NOTICE: This post references card features that have changed, expired, or are not currently available

Citi’s Prestige card may still be available in-branch with an increased bonus and reduced annual fee.

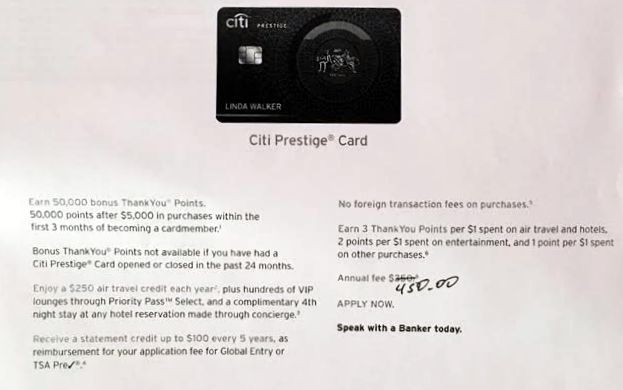

The Offer

Earn 50,000 bonus ThankYou points after $5,000 in purchases within the first 3 months of becoming a cardmember.

Need to Know

- In-branch only

- Annual fee states $350, but may be $450 if you are not Citigold. YMMV

- You are not eligible if you have opened or closed a Prestige card within the past 24 months

HT: https://twitter.com/JeffTheWanderer

[…] tip to @JeffTheWanderer via Frequent […]

[…] you checking a local Citi branch, however, as there have been reports of local bankers providing the old offer of 50,000 bonus points for completing a spend of $3,000 in the same period of […]

Will we be able to get a match if we apply for the 40k miles link now?

Curious too.

I got this same deal a day before the supposed deadline for the old deal. I thought I had gotten in under the old deal ($50k for $3k spend), and had convinced the branch officer to give me a discount on the AF down to $350. When I got my welcome packet I saw that the required spend was $5k, but did get $350 af. I complained, but they wouldn’t change it. I guess it appears that I simply got the new branch deal. Oh well, that’s fine, I just paid rent with CC on Plastiq, and have already met minimum spend. I hope the $350 AF remains next year, if so I’ve got a keeper.

[…] Now, it seems that the 50K offer may still be available in-branch. Jeff the Wanderer shared with Frequent Miler a photo of a brochure he found in-branch. It details the following […]

[…] week. My prior Citi Prestige was approved 9/2/14, so will not be heading to the branch for another 50k bonus and $350 annual fee. My prior Premier was approved 8/17/15. My 3 Preferred are all 24+ months so can get […]

I’ve never been at a Citi branch, but have an opportunity in a few days, would like to take advantage of this offer. I’ve opened up several CC’s lately, including Citi, “borrowed” a few $k from a few with 0% intro APR, so my FICO score took a hit, about 700 now (was 820). Never had a late payment or delinquencies in 2 decades of the credit history. The Citi Prestige though requires an exceptional score, as I understand. I’m wondering if anybody can suggest an approach strategy for me to get this approved at the branch. One thing I’m planning on doing, which I HOPE will help, is open up a new checking account and load it up right there with $15k (which will also qualify for their $400 new checking act. promotion). Maybe that will demonstrate to the banker that I can handle the Prestige, assuming he or she has the power to influence the approval. Any tips or suggestions on how to handle this would be greatly appreciated.

slip him a $20 ?…lol…but seriously. it sounds like you have a good plan….just be prepared with answers if they ask why you need it, why you got so many cards recently, ect., ect. …it is always good to be prepared for the hard questions (especially face to face) just in case they ask them.

Thank you ! The answers I’m planning on giving to both questions is that I’ve been trying different membership reward programs (others being Chase and AMEX), and seeing which one works for me best, which is not really that far from the truth : )

Lower your credit utilization. If you pay off some of those other ccs before their statement closing date, your score will skyrocket. If you time things right, you can likely use credited money to do it if you have to, you just need to time the cycles right. If you can lower your credit utilization to below 5% your score will likely go back to 820, but it will go up either way, the more you lower balances.

My husband and I both applied for separate cards (online) last month and we were both approved, and our scores barely hit 600. But this was our 4th and 5th card with Citi, so I think a good history with Citi may be more important to them than score.