NOTICE: This post references card features that have changed, expired, or are not currently available

After reading some of the rumors in advance of Monday’s Marriott announcement, I commented to Greg that I was excited about going to the Marriott event in New York to find out how they would put a positive spin on it if all of the rumors were true (going revenue based, eliminating transfers to airlines, etc). I think I went into the event with a healthy bit of skepticism. I found myself pleasantly surprised by the outcome. Of course, not everyone is happy.

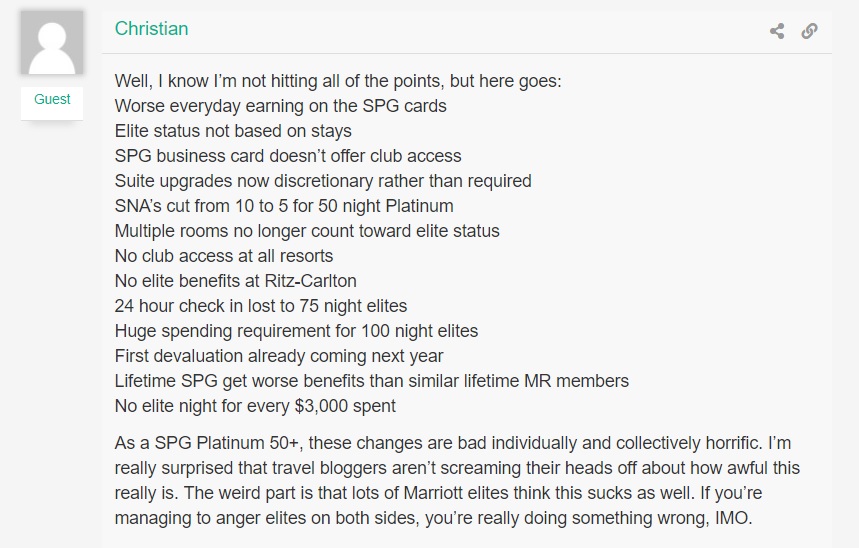

In my post about the new sweet spot created at the top end of the chart the other day (See: The huge wins in yesterday’s Marriott announcement), reader Christian said that despite that bright spot, the negatives of the new program far outweigh the positives, calling the new program the “worst of both worlds”. While I certainly agree that there are some negatives, I thought that they were significantly less catastrophic than many anticipated. Since Christian disagreed with me, I was curious to get his thoughts and asked him about the key negatives in his opinion. Here was his response:

In today’s post, I wanted to take a look at some of those changes he highlighted. Many of them are negative individually. Are they collectively horrific? Let’s see.

1) SPG credit card holders are getting devalued

Without a doubt, SPG credit card holders are taking a big hit. The SPG cards will go from being cards I routinely used for unbonused spend to cards I’ll use strategically — in other words, they’ll become ordinary hotel credit cards. They won’t be the same. Truth be told, once the merger happened, I never expected they would be as generous for as long as they have been.

Everyone looks at these cards a bit differently, so I’ll break the losses into a few sub-categories:

SPG cardholders who viewed points as airline miles

If you primarily used your SPG card as a means of earning airline miles due to the 1:1 transfer ratio and 5,000 mile bonus when transferring 20,000 Starpoints, there is no doubt you are losing what has long been a great opportunity. Starpoints were very special in this regard, with no other hotel currency like them.

The good news here is that those who are flush with Starpoints don’t need to flush those points in order to get value from airline transfers. Marriott is essentially keeping the transfer ratio, with 60K Marriott points (the current equivalent of 20K SPG points) transferring to 20K airline miles plus a 5,000 mile bonus for transferring 60K. In other words, every 20K Starpoints that you have right now will still transfer to 25K airline miles in the new program.

Moving forward from August 2018, Marriott Rewards points will be harder to earn from credit card spend (since the everyday earning on the SPG cards is being slashed from 3 Marriott Rewards points to 2 Marriott Rewards points), so the airline conversions won’t be a compelling reason to spend on the cards after August. But those who have spent in anticipation of eventually transferring to an airline are going to come out fine.

SPG cardholders who used the card as a daily spender

Due to the strong value of Starpoints, both as a currency transferable to airline miles (as noted above) and towards rooms in the Starwood Preferred Guest program, many people have viewed the SPG cards as the best in the market for unbonused everyday spend. Between earning an effective 1.25 airline miles per dollar spent (as long as you transferred in 20K increments) and being able to redeem for free nights starting from 2,000/3,000 Starpoints, you could spend with confidence that you would pretty easily redeem each Starpoint for more value than you could have otherwise earned from a cash back credit card.

Starting in August, you’ll be earning less – just 2 Marriott Rewards points per dollar on unbonused spend. Since our Reasonable Redemption Value for Marriott Rewards points is only 0.72 cents per point, it won’t make sense to put unbonused spend on these cards in most scenarios since you could earn a better return with a cash back credit card.

SPG Business cardholders who frequently stay at Sheratons with a club lounge

The SPG Business credit card currently offers club lounge access during Sheraton stays. Starting in August, it won’t. That’s a big hit if you booked a Shertaton stay for August or later counting on lounge access from the credit card. I especially feel for anyone who made a prepaid, nonrefundable reservation counting on this one.

I’ve personally made good use of this benefit before. Lounge access at the Sheraton Maldives saved me a bunch of money on food a couple of years ago.

On the flip side, I’ve found some domestic Sheratons less enthusiastic in their offerings. At the Sheraton Tribeca, for example, they advertise access to snacks and drinks throughout the day. On the second day of my stay, here were the snacks:

That’s a few bags of Lay’s potato chips — barbecue flavor only — and a few bags of Lorna Doones, accompanied by a few nutrigrain bars. To be fair, there was also a basket with bananas. That photo was from Day 2. On Day 1, there were no chips or cookies — only raspberry flavored nutrigrain bars. Raspberry isn’t my flavor, so I went to grab a Pepsi from the cooler, only to find that they had no regular Pepsi – only diet. On Day 2, they did restock the regular Pepsi. My point here is this: the value of this benefit varies tremendously. In the case of the Maldives, my wife and I probably saved a couple hundred dollars on food and drinks over the course of our stay. At the Sheraton Tribeca, I got 3 cups of coffee and a bagel in the morning. Since there was an in-room coffee maker and a bagel shop literally right next door, I don’t place huge value on the club lounge there.

Furthermore, I never really understood the target market on this benefit. I think it’s a confusing benefit for anyone who isn’t a credit card enthusiast. Lounge access at 1 brand out of 30 in the combined program is a weird benefit for the average consumer to follow. It also created confusion at the hotel level — while you neither need to pay with your SPG Business card nor physically have your card with you to access the lounge, there were periodic reports of hotels that misunderstood the benefit. I’m not terribly surprised to see it go.

2) SPG Platinum devaluations

The majority of negatives in the new program (and indeed in Christian’s comment) affect SPG Platinum members, who will become Marriott Platinum or Platinum Premier members in the new program. Again, I’ll break the negatives into a few separate groups.

SPG Platinums who qualified on stays

In the old Starwood Preferred Guest program, you could qualify for Platinum with 25 stays. In the new program, Platinum will require 50 nights. If you only stay 25 times each year and most of your stays are only 1 night, you’re deifnitely going to lose out. What percentage of SPG Platinum members qualified based on stays? I have no idea, but I would suspect that most people who came to enjoy Platinum benefits probably stay more than 1 night on average. My guess is that this affects some Platinum members, but probably not the majority.

On the flip side, Marriott Rewards members didn’t previously have this option, so they aren’t losing.

SPG 50, 75, and 100-night Platinums

Starwood offered very generous benefits for the various tiers of Platinum. The 10 suite night awards at 50-night Platinum status will now drop to just 5 and the ability to check in at the time of your choice and stay for 24 hours for 75-night Platinums (known as Your24) will become a benefit reserved for 100-night Platinums who spend an average of $200 per night. Those are definitely hits that will sting those counting on them.

The flip side of this is that Marriott Gold members will become Platinum under the new program, meaning that they should qualify for 5 suite night awards starting in August. That’s awesome news if you are a Marriott Gold member (including one who has matched from SPG Gold). In years of being a Marriott Gold member, I only recently received my first upgrade to a suite (via Marriott chat — see: Marriott chat upgrade success). Getting 5 guaranteed suite nights will be a big win for people who matched over from SPG Gold or for 50-night Marriott loyalists who have earned status the old-fashioned way.

While the revenue requirement for Platinum Premier Elite 100-night status sounds very steep at $20,000 per year, I wonder if there isn’t a healthy number of 100-night elites that aren’t that far off of this number. After all, if you’re spending 100 nights a year in hotels, you are likely traveling for business and expensing your room, meals, etc. I would think that a fair number of people with a job that requires this much travel are spending a lot of nights in cities where room rates are expensive enough to make this attainable. It’s clearly a negative for those who regularly spend less than enough, and maybe I’m off in my assumption that a fair number of 100-night members spend somewhere in this vicinity each year, but I would think there is at least a substantial number of people who are unaffected by the revenue requirement. It will clearly affect some – will it be most 100-night members that are hurt by this? I’m not sure.

SPG Platinums who counted on earning status from multiple rooms

If you frequently travel with others and have been able to book and take credit for those extra rooms for additional elite nights, you’re going to be losing that benefit in August. Starwood currently lets you receive elite night credit for up to 3 rooms in one night. Marriott will only award 1 elite night per calendar day.

No club lounge access at resorts

This is again a loss for SPG Platinum members, who have had access to SPG club lounges even at resorts. I’m not sure how many SPG resorts offer club lounges, but it’s a loss at those that do.

On the flip side, Marriott Platinum members and above are gaining breakfast at Courtyard, AC Hotels, Protea hotels and at resorts. While I’ve long griped about the lack of free breakfast at Courtyard hotels, I certainly don’t think that getting it makes up for club lounge access at a resort. However, a much bigger gripe (and therefore bigger win in my book) is the breakfast situation at Marriott resorts. I regularly ignored Marriott resorts for reservations because of the lack of free breakfast on vacation, a time when it matters more to me than when I’m working or on a road trip. This won’t mean much for SPG Platinum members, but it’s a huge win for Marriott members.

3) No elite benefits at Ritz-Carlton resorts

While this is disappointing, it’s not a change. Platinum memembers don’t currently get free breakfast or lounge access at Ritz-Carlton properties and they won’t moving forward. I wish Marriott would have changed this to at least offer free breakfast, but it’s not a negative change.

4) No elite night for every $3,000 spent

Previously, Chase Marriott Rewards Premier credit card holders have earned an elite night credit for every $3,000 spent on the Marriott Rewards Premier (or Premier Business) credit card. That will be going away with the new Chase Marriott Rewards Premier Plus card. Current cardholders will keep their current product for the time being, though my bet is that this benefit will end in 2019 as it doesn’t line up with the new product offerings.

This is a loss for those folks who regularly spend almost enough nights to qualify for the next tier, but fall just a few nights short. For example, if you were staying 48 nights this year, it would be helpful to earn 2 more nights for spending $6,000 on a Marriott credit card.

However, given the very low earn rate (since we value Marriott Rewards points around 0.72 cents per point, it’s like a return of 0.72% on spend), there is a huge opportunity cost to spending at 1x on a Chase Marriott credit card. Since you could earn 2-3% cash back on other cards, you’re essentially coming out behind $38.40 for every $3K spent on this card (versus a 2% cash back card — $68.40 versus a 3% card). If you’re manufacturing spend to meet these requirements, you have to further include your MS costs. Even in the bonus categories, the return just doesn’t beat other cards on the market, which makes it hard to justify earning more than a couple of elite nights this way in my mind.

5) Lifetime elite status changes

We’ll cover this in another post. Christian isn’t wrong; SPG Lifetime members get the short end of the stick. On the other hand, some people who weren’t yet lifetime members in either program but have enough combined activity may now reach lifetime status when the programs combine. There are pluses and minuses here for different people.

Why I don’t think the negatives outweigh the positives

No doubt, the list above includes a number of negative points — most of which apply strongly to SPG Platinum members. However, I wouldn’t say that they are collectively horrific for one big reason: there isn’t a lot of overlap between the groups affected. In fact, there is no one person affected by all of the negative changes.

Here’s what I mean: Someone who is spending 100 nights but not spending $20K or who is losing Your24 for 75 nights probably couldn’t care less about not having a 25-stay path to Platinum status or not getting an elite night for every $3K spend on the Marriott credit card. Those folks who count on getting elite credit for 2 or 3 nights when booking multiple rooms probably aren’t concerned about Sheraton club lounge access (because I’m not going to travel with my sister and parents and go eat breakfast in the club lounge while they fend for themselves). Someone who spent money on SPG credit cards primarily to earn airline miles probably wasn’t staying enough for elite benefits to matter to them (otherwise they would presumably be using more points for stays). Someone like me who is losing guaranteed 4pm late checkout that was gained from the Amex Platinum card partnership was never going to have an Ambassador, so that change isn’t relevant for me.

I think each of the negatives hurts a set of people for sure, and I find myself hurt by a few of them (mostly by the loss in value of the SPG card as a daily spender). That said, the fact that Marriott didn’t go revenue-based, didn’t get rid of benefits for current Marriott Golds who got that status because they stay at Marriott hotels (and in fact increased benefits for that group), didn’t create an award chart with a top end that is higher – but rather is lower — than today’s top tier, and didn’t get rid of a favorable transfer to airlines are all nice surprises.

SPG Platinum members knew that the writing was on the wall when the chain sold; the program was very generous because it had to be. Being loyal to Starwood required real effort due to its smaller footprint. Being loyal to Marriott is easy with its massive global footprint. We knew they wouldn’t have to offer as many benefits in order to retain loyalty, and yet they have maintained benefits like guaranteed 4pm late checkout for 50-night elites and added suite night awards for that group, which I would not have expected when the merger was first announced. I’m personally very bummed that the SPG Gold status I got from the Amex Platinum card will no longer give me guaranteed 4pm checkout, but I am also glad that it’s a benefit that will stick around for those folks who spend 50 nights a year in hotels.

Furthermore, while SPG Platinum members are losing some benefits, they are maintaining access to a pretty good set of benefits (let’s not forget that comparably-sized chains like Hilton and IHG do not guarantee late checkout or suite upgrades to anyone) at a massive number of hotels around the world. While I know that’s not a trade that any SPG Platinum member asked for, it’s nonetheless got some value to it.

Bottom line

I think that individually, there are obviously some losses, the biggest being the devluation to the SPG cards. We’ve yet to see what will happen with mapping existing hotels to the new award chart, so there is room for more negative to come in that regard. On the other hand, I think that the negatives weren’t as catastrophic as might have been expected: let’s not forget that when this merger was first announced, many assumed that Marriott would just absorb SPG into Marriott Rewards and not add any of Starwood’s benefits. Furthermore, I think that each of the negatives affects some people, but there isn’t a lot of overlap in the groups hurt by the changes (apart from the fact that the SPG card earning devaluation hurts everyone). Overall, I think the benefits that are sticking around look pretty good in comparison to Marriott’s closest competitors in terms of scale. They didn’t keep everything great about Starwood, but I definitely wouldn’t call it the worst of both worlds.

What do you think? Are the changes more bad than good? What additional negatives affect you? Let me know in the comments.

Hi Nick, just curious what kind of food did you snag in the Sheraton Maldives?

I have the AF for my SPG personal due on 4/28 and my SPG Biz will be due the end of May. Other than getting a free night on each card, I see no value in holding these anymore. If the Biz retained lounge access, that would be a consideration, but that’s gone. I have Amez Plat card so get measly status there. Anyone else in the same boat? Not sure it’s worth holding these anymore.

Price is important

— recent devaluation in March 2018

—another one coming in August, I suspect, we will see

—then around January 1, peak and non peak periods come into play. Virtually all of my points booking have been in peak

—another one coming March 2019

Cost of points going up for me because virtually all of my points have come from credit card spend.

Total expected cost increase is well over fifty percent, and may be as high as one hundred percent. It will be over one hundred percent if there is no Canadian credit card giving 15 elite credits, so I would be paying for 50 nights instead of 25. 35 is doable, but at 50, 2019 will be my seventh and unfortunately last year qualifying as platinum, with expected nights after that about five or less as a lifetime gold .

I know that Marriott hotel and air certificates are valid for a year. Is it one year to complete the stay or to book a stay?

I have a practical question. My wife and I will be staying three days in Melbourne, Australia in October. We both have SPG Business cards and are SPG Golds. We were looking at either the Marriott Melbourne or the Melbourne Westin or Sheraton. The Marriott has a lounge but the Westin and Sheraton do not. Since the W and S don’t have lounges I was originally (up to a few days ago) assuming we would get free breakfast. It doesn’t seem like that is the case now? We both show now as Marriott Golds. If indeed we would be upgraded to M Platinum we could upgrade to a suite, get a better room and get free breakfast this is a no brainer to book the Marriott and not the Sheraton or the Westin. Am I reading this wrong?

Hey Nick, I can’t find any other mention that SPG Platinums will lose Lounge access (which often translates to free breakfast if you prefer to go to the restaurant) at Resorts. Can you point to what the new requirements are? I just looked back at a bunch of the coverage I read and don’t see this mentioned anywhere.

Reading back through some of the coverage I read day of I see “”Also, according to Marriott, the breakfast offering for Platinum and Platinum Premier members will be available at 23 of the 29 participating brands, as well as all resorts.” posted by OMAAT on BoardingArea. If that is true even if the lounge thing is also true its less of a problem… but still. Can you clarify?

Nick, in TPG’s interview with David Flueck here (check at the -14:44 mark), David explicitly states that members who have matched to Marriott Gold from SPG Gold via the AMEX Platinum will get Marriott Gold after Aug. 1, NOT Marriott Platinum.

https://thepointsguy.com/news/marriotts-david-flueck-combined-program-questions/

Only members who have **earned** true Marriott Gold from stays will get converted to Marriott Platinum.

Seems to contradict what Bob said?

That’s interesting as it is directly contradictory to what Bob told us. At the Marriott event, Greg and I first approached David and began the conversation asking him questions. He introduced us to Bob and told us that Bob knows everything about the program and could answer all of our questions. Obviously, there is some internal confusion going on. I guess we’ll see in the coming days and weeks when the full details roll out.

Thanks! Would appreciate if you can get to the bottom of this. Super frustrating!

I think the “bottom line” of this change is that Hotel Points become more valuable. Reason is before most earned “lots” of points through credit card use. Now, credit card use to get Points has been devalued and earning Points via actual Hotel spend is increased. Result is having Points is more valuable because they are more difficult to get.

Nick – Go take a peek at how the Suite Night Awards work in the T&Cs. I don’t have experience with them in SPG, but in Hyatt the suite nights are guaranteed at time of use. In this scheme, they are begin attempting to apply to the reservation 5 days prior. Seems like these suite night awards may be tough to redeem…

I’ve used these before, and while they aren’t as good as Hyatt’s, they do offer some value, or at least have previously for me. SPG corporate would check availability 5 days out and would book the suite if it was available. That meant that you could prioritize when a suite meant more to you, since it always seemed that you got a suite on a one night stay at an airport hotel rather than at a beach resort on a week long stay.

Sorry I had to re-read this post a couple of times. I really don’t see how you came up with conclusion that the negatives don’t outweigh the positives.

I would say the negatives from this merger were not as bad as it could have been, but I agree Christian’s list on the negatives are pretty significant. Lower earning rates, no free lounges at resorts, SPG AMEX credit card perks, SPG Amex earning rates etc.

Lower SPG earning rates are definitely the killer — it hurts. But Marriott’s card has long only earned 1x everywhere. Personally, I expected the SPG card to eventually become a 1x Marriott card. I think making it 2x was better than I anticipated (especially when you consider that the top end of the chart is actually decreasing). Don’t get me wrong — it’s not a daily spender and you and I will likely stop using it / cancel it. I just didn’t have any expectation of maintianing 3x forever. It’s an obvious negative, but we’ve had a long time to spend to our heart’s content to prep for the change.

No free lounges at resorts is a negative for SPG Platinums who were used to that. It was never a thing for Marriott members, so it’s not a negative for them. It’s not a negative for SPG Gold members. It’s only a negative for a relatively small segment of the Marriott membership. Of course I’d be disappointed at losing anything if I’d invested my time and money in SPG status — so it’s not that I don’t have sympathy. But it’s not a negative change for the vast majority of Marriott members who never had it. Further, it’s again something that never had any hope — Marriott wasn’t ever likely to make that huge of a change in policy. Look at it this way: there are about 1200 SPG properties total. How many of them have a lounge? Now out of those that have a lounge, how many are resorts? Maybe a couple hundred? So Platinum members lose access to maybe a couple hundred lounges and gain access to breakfast at almost all of the 6500 Marriott properties (excluding just a couple of brands). I have a hard time viewing that as a net loss. Of course it’s a loss to the person who was planning to go to Resort XYZ next year and have lounge access, but on the whole it doesn’t look like a loss to me.

So I guess those might help explain my perspective on it a bit more. Many expected much more significant changes that would impact everyone.

Maybe you are right, Nick, that these changes won’t matter as much to consumers in the long run as they will simply move their loyalty to other more appealing programs.

Marriott may not be entirely gutting the SPG program to the extent there are still some acceptable work-arounds, but there is also no real draw for increasing stays at their properties. As a lowly Gold, I will only stay now at a Marriott when there is no other reasonable option after 2018 and will not use my 2 AMEX cards again after August.

Personally, I’m probably more loyal to Hilton than anything else at this point (especially with the Aspire). That said, let’s look at it this way: SPG Platinum used to require 25 stays or 50 nights. If you had both credit cards, it was 21 stays or 40 nights.

Marriott Platinum (which still includes breakfast at the vast majority of properties, 5 SNAs, guaranteed 4pm late checkout, lounge access at most properties, etc) requires 50 nights under the new program. You can get 15 nights from a credit card. That means you’ve got to spend 35 nights to get those benefits — 14 more than the bare minimum for SPG Platinum and 5 less than the minimum if you qualified on nights as opposed to stays. It’s also 5 more nights than the minimum required for Hilton Diamond (if you do 30 one-night stays….and Hilton Diamond won’t get you any SNAs or guaranteed late checkout). It’s 25 less nights than you’ll need for Hyatt Diamond…and it gives you a much larger footprint of hotels at which to do those nights.

I’m as close to a Hilton faboy as you’ll find in the blogosphere. Especially with Diamond status from the Aspire, I’m more likely to be choosing a Hilton than spending 35 nights with Marriott. But if you’re a business traveler, 35 nights isn’t a ton (less than 3 nights per month) and it gets benefits that other chains don’t have for that level of business.

I’m enjoying the discussion here, so don’t take this as argumentative: what is the more appealing program consumers will run off to? What will you choose instead of Marriott? If you spend less than 35 nights a year in hotels, I imagine the answer is Hilton. But if you spend 35 nights or more, I’m not sure what’s better?

To be clear, I’ve never been a Marriott guy….but I think the new program looks as good or better than the competitors – especially since awards aren’t (yet) revenue-based.

If I wanted the most convenient property, well then Wyndham has 30% more worldwide at 9,000 properties (as opposed to rooms) than even Marriott. I’m just not personally super-fired up about Super 8s but do, however, enjoy an occasional Dolce & Wyndham Grand. I am also a big fan of their loyalty program and credit card earnings programs because my expectations are being met by them, and often times even exceeded.

Wyndham has targeted bonus point offers quarterly and at 15,000 points/room, I continue to get good value and very nice accommodations from their program. They are solid. And you know what, Nick? Even Best Western is impressive to me with 10,000 point room specials and no point expirations. Not my standard go-to, but from Eureka Springs to Maui having some hoarded points has come in handy and the properties take care of their customers, relatively speaking.

For luxury/upscale properties, I can say the same for Hilton. They might devalue their point structure from time to time, but then they at least have the foresight to increase ways for us to earn more of them through credit card spend. Like you, I also find the new Aspire card to be a home run with its automatic highest tier status and elevated bonus categories. Hilton for life unless they go and do something stupid like Marriott just did.

I am also in transition to Le Club Accor (AccorHotels) from the Fairmont Presidents Club. It looks like it will be fairly easy to earn future points/stays thru hotel spend with them. All the rooms/upgrades/dining/spa/experiences Fairmont is throwing at Platinums this year, I am going to be too busy escaping to free suites to mourn SPG (for at least awhile). Fairmont did/does it all just right, RIP – by the way, that same level of excitement I have about planning a Fairmont stay is completely devoid with Marriott Gold “Elite”/No Eat status.

I guess we will soon see, but Marriott will likely devalue their point structure along with already devaluing the ability to earn them via credit card spend. For all the business folks out there on the road much of the year with companies booking them on their dime at Marriotts, then there may not be much of an issue there. Of course, that will likely depend on what changes are also to be made to the old SPG corporate programs.

So that and a buck will get you a cup of coffee – just not at a Marriott lounge.

My husband is also signing up for the new 3x Chase Freedom Unlimited Card. Used with my CSR, 4.5 for an entire year towards Four Seasons, Mandarin Orientals, cool boutique places where every room is an instant upgrade. Chase is awesome, I also choose the UR program for our escape from Marriott Rewards!

So, was I mistaken that Marriott will not guarantee suites? Given the rest of the bad news, a little good would be very welcome.

Only sort-of mistaken :-). They will have a mechanism for it. See my response to the comment above this.

Others have brought this up, but I am looking for clarity.

Question: After this first year, If you are a lifetime Platinum Elite, you will only get the 5 “Suite Night Awards” or 10 “Suite Night Awards” if you actually qualify be staying either 50 or 75 nights respectively.

I have seen some complaints from Lifetime SPG Platinums that aren’t getting Lifetime Platinum Premier with the transition.

But, if you have to qualify each year for 10 SNAs by having 75 “nights” EACH year, you get the Platinum Premier status anyway. The only thing the Platinum Premier gets is and additional 25% bonus (75% total bonus). But if the SNAs are so valuable and you are able to score 75 nights, you get that same bonus anyway.

I am only asking because I could reach Marriott Lifetime Platinum this year, but it would take some work. Not sure that work is with it…if there is little difference in the Platinum levels and benefits.

Are the SNAs valuable? Do they regularly clear?

Thanks to anyone that can help!

We’ll have a closer look at lifetime status to come soon.

As for whether or not the SNAs are valuable / do they clear: they don’t yet exist. Marriott hasn’t had suite night awards before now, so we don’t know for sure how valuable they are.

Having a chance at a confirmed suite is better than not having it. On the other hand, it’s not the strongest benefit ever. You need to use one for each night of your stay — so 5 SNAs get you a suite for up to 5 nights total. You can’t use them for a partial stay. For example, if you want to stay for 7 nights, you can’t apply them to the first 5 nights — it’s all or nothing (though of course you can make a 5-night reservation and apply your SNAs and then make yourself a separate 2-night reservation). Further, they only start looking to confirm the upgrade 5 days before check-in and they continue to look until 2pm the day before arrival. So during peak season in popular destinations, there is unlikely to be upgrade inventory available 5 days before you get there (though if your upgrade doesn’t clear, you get the SNAs back). I imagine their usefulness will be a function of when and where you try to use them.

Thanks for the response. In reference to SNAs value and clearing…was really meaning in the context of SPG…and was assuming that they would transition a program that would be functionally the same.

Looking forward to the deeper insight into Lifetime Status….publish quickly…we need to plan!! Thanks!

The above are only negative on top statuses and credit cards. Do the majority of the combined 100 million plus members even have either a credit card or top status? For me who only has gold and stay mostly on points there is a huge negative as my points will more likely get me fewer nights than before. I don’t stay at SPG properties that cost 20k SPG points and above.

I’m not sure that’s true (that your points will get you fewer nights than before). They certainly might get you fewer nights — it depends where you stay. Marriott says that more properties are going down in price than up. My interpretation of that is this: a lot of Category 1 SPG properties currently cost 3K on weekdays, which is equivalent to 9K Marriott. My bet is that they will keep those properties in Marriott Cat 1, which is 7500 points. SPG Category 3 is 7K SPG points (21K Marriott). Again, it’s easy to place these in the 17.5K band (which will have peak pricing of 20K in 2019) for the purposes of having a greater quantity of hotels moving down than up.

In fact, my bet is that a number of SPG properties in Categories 1-4 will move down a hair in the new chart and that many of the Category 8 and 9 Marriotts are more likely to move up in price (right now, Cat 9 Marriott = 45K and the new chart has a 35K and a 50K level — the smart money is on most Cat 9s moving up 5K rather than down 10K, so they need other properties to balance that out).

Of course, it’ll be harder to earn points from the SPG card, so your spend won’t get you as far as before. But your existing points won’t necessarily get you fewer nights. It’ll really vary depending on where you want to stay.

Points usually become less valuable over time, not more valuable — so iI’m not saying that I expect Marriott’s new chart to suddenly make it easier and cheaper to stay at Marriott hotels. But until we see the full list of new categorizations, it’s hard to say how it will affect each of us individually. It’s not impossible that your points will get you a little further in the short term, depending on where you’re going.

“Getting 5 guaranteed suite nights will be a big win for people who matched over from SPG Gold”. Please clarify.

I have SPG Gold from Amex Platinum. Does the SPG Gold status automatically match to Marriott Gold or do I have to apply for a status match with Marriott? Because if the SPG Gold status automatically gives me Marriott Gold status then I now would get 5 guaranteed suite night upgrades just for having an Amex Platinum card. Sounds to good to be true.

Please confirm.

You need to connect your SPG and Marriott accounts now.

http://www.marriott.com/marriott-rewards/connect-my-accounts.mi

You won’t get Marriott Gold unless you link them.

As I noted in a response above, in our conversation, Bob indicated that anyone who has matched to Marriott Gold prior to August 1st will get Marriott Platinum (50-night status) on August 1st. We didn’t specifically talk suite night awards. I can see how some are interpreting it that you’ll have to have 50 nights in order to get the SNAs. I can’t say for sure, but my impression was that Golds will get full 50-night Platinum status in August.

The biggest loser in this deal isn’t just the big SPG Amex spender, who can easily switch to more lucrative cards such as the Chase Sapphire Reserve, it’s AMEX itself who will be losing tons of revenue.