| Card Details and Application Link |

|---|

Capital One Venture Rewards Credit Card  ⓘ $985 1st Yr Value EstimateClick to learn about first year value estimates 75K Miles ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 75k miles after $4k spend within first 3 months$95 Annual Fee Click here to learn how to apply This is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert "miles" to airline miles & hotel points ✦ No foreign transaction fees |

The Capital One Venture Rewards Credit Card makes for a unique one-card solution in that it offers the best of both worlds: earn 2x “miles” on all purchases and then redeem those “miles” for paid travel at a reasonable rate of return or transfer those “miles” to airline partners. While there are credit card combinations from other issuers that can offer greater returns, the Capital One Venture card likely appeals the most to those looking for one card to keep on hand for all purchases. In fact, the simplicity of being able to use one card to earn rewards and travel any time is why this card (along with its business twin: Spark Miles for Business) topped the list in our post answering the question: What is the best credit card?. This guide contains everything you need to know about the Capital One Venture Rewards credit card.

Capital One Venture Application Tips

Capital One Application Tips

Call (800) 903-9177 to check your application status |

Should you apply?

This is a decent travel rewards credit card with good “everywhere” rewards. Earn 2 miles per dollar for all spend. Miles are worth 1 cent each when redeemed for travel. Simply use the card to pay for any travel expenses, and then log onto your account and apply miles to offset your statement charges.

Things get more interesting now that Capital One Miles are transferable to airline miles. The ability to earn the equivalent of 2 airline miles everywhere is excellent.

It is worth noting that Capital One is known to pull from all three bureaus for new applications, resulting in hard inquiries on all of them. Anecdotally, some have reported being approved with a single report frozen.

Are you eligible?

Capital One allows at most 2 Capital One consumer cards and you must wait six months before applying for another card.

Existing or previous cardholders are not eligible if they have received a new cardmember bonus for a Venture Rewards card within the last 48 months.

However, beyond those rules, Capital One also tends to be less likely to approve those who have opened many credit cards with other issuers. There is no known rule as to how many is too many, but those who regularly open rewards credit cards are likely to have difficulty being approved.

How to apply

You can find the current best welcome bonus offer and application link at the top of this page: Capital One Venture Rewards Credit Card.

Application status

After you apply, call (800) 903-9177 or (877) 277-5901 to check your application status.

Reconsideration

If your application is denied, we recommend calling for reconsideration (800) 625-7866. It’s surprising how often denials can be changed to approvals just by asking, though note that Capital One is unlikely to approve those with many open credit cards.

Capital One Venture Rewards Credit Card Perks

Capital One “Miles”

Capital One calls its rewards currency “miles”, though really it is like other transferable currencies in that it offers the ability to redeem towards travel or to transfer to airline miles as follows:

- Redeem Points $0.01 each toward travel: Points are worth 1 cent each toward travel and can be used to reimburse a broad range of travel purchases (including flights, lodging, ride shares, cruises, and more) within 90 days of purchase.

- Transfer Points to Partners: Points can be transferred to a number of airline and hotel loyalty programs. It’s possible to get much better than 1 cent per “mile” value via high value airline or hotel awards. See Capital One Transfer Partners for details.

Travel Protections

- Auto Rental Coverage: Capital One offers secondary auto rental CDW (collision damage waiver), which means that it acts as supplemental insurance to your personal car insurance if you have any (if you do not have car insurance, it acts as primary CDW). Here’s the description directly from Capital One: “Rent an eligible vehicle with your credit card and you can be covered for damage due to collision or theft.”

- Travel Accident Insurance: When you charge the entire cost of the passenger fare(s) to your card, you, your spouse and unmarried dependent children will be automatically insured up to $250,000 against accidental loss of life, limb, sight, speech or hearing while riding as a passenger in, entering or exiting any licensed common carrier.

Global Entry or TSA PreCheck® credit

- Receive up to $120 credit for Global Entry or TSA PreCheck® when you use your Venture card. Get one statement credit every four years.

Purchase Protection

- Extended Warranty: “Doubles the time period of the original manufacturer’s written U.S. repair warranty up to one (1) additional year on eligible warranties of three (3) years or less for items purchased entirely with your eligible Mastercard.”

Capital One Venture Rewards Credit Card Earn Points

Welcome Bonus

This card earns Capital One “miles”. Here’s the current welcome offer:

| Card Offer |

|---|

ⓘ $985 1st Yr Value EstimateClick to learn about first year value estimates 75K Miles ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 75k miles after $4k spend within first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review |

Refer Friends

Capital One occasionally sends out targeted email offers to refer friends and receive a bonus for each referral.

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel |

Capital One Venture Rewards Credit Card offers 2X everywhere with no permanent bonus categories.

Capital One Venture Rewards Credit Card Redeem Points

Cash Back

Cash back is the poorest use of Capital One “miles”. This is because if you redeem for cash back, whether as a statement credit or via check, you’ll only receive half the value of travel redemptions: just 0.5 cents per “mile”. If you are looking for cash back rewards, there are much better options on the market.

Travel

Redeem points for paid travel: 1 cent per “mile”

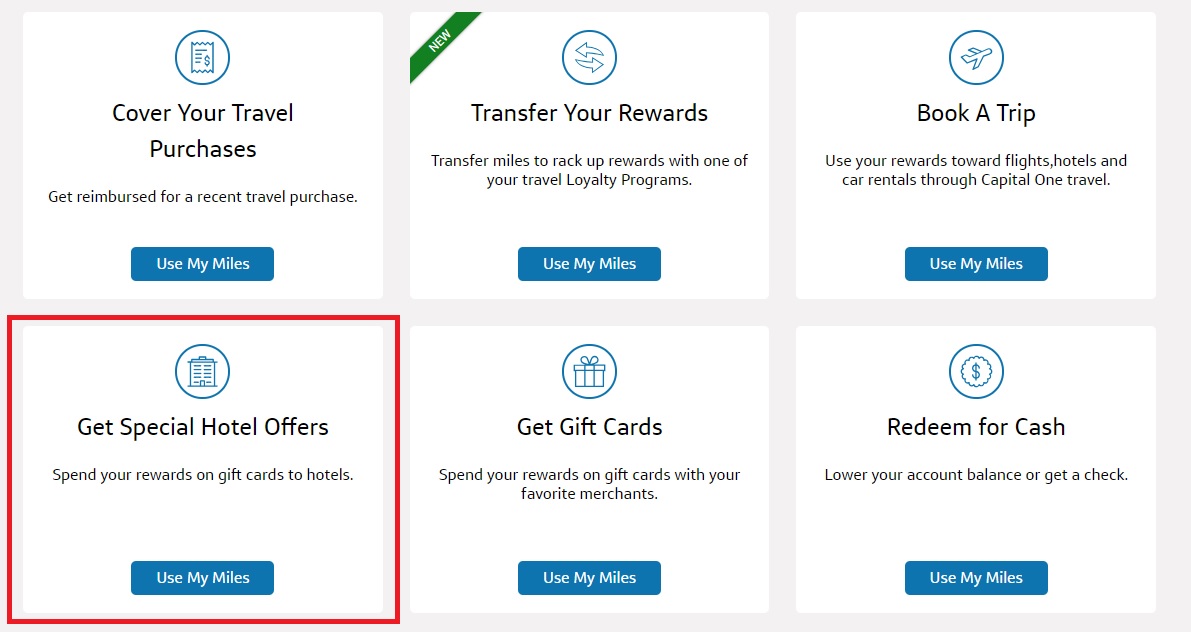

Capital One "miles" can be redeemed for paid travel at a rate of 1 cent per "mile". Travel purchases can be reimbursed by redeeming miles within 90 days of purchase. Note that Capital One keeps a fairly broad definition of travel, with things like flights, hotels, Airbnb, ride shares, cruises, and more qualifying. There is no minimum redemption if you are covering the charge completely with your "miles". If you are redeeming for a partial credit toward a travel purchase, the minimum is 2,500 miles. Also keep in mind that Capital One allows you to combine miles earned on each of their miles-earning cards as well as transfer to other cardholders with eligible miles-earning cards.Some customers get “special hotel offers”

Capital One "miles" can be redeemed for gift cards for many popular merchants. Some cardholders with older Capital One miles-earning cards may additionally have the ability "Get Special Hotel Offers". If you happen to have a card with this option, you can redeem 64,250 Capital One "miles" for a $900 gift card with select hotel chains. See this post for more detail.

Capital One "miles" can be redeemed for gift cards for many popular merchants. Some cardholders with older Capital One miles-earning cards may additionally have the ability "Get Special Hotel Offers". If you happen to have a card with this option, you can redeem 64,250 Capital One "miles" for a $900 gift card with select hotel chains. See this post for more detail.

Transfer points

Transfer to another Capital One miles-earning card

Capital One allows you to combine miles earned from all of your Capital One miles-earning credit cards. Additionally, Capital One allows transfers to any other cardholder who has a miles-earning Capital One card. This makes it very easy to combine miles to redeem for a valuable award.Transfer Partners

| Rewards Program | Capital One Transfer Ratio | Best Uses |

|---|---|---|

| Accor Live Limitless | 1000 to 500 | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia |

| Aer Lingus Avios | 1 to 1 via BA | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Emirates Skywards | 1 to 1 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| EVA Air Infinity MileageLands | 1000 to 750 | If you want to fly one of the best business class products in the sky, the best way to snag EVA flights is with their own miles since they release more award space to their own members. One-way business class flights from the US to Taipei cost 75K to 80K miles. Fuel surcharges are very low on these routes. |

| Finnair Plus+ | 1 to 1 | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Iberia Avios | 1 to 1 via BA | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| JetBlue | 1,000 to 600 | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 via BA | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| TAP Air Portugal | 1 to 1 | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. |

| Turkish Airlines Miles & Smiles | 1 to 1 | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

| Wyndham | 1 to 1 | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Additionally, you can book Vacasa vacation rentals starting at 15K points per bedroom per night. Wyndham Earner cards offer automatic 10% discount on award stays. |

Other ways to redeem points

You can also use points to pay some merchants directly (for example: Amazon.com). Don't do this. These options offer poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your Capital One "miles" - causing you a headache in getting your points reinstated).

Capital One Venture Rewards Credit Card Manage Points

Combine Points Across Cards

Share Points Across Cardholders

How to Keep Points Alive

Capital One Venture Rewards Credit Card Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

Is this card worth keeping in the long run? If you are looking for a simple one-card solution that offers a reasonable return on everyday purchases, it might be. With a baseline redemption of 2 cents per dollar spent and the ability to also transfer to airline partners, this card offers just enough flexibility to make it worth considering as a lone card solution. However, keep in mind that there are long-term options on the market to earn 2% cash back with no annual fee and several cards that are even better in the first year. There are alternatively cards that offer bonus categories for more miles per dollar. The Venture card’s strength is in offering a combination that is less common in a single card.

For Capital One products listed on this page, some of the benefits may be provided by Visa(R) or Mastercard(R) and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

DP: just got instantly approved which surprised me honestly. The Cap 1 VX is my only C1 card and I have 9 other open cards (mostly Chase). 820+ credit score. I also have a fraud alert on all 3 credit accounts which usually requires them to verify the legitimacy of the credit request.

lucky! i got denied stating I have too many open cards….

makes no sense does it?

Interesting how C1 is messing with the referral offer. P2 has a referral offer that explicitly states it’s a 100K SUB – “Once your friend applies with your link and gets approved, they are eligible for an exclusive limited-time referral offer to earn 100,000 miles in their first three months.” I tried multiple ways (browsers, devices, incognito) and got the 100K offer every time except once when it gave me a 75K offer with no cash. So weird that C1 would make a written and explicit offer, once you accept that offer (by sending it), they change it. Isn’t that fraud??? Anyway, I recommend: 1. don’t settle for anything less than the 100K SUB, it’s out there. 2. if you send a referral link to a friend, make sure to tell them to only apply if they get the 100K.

DP: approved for the 100K offer via P2 referral. 3/24, 1/12, 9 existing personal cards, 1 existing C1 card (VX), 800+ credit. I use the C1 VX as my everywhere else card. Based on all the reports, I was worried but I got the approval!

My second attempt after trying a year ago. I was denied: “Based on your credit report from one or more of the agencies on the back of this letter, there are too many active credit cards based on your loan history.” Equifax 825, Transunion 827. Never had a Capital One CC before.

I got denied for this, I also called the reconsideration line and they said they can’t manually change the decision. The reason was too many open credit cards.

I just applied with a score of 780 and I already have a venture X card. I have 3 hard pulls in the last 24 months. However, I have close to 5-6 cards open right now.

Hi guys, I don’t understand how this thing works. I always get the pre-approval page and it says I’m only eligible for the free Venture which is a lower award. Is there a link to apply directly without going through the pre-approval page? I have excellent credit, annual household over $250K and $0 debt except for my house. I only have taken out 2 cards in the last 24 months.

Is Cap1 as stringent as say Amex when it comes to “churners”? I ask because I am seeing numerous accounts of denial from applicants with 800+ FICO scores. Typically that would be grounds for automatic approval in my opinion but the common denominator amongst the denied was that they all had several open credit cards, albeit paid in full. I don’t want to apply and waste an inquiry (or 3 since they apparently check all bureaus) if they are going to see several open, paid off accounts as a deterrent. Any advice or insight as to what they look for in an applicant?

Just applied for my P2 who has a VX and credit score in the 800s. DENIED!

I’m copy/pasting this comment from Ralph posted 5 months ago that never got a response because I have the exact same question.

The article states “Existing or previous cardholders are not eligible if they have received a new cardmember bonus for a Venture X card within the last 48 months.”

Has it been confirmed that this eligibility criterion is related to the Venture X and not the regular Venture? The application page states: “Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months.” I assume “this product” would be the Venture.

My P2 received a Venture X bonus 35 months ago and is also an authorized on my regular Venture so I’m trying to figure out if either and/or both of those criteria disqualify her. Thanks!

Oops. Thanks for pointing that out. No that was an error on our part. I’ve updated the page to say Venture Rewards in that sentence instead of Venture X

Thanks for confirming!

I already have a venture x card and I qualify for another capital one card based on all of the criteria. I go to the pre approval offers page and am targeted for cards, but not this one. Is it worth applying? I’m worried about a hard pull effecting my credit when there are other cards I’m interested in as well. I want this card for the first year intro bonus then downgrade to the savor.

There’s no way to say for sure, especially with C1. The “pre-approval” tool is no guarantee that you will be approved for the cards that it lists and, conversely, won’t be approved for cards that it doesn’t list.

A hard pull should only drop 3-6 points from your credit, so one is unlikely to have much of an impact on most applications…although some folks believe that Citi is less likely to approve you if you’ve had more than 6 hard pulls in the last six months.

I often check this page to see which offers are “the best one yet” and this one looks to be the same as “ the recent better offer: Expired 9/9/24: 75K after $4K spend in 3 months + $250 Capital One Travel credit in first cardholder year”. Am I missing something or is this the best offer in recent years?

Yes, this matches the best ever offer on this card.

Thanks nick! Would you happen to know when it expires? Trying to space out my applications so I don’t have to meet 2 different min spend requirements.

Has it been confirmed that this eligibility criterion is related to the Venture X and not the regular Venture? The application page states: “Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months.” I assume “this product” would be the Venture.

Oops. Thanks for pointing that out. No that was an error on our part. I’ve updated the page to say Venture Rewards in that sentence instead of Venture X

[…] Click Here To Apply […]

Any tips on how to use $200 avelo credit if there is no avelo airport nearby? Would be a hassle to use, but would love to not let it waste.

Looks like previous card holder have a 48month cool down period.

How does my spend bonus work?

You will earn 75,000 bonus miles if you spend at least $4,000 within 3 months of your rewards membership enrollment date. Once you qualify for this bonus, we will apply it to your rewards balance within two billing cycles. Existing or previous cardmembers are not eligible for this product if they have received a new cardmember bonus for this product in the past 48 months.

No dice – rejected 🙁 I haven’t applied for many (personal) cards this year, but I have a number of cards open.

I’m afraid I’m going to have the same fate. I wonder what their threshold is.