and the 2nd year benefit to get $50 WiFi that month?

What happened to Barclay’s AA biz card – it’s gone from their site

It’s been that way for a bit. We’re assuming that the takedown is temporary, but haven’t heard anything for sure one way or the other.

I had a Barclay’s AA Aviator card a few years ago, and only kept it 2 years. Just applied for this 60K & 15K w/AU sign up bonus and got approved today. So much for lifetime language in the fine print.

Hi Nick and Friends!

Great post and great comments. Two questions:

Thanks everyone – take care!

1) There’s no guarantee what they’ll pull. While some issuers are semi-consistent, even with those that are pretty consistent it can vary geographically (way back in the day, some bureaus were just more prevalent in certain pockets of the country and so some issuers primarily pull from one bureau in a specific date but then primarily pull from another in other states, etc. It was Experian for me. YMMV.

2) Sure, there’s no problem with that plan.

Thanks, Nick! That’s great info.

What is effed up is that P2’s credit is 100 points lower at Experian than TU. How crazy is that?

[…] HT: FM […]

Will AA claw back the miles after the card is cancelled?

I wouldn’t expect that if you have the card open for a year. If you try to like cancel within 30 days or something, then I would expect they would.

After being hAAmered some years ago, should I apply?

Unfortunately, I have no idea.

FWIW, the language about not being able to get this card if you have had it before (“You may not be eligible for this offer if you currently have or previously had an account with us in this program.”) is the same or equivalent to language that has been around for many years, dating back to the days when the card was being issued for USAir(ways). In my experience (and the experience of others – check the threads at DoC and/or Flyertalk for confirmation):

Barclays may reject your application, and it may be for this reason, although it is doubtful you would know that for sure.But if Barclays approves your application, you will get the sign-up bonus.As a person who has had several of these cards, my qualms about this offer are:

You have to pay the annual fee. I know, I know, it’s still worth it, and yet the fact that in the not-so-distant past you could get the miles with no annual fee makes me gourmand and greedy.To make it go from 60K to 75K, you have to burn a second 5/24 slot within your P empire. I know, I know, as Greg often points out, if this were to be an issue on a subsequent Chase application, you can potentially call in to Chase for reconsideration, in asking them to scrub a card from the 5/24 count when you are “only” the authorized user. And yet, isn’t Greg the one who writes about how much he seeks to avoid having to call in on credit cards, not to mention that the P who has to call in could be a P2 or higher? Again, not a deal breaker – just something to factor in.

I don’t remember when they offered the miles without paying the annual fee. To the best of my recollection, the offer on this card has always (or at the very least for years) been to get the bonus after first purchase and payment of the annual fee. Do you remember an offer otherwise?

In terms of the 5/24 slot, you don’t need to burn a 5/24 slot. You can add anyone – it doesn’t have to be P2. I personally wouldn’t add P2 (and don’t intend to for that reason). Barclays only asks for a name and date of birth. Justin Beiber’s birthday is March 1, 1994. I’m not suggesting that you add the Biebs (nor will I), but my point is that if that is a concern, I view it like a puddle on the sidewalk. I’m not going to refuse to walk because my shoes might get wet when I can easily step around it.

Earlier this year there was a 60k offer with $0 AF for 1st year, maybe that’s what they’re referring to? The most recent 70k offer required the AF though, and this offer is even better. I’d personally much rather take the 75k with AF than the 60k with $0 AF.

Ah, useful info. I was conflating with the current Amex situation, where they really do seem to be insisting on the SSN.

As for the waived first-year AF, as per @D.W.

I was approved on 9/18 and received my card last week under the 50k promo. My wife was approved last week and is waiting for her card under the same. Called Barclay and they refused to honor the new 75k promo. Spoke to a supervisor and was told they said once the application was in the system they could not change it.

Yeah, that’s a bummer. Sadly, Barclays isn’t known for matching. We had been intending to add one of these cards in my household and I was also looking at them last week, but I knew that 50K was lower than usual. Since it was very close to the end of the month, I figured I’d wait and see if the offer changed on the first of the month. This time around, I got lucky by waiting.