NOTICE: This post references card features that have changed, expired, or are not currently available

On Tuesday, while my wife lazily applied for just one card (and will ultimately net over 120,000 points), I went on a crazy App-No-Rama application spree. The idea behind an App-No-Rama is to apply for multiple cards in one day from a single issuer. By doing so, in many cases, multiple hard credit inquiries will be combined into one. In this way, it’s possible to sign up for many cards with very little negative credit score impact. Yes, your score will be impacted negatively because new cards will reduce your average age of credit, but that should be countered by the positive impact of larger combined credit lines on your report.

In some cases, there is no impact whatsoever to your credit report (other than the one hard inquiry). When you sign up for business cards from certain banks, the new accounts are not added to your credit report. These banks include: American Express (except for Canadian Amex), Bank of America, Chase, Citi, US Bank, and Wells Fargo. See “Flying under 5/24” for more details.

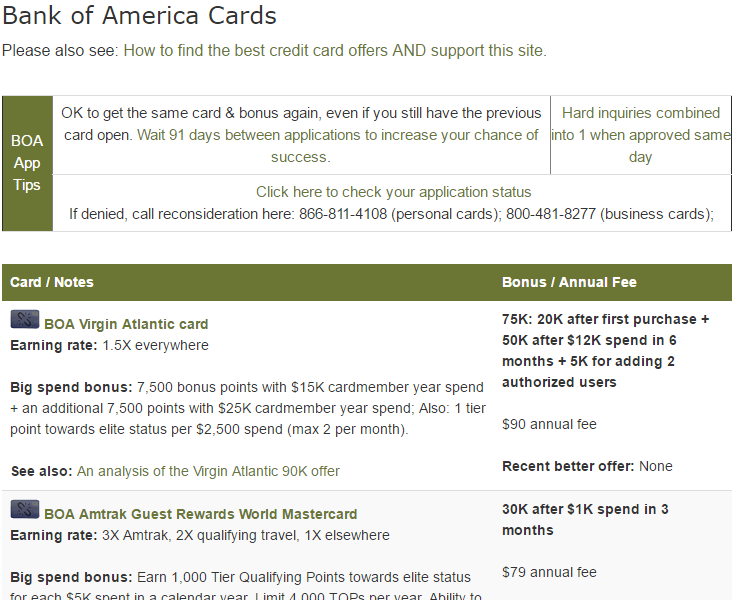

In my case, there were a few personal Bank of America cards that I had my eye on, so I decided not to stick only with business cards. In particular, I believe that the Amtrak 30K offer will be going away after December 31. And, both the Amtrak card and the Virgin Atlantic card are currently on my Unbiased Top 10 Signup Bonuses list. If you go one past the top 10, to number 11, you’ll also find the BOA issued Merrill+ 50K offer.

To get started, I visited my own Best Offers page, and jumped to the BOA (Bank of America) section. I reviewed the BOA App Tips, then started the process…

Amtrak 30K after $1K spend

Amtrak 30K after $1K spend

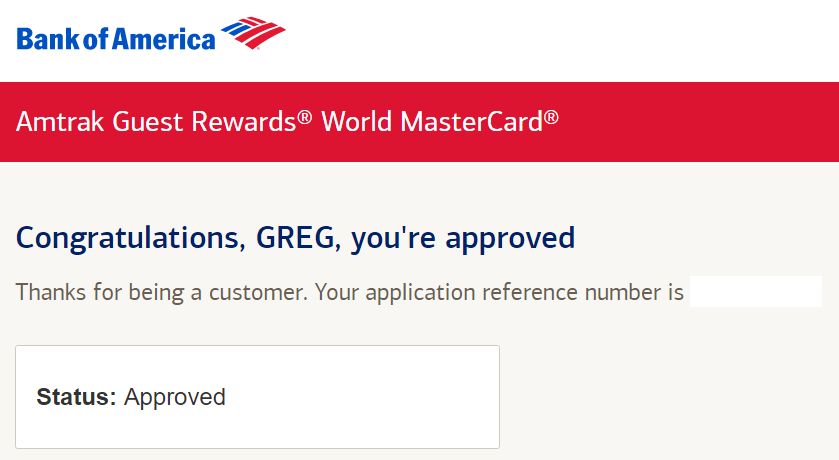

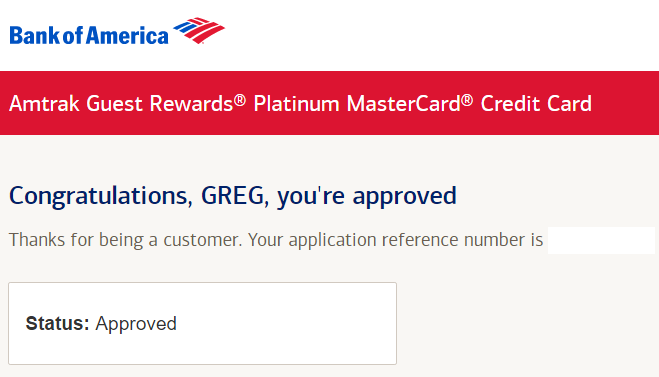

All-righty then! With my vague plan of signing up for as many BOA cards as possible, I began with the 30K Amtrak offer. Instantly approved!

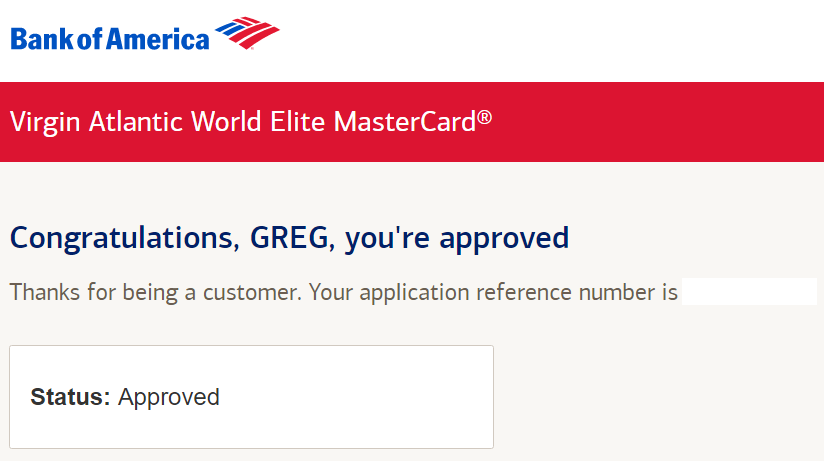

Virgin Atlantic 75K after $12K spend + 2 authorized users

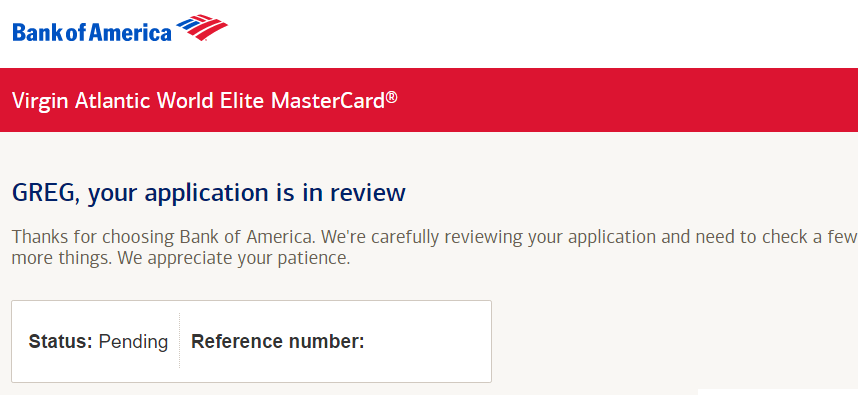

Next, I went for the Virgin Atlantic 75K offer. Instantly approved!

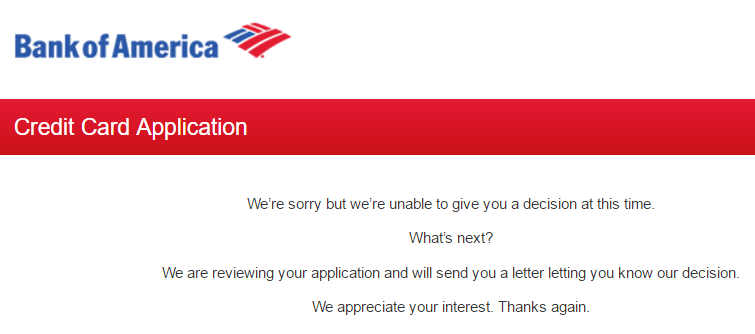

Merrill+ 50K after $3K spend

Rolling the dice… Can we make it three in a row for instant approval? Doh! Nope. Application pending. Hmm. Maybe BOA has a limit of 2 instant approvals per day for personal card applications?

Alaska 30K + $100 statement credit after $1K spend

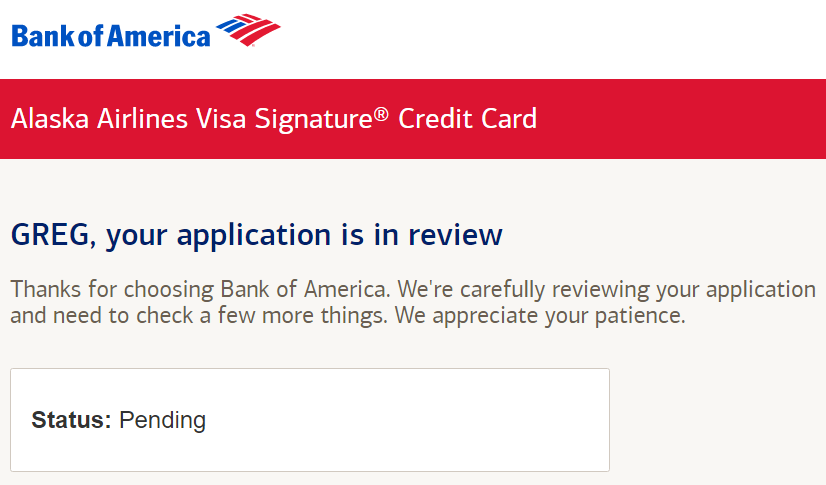

I tried the Alaska card and it too went pending. This appeared to be more evidence of a 2 card limit for instant approvals:

Amtrak 12K after $1K spend

Next I went for the no-fee Amtrak card. The 15K offer had recently died, so I went for the 12K point offer. Instantly approved! I threw my “max 2 personal card instant approval” theory out the window.

Alaska Business 30K after $1K spend

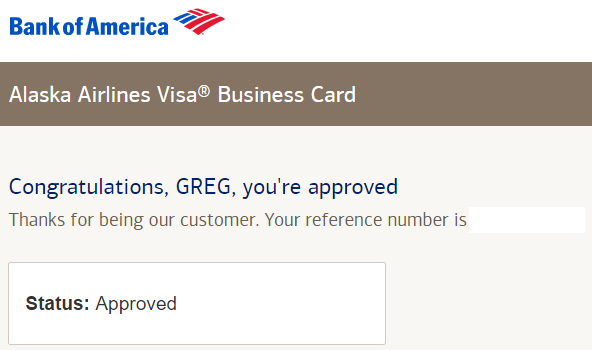

As I mentioned in the beginning of this post, adding business cards to my application spree should have no negative impact on my credit, so I decided to add a few I started with the Alaska 30K offer. Instant approval!

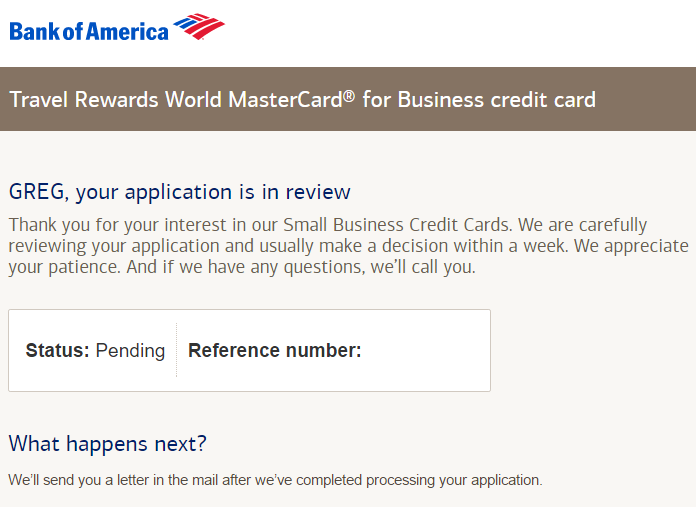

Travel Rewards for Business 25K after $1K spend

Encouraged by the Alaska business card instant approval, I figured I’d get at least one more instant business card approval. Nope. The Travel Rewards Business card application went pending:

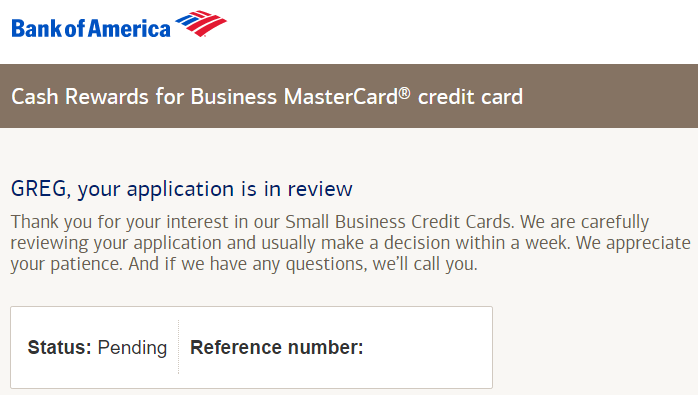

Cash Rewards for Business $200 after $500 spend

The same happened with the Cash Rewards for Business card. Pending:

Amtrak 30K and Virgin 75K

I decided to circle back to a couple of the personal cards that were previously instantly approved. I applied again for the Amtrak 30K offer and the Virgin Atlantic 75K offer. Would these be approved too? Nope. Both went pending.

Approved: 147K

In total, four cards were instantly approved:

- Amtrak 30K after $1K spend

- Virgin Atlantic 75K after $12K spend + add 2 authorized users

- Amtrak 12K after $1K spend

- Alaska Business card 30K after $1K spend

The instant approvals sum to 147,000 bonus points after $15K combined spend.

Pending: 210K + $300

I have six applications still pending:

- Merrill+ 50K after $3K spend

- Alaska personal card 30K + $100 after $1K spend

- Travel Rewards for Business 25K after $1K spend

- Cash Rewards for Business $200 after $500 spend

- Amtrak 30K after $1K spend

- Virgin Atlantic 75K after $12K spend + add 2 authorized users

My plan is to simply wait for decisions on all of these cards. I’m sure some will be denied (most likely the second Amtrak and Virgin Atlantic cards). If I’m feeling up to it, I’ll then call to try to reverse the decision.

And one more card…

I applied for one more card. I purposely broke from the one-bank-only App-No-Rama process, and applied for a Chase card. Why did I do it? Which card did I apply for? What was the outcome?

That story is for a future post…

Way to go toolbag – now boa has implemented limits. Apparently there is no such thing as slow, steady, and consistent. You’d rather redline and burn down the entire system for everyone. Hey but at least you got yours right?

Do your personal BoA card approvals count towards Chase 5/24 soyou’re now prohibited from any more Chase approvals for awhile?

Yes, they do count so I would have to wait 24 months after this round of applications in order to get approved for Chase cards that fall under the 5/24 rule.

[…] My end of year App-No-Rama application spree. 147K and counting. – Going big with Bank of America during a recent round of applications. […]

[…] my recent posts “My end of year App-No-Rama application spree. 147K and counting.” and the follow-ups “Chase IHG was the +1 at my application spree party” and […]

[…] can sign up for as many 5/24-safe business cards as you want. What you can’t do is go on a crazy application spree like I did recently, unless you restrict those applications to 5/24-safe […]

Any further updates, Greg? Considering a similar (smaller scale) BoA AoR soon.

Yes, I followed up in a number of posts:

https://frequentmiler.com/2016/12/23/23246/

https://frequentmiler.com/2017/01/05/application-spree-results/

https://frequentmiler.com/2017/01/10/application-spree-reasons/

Ah, shoot, I should’ve looked harder. Thanks!

[…] couple of weeks ago I reported my end of year application spree. With a single card issuer, I started with one application, then did another, and another, etc. […]

The Alaska Business card (and many other BoA business cards) are managed by FIA. This is an entirely different creditor than BoA. FIA also consistently pulls from a different bureau than BoA. It is impossible for credit inquiries from BoA and FIA to be combined.

Please check your credit report and correct your post to reflect the number of credit inquiries that resulted from these applications. Were the FIA inquiries from your business cards applications combined into a single pull with FIA listed as the creditor?

That’s not right — at least not for me.

BOA has always pulled from two bureau’s for me (transunion and experian) regardless of whether I’ve applied for only personal cards or a mix of personal and business. And they’ve never issued more than 1 inquiry per bureau. This time was no different. I have a transunion inquiry listed as bank of america and an experian inquiry listed as bank of america.

I applied for the Amtrak 30k offer and received 1x Experian pull from “Bank of America”. Then I applied for the Alaska Business 30k offer and received 1x Equifax inquiry from “FIA/CS”.

I’ve applied for at least 3 separate BoA Alaska business cards while residing in 2 different states over the years and those applications have always resulted in inquiries from FIA and not BoA.

Is no one else seeing “FIA/CS” as the credit puller for Alaska Business apps?

Can we get an update on the cards that went to pending? I’m guessing you may have been approved for some and declined for others. So, I’m really curious. Thanks in advance.

I logged on this morning and saw the Alaska personal card, and the Travel Rewards for Business listed in my account, so obviously those were approved. I’ll update others when I get home from vacation and go through my mail.

Hi Greg! I also got approved for the Alaska card immediately and went to pending on the Merrill card. I got a decline letter today, but can’t seem to find a working reconsideration phone number and got bounced around for about an hour without ever getting to the right department when I called 877-721-9405. Various threads have said 888-221-6262 and 866-458-8805 are good numbers, but both of them seem to be dead. Any intel on a correct number to call? Thanks as always!

Have you tried the numbers listed on my Best Offers page under BOA?

“If denied, call reconsideration here: 866-811-4108 (personal cards); 800-481-8277 (business cards);”

Yup, nope, hadn’t noticed that on there. =) That seems like it worked, thanks Greg! And happy new year!

Glad it worked! Funny thing is that I tried it today and the number no longer worked. I scoured the internet, tried a bunch of numbers, and finally found one that worked. I’ve updated the Best Offers page accordingly.

[…] Another card I wanted was the Amtrak 30K offer which is set to expire on December 31st. The bonus for that card is usually 20K, and so I wanted to get in on it before the offer dropped back down. We actually travel on Amtrak now and then, so we know the points will be useful. Points are worth up to 2.9 cents each, so we could theoretically get up to $870 worth of travel with the 30K bonus points. One can argue that points are worth a bit less than 2.9 cents each because the point price is based on the full price of a ticket rather than a discounted AAA or student price. On the other hand, the credit card automatically gives card holders a 5% rebate on points, so that partially makes up the difference. Of course, while applying for the Amtrak card, I went ahead and added a few more Bank of America cards to my arsenal. Read the story here: My end of year App-No-Rama application spree. 147K and counting. […]

When you canceled your boa cards how did you do it ? Did you have to call in ? Can you do it online ? Just asking because right now I have 3 Alaska airlines cards …. Thanks

I called. For each one I asked if I could product change to a no fee card, but for some reason that option supposedly wasn’t available on my account for any of the cards. That was fine with me.

[…] I detailed my latest application spree. I applied for 10 Bank of America cards. Four were instantly approved and the rest are […]

Greg probably has some secret MS techniques which he is not sharing.. would be nice to find out though..:)

How do you intend to meet all the required spending to get the bonuses? I have little trouble getting cards, but meeting the minimum spend is the problem.

Also, aren’t you paying a lot in annual fees?

See my answer to jcb, above. The first year annual fees are well worth it to me in exchange for valuable points and miles. I’ll cancel or downgrade to no-fee cards after 12 months (unless offered good retention offers).