| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

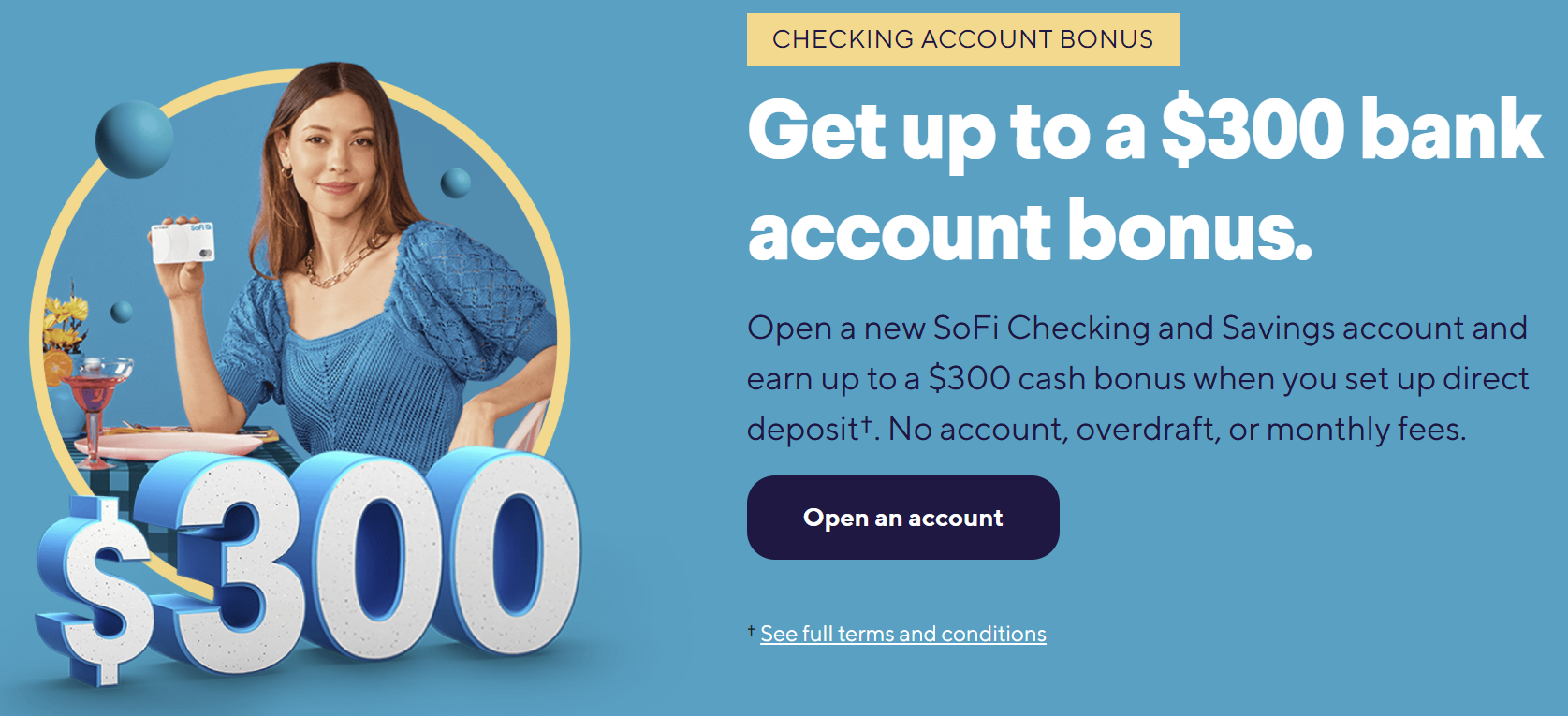

SoFi has again increased a stackable offer that can give you up to $715 back when opening a new checking/savings account.

The shopping portal Swagbucks is offering a 41,500-point (~$415) bonus for opening a new SoFi Checking/Savings account by clicking through the portal link and making a $400 direct deposit within 45 days. Once the Swagbucks are credited, they can be redeemed for cash via a PayPal gift card or for merchant gift cards. I signed up for this offer when it was 25,000 SB, and it was easy money.

The Swagbucks promo will stack with SoFi’s direct $300 sign-up bonus for a total of up to $715 back when opening a new online account and completing a qualifying direct deposit.

It’s worth noting that the amount of these SoFi/Swagbucks bonuses is sometimes targeted, so you may see a different amount than 41,500. If so, let us know in the comments.

The Deal

- Open a SoFi Checking/Savings account and get a $50-300 bonus when completing qualifying direct deposits (see table below for amounts).

See Doctor of Credit’s list of what SoFi considers a direct deposit

- Stack with Swagbucks for an additional ~$415/41,500 points when opening a new account through the portal and completing a direct deposit of at least $400 within 45 days.

Direct Link to Offer (listed under “featured offers”)

Key Terms

Swagbucks

- Existing accounts are not eligible to earn 41,500 SB.

- Must open a new account and set up a Direct Deposit to earn SB.

- Qualifying Direct Deposits must be made from the enrolled member’s employer, payroll, or benefits provider via ACH deposit. SB will appear as Pending for 32 days.

- Must enter valid sign-up information, including funding information, to earn SB.

- Must be the first deposit to earn.

- This offer may only be redeemed once (1) per user.

SoFi Checking

- Promotion Period: 12/7/23 12:01AM ET to 1/31/2026 11:59PM ET.

- Must be a new user to SoFi.

- In order to qualify for a bonus of either $50 OR $300, SoFi must recognize receipt of at least one Eligible Direct Deposit (as defined below) from an Eligible Participant, the first of which must be before the end of the Promotion Period. The amount of the bonus, if any, will be calculated during the Direct Deposit Bonus Period as described and defined below.

- Eligible Direct Deposit means a recurring deposit of regular income to an account holder’s SoFi Checking or Savings account, including payroll, pension, or government benefit payments (e.g., Social Security), made by the account holder’s employer, payroll or benefits provider or government agency (“Eligible Direct Deposit”) via the Automated Clearing House (“ACH”) Network.

- Deposits that are not from an employer or government agency, including but not limited to check deposits, peer-to-peer transfers (e.g., transfers from PayPal, Venmo, etc.), merchant transactions (e.g., transactions from PayPal, Stripe, Square, etc.), and bank ACH funds transfers and wire transfers from external accounts, or are non-recurring in nature (e.g. IRS tax refunds), do not constitute Eligible Direct Deposit activity. SoFi Bank shall, in its sole discretion, assess each account holder’s Eligible Direct Deposit activity to determine eligibility and may require additional documentation to complete this verification.

- The Direct Deposit Bonus Period begins when SoFi receives an Eligible Direct Deposit of $1 or more within the Promotion Period and ends 25 calendar days later (the “Direct Deposit Bonus Period”), subject to the Bonus Terms. For the avoidance of doubt, the Direct Deposit Bonus Period shall not extend beyond the Promotion Period.

| Total Direct Deposit Amount in Direct Deposit Bonus Period | Cash Bonus Tier |

|---|---|

| $1,000.00 – $4,999.99 | $50 |

| $5,000.00 or more | $300 |

- Once the Direct Deposit Bonus Period has elapsed, SoFi will determine if you have met the offer requirements and will deposit any earned bonus into your checking account within seven (7) business days. For example, if SoFi receives between $1,000.00 and $4,999.99 in Eligible Direct Deposits during the Direct Deposit Bonus Period, you will receive a one-time cash bonus of $50.

- Bonuses are considered miscellaneous income and may be reportable to the IRS on Form 1099-MISC (or Form 1042-S, if applicable).

Quick Thoughts

In order to max out these offers, you have to sign up for a SoFi checking account through the Swagbucks link and then make a total of $5000 in direct deposits.

In terms of timing, if you make your first direct deposit on January 28th (for instance), then you have until February 22nd to meet the $5,000 in combined total direct deposits to qualify for the full $300 bonus. It doesn’t need to happen all at once, but it does need to happen within 25 days of the first direct deposit. Each deposit needs to be at least $1,000 to be considered qualifying. Note that the money doesn’t need to remain in the account to qualify toward the $5,000 total.

SoFi is known for being fairly strict with what it considers a direct deposit (see DOC methods list here). I was able to trigger both Swagbucks and SoFi by making a $5,000 transfer from Wells Fargo and entering “Payroll Direct Deposit T. Steinke” as the reference (based on a few positive comments I saw in the DOC thread). But, of course, YMMV.

both P2 and i got our money from SoFi very easily. Swagbucks shut both of us down, even after our payments credited but before we could withdraw it. (actually I withdrew, but they immediately shut it down so I never received the money). for me they made up some BS excuse about multiple requests for credit (not true) and for P2 they said she has multiple accounts (also not true). complained through BBB, that went no where–swagbucks just cut/paste the same false response. BBB closed the case. so just beware that there’s a possibility swagbucks won’t pay out.

when i click on swagbucks, the Rove extension pops up giving me an alert for miles on the transaction. will clicking through rove potentially invalidate any swagbucks being awarded ?

Does this promo work if I had an account but closed it?

If yes, how much time do I need to wait after I closed my account before opening a new one for the bonus?

To get my $300 (and Rakuten bonus) from SoFi I had to make a CFPB complaint: I do not think I am alone in having had problems from the many similar reports on, say, the BBB website.

ugh had player 2 do this and they right away funded it from another checking account, but then I had them cancel the transaction an hour later. Will this count as the first deposit?

You gotta keep an eye on your P2…

just clarifying I need to open checking or savings? or is it both?

They always give you two accounts. If you open a checking, they give you a savings and vice versa.

can this be churned, i closed p2 account last week.

I had this account years ago but thought SoFi was not churnable — prove me wrong someone?

DoC data points indicate the bonus from SoFi itself is not churnable but that each shopping portal with an offer can be done once (i.e. you could do this offer once with Swagbucks, then in the future with Rakuten, but you can only earn the bonus from SoFi the first time).

i did not do it from swagbucks but my P2 did not get the bonus, probably because her online account was old although the sofi account was brand new.

Miles Earn And Burn has fairly recently said that SoFi bonuses can be churned. I just don’t know how to manage it.

Thanks – tried searching the site but nothing.

You’re right, he doesn’t explicitly say that you can churn but if you look below he implies it pretty heavily. I just don’t know what time frame works.

July 31, 2025 matt