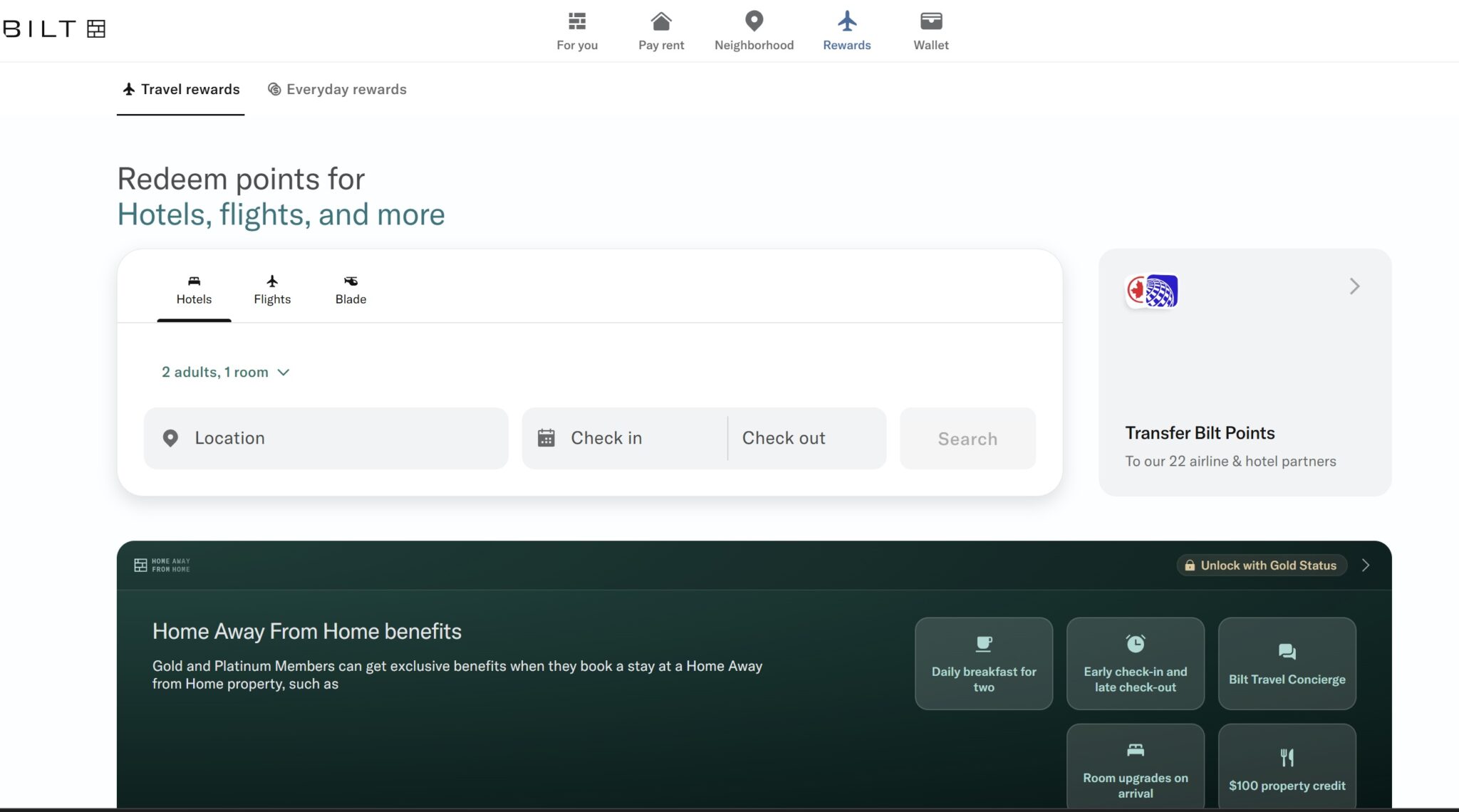

Bilt Rewards recently launched a revamp of its travel booking platform, with many flights and some hotels now functioning as direct bookings with the airline/hotels, which is a major improvement in those cases. Furthermore, they launched a new luxury hotel booking platform called Home Away from Home that has the potential to be an interesting competitor to Fine Hotels & Resorts, The Edit, and other luxury booking platforms.

Bilt direct-booking hotels and airlines

The Bilt travel portal now offers an enhanced capability on many travel bookings: book flights and hotels through Bilt and, in some cases, your booking will show up with the airline or hotel as a direct booking, enabling both the ability to manage travel through the provider and the ability to earn hotel points and elite credit while using Bilt points at 1.25c per point to pay for travel.

The idea here is that they are connecting directly to the NDC so that airlines in many cases recognize bookings through Bilt as if they were direct, though it is worth noting that this is not yet live for all airlines and hotels and it isn’t yet clear in search results which flights are direct bookings in advance. I suppose it would probably be easy enough to make a booking and see if the booking could be easily managed via the carrier (changed, etc) since you should have 24 hours to cancel if not.

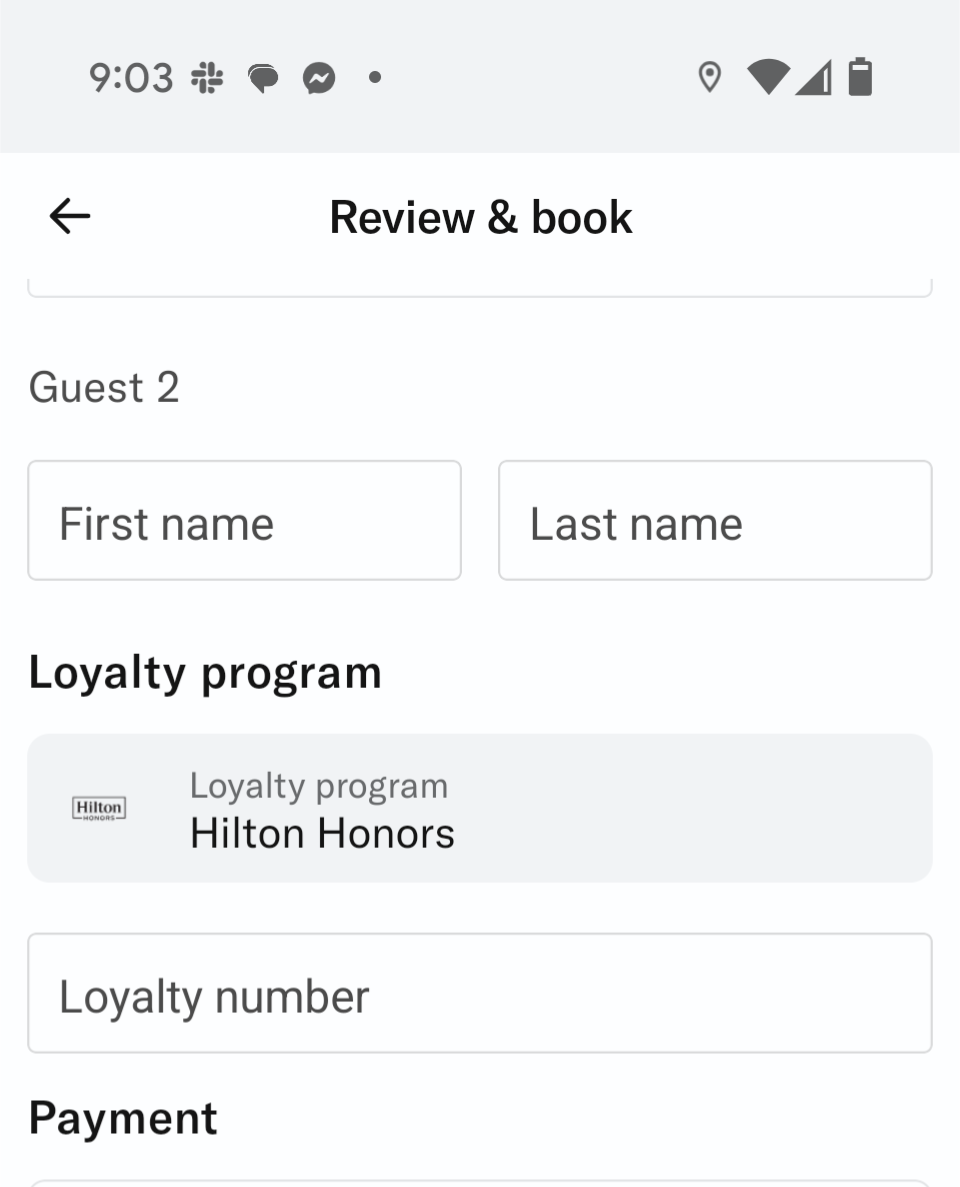

It is worth noting that this is not yet live for all airlines and hotels. My understanding is that most flights should function as a direct booking, with more expansion in the coming weeks. Hyatt, Marriott, Hilton, IHG and Accor “Home Away from Home” bookings are direct bookings where you can enter your member number during the booking flow.

Those chains are expected to expand access to member rates to other bookings as well. If you see a place to enter your loyalty number in the booking flow, that is the indication that it will be eligible to earn hotel points and elite benefits / credit with the program, though note that I don’t yet see this widely available.

An obvious advantage here will obviously be in ease of use. Whereas we have often warned about the downsides of booking flights through a credit card portal, that has mostly centered around needing to make changes and receive service through the booking portal when things go wrong. For instance, if your flight is cancelled or plans change, in most cases, you would need to call your travel portal in order to get help with your booking. Bilt is offering the chance to book through Bilt but manage directly with your airline or hotel, which should make it far easier to make changes as the need arises.

Bilt continues to offer the chance to book travel at a value of 1.25c per point when booking through the Bilt portal. While that doesn’t yield an opportunity for outsized value, the chance to get 1.25c per point and also manage your travel directly with your airline or get your hotel points / elite benefits / elite credit certainly makes it more appealing than it was before. Note though that points can not yet be used at 1.25c per point toward Home Away from Home bookings.

Keep in mind that if you’re booking hotels through Bilt, you’re still sacrificing the ability to stack with a shopping portal. In some cases, you can earn as much as 10-15% back by clicking through a shopping portal to book directly with a hotel chain. You lose that when booking through Bilt. However, in cases where portal rewards are low or nonexistent, Bilt may offer competitive return since you can earn Bilt Rewards on paid bookings.

Bilt launches a new luxury hotel booking platform: Home Away from Home

Also launched last week is Bilt’s new luxury hotel booking platform, Home Away from Home. On the surface, this looks like a mirror of Amex Fine Hotels & Resorts or The Edit by Chase, though there are some key differences.

For starters, you do not need a specific ultra-premium credit card to access Home Away from Home, though you do need Bilt Gold or Platinum status. That means that the Home Away From Home program is mainly open to those with significant rent costs and/or high Bilt credit card spend.

For those who can access the platform, this could be an interesting option that potentially adds quite a bit over traditional credit card programs.

For starters, these hotel bookings are effectively virtuoso bookings under the covers. Those making Home Away from Home bookings will be assigned a Virtuoso advisor to handle any additional arrangements necessary.

It sounds like Bilt intends to add quite a bit to this platform over time. For instance, perhaps instead of or in addition to the typical virtuoso hotel benefits, Bilt intends to customize offerings over time that are meant to personalize the experience and/or take advantage of their wider partnerships. For instance, they may offer a round of drinks at a trendy neighborhood cocktail bar near your hotel (and long-term may offer the ability to book a table a that cocktail bar through Bilt). Similarly, hotels may offer specific rewards for those booking premium rooms — an example floated was a free Blade helicopter transfer for those booking a 2-bedroom suite at a luxury Manhattan property. Offerings here will vary and will probably be based somewhat on Bilt member activity as well as offerings controlled by property owners participating in the program who want to incentivize certain types of bookings.

Overall, at launch, this program looks fairly similar to Fine Hotels & Resorts, The Edit, or Citi Reserve. Over time, the personalized touch of an assigned advisor has the potential to add value for a client looking for additional assistance, though for others it will likely be all about whether Bilt can offer interesting benefits. Either way, it is nice to see this available without an ultra premium credit card.

Speaking of an ultra premium credit card, I do not yet have any detail, but I don’t expect to see Bilt’s coming premium card come with a coupon credit for Home Away from Home. While Bilt has been tight-lipped on how the new cards will work, they were pretty adamant that they did not want to follow the coupon book model. I therefore wouldn’t have my hopes set on a coupon for Home Away from Home, but we’ll see. I’m also not sure that ultra-premium cardholders will automatically get access since Bilt billed an advantage of Home Away from Home being the fact that you don’t need an expensive credit card for access, just Bilt status which can be earned from paying your rent (albeit with a high monthly rent cost required to reach the Gold and Platinum status tiers). Of course, it is possible that a benefit of the ultra premium card could be elite status or an accelerated path to it. We’ll see.

Bottom line

Bilt is expanding their travel offerings, with many flight bookings now showing up as direct bookings that can be managed directly with the airline. They also launched a premium hotel booking channel branded as Home Away from Home that is likely to have solid benefits and that offers the chance to earn hotel points and elite credit when booking chain properties. We expect to see an expansion of that direct booking model to more flights and hotels in the coming weeks and months, though it is worth noting that Expedia does still manage a large chunk of hotel bookings at this time and likely will continue to still manage them in some regions in the long-run, though Bilt expects to be offering more and more direct booking deals for hotels in the near future.

Might rates available to members include AAA rates? Thanks.

One of the big benefits here is spending toward Bilt status. All the partner spend counts in the program. I’ve been Silver the last couple of years (and on pace to stay that way), but integrations like this help provide a reasonable path to Gold status. If you get the benefits of booking direct, get 1 or 2 extra points per dollar, but also get the opportunity to pick up bigger transfer bonuses, this might be worth the time.

Agreed Brent.

The irony is that as silver / no status, we can’t get on this train to *earn* ourselves status with it…while those who already have gold or higher can boost themselves further.

Bilt, if you really want more folks heavily engaged in your program, you’ll open this travel portal option up to non-elites ASAP.

The travel portal is open to all Bilt members, just the more limited luxury travel booking platform Home Away from Home is limited to Gold+.

Thanks for this comment, LSP.

I realized that we could access the portal, but wasn’t getting that only the Home Away from Home benefits were walled off–not the earning per se.

After your comment, I tried re-booking a stay I had at the Rio Las Vegas. It wasn’t even available in the portal…all of 20ish from dozens of properties.

recommendation to add the points earnings in the article since that seems to have been missed. i.e. how many points you earn by using the portal in addition to cc points

Is there any hope for other portals looking to the NDC? I would never book a flight through a cc portal, but this might make it worthwhile.

Doesn’t seem like any higher points multiple when booking through Bilt compared to direct. The 2x applies when booking direct or through the Portal.

The portal gives points on top of the card’s points.

@Nick- on the topic of the premium card, when Bilt did their credit card survey last year, all of the AF options came with some coupons, including hotel credits for their portal. So it’ll be interesting to see what the final products look like when they announce them this fall

If different from LSP’s question, can you pay with a credit card from another issuer and if so how many Bilt points would a person earn on such bookings? Thanks in advance.

The app says you earn 2x on hotels, 1x on flights “When you book with any linked card”. So yes, you can pay with any card. I assume you’d earn the standard multiplier for the card you were using as if booking direct, at least for those brands Nick mentions you can “book direct”. IE 4x on hotels using the CSR.

Thanks. Let’s see which loyalty programs will work.

PS – It would be good to get a credible answer from Citi as to whether Citi Travel is NDC or not. Thanks again.

I highly doubt it. What Bilt is doing is pretty tech-forward and forward-thinking, neither of which I use to describe Citi. While Chase got some (appropriate) flack from Greg for overcomplicating the new CSR, their new lounges and ability to earn loyalty benefits booking through their portal are similarly forward-thinking and impressive. Citi just seems very B/C-tier when it comes to impressive features or tech.

But I’d love to be wrong.

Hopefully this means the bookings/flights will also count towards status spending with Bilt

If Bilt can connect directly to the NDC, hopefully US Bank and Capital One (who give you $300-$325 travel credit for spending in their travel portal) can do the same.

Is the only reason to book through Bilt to use your Bilt points at $0.0125? Is there some other advantage (earning Bilt points) that I’m missing out on? Otherwise, I don’t see the point, or why I would go this route versus booking direct.

Earning Bilt points on the bookings. And long-term, I think it’s possible that they’ll negotiate deals for Bilt members, but at present the main advantage is using points at 1.25cpp.

Thanks – what’s the earn rate? Is it consistent?

Answered my own question – 2x on hotels, 1x on flights. I’ll be curious how CC bonus categories work here – hopefully since you’re “booking direct”, it’d be the same as actually booking direct. I’m just confused why Bilt doesn’t more clearly advertise the “Earn Bilt points by booking through us” value proposition better (earn rate was buried on the booking page) in addition to the “Redeem points for travel…” value prop.

I think the idea is if I book Hyatt through Bilt portal using Sapphire Reserve, it will be 4x Chase points + 2x Bilt points, as the merchant will show up as Hyatt.

Does this mean booking a Hilton hotel through Bilt will give me 1.25 cpp instead of the normal .5 cpp through Hilton?

Thanks Nick.

Hyatt seems an obvious choice for this platform, since (a) there is no portal cashback to be lost, and (b) you’ve confirmed that Hyatt bookings are direct.

A shame one has to have Gold status or better to play with their premium booking. Will look forward to seeing data points on that.

I’ll be really interested to see if this ends up being truly better than other booking portals in the long run.