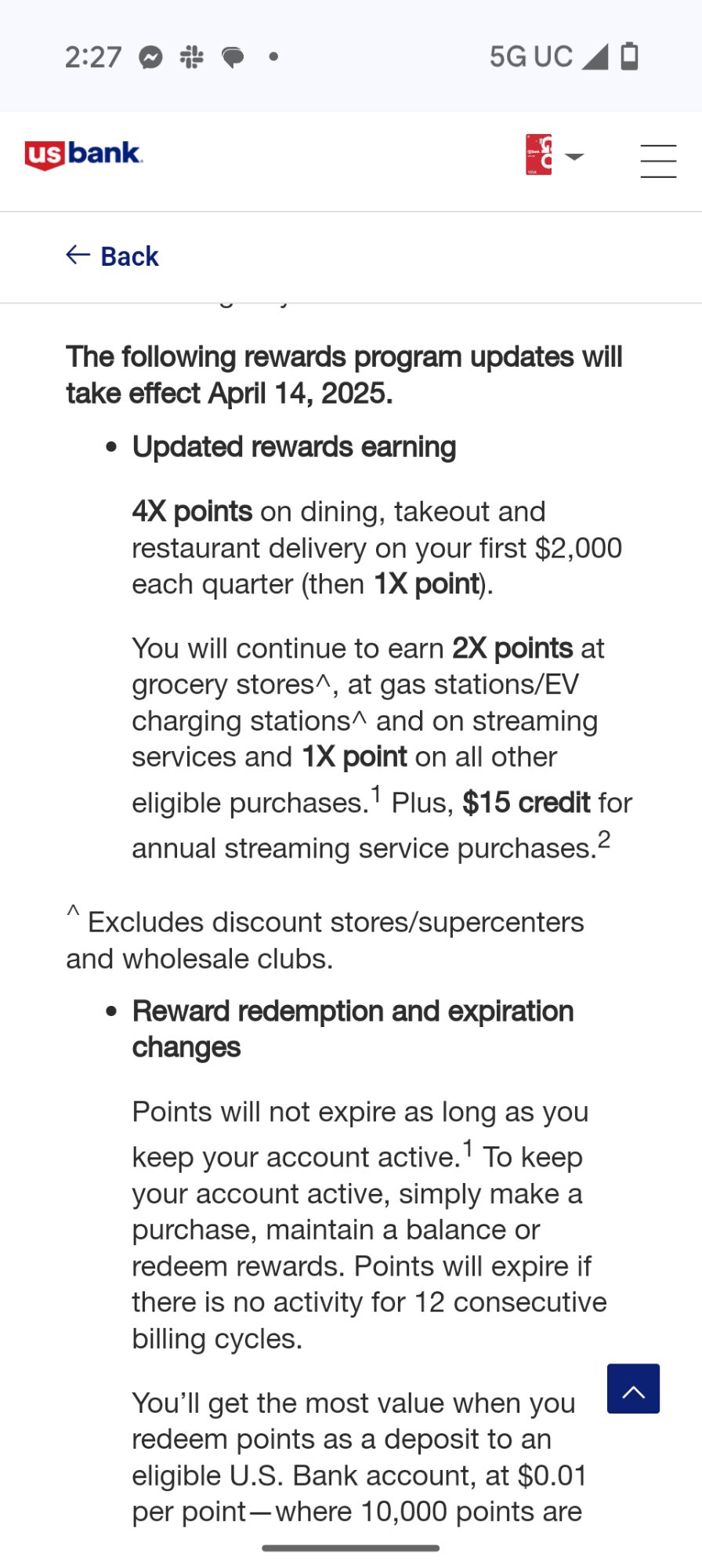

The US Bank Altitude Go card has been a great card to have in the wallet for a cash back enthusiast / those averse to annual fees. The card offers 4x on dining, takeout and restaurant delivery, which has been uncapped. I’ve often carried the card as a backup in situations where my Amex Gold card isn’t accepted. However, when logging in to my account today in the mobile app, I noticed a link to an announcement saying that, beginning on April 15, 2025, existing cardholders will be limited to earning 4x on the first $2,000 in dining, takeout and restaurant delivery purchases each quarter. That’s probably enough to meet needs for many folks, but for some it will introduce some headache in tracking.

Quick Thoughts

I noticed the above when logging in to my account on the US Bank mobile app.

This certainly isn’t the most popular rewards card on the market given pretty pedestrian earnings apart from dining. I have the card because my old Club Carlson card got converted to a Radisson card and then when Radisson got acquired by Choice Privileges, US Bank converted Radisson cardholders to the Altitude Go. Since the card has no annual fee, I didn’t see any reason to close it. And the card offers a $15 streaming services credit after 11 consecutive months of charging a streaming service to it, so I charge my Spotify subscription to the card and save $15 a year without any annual fee. As noted above, I have sometimes carried the card as a backup for dining purchases.

Moving forward, my own behavior won’t change much — since the Altitude Go is only a backup dining card for me, I wouldn’t be anywhere near the $2,000 quarterly dining cap with it. However, since acquiring the Capital One Savor card, I’ve been mostly carrying that card as my dining backup card since that card earns 3% cash back that can be converted to 3 Capital One miles, adding the flexibility to redeem for more value without sacrificing a lot of cash value.

With the US Bank Smartly card offering a base rate of 2% cash back everywhere and 2.5% back everywhere with $5,000 in cash or investments held with US Bank and a Smartly Savings account, and plenty of other 2% back cards on the market, it’s hard to get excited about the 2x categories on the Altitude Go (which aren’t changing). I’m not necessarily in a hurry to cancel mine, but I wish I could get US Bank to let me product change it to something more useful.

The announced changes also include “discounts of up to 5% on dozens of name brand gift cards” (coming sometime in 2025) and a “new Travel Center” that is powered by Booking.com. Given that those redemptions are expected to yield less than 1c per point in value, you’d probably be better off redeeming rewards for deposit to a US Bank account at a value of 0.01 per point.

[…] Update 1/13/25: Beginning on April 15, 2025, existing cardholders will be limited to earning 4x on the first $2,000 in dining, takeout and restaurant delivery purchases each quarter. Hat tip to FM […]

I think USB is simply trying to make Smartly your go to card for everything so the other cards outshining it have to be nerfed and so you’ll move over a bunch of AUM for their investment division. Not to mention 4% isn’t profitable on a 0 AF card anyways.

Agreed. If one looks at USB’s card strategy over the past couple years, it almost seems like so many fi-tech cards. That is, attract attention then reality sets in then devaluation follows then people leave. I think you’re right in that USB might be trying to create a stickier customer relationship with the tie to investments. Make it a hassle to leave.

Side note: USB’s investment platform is fine for parking assets. But, it is inadequate for advanced objectives/strategies.

Nick, Did you know that you can save more than $15/yr on spotify by buying a $99 1 yr card on Amzn?

That’s what I do.

I’m interested in the Smartly card but I’m leery of US Bank eventually capping their 4% cash back, as it doesn’t seem sustainable, especially given this news.

I’m sure they eventually will, but that doesn’t make me less interested in the near term.

Even given the opportunity cost?

US Bank will give you $0 for transferring assets, $0 for opening the required savings account, $0 for opening the Smartly card (or product changing to it).

Robinhood will give a 3% match to Gold members for an IRA transfer. If you move $100k over that’s $3,000 in potentially tax free money (if Roth) you’re skipping over to go the Smartly route. Yes 3% on Robinhood’s catch-all card is less than 4% on Smartly, and things like tax and rent payments are ineligible, but it’s going to take up to $300,000 of spend on the Smartly card to break even with what you get performing the same actions here. (move assets, open card) Edit: It looks like they’re only matching 1% on transfers at the moment, so adjust the math down to $100k.

For someone who hasn’t setup with BoA yet, they’re skipping over up to $500 for opening the checking account, up to $1000 for transferring over assets to Merrill, and $600 in welcome bonus cash on the Premium Rewards card. 2.625% and 3.5% are less than 4%, but given the maximum benefit is $1375 per $100k of spend (2.625% vs 4%, ignoring any 3.5% spend), that account opening cash Bank of America is paying out means a pretty significant chunk of spend to catch up with the Smartly card.

I really like the idea of the 4% Smartly card in a vacuum, but when you consider all of the actions you need to take without receiving the up-front payouts that other players will give you for performing those tasks I am less convinced it is such a great deal.

Read up on X1 card and how they treat 3% rewards. (it’s the same exact ppl behind Robin hood card)

This fits the devaluation pattern of USB. It’s hard to imagine USB will not shut down someone who attempts to use the Smartly at scale? Even if bona fide spending (not MS).

If the Smartly is devalued, it will say a lot about UBS’s card strategy to those who haven’t already gather what it is.

Just think X1.