| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Update 5/9/25: It’s been a good run, but this increased offer will be ending on 5/12/25, both directly and for referral links. If you’re looking for some Venture love, now’s the time to jump. For some time, we were displaying reader referral links for this offer, but those only go to the Capital One pre-approval tool, which was junk and didn’t allow most people to actually apply for the offer. Because of that, we’ve replaced those with direct links.

~~~

Capital One is once again offering a $250 Capital One Travel credit on top of 75,000 miles for new Venture Rewards cardholders.

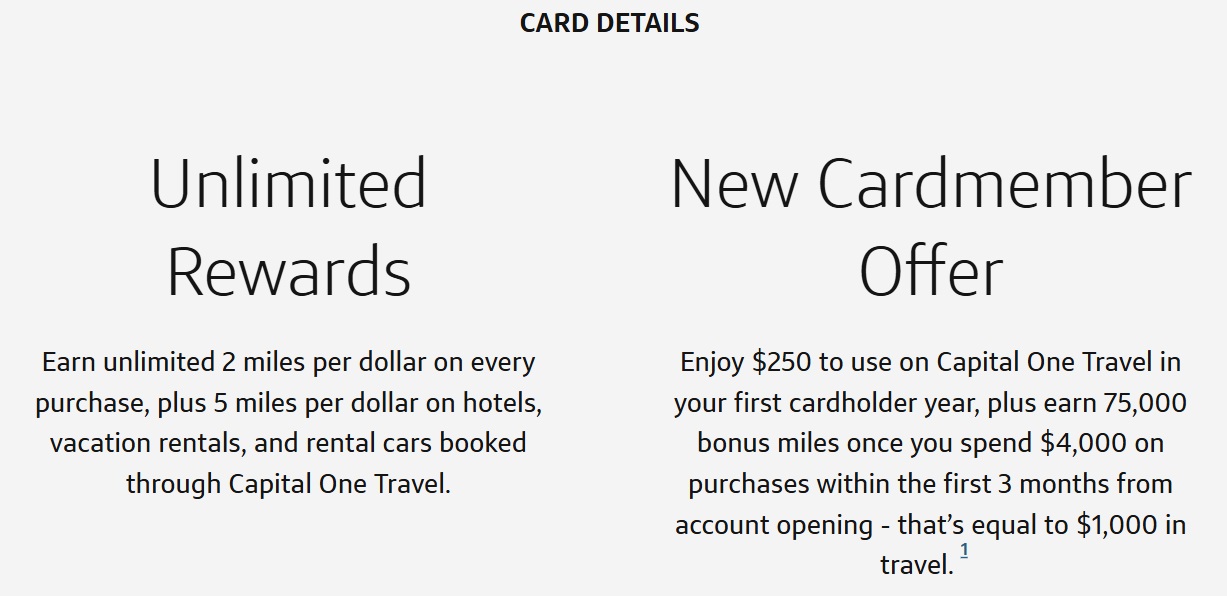

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points ✦ No foreign transaction fees |

Quick Thoughts

This is a very compelling offer from Capital One. Earning 75,000 transferable miles was already a good offer, so getting an additional $250 of credit to use on Capital One Travel during your first year of card membership is excellent.

That $250 travel credit can be used for flights, hotels, car rentals, etc. If your plan is to book a hotel stay, be aware that the hotel chain will regard the booking as an Online Travel Agency (OTA) booking and so you won’t earn points, receive status benefits, etc. That’s not a concern when booking flights or rental cars though.

Be aware that this offer is on the Venture Rewards card, not the Venture X. Also be aware that the $250 credit is only available in your first cardholder year; it’s not like the Venture X’s $300 credit that’s available every year.

I received the preapproval. However, under New Card Member Offer it states NONE.

After being in “Capital One Jail” the last few years and getting denied with excellent credit score… I decided to check the pre approval tool and was surprised to see I was pre-approved with this offer. Gave it a try and applied. Finally got approved! Stats: Last card applied was Dec 2024 for an Amex biz card and the last approved personal card was Nov 2023.

This offer is in name only.

I got denied 9-22-24 with an 825 credit score and 1 percent debt.

Don’t fall for it.

Capital One is playing some kind of game.

P2 4/25 (with only 1 biz card in last 6 months) with 800+ FICO got denied when she applied through the FM affiliate link 🙁

This is very tempting. Although I was able to get a VentureOne card about four years ago, I’ve had so much trouble with Cap1 when it came to applying for the SavorOne card (multiple times and before the change) I hate risking another denial going for the Venture card. I have excellent scores (ranging from 818 to 848), 1% debt ratio, 7+ year average credit, but they have me down for 4 pulls in the past 2 years. Even with being told by their “pre approval” scam that I was pre approved (twice!), but then denied when I applied!

I hate risking another pull to get smacked down again. May take Cap1 out of my wallet for good if they deny me… but not sure if I want to stick my neck out…. again.

Gman58

Same here. I’ve applied three times over the past two years for Cap1 cards, even the one that only offers 1.5% cash back, only to get denied. That’s after they said I was pre-approved. Cap1 and Chase not having much luck these days.